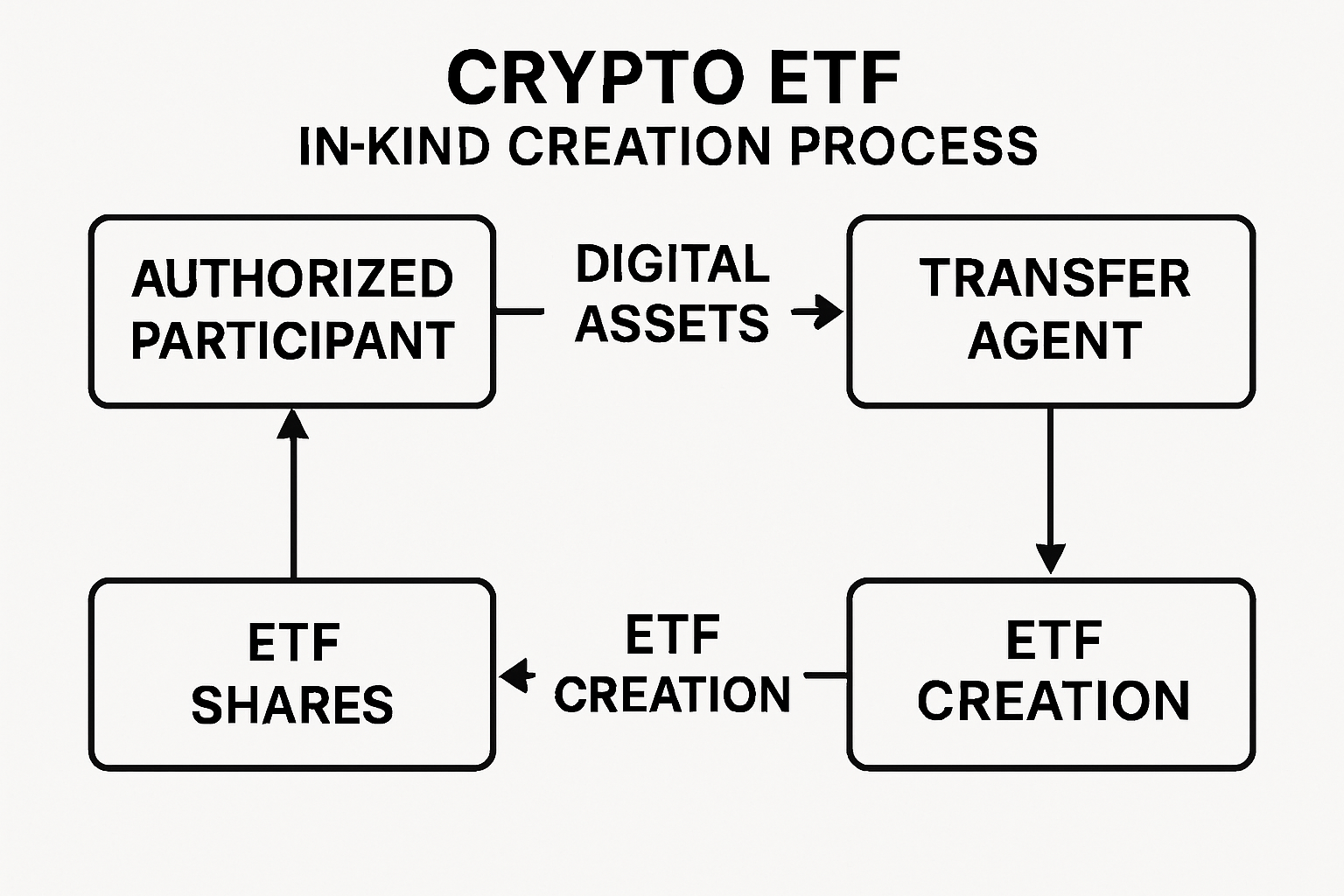

The U. S. Securities and Exchange Commission’s (SEC) July 2025 approval of in-kind creation and redemption for crypto ETFs marks a seismic shift in the digital asset landscape. This regulatory breakthrough allows authorized participants to swap ETF shares directly for underlying cryptocurrencies, such as Bitcoin and Ethereum, without the cumbersome detour of cash conversions. For years, crypto ETFs were forced to operate with cash-only mechanisms, driving up costs and operational friction. Now, with the SEC’s green light, the crypto ETF market is poised for dramatically improved efficiency, liquidity, and institutional adoption.

