On-chain crypto ETFs are rapidly changing the landscape of decentralized finance (DeFi) investments, blending the efficiency and transparency of blockchain with the familiar structure of exchange-traded funds. For both retail and institutional investors, these new financial products offer a gateway to diversified crypto exposure without the friction and opacity of traditional intermediaries. As DeFi matures, on-chain ETFs are emerging as a cornerstone for the next phase of digital asset investing.

Why On-Chain Crypto ETFs Are Gaining Momentum

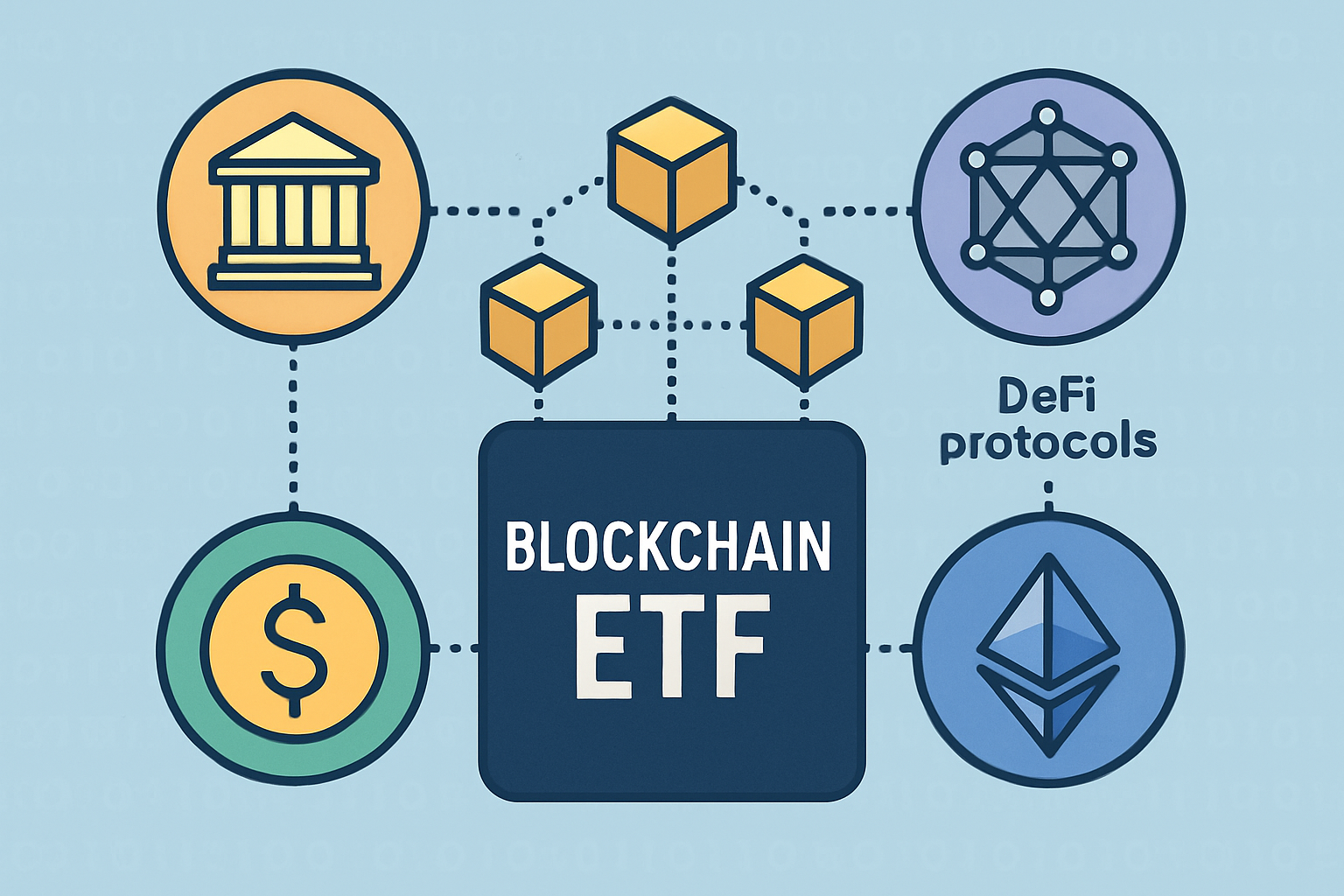

The surge in interest around on-chain crypto ETFs can be traced to several groundbreaking developments. Major players like Franklin Templeton are seeking regulatory approval for crypto index ETFs, signaling growing institutional confidence in blockchain-based investment vehicles. Meanwhile, innovative protocols such as DamFi are introducing On-Chain Autonomous Funds (OAFs) – essentially smart contract-powered ETFs that natively interact with DeFi ecosystems. These OAFs use technologies like Zero-Knowledge Proofs (ZKPs) to maintain trustless, efficient operations while maximizing yield by tapping into external DeFi protocols.

