For years, crypto ETF asset management has been hamstrung by unreliable, delayed, or opaque market data. The rise of on-chain ETF products promised transparency and programmability, but without real-time, high-quality data feeds, risk management and price discovery remained fundamentally compromised. Today, Chainlink’s Data Streams are rewriting those rules, delivering low-latency, cryptographically verified ETF and equities data directly onto dozens of blockchain networks. The implications for tokenized ETFs, DeFi protocols, and institutional managers are profound.

Chainlink Data Streams: The Backbone of Real-Time ETF Data on Blockchain

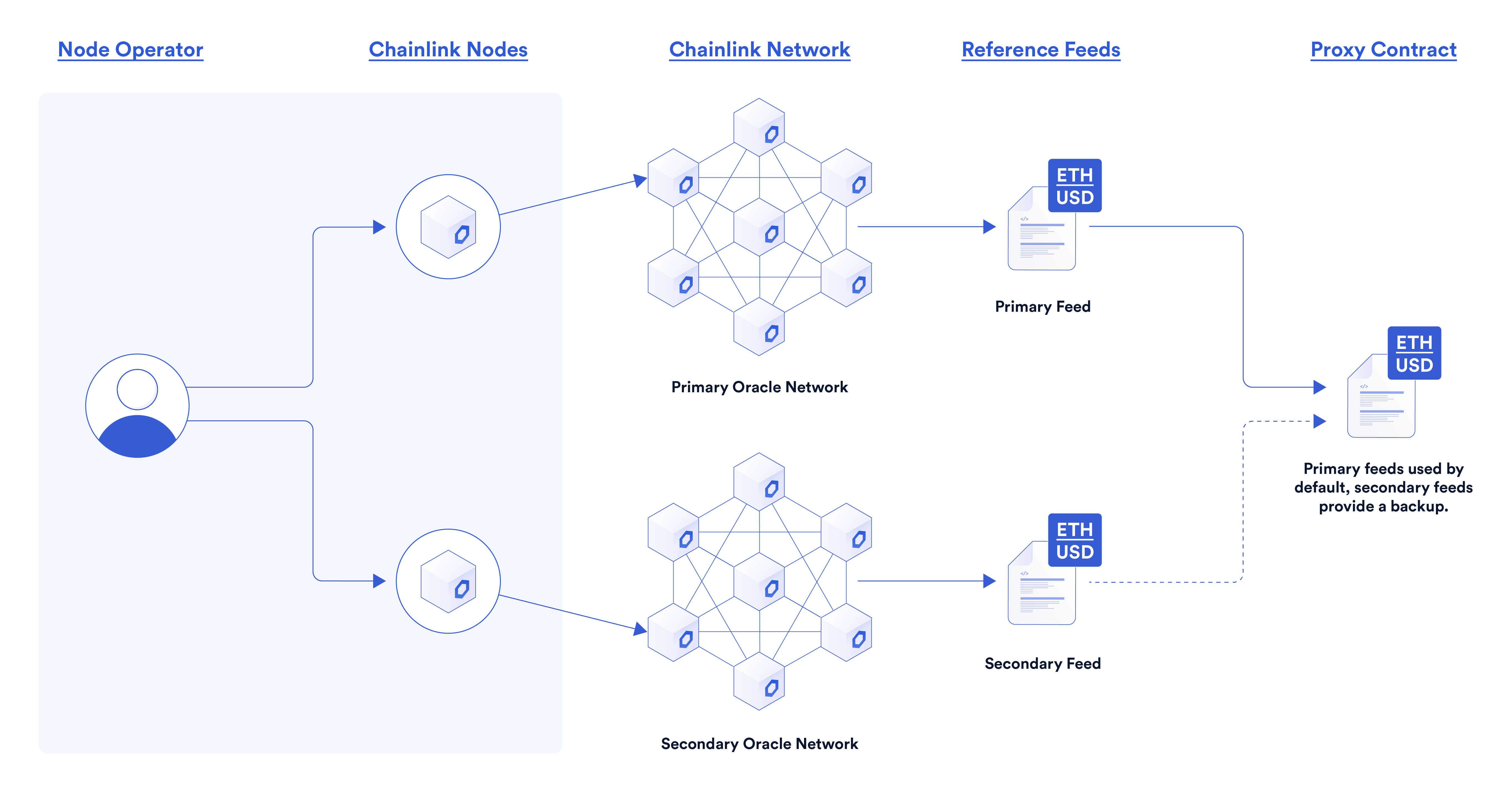

Chainlink’s Data Streams are purpose-built for on-chain ETF products, providing real-time, high-throughput pricing for major U. S. equities and ETFs, including SPY, QQQ, NVDA, AAPL, and MSFT. As of October 17,2025, Chainlink (LINK) trades at $16.02, down 11.88% in the past 24 hours, highlighting the volatility inherent in this sector. These data streams aggregate inputs from multiple independent primary and backup sources, then deliver them to decentralized oracle networks (DONs) for on-chain verification. Every price point is timestamped, making it possible to distinguish between fresh and stale data, automate trading pauses during market closures, and enable context-aware risk controls.

This is not just a technical upgrade. By ensuring both high availability and resilience, Chainlink Data Streams are closing the gap between traditional finance (TradFi) and decentralized finance (DeFi). Industry leaders like GMX and Kamino Finance have already begun integrating these feeds to launch lending products and yield strategies based on live U. S. stock prices. That means programmable ETFs with automated rebalancing, synthetic ETF products that track real-world assets (RWAs), and new classes of perpetual futures – all with risk management rooted in verified, low-latency data.

Why Real-Time On-Chain ETF Data Is a Game Changer for Risk Management

For asset managers, timely and accurate ETF pricing is non-negotiable. In legacy markets, milliseconds matter; in DeFi, block times and oracle lags can introduce unacceptable slippage and front-running risk. Chainlink’s approach – aggregating offchain data, cryptographically verifying it onchain, and timestamping each update – brings DeFi closer to institutional-grade standards. If a protocol detects stale data or an exchange closes, it can automatically halt trading or adjust margin requirements in real time.

