For modern crypto investors, the landscape of exchange-traded funds is undergoing a profound transformation. The emergence of on-chain ETFs, sometimes called decentralized or tokenized ETFs, has introduced a new paradigm that challenges the traditional model managed by established financial institutions. As blockchain technology matures and adoption accelerates, understanding the critical differences between on-chain and traditional ETFs becomes essential for anyone seeking transparency, flexibility, and advanced features in their digital asset portfolios.

Transparency and On-Chain Verification: Real-Time Oversight vs. Periodic Disclosures

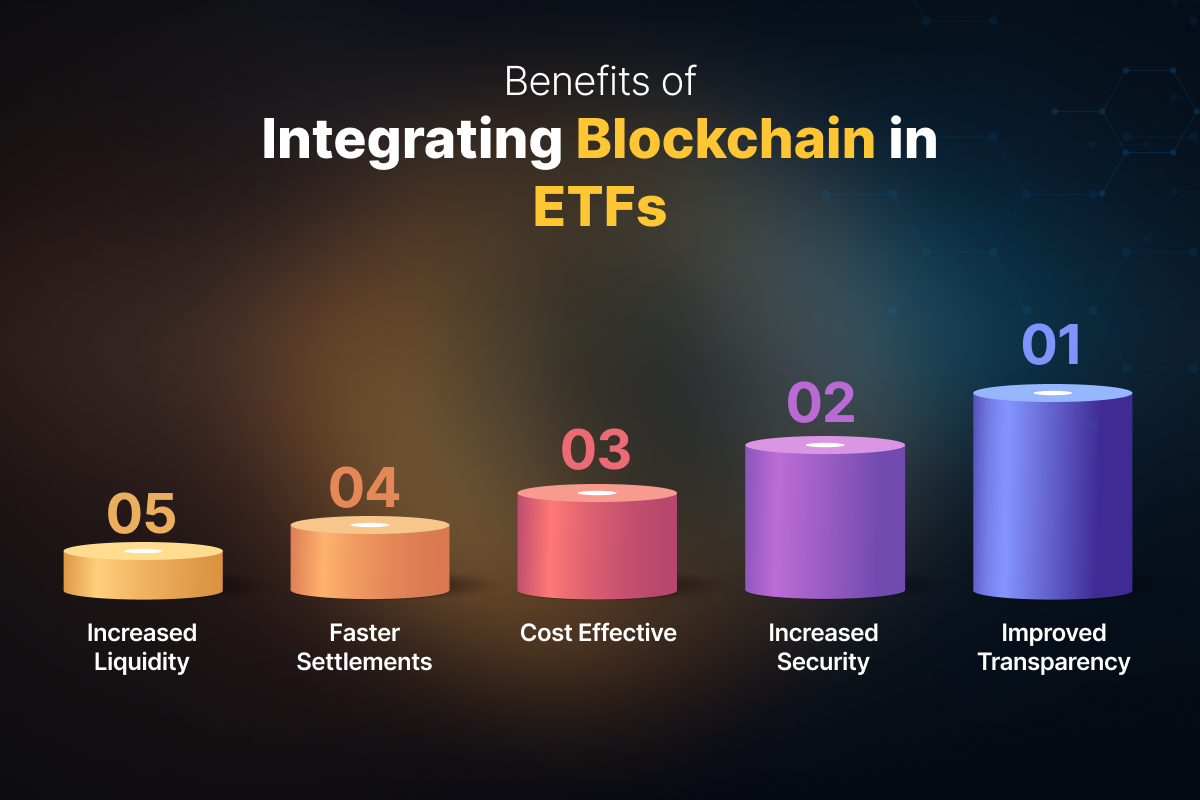

One of the most compelling advantages of on-chain ETFs lies in their unparalleled transparency. Every transaction, holding, and portfolio adjustment is immutably recorded on a public blockchain. This enables investors to independently verify fund assets in real time without relying solely on periodic reports or statements from fund managers. In contrast, traditional ETFs typically disclose their holdings at set intervals, often quarterly or monthly, which can obscure short-term changes and limit an investor’s ability to monitor risk exposures dynamically.

This real-time verification is not just a technical upgrade; it represents a fundamental shift in investor empowerment. With on-chain ETF benefits such as open-access auditing, investors can track rebalancing events, fee distributions, and even governance decisions as they occur, all without third-party gatekeepers. For those who prioritize data integrity and trustlessness in their investments, this feature alone can be transformative.

24/7 Global Accessibility and Trading: Breaking Free from Market Hour Constraints

The global nature of cryptocurrency markets has set new expectations for accessibility, and on-chain ETFs deliver continuous trading. Unlike traditional ETFs that are confined to specific exchanges with limited trading hours (such as 9: 30 AM to 4: 00 PM Eastern Time for U. S. -listed funds), decentralized token folios are available around the clock via decentralized exchanges (DEXs). This means investors can enter or exit positions at any time, regardless of local holidays or after-hours market closures.

