In the heart of 2025’s crypto market, a silent revolution is reshaping how Bitcoin ETFs settle and interact with the underlying asset. With the U. S. Securities and Exchange Commission’s July approval of in-kind creations and redemptions for spot Bitcoin and Ethereum ETFs, the market’s infrastructure has entered a new era. The implications reach far beyond operational tweaks; they represent a fundamental shift in how digital assets are integrated into the broader financial system.

Bitcoin ETF Settlement: The In-Kind Paradigm Shift

Until recently, most crypto ETFs in the U. S. operated on a cash-only basis. If an authorized participant wanted to create or redeem shares, they had to deliver or receive cash, which the ETF issuer would then use to buy or sell Bitcoin. This process introduced friction – extra transaction costs, slow settlement times, and exposure to price slippage. With Bitcoin now trading at $108,506.00, even minor inefficiencies can translate into significant dollar amounts for institutional players.

The SEC’s green light for in-kind ETF redemption changes the game. Now, authorized participants can deliver Bitcoin itself to the ETF issuer when creating shares, or receive Bitcoin when redeeming them. This mirrors the model long used by commodity ETFs (think gold), where physical assets can be exchanged for ETF shares directly. Bitwise, a market leader, executed the industry’s first in-kind creation for a spot Bitcoin ETF this year, setting the stage for a wave of operational innovation.

On-Chain Finance Meets Traditional Infrastructure

What’s truly transformative is the convergence of on-chain finance and ETF market mechanics. With in-kind transactions, settlement can now occur on-chain – directly on the Bitcoin blockchain. This reduces reliance on intermediaries and legacy banking rails, aligning ETF operations more closely with crypto’s native architecture. For market makers and liquidity providers, this means faster, more transparent settlements and fewer points of systemic risk.

The benefits ripple outward: operational efficiency improves as the need for cash conversions drops away, transaction costs shrink, and the ETF’s net asset value (NAV) tracks the underlying asset more tightly. These changes are not just technical footnotes; they’re pivotal for attracting institutional capital that demands robust, predictable infrastructure.