Why In-Kind Creation and Redemption Is a Game-Changer for Crypto ETFs

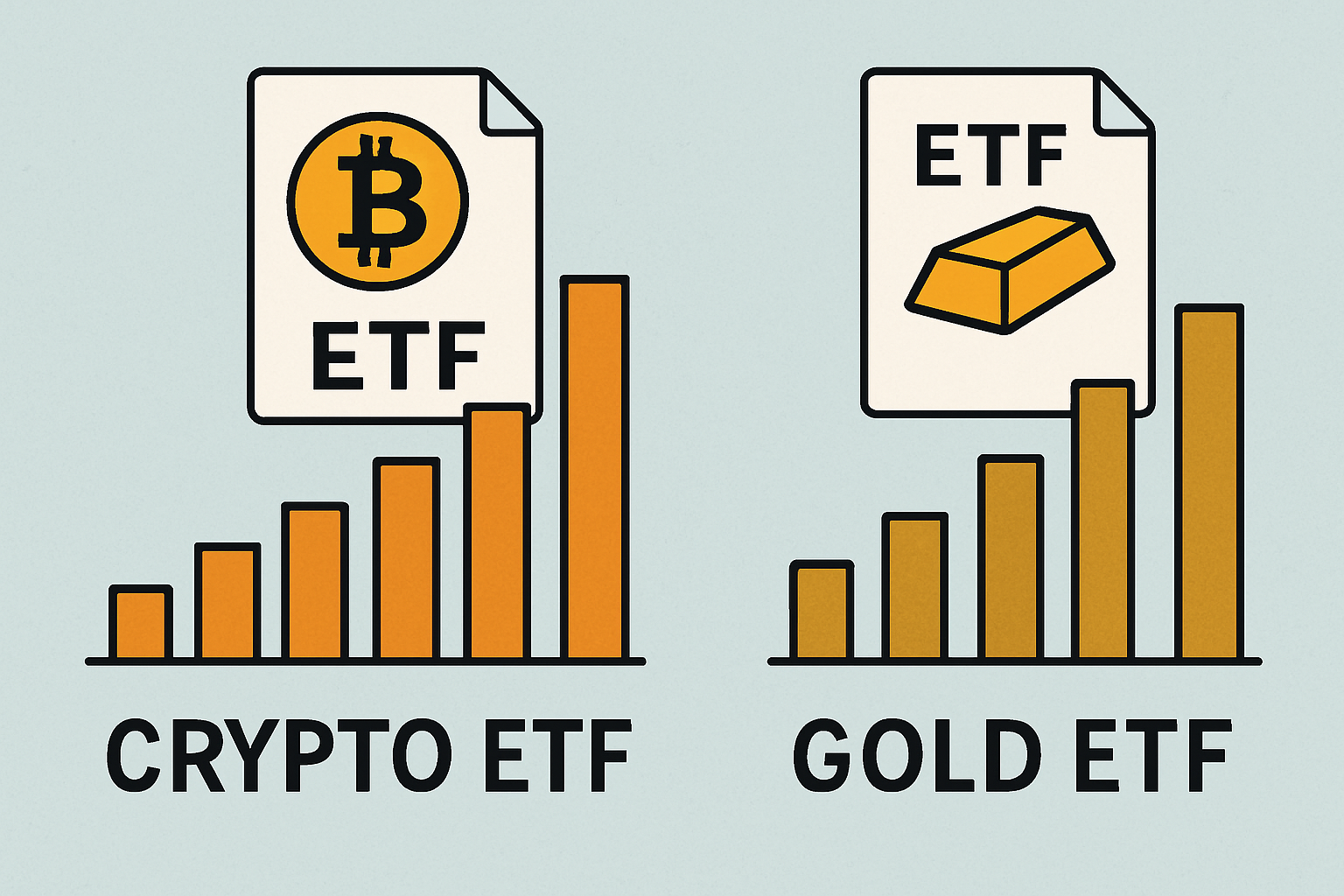

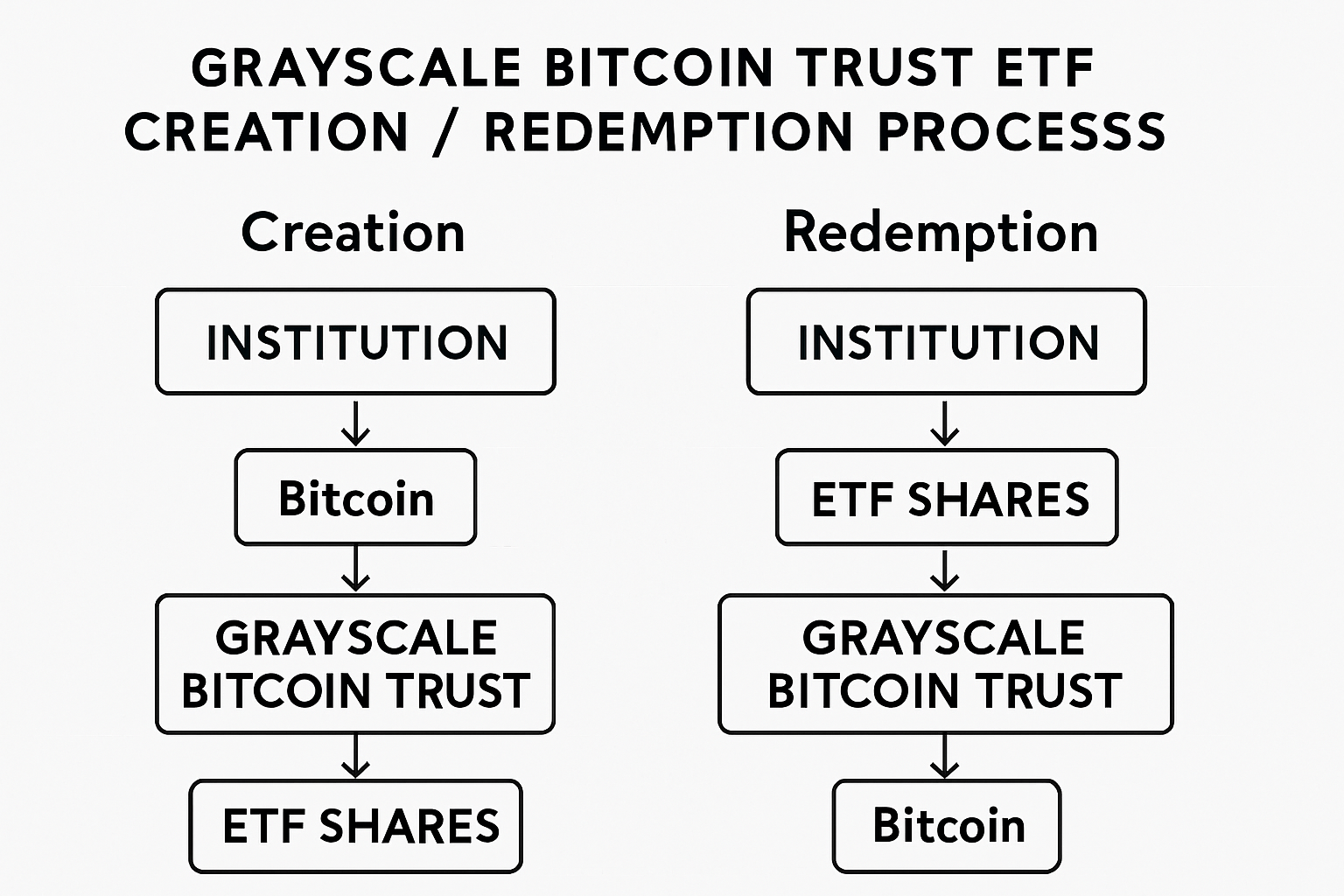

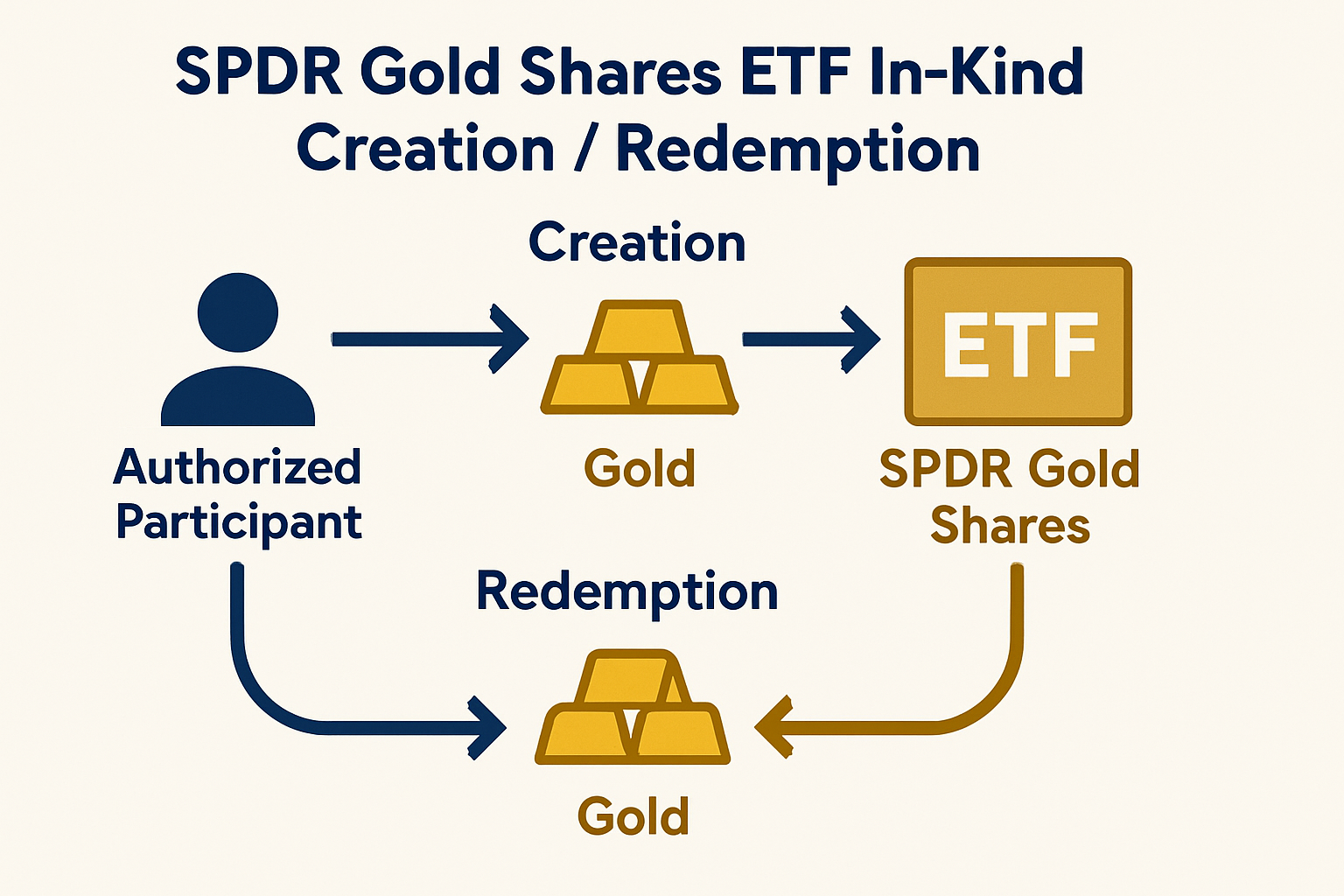

To understand the impact, consider how traditional commodity ETFs like gold have long benefited from in-kind processes. In these structures, authorized participants (APs) can deliver the physical asset in exchange for ETF shares or vice versa, minimizing slippage and keeping ETF prices tightly aligned with the underlying asset’s net asset value (NAV). Until now, crypto ETFs couldn’t replicate this efficiency – every creation or redemption required converting crypto to cash or vice versa, introducing extra fees, settlement delays, and tracking error.

The SEC’s new policy levels the playing field. By allowing direct crypto-for-ETF share exchanges, issuers and APs avoid costly conversions and operational bottlenecks. This is expected to reduce transaction costs, boost liquidity, and narrow the gap between ETF prices and the NAV of their underlying digital assets. According to Jamie Selway, Director of the SEC’s Division of Trading and Markets, in-kind mechanisms “provide flexibility and cost savings to ETP issuers, authorized participants, and investors, resulting in a more efficient market. “

