The landscape of traditional finance is undergoing a seismic shift as tokenized US equities and ETFs on Ethereum become a reality for global investors. This transformation is being spearheaded by Ondo Finance, which has launched Ondo Global Markets, a platform that delivers more than 100 tokenized U. S. stocks and ETFs directly on Ethereum. With plans to expand to over 1,000 assets by the end of 2025, Ondo’s initiative is set to redefine access and liquidity for non-U. S. investors seeking seamless exposure to American financial markets around the clock.

How Tokenized US Equities Work on Ethereum

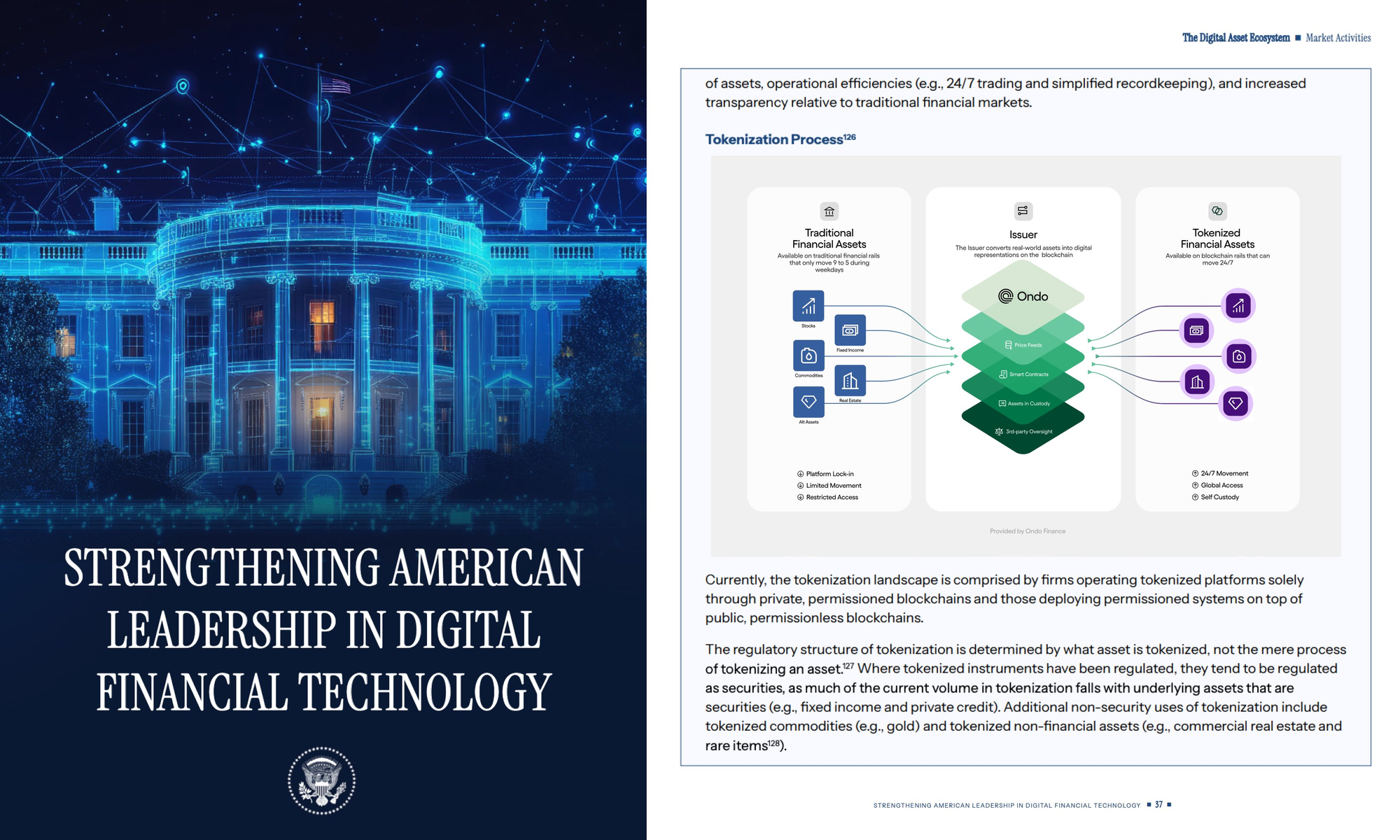

Ondo Global Markets bridges the gap between traditional securities and decentralized finance (DeFi) by offering fully backed equity tokens. Each token represents ownership in a specific underlying security, such as Apple or S and P 500 ETFs, held with U. S. -registered broker-dealers. This structure ensures regulatory compliance while unlocking peer-to-peer transfers across wallets, exchanges, and DeFi protocols.

Unlike legacy brokerage accounts with limited trading hours and settlement friction, these tokenized ETFs on Ethereum are available 24/7. Investors can transfer them instantly or use them as collateral within DeFi applications without intermediaries. The tokens are interoperable with leading infrastructure partners like BitGo and Ledger, enhancing security and institutional-grade custody options.

Key Benefits of Tokenized US Equities via Ondo Finance

-

24/7 Onchain Access to US Stocks and ETFs: Ondo Global Markets enables non-U.S. investors to buy and sell tokenized versions of over 100 U.S. equities and ETFs on Ethereum, providing round-the-clock trading beyond traditional market hours.

-

Peer-to-Peer Transfers and DeFi Integration: Tokenized equities can be transferred directly between wallets or traded across exchanges and DeFi protocols, increasing liquidity and enabling seamless participation in decentralized finance ecosystems.

-

Fully-Backed by US-Registered Broker-Dealers: Each tokenized asset is backed 1:1 by the underlying security, held with U.S.-registered broker-dealers, ensuring regulatory compliance and asset security.