This level of granularity enables sophisticated risk mitigation strategies for onchain ETF products. For example, a tokenized ETF tracking SPY can now implement circuit breakers or dynamic fee structures triggered by live volatility readings. The result: fewer flash crashes, lower systemic risk, and a more robust foundation for institutional capital to flow into crypto ETF asset management.

Expanding Coverage: From U. S. Equities to the $30 Trillion Tokenized RWA Market

The current rollout covers major U. S. stocks and ETFs across 37 blockchain networks, but Chainlink’s ambitions are much larger. The roadmap includes support for commodities, foreign exchange, and OTC markets – all critical for the next wave of tokenized RWAs. According to projections, the tokenized RWA market could top $30 trillion by 2030, making reliable on-chain ETF data feeds a strategic necessity for anyone serious about crypto ETF asset management.

Chainlink’s collaboration with MegaETH to deploy the first native real-time on-chain data stream oracle further cements its leadership in this space. As more protocols integrate Chainlink Data Streams, expect an explosion of new tokenized ETF strategies, from actively managed funds to synthetic index products.

Chainlink (LINK) Price Prediction 2026-2031

Professional outlook based on Chainlink’s real-time ETF data innovations and evolving DeFi integration.

| Year | Minimum Price | Average Price | Maximum Price | Potential YoY Change | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $14.50 | $19.80 | $27.00 | +23.6% avg | Post-ETF launch volatility; early institutional adoption; possible regulatory uncertainty |

| 2027 | $16.20 | $23.40 | $32.50 | +18.2% avg | Broader DeFi integration; expansion to commodities/FX data; RWA market growth |

| 2028 | $18.00 | $27.80 | $39.00 | +18.8% avg | Tokenized asset boom; Chainlink dominates onchain data infrastructure |

| 2029 | $21.00 | $33.10 | $47.50 | +19.1% avg | Mainstream tokenized ETF adoption; global regulatory clarity; increased competition |

| 2030 | $24.50 | $39.20 | $56.00 | +18.4% avg | $30T+ RWA market; Chainlink expands partnerships with TradFi; higher institutional inflows |

| 2031 | $28.00 | $46.10 | $65.00 | +17.6% avg | Matured DeFi-TradFi convergence; cross-chain utility and new use cases drive demand |

Price Prediction Summary

Chainlink (LINK) is positioned for substantial growth through 2031, fueled by its pioneering real-time data streams for U.S. equities, ETFs, and future expansion to other asset classes. The integration of Chainlink’s oracles into leading DeFi protocols and the accelerating tokenization of real-world assets underpin a bullish long-term outlook. However, price volatility is expected, especially as regulations evolve and competition intensifies. Overall, LINK is set to benefit from being the backbone of onchain financial data, with significant upside potential as institutional adoption increases.