SEC Crypto ETF Approval: Unlocking Institutional Demand

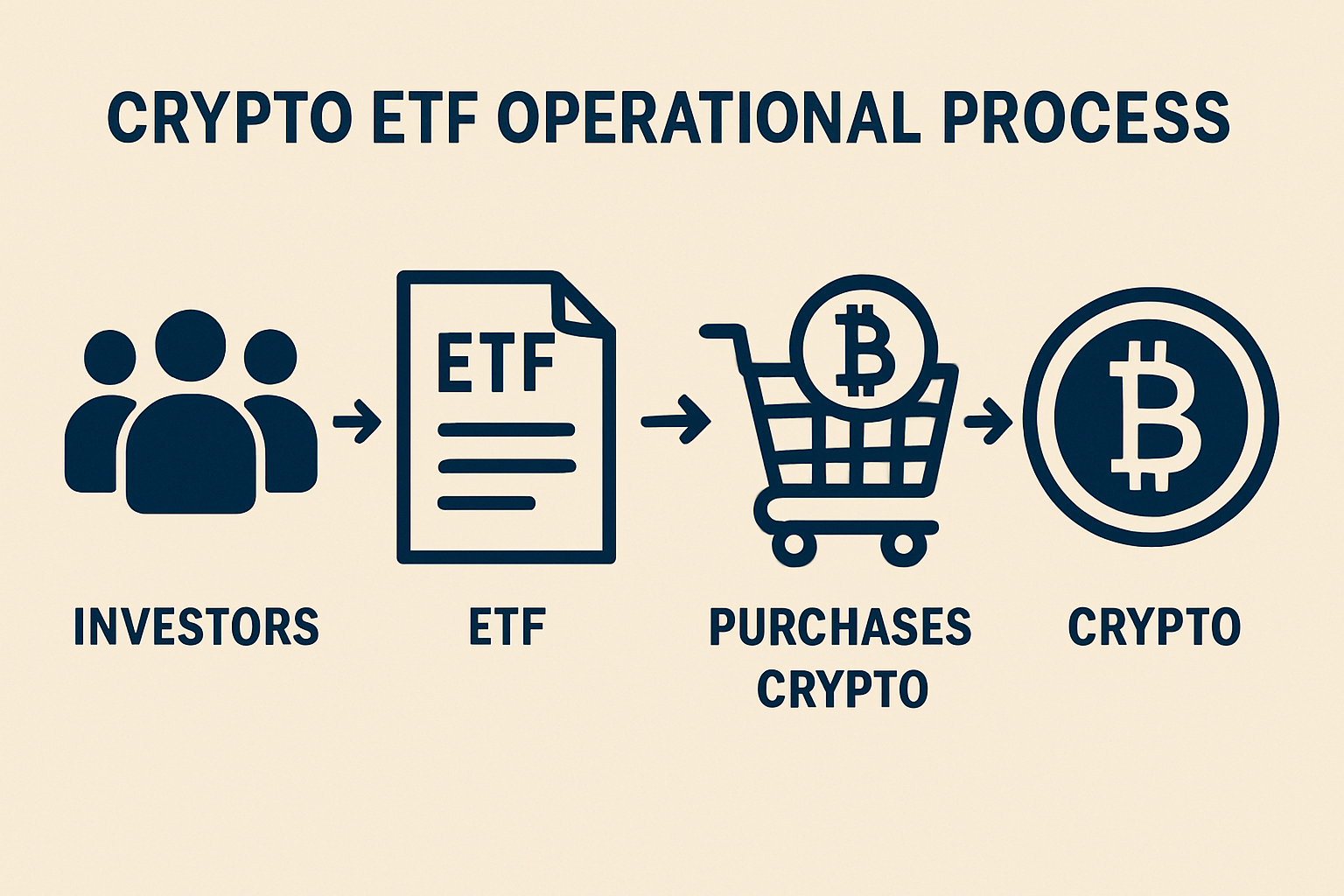

Institutional participation in crypto ETPs has long been hampered by operational risks and cost inefficiencies. The previous cash-only model required APs to source large amounts of cash or crypto on short notice – a logistical headache that deterred many big players. With in-kind creation and redemption now permitted, major banks and trading firms can operate with the same confidence and efficiency they enjoy in traditional ETF markets.

This regulatory milestone is more than a technical upgrade; it signals the SEC’s intent to foster a robust regulatory framework tailored for crypto asset markets. SEC Chairman Paul S. Atkins emphasized that the change is designed to “enhance efficiency and reduce costs for investors” while maintaining market integrity. The move also aligns U. S. crypto ETPs with global best practices, paving the way for broader adoption and deeper liquidity pools.

Top Benefits of In-Kind Creation and Redemption for Crypto ETFs

-

Lower Transaction Costs: In-kind mechanisms let authorized participants exchange ETF shares directly for cryptocurrencies, bypassing costly cash conversions and reducing overall transaction fees for both issuers and investors.

-

Improved Market Efficiency: By aligning crypto ETFs with traditional commodity ETPs, in-kind redemptions help minimize tracking error and keep ETF prices closer to the net asset value of the underlying assets.

-

Enhanced Liquidity: Direct in-kind exchanges make it easier for large institutional players to enter and exit positions, boosting liquidity and deepening the market for crypto ETFs.

-

Operational Flexibility: In-kind creation and redemption provide ETF issuers and authorized participants with more options to manage inventory and respond to market demand, supporting smoother operations.

