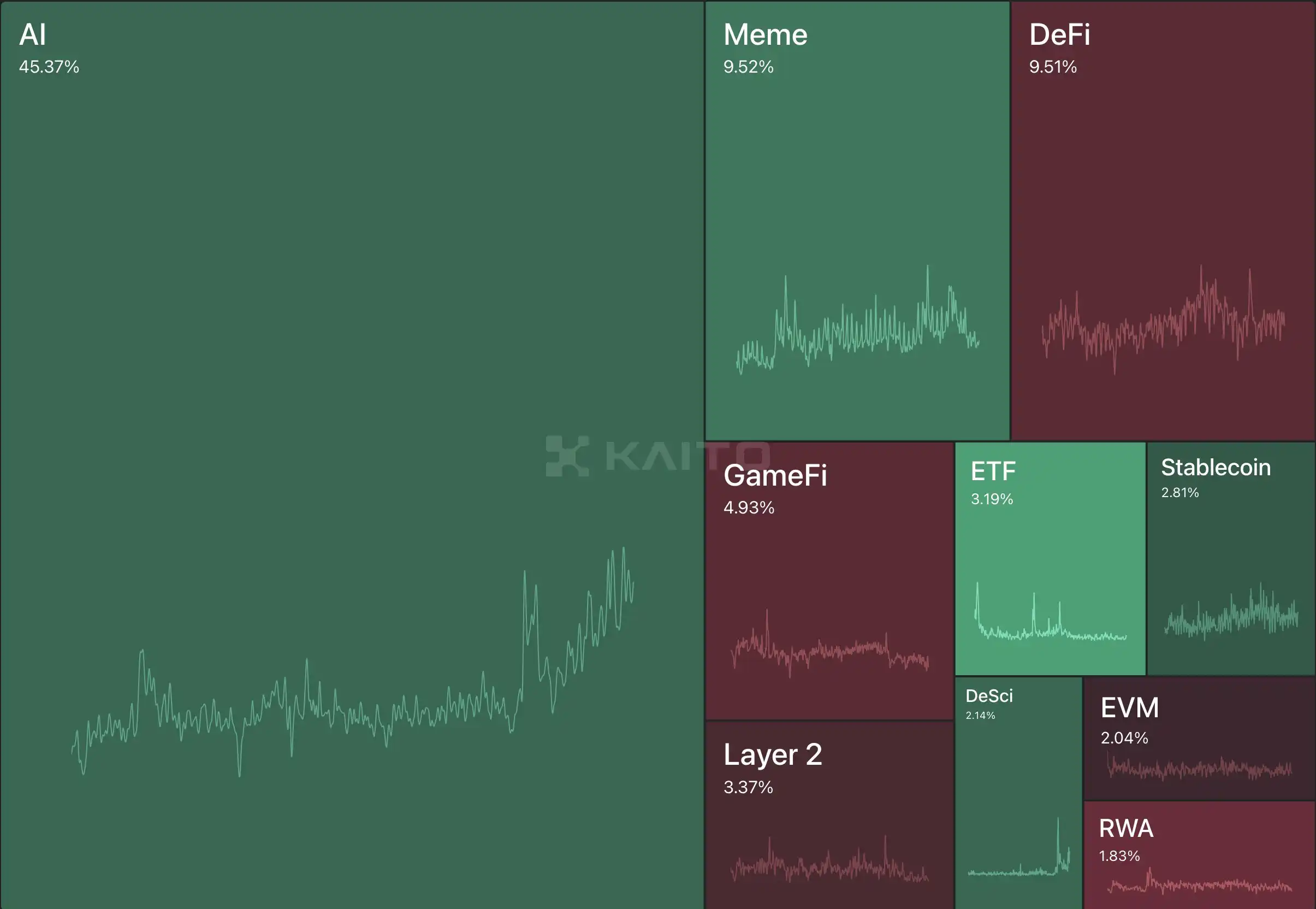

As Bitcoin sits at a remarkable $111,303, the landscape for crypto ETFs is evolving at a blistering pace. The latest market surge has not only propelled Bitcoin to new heights but also triggered record inflows into global crypto ETFs, with $5.95 billion pouring in during the week ending October 4,2025. Amid this momentum, a new class of investment vehicles is emerging: on-chain Bitcoin ETFs. But how do these innovative structures stack up against traditional crypto ETFs? Let’s break down the differences and why they matter for investors seeking transparency, efficiency, and exposure to digital assets.

Spotlight on Market Momentum: Bitcoin at $111,303 and ETF Inflows Surge

The numbers are impossible to ignore. With Bitcoin currently trading at $111,303: up 2.06% over the last 24 hours, the narrative surrounding digital asset investment vehicles is shifting rapidly. Institutional giants like BlackRock have seized the spotlight; its iShares Bitcoin Trust now leads as the world’s largest Bitcoin fund with nearly $20 billion in assets since its U. S. debut in January 2024.