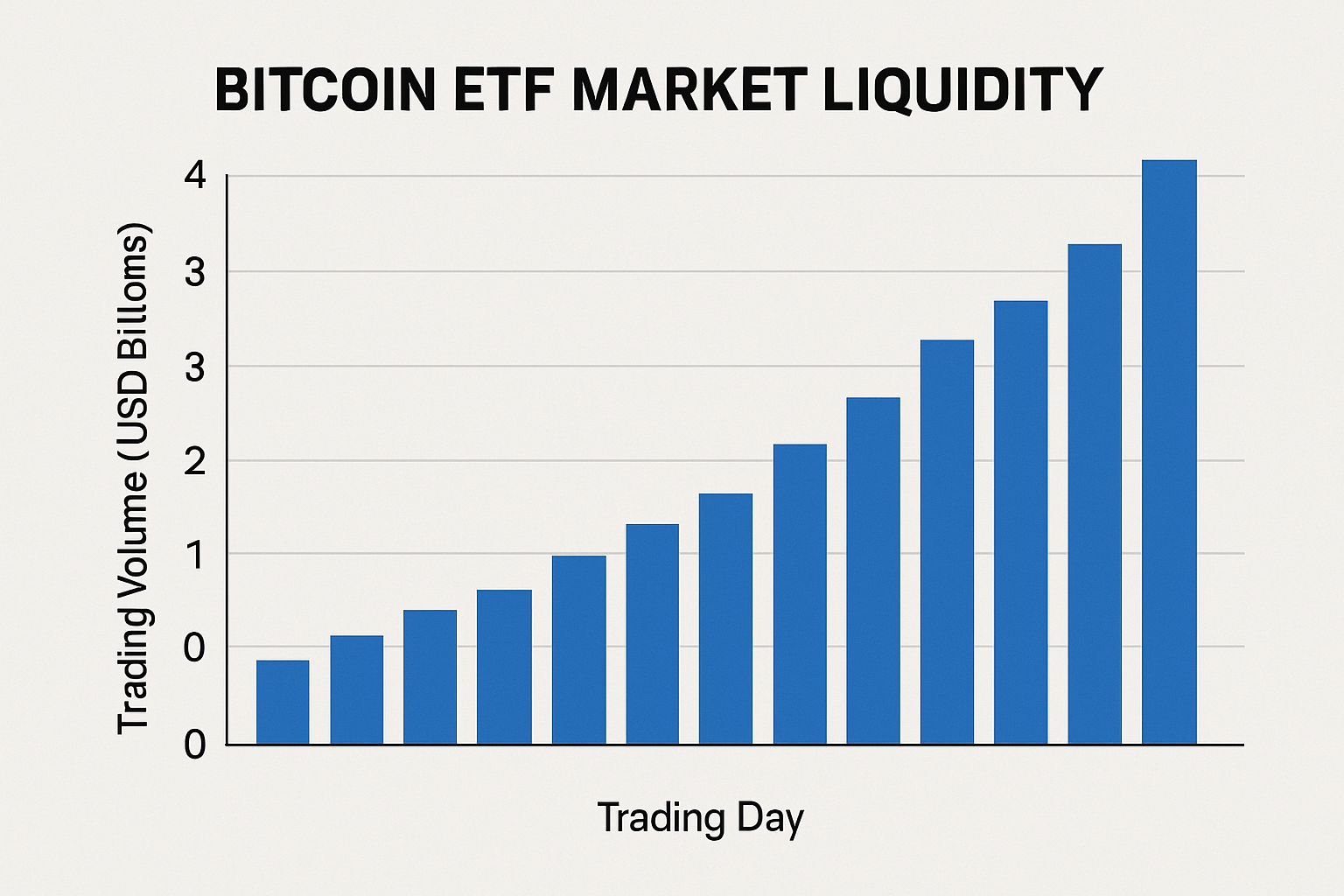

Liquidity Flows and Arbitrage: New Dynamics at $108,506

With Bitcoin maintaining its position above $100,000 – currently priced at $108,506.00 – the stakes for liquidity management have never been higher. In-kind ETF redemptions foster deeper liquidity by allowing authorized participants to arbitrage price discrepancies between ETF shares and spot Bitcoin with minimal friction. This mechanism helps keep ETF prices closely aligned with their underlying assets, reducing premiums or discounts that can erode investor returns.

But there’s nuance here. As noted in recent SEC filings and industry commentary, on-chain settlement also introduces new complexities around transparency and potential arbitrage schemes. Blockchain infrastructure makes it easier to monitor large movements of Bitcoin associated with ETF flows – but it also creates opportunities for sophisticated market participants to anticipate (and potentially front-run) these trades.

Bitcoin Price Prediction 2026-2031 Post In-Kind ETF Adoption

Forecasts based on the impact of in-kind ETF redemptions, regulatory shifts, and evolving market dynamics. All prices are in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $88,000 | $120,000 | $155,000 | +10.6% | Post-ETF adoption volatility; market digests new flows |

| 2027 | $101,000 | $140,000 | $195,000 | +16.7% | Institutional participation rises; ETF volumes grow |

| 2028 | $120,000 | $168,000 | $240,000 | +20.0% | Mainstream acceptance; new use cases, higher liquidity |

| 2029 | $137,000 | $192,000 | $282,000 | +14.3% | Global ETF expansion; tech improvements drive interest |

| 2030 | $158,000 | $222,000 | $325,000 | +15.6% | Bitcoin seen as digital gold; macro adoption increases |

| 2031 | $180,000 | $250,000 | $370,000 | +12.6% | Stabilizing growth; mature ETF infrastructure |

Price Prediction Summary

Bitcoin is projected to experience steady growth from 2026 to 2031, supported by the adoption of in-kind ETF redemptions, improved market infrastructure, and increased institutional participation. While there may be short-term volatility as markets adjust to new ETF mechanisms, the long-term outlook is bullish, with average prices potentially more than doubling by 2031. The wide min/max range reflects ongoing regulatory, macroeconomic, and technology-driven uncertainties.

Key Factors Affecting Bitcoin Price

- Impact of in-kind ETF redemptions on market liquidity and efficiency

- Increased institutional adoption due to familiar ETF structures

- Evolving global regulatory landscape and potential for further ETF approvals

- Technological improvements in blockchain and trading infrastructure

- Competition from alternative cryptocurrencies and digital assets

- Macro-economic trends, including global monetary policy and inflation

- Cycles of Bitcoin halving events and their effect on supply/demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tax Efficiency: A Quiet Revolution for Crypto Investors

The tax implications of in-kind redemptions are subtle but profound. By exchanging ETF shares for Bitcoin directly rather than cashing out, investors may be able to defer capital gains taxes that would otherwise be triggered by a sale event. This mirrors the tax efficiency that has made commodity ETFs so attractive to long-term holders.