At the same time, platforms like Trust Wallet and Ondo Finance are tokenizing access to U. S. stocks and traditional ETFs. This allows users from around the world to trade assets such as Apple or S and P 500 ETFs directly on-chain, sidestepping conventional brokerage barriers. The result is a more inclusive financial system where anyone with an internet connection can participate in global markets.

Impact on DeFi: Liquidity, Diversification, Accessibility

The integration of on-chain ETF products into DeFi platforms is already having profound effects:

- Enhanced Liquidity: The influx of assets into on-chain ETFs is tightening supply across major cryptocurrencies. For example, Bitcoin ETFs now collectively hold about 1.47 million BTC – roughly 7% of all Bitcoin in existence – while Ethereum ETFs manage $28.8 billion worth of ETH, accounting for around 6% of its market cap. This institutional custody is reshaping liquidity dynamics within DeFi markets.

- Diversification Opportunities: By packaging multiple tokens or strategies into a single ETF-like product, investors can spread risk across a basket of assets rather than betting on individual coins. This approach mirrors how index funds democratized access to stock markets and could have similar effects for crypto adoption.

- Increased Accessibility: On-chain ETF products eliminate middlemen and paperwork; anyone with a digital wallet can invest directly from anywhere in the world. This democratization opens up DeFi investments to millions who were previously excluded from traditional finance.

