The arrival of spot Bitcoin ETFs in 2024 has fundamentally altered the landscape of crypto portfolio diversification. With Bitcoin (BTC) now trading at $121,801.00, the launch of these ETFs has provided a new, regulated on-ramp for both retail and institutional investors seeking exposure to digital assets without the operational complexity of self-custody. This shift has not only driven inflows into Bitcoin itself but has also changed the calculus for portfolio construction and risk management in the digital asset space.

Spot Bitcoin ETFs: A Game-Changer for Portfolio Strategies

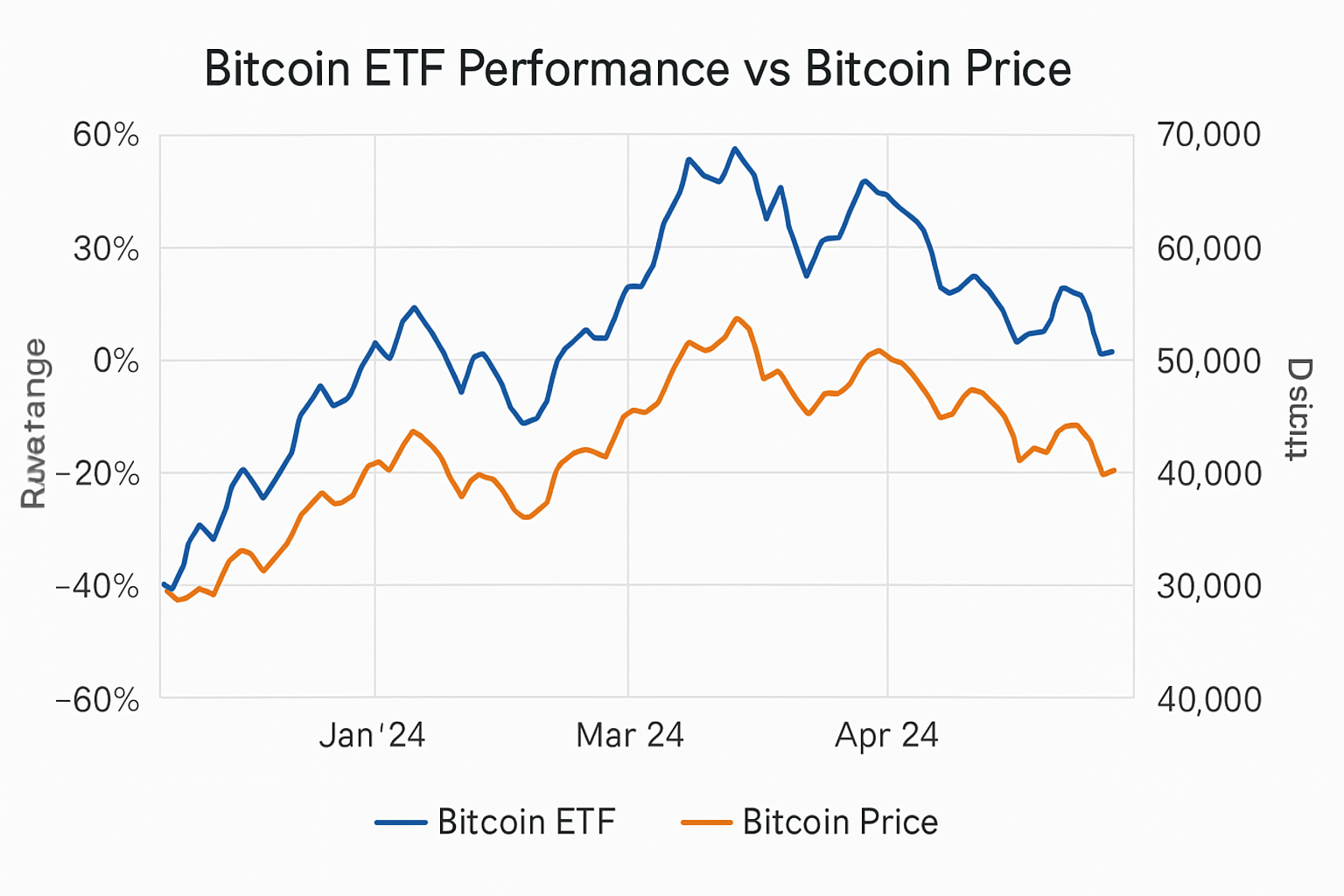

Spot Bitcoin ETFs have quickly become a cornerstone in modern crypto portfolio strategies. Unlike futures-based products, these ETFs are physically backed, holding actual Bitcoin in reserve for every share issued. This structure ensures that ETF performance tracks Bitcoin’s price closely, with recent research showing an average monthly return of 6.85% for spot Bitcoin ETFs since their approval, slightly outpacing Bitcoin’s own 6.77% average return. The tracking error is minimal, at just 0.88 percentage points (source).