-

Alignment with Established ETP Practices: The SEC’s approval brings crypto ETFs in line with gold and other commodity ETPs, increasing their appeal to traditional investors and fostering greater institutional adoption.

How In-Kind Structures Improve Bitcoin and Ethereum ETF Efficiency

What does this mean for the structure of flagship products like Bitcoin and Ethereum ETFs? The answer: a leap forward in on-chain ETF efficiency. In-kind mechanisms allow APs to deliver Bitcoin or Ether directly to the ETF issuer’s custodian wallet, receiving new ETF shares in return. Conversely, when redeeming shares, APs can receive crypto instead of cash. This streamlined process cuts out expensive fiat ramps and market makers, reduces bid-ask spreads, and helps keep ETF prices in lockstep with spot crypto prices.

For investors, these changes translate to tighter tracking of underlying assets, fewer hidden costs, and improved price discovery. As the market digests this regulatory evolution, expect to see increased trading volumes and narrower spreads on the most popular crypto ETFs. For a deep dive into the mechanics and investor impact, see our analysis: How In-Kind Redemptions Are Transforming Bitcoin and Ethereum ETFs.

One of the most significant ripple effects of the SEC’s decision is the anticipated surge in liquidity for both Bitcoin and Ethereum ETFs. When authorized participants can transact directly in crypto, they’re no longer at the mercy of banking hours, fiat settlement delays, or costly intermediaries. This means ETF shares can be created or redeemed in real-time, closely shadowing the 24/7 nature of the underlying crypto markets. As a result, arbitrage opportunities shrink, tracking error diminishes, and the ETF’s price becomes a more reliable reflection of actual crypto value.

