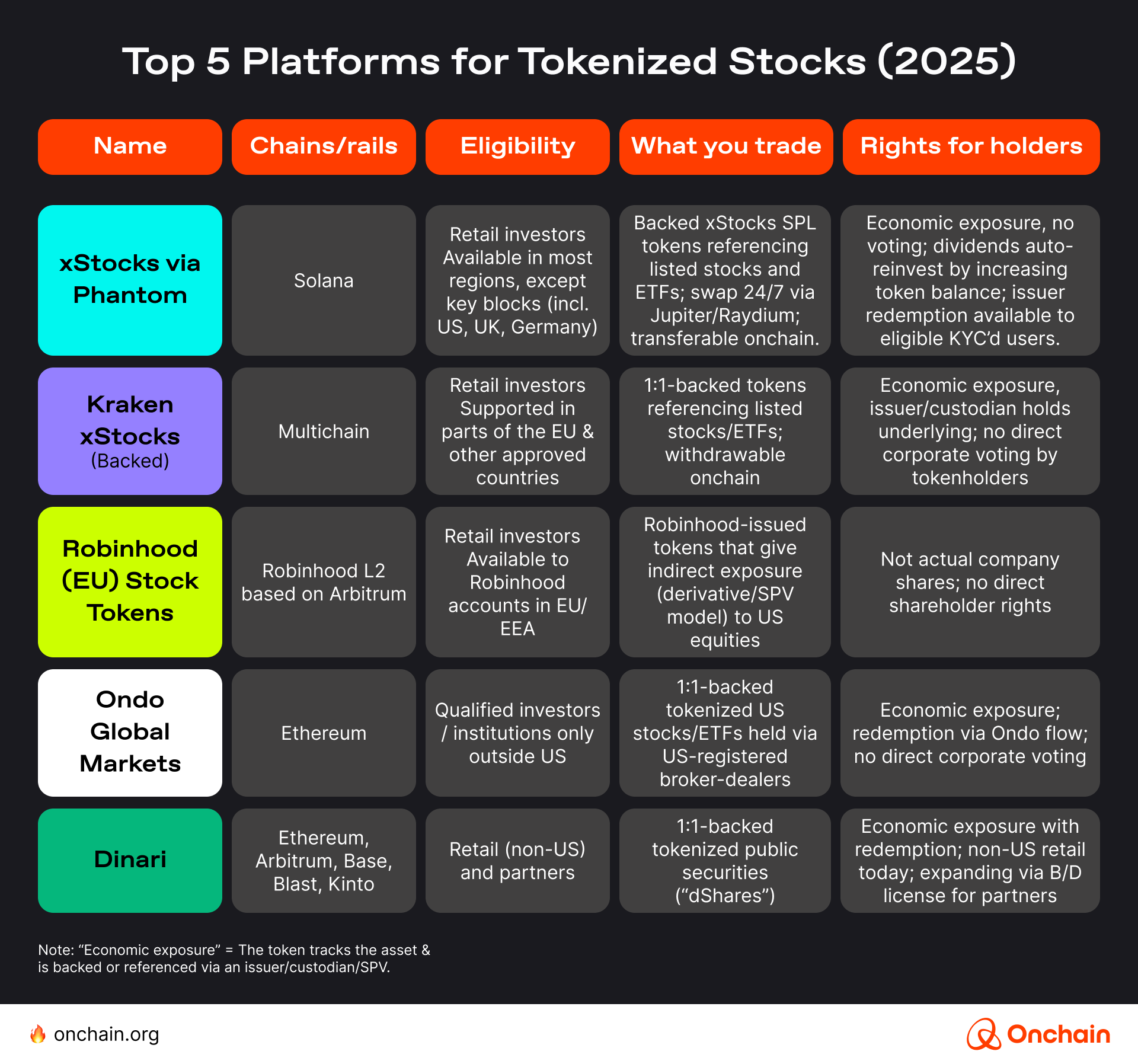

Ondo Finance is making headlines in the crypto and ETF world by launching over 100 tokenized U. S. stocks and ETFs directly on the Ethereum blockchain. This groundbreaking initiative, called Ondo Global Markets, is more than just another leap for DeFi – it’s a fundamental shift in how global investors can access and interact with U. S. securities.

Why Tokenized ETFs on Ethereum Are a Game Changer

The core appeal of Ondo Finance tokenized ETFs lies in their ability to break down barriers that have long kept international investors at arm’s length from U. S. markets. Historically, high fees, complex onboarding processes, and geographic restrictions made it difficult for individuals in Asia-Pacific, Africa, and Latin America to buy leading U. S. equities or ETFs. Ondo’s solution is elegant: represent shares as tokens on Ethereum, making them transferable, tradable 24/7, and compatible with the infrastructure of the broader crypto ecosystem.

