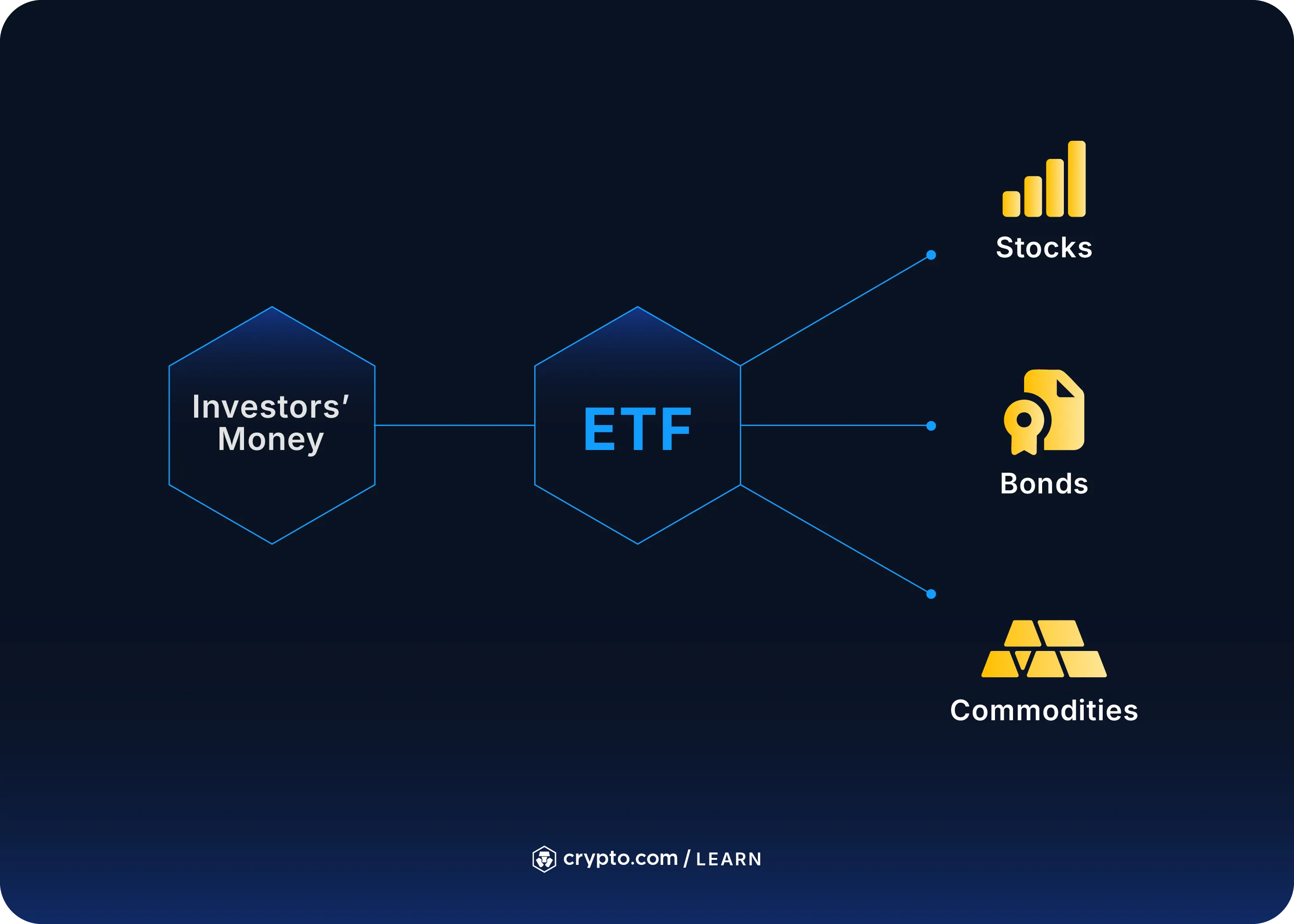

The U. S. Securities and Exchange Commission (SEC) has set a new precedent in digital asset investing by approving Grayscale Investments’ Digital Large Cap Fund (GDLC) as a multi-asset crypto ETF. This historic approval not only allows GDLC to be listed as an exchange-traded product (ETP) on major U. S. exchanges, but also signals the SEC’s willingness to embrace more sophisticated, diversified crypto investment vehicles. For investors, this means regulated access to a basket of leading cryptocurrencies through a single security, without the operational complexity of managing individual wallets or private keys.

SEC Crypto ETF Approval: A New Era for Digital Asset Diversification

The SEC’s decision marks a turning point in U. S. crypto regulation. By approving Grayscale’s GDLC under new generic listing standards, the Commission is streamlining how spot crypto ETFs come to market. These standards reduce friction for exchanges looking to list commodity-based ETPs, including those backed by digital assets, by eliminating the need for lengthy individual product reviews.