Key Factors Affecting Chainlink Price

- Expansion of Chainlink Data Streams to more asset classes and blockchains

- Integration and adoption by leading DeFi protocols and TradFi institutions

- Growth of the tokenized real-world asset (RWA) market

- Evolution of global crypto and securities regulations

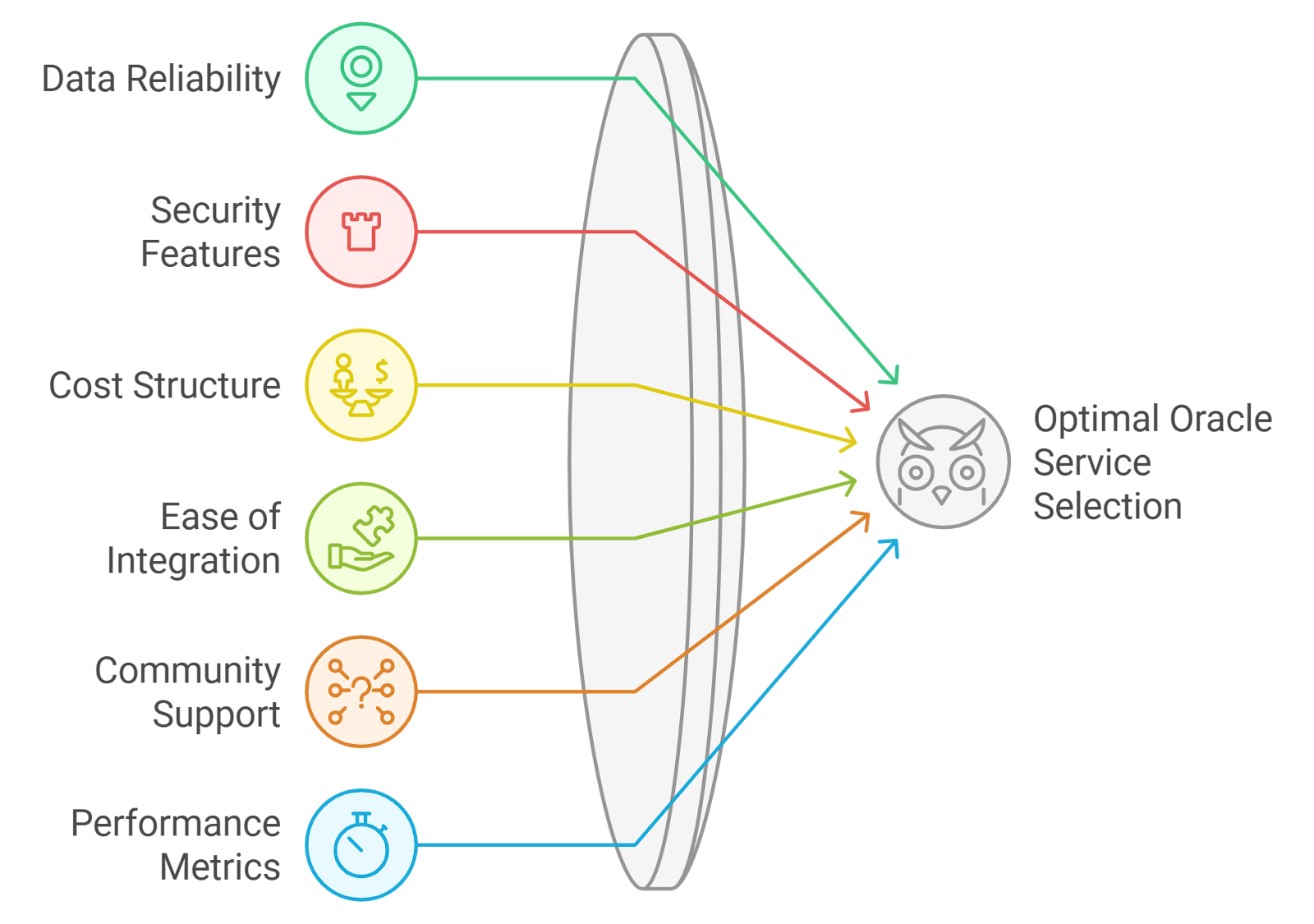

- Competition from alternative oracle solutions and data providers

- Market cycles and broader crypto sentiment

- Chainlink’s continued technological innovation and network upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With Chainlink Data Streams now live, the paradigm for on-chain ETF data feeds has shifted. Asset managers and DeFi builders can finally design products around real-time ETF data on blockchain: not delayed, unreliable price oracles. This means automated rebalancing, dynamic hedging, and context-sensitive trading logic are no longer theoretical. They’re operational realities that reduce risk while increasing transparency for both institutional and retail participants.

Institutional Adoption: The Tipping Point for On-Chain ETF Products

The integration of Chainlink’s real-time data isn’t just a technical win, it’s also a regulatory and operational milestone. As Bitwise and other issuers file for spot Chainlink (LINK) ETFs with the SEC, the demand for secure, low-latency market data is moving from the fringe to the mainstream. Financial institutions are now experimenting with tokenized ETFs backed by cryptographically verified feeds, which could unlock new liquidity channels and compliance frameworks previously out of reach for DeFi protocols.

“Plan your trades, protect your capital. “ This guiding principle is more achievable than ever when you have access to granular, high-frequency pricing that matches TradFi standards. For portfolio managers navigating volatile conditions, such as LINK’s recent drop to $16.02, down 11.88% in 24 hours, having trustworthy data is not optional; it’s existential.

Top 5 Benefits of Chainlink Data Streams for Crypto ETF Management

-

1. Real-Time, Low-Latency Market Data: Chainlink Data Streams deliver live pricing for U.S. equities and ETFs (e.g., SPY, QQQ, NVDA, AAPL, MSFT) directly to blockchain networks, enabling DeFi protocols to react instantly to market movements and execute trades with minimal delay.