Key Advantages of Ondo’s Tokenized ETFs Over Traditional Brokerage

-

24/7 Trading Access: Ondo Global Markets enables investors to buy and sell tokenized U.S. stocks and ETFs around the clock during trading days, offering flexibility beyond the limited hours of traditional brokerages.

-

Global Accessibility: Qualified investors outside the U.S.—including those in Asia-Pacific, Africa, and Latin America—can access U.S. equities without the geographic restrictions or high fees often imposed by traditional brokers.

-

Deep Liquidity Backed by Real Securities: Tokenized assets on Ondo are fully backed by actual U.S. stocks and ETFs held at U.S.-registered broker-dealers, ensuring robust liquidity and investor confidence.

-

DeFi Integration and Utility: Investors can use tokenized equities within decentralized finance (DeFi) protocols for activities like collateralized lending or yield generation—features not available through standard brokerage accounts.

-

Cross-Chain Compatibility: While starting on Ethereum, Ondo plans to expand to other blockchains like Solana and BNB Chain, enhancing interoperability and future-proofing access for investors.

This innovation is not just about convenience; it’s about genuine financial inclusion. By leveraging blockchain rails, Ondo enables peer-to-peer transfers and opens up new possibilities for using these assets within DeFi protocols – think collateralizing loans or participating in on-chain yield strategies.

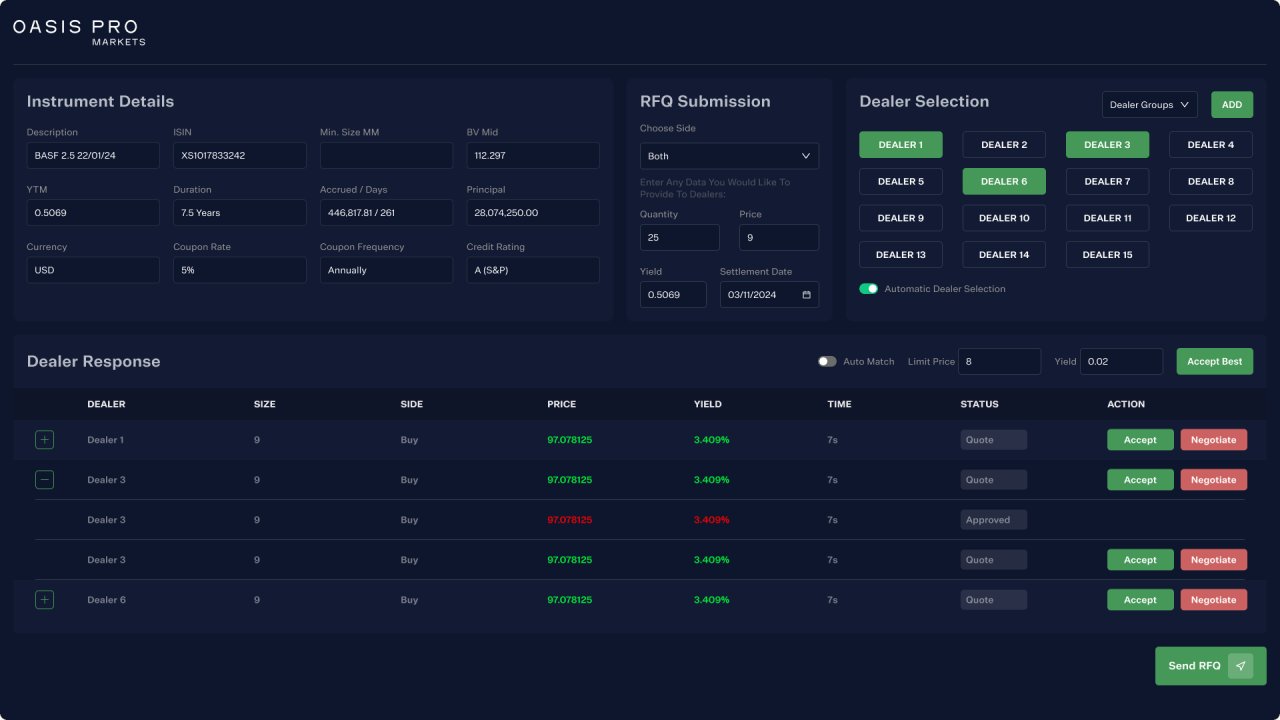

How Ondo Global Markets Works: The Nuts and Bolts

The process begins when a qualified investor mints a token representing a specific U. S. stock or ETF (such as SPY or AAPL). Each token is fully backed by actual securities held at U. S. -registered broker-dealers. This ensures that every on-chain asset corresponds to a real-world share or ETF unit – no synthetic exposure here.