The result? Crypto ETFs become more competitive with traditional investment vehicles at precisely the moment institutional adoption is accelerating. With Bitwise’s pioneering moves and regulatory clarity from the SEC, we’re witnessing the maturation of crypto ETF infrastructure into something that looks – and functions – much like its gold-backed predecessors.

Yet, the impact of on-chain ETF redemption goes beyond the mechanics of settlement and tax. It is actively reshaping how liquidity pools form and dissolve across exchanges, OTC desks, and decentralized protocols. With authorized participants able to move substantial sums of Bitcoin in and out of ETF wrappers at scale, arbitrage spreads have tightened. This efficiency not only benefits institutional traders but also trickles down to retail investors through narrower bid-ask spreads and more reliable ETF tracking.

Consider the macro picture: as ETFs like Bitwise’s BITB leverage in-kind mechanics, they become a bridge between legacy capital markets and the evolving world of on-chain finance. The direct settlement of Bitcoin at $108,506.00 via blockchain rails means that ETF liquidity is now inextricably linked to global Bitcoin liquidity. This is a step-change from the days when ETF flows were siloed within traditional banking infrastructure.

Risks and Opportunities: Navigating a New Market Structure

Of course, this transformation is not without challenges. On-chain transparency is a double-edged sword; while it enables real-time auditability and reduces settlement risk, it also exposes large ETF-related flows to public scrutiny. Sophisticated actors may attempt to front-run or otherwise exploit visible movements, as highlighted in Bitwise’s own regulatory filings. The arms race between transparency and market integrity is now playing out in real time.

Still, the opportunities outweigh the risks. As more ETF issuers adopt in-kind models and settlement infrastructure matures, we can expect further convergence between crypto’s decentralized ethos and the demands of institutional-grade finance. This is likely to drive new products, such as multi-asset crypto ETFs and on-chain index funds, that offer both efficiency and transparency.

Key Advantages of On-Chain ETF Redemptions

-

Enhanced Operational Efficiency: In-kind redemptions allow ETF issuers and authorized participants to exchange ETF shares directly for Bitcoin, eliminating the need for cash conversions. This streamlines settlement processes and reduces transaction costs for both investors and institutions.

-

Improved Market Liquidity: Direct handling of Bitcoin during ETF creations and redemptions increases liquidity in both the ETF and spot Bitcoin markets. This mechanism aligns crypto ETFs with traditional commodity ETFs, such as those for gold, which have long utilized in-kind transactions.

-

Tax Efficiency: In-kind redemptions can help investors defer capital gains taxes by allowing them to receive Bitcoin directly, rather than triggering taxable events through cash sales. This tax treatment mirrors the advantages seen in traditional commodity ETFs.

-

Alignment with Traditional Financial Practices: The SEC’s approval of in-kind redemptions brings crypto ETFs in line with established financial products, making them more attractive to institutional investors seeking familiar structures and operational standards.

For investors watching the market at $108,506.00, this moment is pivotal. The seamless integration of ETF shares with native Bitcoin settlement is not just a technical upgrade; it signals Wall Street’s growing comfort with blockchain rails. As familiar mechanisms from gold and commodity ETFs are ported into crypto, the line between traditional and digital asset markets is blurring.

Bitwise’s leadership in executing the first in-kind creation for a spot Bitcoin ETF is more than a headline – it’s a signal that crypto ETF infrastructure is ready for prime time. For those seeking deeper insight into how these mechanics work and what they mean for portfolio construction, see our comprehensive analysis at How In-Kind Redemptions Are Transforming Bitcoin ETFs: What Crypto Investors Need to Know.

As regulatory clarity continues to emerge and in-kind models become industry standard, expect the next wave of innovation to focus on scalability and cross-chain compatibility. The future of Bitcoin ETF settlement – at today’s price point or higher – will be defined by its ability to harness both the security of blockchain and the efficiency demanded by global capital markets.