This institutional embrace has catalyzed fierce competition among ETF providers and underscored a global appetite for regulated crypto exposure. In Asia, Hong Kong’s launch of spot Bitcoin and Ether ETFs drew robust participation, with all three Bitcoin ETFs advancing over 2% on their first day. The SEC’s recent approval of in-kind creations and redemptions for U. S. -listed crypto ETPs further aligns these products with traditional commodity ETFs, potentially lowering costs and increasing efficiency for investors.

Core Structural Differences: On-Chain vs Traditional Crypto ETFs

The term on-chain Bitcoin ETF refers to funds that settle and verify their underlying assets directly on a public blockchain, usually Ethereum or another programmable network supporting tokenized representations of BTC. In contrast, traditional crypto ETFs (including most spot and futures-based offerings) rely on off-chain custodianship and legacy financial rails for settlement.

- Transparency: On-chain ETFs allow investors to independently verify fund holdings via blockchain explorers, a radical leap from opaque quarterly disclosures typical of traditional structures.

- Real-Time Settlement: On-chain mechanisms can enable near-instant creation/redemption cycles, versus T and 1 or longer timelines in legacy ETF systems.

- Custody Model: Traditional ETFs depend on third-party custodians; on-chain funds may use smart contracts or decentralized custody protocols to manage assets.

- Auditability: Every transaction within an on-chain ETF is immutably recorded, offering an unprecedented level of auditability compared to private books maintained by custodians or fund administrators.

This enhanced transparency is not just theoretical, it’s increasingly demanded by sophisticated investors wary of counterparty risk after high-profile collapses in both centralized finance (CeFi) and DeFi sectors.

The SEC’s Green Light: In-Kind Creation/Redemption Transforms Crypto ETPs

A pivotal regulatory shift arrived this year when the U. S. Securities and Exchange Commission approved in-kind creation and redemption for crypto ETPs. This move enables authorized participants to deliver or receive actual cryptocurrency rather than cash during primary market transactions, a process already standard for gold or commodity-backed ETFs but novel for digital assets until now.

The implications are profound: reduced tracking error, minimized slippage during volatile periods, and lower operating costs as funds can avoid unnecessary conversion fees. For on-chain ETFs specifically, this regulatory clarity paves the way for even tighter integration between blockchain infrastructure and mainstream capital markets, potentially setting a new benchmark for efficiency across all ETF types.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on current ETF trends, institutional adoption, and regulatory developments (as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $94,000 | $120,000 | $148,000 | +7.8% | Potential post-ETF euphoria correction; ETF inflows stabilize; regulatory clarity continues |

| 2027 | $105,000 | $135,000 | $168,000 | +12.5% | Renewed institutional interest; macroeconomic uncertainty drives safe-haven demand |

| 2028 | $118,000 | $155,000 | $196,000 | +14.8% | Next Bitcoin halving event boosts scarcity narrative; global ETF expansion |

| 2029 | $132,000 | $172,000 | $218,000 | +11.0% | Mainstream portfolio allocation rises; increased competition from altcoins |

| 2030 | $145,000 | $192,000 | $245,000 | +11.6% | Global adoption grows; regulatory frameworks mature; technology improvements (scalability, privacy) |

| 2031 | $160,000 | $215,000 | $272,000 | +12.0% | Bitcoin seen as digital gold; robust ETF infrastructure; potential new all-time highs |

Price Prediction Summary

Bitcoin is projected to experience steady growth through 2031, supported by strong ETF inflows, increasing institutional adoption, and maturing regulatory frameworks. While volatility and periodic corrections are expected, the long-term trajectory remains bullish, with average prices potentially reaching $215,000 by 2031. Bearish scenarios (minimums) reflect possible macroeconomic shocks or regulatory headwinds, while bullish scenarios (maximums) assume continued global adoption and favorable policy environments.

Key Factors Affecting Bitcoin Price

- Record ETF inflows and global ETF launches (especially in the US and Asia)

- SEC approval of in-kind redemptions for crypto ETFs, improving efficiency and investor appeal

- Institutional adoption and Bitcoin’s role as a portfolio diversifier amid economic uncertainty

- Technology upgrades (scalability, privacy, and security)

- Periodic Bitcoin halving events increasing scarcity and price potential

- Regulatory clarity in major markets (US, Europe, Asia)

- Competition from alternative digital assets and new ETF products

- Macro-economic factors such as inflation, monetary policy, and geopolitical risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Appeal, and Potential Risks, of On-Chain Crypto ETF Models

The promise of real-time settlement and radical transparency comes with its own set of considerations:

- Smart contract vulnerabilities: Even rigorously audited code can harbor bugs leading to potential exploits or losses.