The Technology Behind On-Chain ETF Products

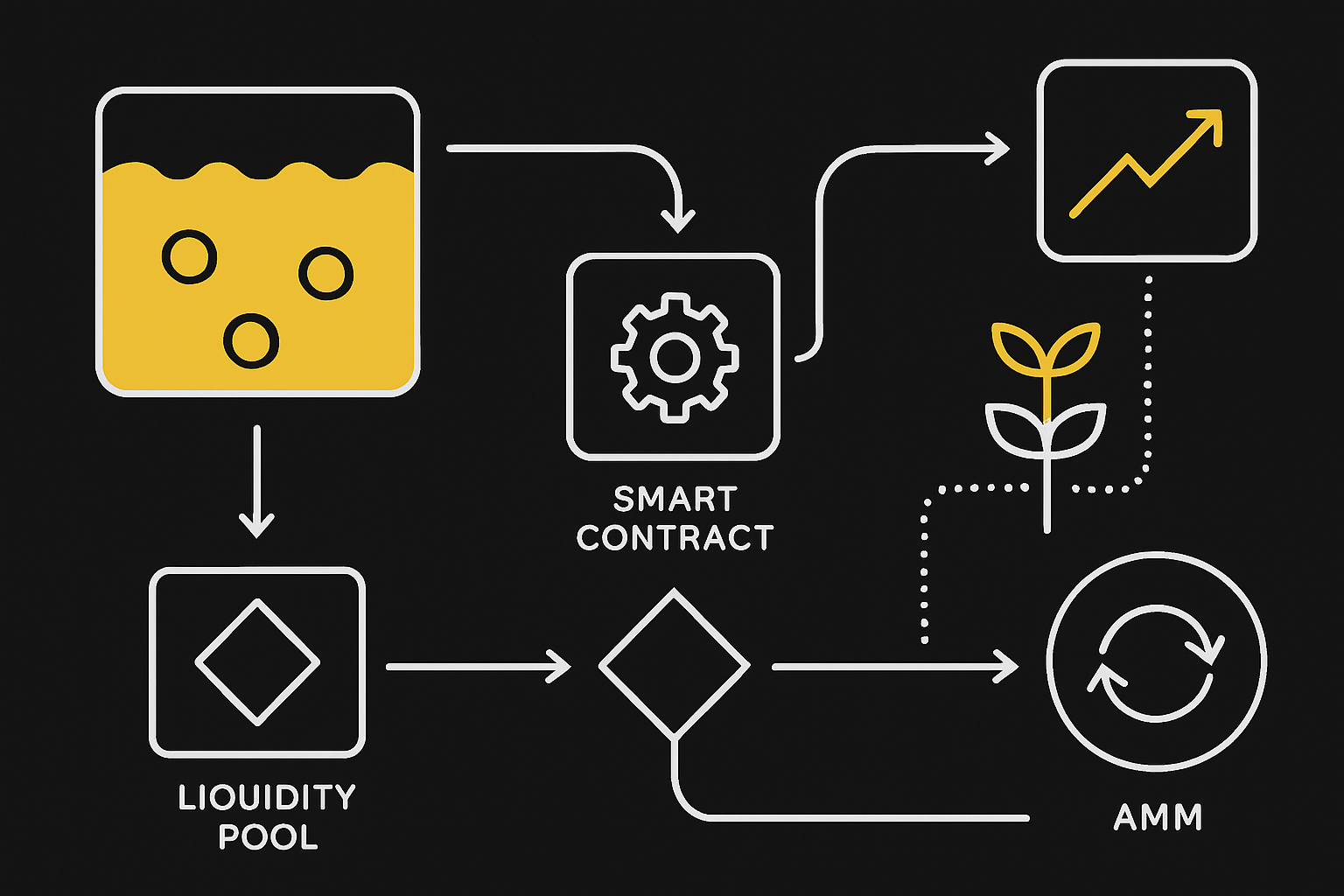

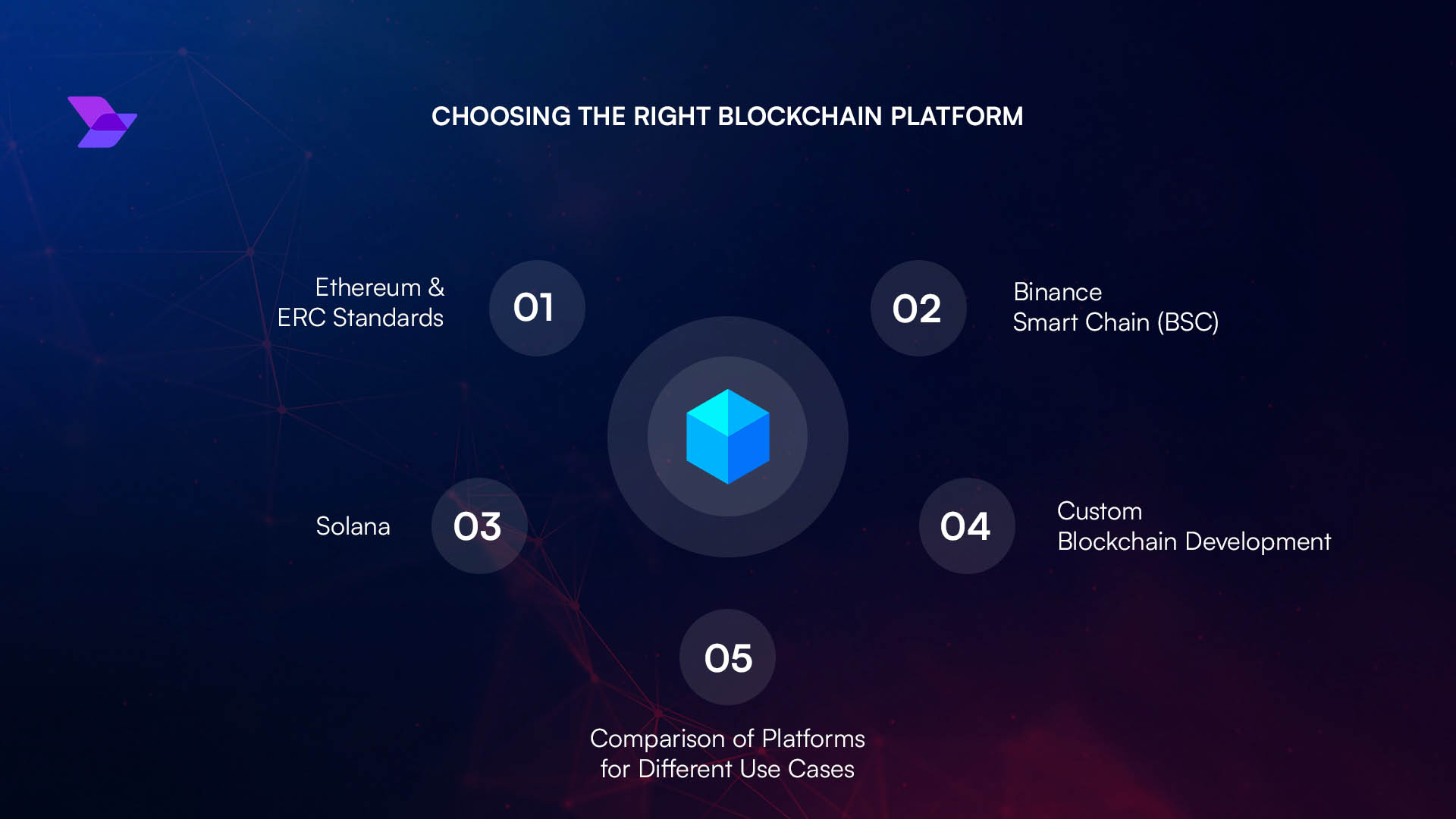

Unlike conventional crypto funds that rely on centralized custodians and off-chain accounting, true on-chain ETFs operate transparently via smart contracts deployed directly onto blockchains like Ethereum or Solana. These contracts automate portfolio rebalancing, fee distribution, and share issuance/redemption – all visible and verifiable by anyone using blockchain explorers.