This 24/7 global access isn’t just about convenience; it provides strategic advantages in volatile markets where price movements can be rapid and unpredictable. By eliminating geographic barriers and market hour limitations, on-chain ETFs align with the always-on ethos of crypto investing, enabling participants worldwide to react instantly to news events or macroeconomic shifts.

Key Accessibility Differences: On-Chain vs Traditional ETFs

-

Transparency and On-Chain Verification: On-chain ETFs offer real-time transparency by recording all transactions and holdings directly on the blockchain. Investors can independently verify fund assets and activity at any time, thanks to open, immutable ledgers. In contrast, traditional ETFs rely on periodic disclosures from fund managers, which may not provide the same level of immediate visibility or auditability.

-

24/7 Global Accessibility and Trading: On-chain ETFs can be traded 24/7 on decentralized exchanges, providing global investors with round-the-clock access and eliminating the constraints of traditional market hours or regional exchange limitations. Traditional ETFs, however, are restricted to the operating hours of their respective stock exchanges and may face additional barriers for international investors.

-

Programmability and Smart Contract Features: On-chain ETFs utilize programmable smart contracts to automate key functions such as portfolio rebalancing, fee distribution, and governance. This enables innovative features and greater flexibility compared to the static structure of traditional ETFs, which typically lack such automation and customization capabilities.

Programmability and Smart Contract Features: Unlocking Next-Gen Fund Management

The programmability inherent to blockchain technology sets on-chain ETFs apart from their conventional counterparts. Through smart contracts, self-executing code deployed on blockchains, these funds can automate complex functions such as portfolio rebalancing, fee collection/distribution, dividend payments, or even community-driven governance votes. This automation reduces operational overhead while introducing innovative mechanisms that simply aren’t feasible within the static structure of traditional funds.

For example, an on-chain ETF could automatically adjust its allocations based on predefined rules whenever certain price thresholds are met or distribute rewards directly to token holders without manual intervention. These advanced features not only enhance efficiency but also invite experimentation with new investment models that could reshape how diversified portfolios are managed in the digital era.

At the same time, programmability introduces a new layer of flexibility and customization for investors. Want a fund that dynamically rebalances based on on-chain sentiment indicators, or one that enables token holders to vote on asset inclusion? With smart contract-powered ETFs, these capabilities are not just theoretical, they are already being piloted by leading DeFi innovators. This stands in stark contrast to traditional ETFs, which remain bound by rigid prospectuses and require lengthy regulatory approval for even minor structural changes.

However, it’s important to recognize that this innovation comes with its own set of considerations. On-chain ETFs often require a baseline technical proficiency, investors must understand wallet management, interact with decentralized interfaces, and be vigilant against smart contract vulnerabilities. Additionally, the regulatory landscape for these products is still evolving, introducing elements of uncertainty around investor protections and compliance standards.

What Should Modern Crypto Investors Consider?

The choice between on-chain and traditional ETFs ultimately hinges on individual priorities and risk tolerance. For those seeking maximum transparency, real-time oversight, and programmable features that reflect the decentralized ethos of crypto markets, on-chain ETFs represent a compelling frontier. Their 24/7 global accessibility and ability to automate fund management through smart contracts can offer both convenience and competitive advantage, especially in fast-moving markets.

On the other hand, traditional ETFs may still appeal to investors who value established regulatory protections, familiar brokerage interfaces, and the simplicity of conventional finance. The learning curve associated with decentralized token folios should not be underestimated; nor should the potential risks posed by nascent technology or shifting legal frameworks.

Comparing On-Chain vs Traditional ETFs: Key Takeaways

Key Differences: On-Chain ETFs vs Traditional ETFs

-

Transparency and On-Chain Verification: On-chain ETFs provide real-time, blockchain-based transparency, allowing investors to independently verify holdings and transactions. All fund activities are recorded on a public ledger, enabling continuous auditing. In contrast, traditional ETFs rely on periodic disclosures from fund managers, offering less frequent and less granular transparency.

-

24/7 Global Accessibility and Trading: On-chain ETFs can be traded around the clock on decentralized platforms, offering global access without the constraints of traditional exchange hours or geographic barriers. Traditional ETFs are limited to specific market hours and venues, restricting investor flexibility and immediate access to trades.

-

Programmability and Smart Contract Features: On-chain ETFs leverage programmable smart contracts for automated rebalancing, fee distribution, and governance. This enables advanced features and customization not possible with the static structure of traditional ETFs, which lack built-in automation and rely on manual processes.

As digital asset markets mature, and as institutional interest continues to grow, the lines between traditional finance (TradFi) and decentralized finance (DeFi) will likely blur further. For now, understanding these three core differences provides transparency/on-chain verification, 24/7 accessibility, and programmability via smart contracts: is essential for any investor aiming to make informed decisions in this rapidly evolving sector.

If you’re interested in deeper analysis or want to compare specific products side-by-side as new offerings emerge, resources like this guide from PBGLabs provide valuable institutional perspectives on the future of on-chain ETF investing.