For investors who previously viewed crypto as too volatile or operationally challenging, spot Bitcoin ETFs offer a familiar, exchange-traded wrapper with the transparency and regulatory oversight expected in traditional finance. The result? Over $120 billion in assets under management by year-end 2024, with BlackRock’s iShares Bitcoin Trust (IBIT) alone drawing over $14 billion in inflows and holding nearly 700,000 BTC (source).

Diversification Benefits: Unpacking Correlations and Volatility

The primary allure of integrating spot Bitcoin ETFs into a diversified portfolio lies in Bitcoin’s historically low correlation with stocks and bonds. In an environment where traditional asset classes are increasingly moving in tandem – especially during periods of elevated interest rate volatility – Bitcoin stands out as a true alternative. Analyses indicate that even a modest 1% allocation to Bitcoin via spot ETFs could have improved a classic 60/40 portfolio’s performance by 3.16% since 2020 (source).

This uncorrelated behavior is particularly valuable as investors seek to hedge against systemic risks and inflationary pressures. The influx of capital into both gold and Bitcoin spot ETPs underscores a broader appetite for alternatives: gold and Bitcoin spot products saw $19.2 billion and $13.6 billion in net flows respectively year-to-date, reflecting their growing role as portfolio diversifiers.

Risk Management: Navigating Volatility in 2024

While spot Bitcoin ETFs have democratized access to Bitcoin, they do not eliminate the asset’s notorious volatility. Bitcoin’s price can swing dramatically – as seen in its recent 24-hour range from $120,701.00 to $125,094.00 – and these moves are fully transmitted to ETF holders. However, the ETF structure does offer some advantages: regulated custody, daily liquidity, and tighter spreads compared to unregulated crypto exchanges.

Financial advisors remain cautious, typically recommending a conservative allocation of up to 2% to Bitcoin within a diversified portfolio (source). This approach seeks to harness the diversification benefits without exposing investors to undue risk from crypto’s price swings.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast incorporates the impact of spot Bitcoin ETFs, institutional adoption, and evolving market cycles. Prices are based on advanced market analysis as of October 2025, with a current BTC price baseline of $121,801.

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $135,000 | $175,000 | +11% | Possible post-ETF consolidation phase; macro risks may trigger corrections, but ETF inflows and supply constraints support higher averages. |

| 2027 | $110,000 | $152,000 | $200,000 | +13% | Renewed bullish momentum as ETF adoption spreads globally; technology upgrades (like scaling solutions) and sustained institutional interest drive prices upward. |

| 2028 | $128,000 | $178,000 | $235,000 | +17% | Potential Bitcoin halving year—historically bullish. Scarcity narrative and ETF-driven demand push market to new all-time highs; volatility spikes likely. |

| 2029 | $152,000 | $210,000 | $275,000 | +18% | Adoption in pension/sovereign wealth portfolios increases; regulatory clarity in major markets fuels further institutional entry and price appreciation. |

| 2030 | $180,000 | $240,000 | $325,000 | +14% | Maturing ETF market and possible integration of Bitcoin in mainstream financial products; macroeconomic factors (inflation, currency debasement) could boost ‘digital gold’ appeal. |

| 2031 | $170,000 | $260,000 | $350,000 | +8% | Potential for market maturation and stabilization; competition from alternative digital assets tempers upside but Bitcoin remains the dominant store-of-value crypto. |

Price Prediction Summary

Bitcoin is projected to experience continued growth from 2026 to 2031, supported by strong institutional adoption via spot ETFs, reduced circulating supply, and increasing mainstream financial integration. While volatility and corrections are expected, especially after parabolic moves, the overall trend remains upward, with average annual price increases ranging from 8% to 18%. Bearish scenarios may play out during macroeconomic or regulatory shocks, but ETF demand and network effects are likely to underpin long-term value.

Key Factors Affecting Bitcoin Price

- ETF-driven institutional and retail inflows increasing demand and reducing circulating supply.

- Upcoming Bitcoin halving event in 2028 further constraining supply.

- Global regulatory developments improving or hindering institutional participation.

- Technological advancements, such as Layer 2 scaling and improved custody solutions.

- Competition from other digital assets and changing investor preferences.