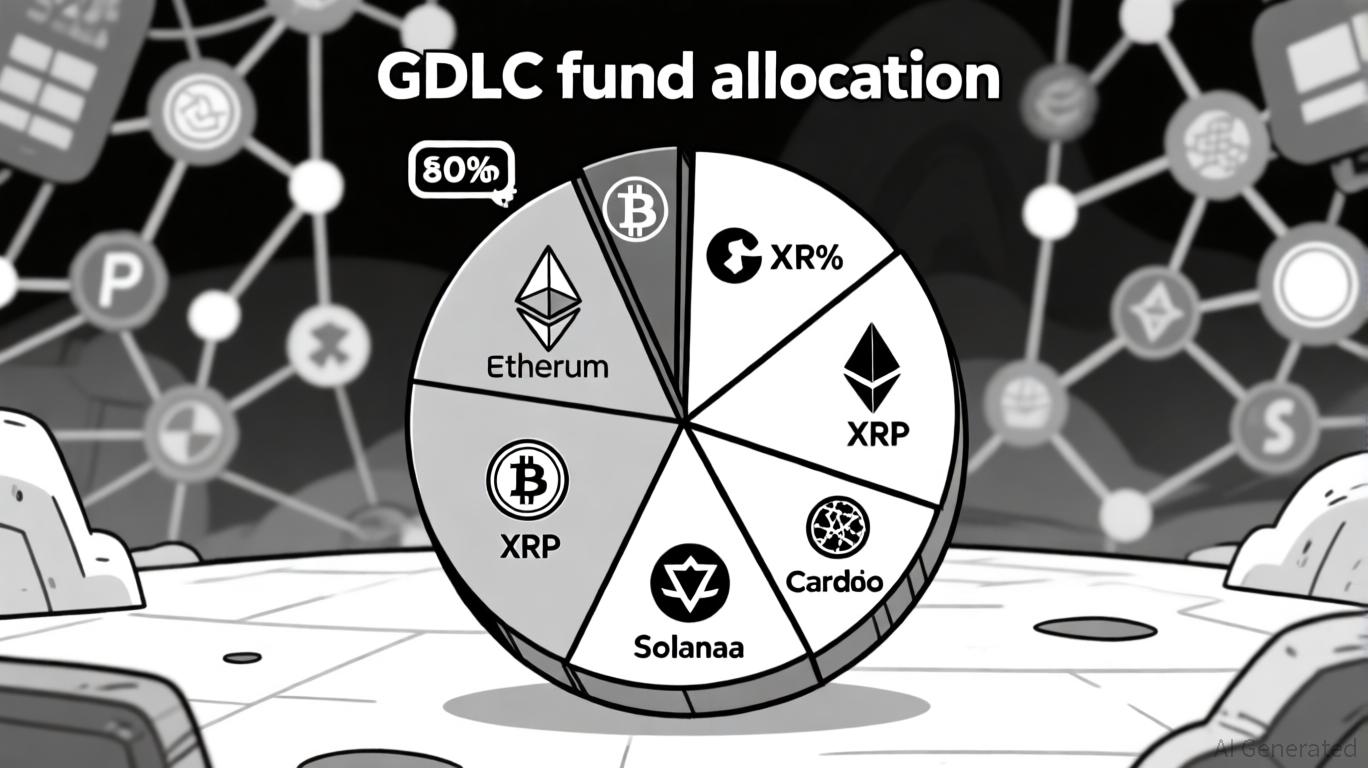

According to Cointelegraph, GDLC provides exposure to Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA): all within one regulated fund structure. This is a significant step forward from single-asset ETFs and opens the door for investors seeking both convenience and risk mitigation through diversification.

What Is the Grayscale Digital Large Cap Fund ETF?

GDLC is designed as a market cap-weighted portfolio tracking five of the largest digital assets by market capitalization: BTC, ETH, XRP, SOL, and ADA. The fund’s composition is rebalanced quarterly to reflect shifts in the underlying crypto market. Investors benefit from institutional-grade custody and transparent reporting while sidestepping direct exposure risks such as wallet mismanagement or exchange hacks.

Key Features of Grayscale’s Digital Large Cap Fund (GDLC)

-

Diversified Asset Mix: GDLC provides exposure to a basket of major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This multi-asset approach helps investors access a broad segment of the crypto market in a single product.

-

Regulated Exchange-Traded Product (ETP): GDLC is approved by the U.S. Securities and Exchange Commission (SEC) and listed on a national exchange, offering a regulated structure for crypto investment and increased investor protections compared to unregulated products.

-

Simplified Access and Liquidity: Investors can buy and sell GDLC shares through traditional brokerage accounts, providing convenient and liquid access to leading cryptocurrencies without the need to manage digital wallets or private keys.

-

Transparent Portfolio Management: GDLC regularly discloses its holdings and follows a transparent methodology for asset allocation, allowing investors to track the fund’s composition and performance over time.

-

Risk Mitigation Through Diversification: By holding multiple digital assets, GDLC aims to reduce the impact of volatility associated with individual cryptocurrencies, helping investors manage risk in the rapidly changing crypto market.