-

2. Enhanced Risk Management with Timestamped Data: Every data point from Chainlink is timestamped, allowing protocols to distinguish between fresh and stale prices, automatically pause trading during market closures, and implement real-time, context-aware risk controls.

-

3. High Availability and Resilience via Decentralized Oracles: By aggregating data from multiple primary and backup sources through decentralized oracle networks (DONs), Chainlink ensures continuous data availability and system resilience, reducing the risk of single points of failure.

-

4. Seamless Integration with Leading DeFi Protocols: Top DeFi platforms like GMX and Kamino Finance are already integrating Chainlink Data Streams, enabling new lending, yield, and synthetic ETF products based on real-world assets.

-

5. Accelerating Tokenized Asset Innovation: Chainlink’s expansion plans for Data Streams—including support for commodities, FX, and OTC markets—are powering the growth of tokenized real-world assets (RWAs), a market projected to exceed $30 trillion by 2030.

Chainlink’s official blog details how these feeds are already being used by leading protocols to offer lending products based on live U. S. stock prices, an early signal that tokenized ETFs will soon rival their TradFi counterparts in speed and sophistication.

The Road Ahead: Risk Management in a Tokenized World

As Chainlink expands coverage into commodities and FX, expect risk mitigation tools to become even more granular. Imagine tokenized ETFs that automatically adjust leverage or rebalance exposure based on real-time volatility across multiple asset classes, all powered by cryptographically secure oracle networks. These advances will be critical as the tokenized RWA market approaches its projected $30 trillion scale.

The bottom line? Secure, real-time ETF data streams aren’t just a feature, they’re a foundational requirement for credible crypto ETF asset management going forward. Whether you’re building synthetic indices or managing institutional portfolios on-chain, integrating robust data feeds like Chainlink’s isn’t just smart, it’s non-negotiable if you want to survive the next wave of volatility.