- Regulatory uncertainty: Jurisdictions differ widely in their stance toward tokenized securities; cross-border compliance remains complex.

- User experience: Blockchain-based operations may introduce friction (e. g. , gas fees) unfamiliar to traditional ETF investors.

This evolving risk-reward calculus makes it essential for investors to stay informed about both technological advances and policy shifts shaping the future of crypto ETF structures. For an even deeper dive into these distinctions, check out our detailed guide: On-Chain vs Traditional Crypto ETFs: Key Differences for Modern Investors.

While the case for on-chain Bitcoin ETFs is compelling, the real-world impact depends on how these innovations play out amid today’s volatile and competitive market environment. With $5.95 billion in weekly global ETF inflows and Bitcoin steady at $111,303, investors are demanding more than just price exposure, they want efficiency, clarity, and robust security measures.

Transparency and Trust: How On-Chain ETFs Reshape Investor Confidence

Traditional crypto ETFs have made digital assets accessible to mainstream investors, but they still operate within a black box compared to their on-chain counterparts. The ability to verify holdings in real time, down to each satoshi, shifts the paradigm of trust from institutional promises to mathematical certainty. This is especially relevant as institutional allocation accelerates: BlackRock’s $20 billion iShares Bitcoin Trust is testament to surging confidence in regulated crypto vehicles, yet even these giants must contend with investor calls for greater transparency.

On-chain ETF transparency doesn’t just satisfy regulatory requirements; it actively empowers investors to audit fund reserves, monitor flows, and assess risk without waiting for quarterly or annual reports. For those who lived through CeFi failures or DeFi exploits, this is a strategic advantage, not just a technical one.

Efficiency Unlocked: Real-Time Settlement and Lower Friction

One of the most significant operational advantages of on-chain Bitcoin ETFs is real-time settlement. Traditional ETF creation/redemption cycles can lag by hours or even days, an eternity during periods of high volatility. By contrast, on-chain structures can process transactions nearly instantly using smart contracts. This means tighter spreads, less slippage, and better price tracking for investors seeking precision exposure at moments when every second counts.

The SEC’s approval of in-kind creation/redemption further narrows the gap between crypto ETPs and their commodity-based relatives. Funds can now accept or deliver Bitcoin itself rather than relying solely on cash settlements, a critical step that reduces conversion costs and makes ETF pricing more responsive to spot markets.

Navigating On-Chain ETF Risks in a Rapidly Evolving Market

No innovation comes without trade-offs. While on-chain ETF risks such as smart contract exploits or evolving regulatory frameworks cannot be ignored, these are increasingly manageable with robust audits, insurance protocols, and adaptive compliance strategies. Investors should weigh these risks against the potential for improved liquidity, transparency, and operational efficiency, especially as more capital flows into tokenized products worldwide.

Key Differences: On-Chain Bitcoin ETFs vs Traditional Crypto ETFs

-

Custody and Transparency: On-chain Bitcoin ETFs hold Bitcoin directly on the blockchain, enabling transparent, verifiable proof of reserves. Traditional crypto ETFs may use off-chain custodians, limiting on-chain auditability.

-

Redemption Mechanisms: On-chain ETFs can offer in-kind redemptions, letting authorized participants exchange ETF shares for actual Bitcoin. Traditional ETFs often rely on cash redemptions, which do not deliver underlying crypto assets.

-

Trading Venue and Accessibility: Both ETF types trade on regulated stock exchanges (e.g., NYSE, Nasdaq, HKEX), but on-chain ETFs may also integrate with decentralized finance (DeFi) platforms for enhanced accessibility. Traditional ETFs remain within conventional brokerage frameworks.

-

Regulatory Oversight: Traditional crypto ETFs are subject to strict regulatory frameworks (e.g., SEC in the U.S.), while on-chain ETFs may face additional blockchain-specific compliance and reporting requirements.

-

Fees and Efficiency: On-chain ETFs can potentially reduce management and transaction fees by leveraging blockchain automation. Traditional ETFs may have higher costs due to intermediaries and manual processes.

The explosive rise in both price ($111,303) and institutional inflows signals that crypto ETFs are no longer niche products, they’re becoming foundational portfolio tools during times of economic uncertainty. As competition heats up between legacy financial heavyweights and innovative blockchain-native entrants, expect further evolution in product design and regulatory standards.

If you’re evaluating whether an on-chain Bitcoin ETF vs traditional ETF better fits your strategy, keep an eye on transparency features, settlement speed, custody protocols, and above all else, the adaptability of your chosen vehicle as new rules emerge.

The next wave of digital asset investing will be defined by those who demand not just access but agency over their holdings. Whether you’re seeking radical transparency or simply lower friction at scale, understanding these structural differences will be key to navigating the future of crypto exposure with confidence.