For ETF issuers, this regulatory shift unlocks new operational strategies. They can now partner with a broader range of liquidity providers, including crypto-native firms, and optimize custody arrangements to reduce friction. The streamlined process also makes it easier to launch new products, such as multi-asset crypto ETFs or on-chain ETF wrappers, which could further diversify the investment landscape. Expect innovation to accelerate as issuers experiment with structures that take full advantage of in-kind flexibility.

What Investors Should Watch: Risks, Rewards, and Market Dynamics

While the benefits are clear, investors should remain vigilant. In-kind creation and redemption introduce new operational nuances, including the need for robust crypto custody and secure settlement protocols. ETF sponsors and custodians must demonstrate airtight controls to prevent losses or hacks during the transfer of digital assets. Regulatory scrutiny will likely intensify, especially as trading volumes swell and more institutional capital enters the arena.

On the reward side, the improved efficiency and cost savings should flow directly to investors. Lower bid-ask spreads and reduced tracking error mean that ETF holders get a product that more closely mirrors the performance of spot Bitcoin or Ether, with fewer hidden fees. As the market matures, look for competitive pressure to drive expense ratios even lower, especially among the largest issuers.

Key Market Shifts as Crypto ETFs Go In-Kind

-

Lower Transaction Costs for Bitcoin & Ethereum ETFs: The SEC’s approval enables authorized participants to directly exchange ETF shares for underlying cryptocurrencies, eliminating the need for costly cash conversions and reducing operational friction for major ETFs like Grayscale Bitcoin Trust (GBTC) and iShares Bitcoin Trust (IBIT).

-

Enhanced Liquidity and Tighter Spreads: In-kind mechanisms are expected to improve liquidity and narrow the gap between ETF prices and the net asset value (NAV) of their underlying crypto assets, benefiting investors trading on platforms like NYSE Arca and Cboe BZX.

-

Increased Institutional Participation: By aligning with traditional commodity ETPs, the new rules lower barriers for institutional players such as Fidelity Digital Assets and Coinbase Prime, who can now participate more efficiently in ETF creation and redemption.

-

Greater Flexibility for ETF Issuers: Leading issuers like BlackRock and VanEck gain operational flexibility, allowing them to manage inflows and outflows with direct crypto transfers, streamlining fund operations.

-

Regulatory Alignment with Traditional ETPs: The SEC’s move brings crypto ETPs in line with established commodity funds, such as SPDR Gold Shares (GLD), setting a precedent for future digital asset products and regulatory clarity.

The Road Ahead: Regulatory Evolution and On-Chain ETF Innovation

The SEC’s green light for in-kind creation and redemption is not just a technical fix, it’s a strategic pivot that sets the stage for broader regulatory evolution. By aligning U. S. crypto ETFs with global standards and traditional commodity ETPs, the SEC is signaling its willingness to integrate digital assets more fully into the financial system. This could lay the groundwork for future approvals of other on-chain ETF products, such as tokenized baskets or DeFi index funds.

As on-chain ETF efficiency improves, so too does investor confidence. The market’s response has already been positive, with trading volumes and liquidity metrics for leading Bitcoin and Ethereum ETFs showing marked improvement since the policy shift. For a closer look at how these changes are impacting real-world trading and settlement infrastructure, explore our feature: How On-Chain ETF Redemptions Are Transforming Bitcoin Settlement and Market Infrastructure.

Ultimately, the SEC’s approval of in-kind mechanisms is a watershed moment for crypto ETF structure and regulation. It removes a key barrier to institutional participation, enhances market efficiency, and opens the door to new product innovation. As issuers, market makers, and investors adapt to this new paradigm, expect the next wave of growth in digital asset ETFs to look markedly different, more liquid, more efficient, and more integrated with the global financial system.