- Macroeconomic conditions (e.g., inflation, fiat currency volatility) enhancing Bitcoin’s appeal as a store of value.

- Potential for new financial products integrating Bitcoin exposure.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Market Impact: Supply Dynamics and Liquidity Evolution

The operational mechanics of spot Bitcoin ETFs also influence market structure. Each new ETF share requires the purchase of actual Bitcoin, reducing circulating supply and potentially supporting prices at key levels like today’s $121,801.00. This has contributed to a new liquidity paradigm and may help dampen some volatility as the market matures.

As liquidity deepens and institutional adoption accelerates, the presence of spot Bitcoin ETFs is also reshaping how investors approach crypto ETF risk management in 2024. The transparency of on-chain reserves, combined with regulated fund structures, provides a level of operational assurance that was previously missing from direct crypto investments. This has encouraged more conservative institutions and pension funds to consider Bitcoin allocations, albeit in small, measured doses.

Another crucial factor is the impact on broader market sentiment. The surge in spot Bitcoin ETF inflows has not only pushed Bitcoin to its current price of $121,801.00, but it has also fueled renewed interest across the digital asset ecosystem. Altcoins and thematic crypto ETFs are seeing secondary benefits as portfolio managers reassess their exposure to digital assets versus traditional alternatives like gold or real estate.

Strategic Allocation: Building Resilient Crypto Portfolios in 2024

For forward-thinking investors, the challenge now is crafting a resilient allocation strategy that leverages the unique properties of spot Bitcoin ETFs without overexposing portfolios to crypto’s inherent volatility. Key considerations include:

Key Steps to Integrate Spot Bitcoin ETFs in 2024

-

1. Assess Portfolio Objectives and Risk ToleranceBefore adding spot Bitcoin ETFs, clearly define your investment goals and evaluate your risk appetite. Bitcoin remains volatile, with its price currently at $121,801.00, so determine if exposure aligns with your long-term strategy.

-

2. Choose a Reputable Spot Bitcoin ETFSelect established ETFs such as BlackRock’s iShares Bitcoin Trust (IBIT) or Grayscale Bitcoin Trust (GBTC), which have attracted billions in inflows and offer strong liquidity and regulatory oversight.

-

3. Determine an Appropriate AllocationFinancial advisors often recommend a modest allocation—typically up to 2%—to Bitcoin via ETFs within a diversified portfolio, balancing potential returns with volatility management.

-

4. Monitor Correlations and Diversification ImpactTrack how Bitcoin’s historically low correlation with stocks and bonds affects your portfolio. Analyses show a 1% allocation to Bitcoin could have improved 60/40 portfolio performance by 3.16% since 2020.

-

5. Review ETF Performance and Tracking ErrorSpot Bitcoin ETFs have closely mirrored Bitcoin’s returns, with an average monthly return of 6.85% and a minimal tracking error of 0.88 percentage points since their 2024 launch. Regularly compare ETF performance to the underlying asset.

-

6. Stay Informed on Regulatory and Market DevelopmentsKeep up with SEC updates and market news, as spot Bitcoin ETFs continue to influence liquidity and market dynamics, including potential effects on Bitcoin’s price and supply.

Risk-aware investors are increasingly using scenario analysis and stress testing, tools borrowed from traditional finance, to model potential outcomes for portfolios with varying levels of Bitcoin ETF exposure. This disciplined approach helps ensure that allocations remain within acceptable volatility and drawdown limits while still capturing upside potential from digital assets.

It’s also worth noting that as more spot cryptocurrency ETFs come online, including those tracking Ethereum and diversified baskets, the toolkit for crypto portfolio strategies in 2024 continues to expand. Investors can now blend single-asset products like spot Bitcoin ETFs with multi-asset crypto funds to further fine-tune their risk-return profiles.

Looking Ahead: The Evolving Role of Spot Crypto ETFs

The momentum behind spot Bitcoin ETFs shows few signs of slowing, especially as regulatory clarity improves globally and new product innovations emerge. Already, global crypto ETFs have attracted a record $5.95 billion in recent months as Bitcoin scaled new highs (source). The interplay between supply constraints, driven by ETF share creation, and surging demand could continue to support elevated price levels, albeit with periodic corrections typical for nascent markets.

Ultimately, the rise of spot Bitcoin ETFs marks a strategic inflection point for both individual and institutional investors seeking smarter ways to diversify portfolios. The key is balance: harnessing the diversification power of an uncorrelated asset like Bitcoin at $121,801.00, while maintaining prudent risk controls tailored to each investor’s objectives.