This transparency not only reduces operational risk but also enables new forms of composability: for instance, an on-chain ETF could integrate with lending protocols to generate additional yield or automatically swap assets based on market conditions using decentralized exchanges.

If you’re curious about how these mechanisms differ from legacy approaches, check out our deep dive: On-Chain ETFs vs Traditional ETFs: Key Differences for Modern Crypto Investors.

As these technical innovations take hold, the user experience is also evolving. Investors now benefit from real-time portfolio transparency, instant settlement, and programmable compliance features that adapt to regulatory changes. This is a sharp contrast to traditional ETFs, where disclosures lag and operational processes are often opaque.

Top 5 Benefits of On-Chain Crypto ETFs for DeFi Investors

-

1. Enhanced Transparency and SecurityOn-chain crypto ETFs operate directly on public blockchains, allowing investors to track fund holdings and transactions in real time. This transparency reduces the risk of mismanagement and ensures assets are held securely in smart contracts, not by centralized custodians.

-

2. Diversified Exposure to Crypto AssetsOn-chain ETFs offer instant diversification by bundling multiple cryptocurrencies or DeFi tokens into a single product. For example, Franklin Templeton’s crypto index ETF and DamFi’s On-Chain Autonomous Funds allow investors to spread risk across various assets, reducing volatility compared to holding individual tokens.

-

3. Increased Accessibility and Global ParticipationBy eliminating intermediaries, on-chain ETFs make it possible for anyone with a digital wallet and internet access to invest. Platforms like Trust Wallet and Ondo Finance enable global users to trade tokenized stocks and ETFs directly on-chain, democratizing access to financial markets.

-

4. Improved Liquidity in DeFi MarketsThe integration of on-chain ETFs has led to significant asset inflows—for instance, Bitcoin ETFs hold about 1.47 million BTC (7% of total supply), and Ethereum ETFs manage $28.8 billion (6% of ETH’s market cap). These inflows are reshaping DeFi liquidity and market dynamics.

-

5. Efficient Yield Generation and Capital ProductivityOn-chain ETFs can interact with DeFi protocols to generate yield by lending or staking underlying assets. This means investors’ funds are not just passively held but can earn interest, turning idle tokens into productive capital—similar to on-chain lending markets described by Galaxy.

Moreover, the ability to create and redeem ETF shares directly on-chain means products can maintain tighter price tracking to their underlying assets. This mechanism reduces the arbitrage gap that sometimes plagues off-chain crypto funds. For those interested in the mechanics of these new models, our analysis on How On-Chain Bitcoin ETFs Differ from Traditional Crypto ETFs provides further insights.

Risks and Regulatory Considerations

While on-chain ETF products offer compelling advantages, they are not without risks. Smart contract vulnerabilities, protocol hacks, and evolving regulatory frameworks present ongoing challenges. Investors must also consider volatility, especially as leveraged DeFi ETF products emerge, amplifying both potential returns and losses.

Regulators worldwide are grappling with how to classify and oversee these hybrid instruments. The SEC’s recent openness to in-kind creation and redemption models signals progress but leaves many questions unanswered about long-term oversight. For a closer look at regulatory shifts impacting the space, explore our coverage: How In-Kind Creation and Redemption Is Transforming Crypto ETFs: The SEC’s Green Light Explained.

What’s Next for DeFi Investors?

The convergence of on-chain crypto ETFs with decentralized finance is still in its early innings. As protocols mature and more traditional assets become tokenized for on-chain trading, expect greater integration between centralized finance (CeFi) and DeFi ecosystems. The next generation of ETF-like products could bundle everything from stablecoins to synthetic equities, expanding both the scope and stability of DeFi investments.

For everyday investors, this means new tools for portfolio diversification with fewer barriers to entry. For institutions, it offers a compliant way to tap into DeFi’s innovative yield strategies while maintaining familiar risk controls.

Ultimately, on-chain ETF products are not just another investment vehicle, they’re a catalyst accelerating the unbundling of financial services as we know them. Their continued evolution will likely define how value moves across digital asset markets for years to come.