This multi-asset approach allows participants to capture sector-wide growth while reducing idiosyncratic risk tied to any single coin. For example, if Bitcoin underperforms relative to Solana or Cardano during a given quarter, GDLC’s dynamic rebalancing helps preserve portfolio balance, something that would require manual intervention in self-managed portfolios.

Implications for Crypto ETF Portfolio Strategy

The arrival of multi-asset products like the Grayscale Digital Large Cap Fund ETF fundamentally changes how both retail and institutional investors can approach crypto allocation:

- Diversification: Access multiple top digital assets through one trade

- Regulatory Oversight: Benefit from SEC-approved fund structures and compliance protocols

- Simplified Operations: Eliminate technical hurdles related to storage and security

- Tactical Allocation: Adjust exposure based on evolving market trends without needing separate accounts on multiple exchanges

This innovation comes at a time when institutional adoption of crypto ETFs is accelerating globally. With streamlined SEC processes now in place (Coindesk), analysts expect an influx of new multi-asset offerings targeting different segments of the blockchain ecosystem.

For investors, the Grayscale Digital Large Cap Fund ETF introduces a new paradigm for crypto portfolio construction. The ability to gain diversified exposure to Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) within a single, regulated product is a significant advancement in risk management and operational efficiency. With quarterly rebalancing, GDLC dynamically adjusts its allocations to reflect real-world market cap movements, ensuring that the fund remains representative of the sector’s leaders while reducing concentration risk.

From a tactical perspective, this multi-asset structure enables both retail and institutional participants to express high-conviction macro views without the administrative burden of managing multiple wallets or navigating fragmented liquidity across exchanges. For institutions subject to regulatory scrutiny, SEC oversight provides an additional layer of compliance assurance, potentially unlocking new flows from pension funds, endowments, and asset managers previously sidelined by custodial or governance constraints.

How Multi-Asset Crypto ETFs Reshape Market Access

The streamlined approval process heralded by the SEC is expected to catalyze a wave of new crypto ETF launches. Under these generic listing standards, innovation can accelerate: issuers are now empowered to experiment with different asset mixes and thematic baskets without protracted regulatory delays. Early movers like Grayscale set the template for future multi-asset products that may eventually include DeFi tokens or layer-2 solutions as the market matures.

Key Advantages of Multi-Asset Crypto ETFs

-

Diversification Across Multiple Cryptocurrencies: Multi-asset crypto ETFs like Grayscale’s Digital Large Cap Fund (GDLC) provide exposure to a basket of major digital assets—including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA)—reducing reliance on the performance of a single coin.

-

Reduced Portfolio Volatility: By holding several cryptocurrencies, multi-asset ETFs can help smooth out price swings associated with individual tokens, offering a more balanced risk profile for investors compared to single-asset products.

-

Streamlined Investment Process: Investors gain broad crypto market exposure through a single, regulated exchange-traded product, eliminating the need to manage multiple wallets or individual exchange accounts.

-

Regulatory Oversight and Transparency: SEC-approved multi-asset ETFs like GDLC operate under established regulatory frameworks, providing greater transparency, investor protections, and standardized reporting compared to unregulated crypto holdings.

-

Efficient Rebalancing and Asset Allocation: Multi-asset ETFs automatically adjust their holdings to reflect changes in market capitalization or index composition, saving investors the complexity and transaction costs of manual rebalancing.

Liquidity is another key consideration. By bundling several high-cap assets into one ETF, GDLC can attract deeper trading volumes than niche single-coin products. This enhanced liquidity facilitates tighter spreads and more efficient price discovery, critical factors for algorithmic traders and large allocators seeking scalability.

Risks and Considerations for Investors

Despite these advantages, investors should remain vigilant regarding inherent risks:

- Volatility: Crypto markets remain highly volatile; even diversified funds can experience significant drawdowns during adverse cycles.

- Tracking Error: While market cap weighting aims for accuracy, rapid shifts in asset rankings or sector rotations may introduce short-term tracking discrepancies versus the broader market.

- Regulatory Uncertainty: Although SEC approval signals progress, evolving global regulations could impact fund operations or underlying asset eligibility in future rebalances.

For those considering allocation, it’s essential to align position sizing with overall risk tolerance and investment horizon. Multi-asset crypto ETFs like GDLC are best viewed as building blocks within a broader portfolio strategy, not as standalone bets on digital assets’ continued growth.

What’s Next? The Road Ahead for Crypto ETF Institutional Adoption

The SEC’s green light for Grayscale’s multi-asset fund is already prompting speculation about which issuers will follow suit with next-generation products targeting other sectors, such as Web3 infrastructure or stablecoins. As regulatory clarity improves and liquidity deepens, expect increased participation from traditional financial institutions seeking uncorrelated returns and blockchain-native exposure via regulated vehicles.

The U. S. market is now positioned at an inflection point: multi-asset crypto ETFs offer mainstream investors access to digital assets with unprecedented convenience and oversight. This development not only enhances portfolio construction options but also reinforces the legitimacy of cryptocurrencies as investable assets on par with equities or commodities.