What makes this system robust? It’s the combination of regulatory compliance (assets are held with licensed custodians), deep liquidity (access to traditional exchange order books), and blockchain-native benefits like instant settlement and programmable ownership.

Current market data: As of today, ONDO trades at $0.8898, reflecting both excitement around this launch and broader market conditions. Investors should keep an eye on price movements as adoption grows.

The Investor Perspective: Opportunities and Considerations

Who can participate? At launch, eligibility is limited to qualified investors outside the United States – an intentional move to navigate regulatory red tape while maximizing global reach. Regions such as Asia-Pacific, Africa, and Latin America stand to benefit most from this expanded access.

What does this mean for your portfolio?

- Diversification: Direct exposure to blue-chip American equities without relying on local intermediaries or expensive ADRs.

- DeFi Synergy: Use tokenized stocks as collateral or liquidity in DeFi platforms – bridging traditional finance with Web3 innovation.

- Around-the-Clock Trading: Mint and redeem assets 24/7 during trading days – no more waiting for Wall Street’s opening bell.

If you’re curious about how Ethereum-based tokenization unlocks new possibilities for market access, check out our detailed guide at How Tokenized ETFs on Ethereum Are Making Traditional Markets Accessible On-Chain.

The implications of on-chain ETF investing go beyond simple access. By tokenizing stocks and ETFs, Ondo is paving the way for programmable finance, where smart contracts can automate everything from dividend distribution to compliance checks. For investors, this means a more transparent, efficient, and flexible market experience compared to legacy systems.

Risks, Security, and What to Watch

While the benefits are compelling, it’s important to consider the risks. Market volatility remains a factor, and as with any new technology, smart contract vulnerabilities or custody challenges could emerge. However, Ondo’s architecture, where each token is backed 1: 1 by real securities held at U. S. -registered broker-dealers, helps mitigate some of the concerns around asset backing and regulatory compliance.

Security is enhanced through partnerships with established custodians like BitGo and Ledger, and peer-to-peer transfers are subject to robust compliance checks. Still, investors should remain vigilant and conduct due diligence, especially as the platform expands to additional blockchains like Solana and BNB Chain.

Looking Forward: The Road to 1,000 and Tokenized Assets

Ondo Finance’s ambition doesn’t stop at 100 tokenized assets. The roadmap includes scaling to over 1,000 tokenized U. S. stocks and ETFs by the end of 2025, with cross-chain support set to further broaden accessibility and liquidity. This could transform the landscape for global access to crypto ETFs, allowing investors from previously underserved regions to build world-class portfolios on-chain.

“Tokenization is the next logical step for capital markets. Ondo’s approach brings the transparency and speed of blockchain to assets that have been out of reach for much of the world. ”

For those watching ONDO’s price, today’s level at $0.8898 reflects both the enthusiasm and the early-stage nature of this market. As adoption increases and more assets are brought on-chain, price dynamics may evolve, offering both opportunities and risks for token holders.

Key Security & Compliance Features of Ondo Global Markets

-

Regulatory Compliance: Ondo’s tokenized stocks and ETFs are fully backed by U.S. securities held in custody by U.S.-registered broker-dealers, ensuring adherence to strict regulatory standards.

-

Investor Eligibility Controls: Access to Ondo Global Markets is restricted to qualified investors outside the U.S., with robust KYC/AML procedures to verify user identity and jurisdiction.

-

Asset Custody & Transparency: All underlying securities are held in segregated accounts at regulated institutions, providing transparency and security for investors’ assets.

-

24/7 On-Chain Trading Security: Tokenized assets are traded and settled on the Ethereum blockchain, leveraging blockchain’s immutable ledger and smart contract security for transparent, tamper-resistant transactions.

-

Partnerships with Trusted Infrastructure Providers: Ondo collaborates with leading custody and wallet providers like BitGo and Ledger, ensuring secure storage and transfer of tokenized assets.

-

Transferability & Compliance Monitoring: Tokenized equities are fully transferable peer-to-peer, with built-in compliance checks to prevent unauthorized transfers and maintain regulatory standards.

How to Get Started with Ondo’s Tokenized ETFs

If you’re eligible and interested, onboarding is straightforward. Investors can connect their crypto wallets, complete KYC checks, and begin minting or trading tokenized assets directly on Ethereum. The process is designed to be intuitive, with support resources available to guide users through each step.

For a deeper dive into the mechanics and broader impact of tokenized ETFs on Ethereum, don’t miss our comprehensive explainer at How Tokenized ETFs on Ethereum Are Making Traditional Markets Accessible On-Chain.

Ondo Finance’s launch is more than a technical milestone, it’s a signal that the future of investing is borderless, programmable, and accessible to all. As this ecosystem matures, expect more innovation, more assets, and a new era of financial inclusion powered by on-chain ETF technology.