-

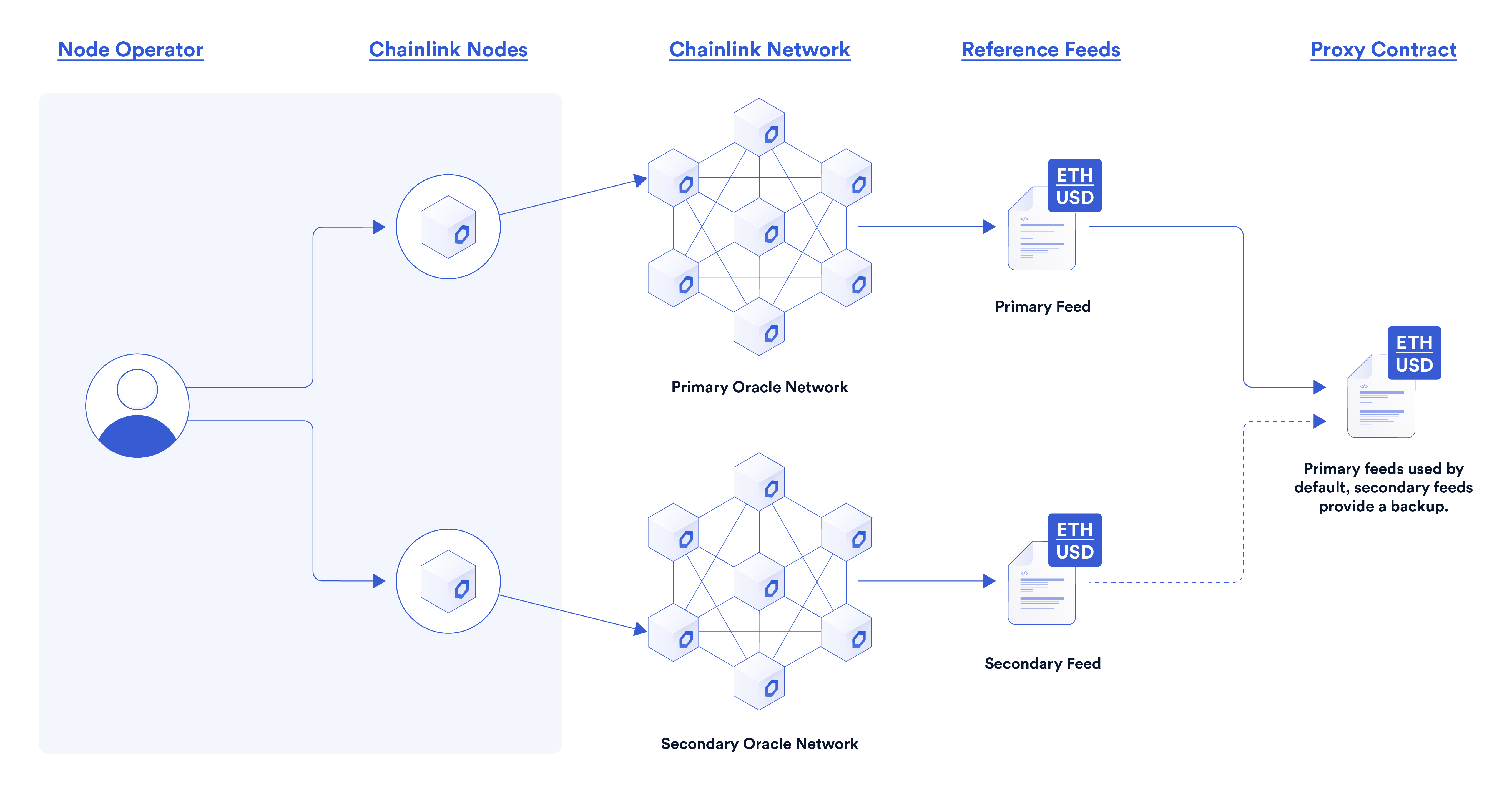

Real-Time, Reliable Pricing via Chainlink Data Streams: Chainlink provides high-throughput, real-time market data for tokenized assets, ensuring accurate and secure price feeds for trading and settlement.

-

Expanding Asset Coverage and Cross-Chain Support: Ondo plans to scale its offering to over 1,000 tokenized securities and add support for BNB Chain and Solana, broadening investor choice and accessibility.

This approach is not just about digitizing shares; it’s about reimagining market access for a global audience previously restricted by jurisdictional boundaries or outdated settlement rails.

The Role of Chainlink: Real-Time Data for On-Chain Assets

The reliability of tokenized asset pricing is paramount for both retail and institutional participants. Here’s where Chainlink Data Streams come into play. Chainlink provides high-throughput, low-latency price feeds for each listed equity and ETF on Ondo’s platform. These data streams ensure that every transaction reflects real-world market prices in real time, reducing slippage risk and supporting advanced DeFi use cases like lending or derivatives based on tokenized stocks.

This integration marks a significant leap forward in trust-minimized infrastructure. By leveraging Chainlink’s secure oracle network, Ondo eliminates single points of failure that have historically plagued synthetic asset platforms or wrapped products reliant on centralized administrators.

Market Context: Growth Trajectory and Asset Performance

The momentum behind on-chain US equities has been reflected in recent price action across relevant protocols. According to recent data, from July 1 this year through September 20:

- Ethereum: up 87.84%

- Chainlink: up 82.17%

- Avalanche: up 65.98%

- Ondo Finance: up 38.51%

This surge underscores both investor enthusiasm for blockchain-native financial products and the growing recognition of Ethereum as an institutional-grade settlement layer for real-world assets (source). As more assets are brought on-chain and made accessible globally, we can expect further innovation in portfolio construction, arbitrage strategies, and risk management tools tailored to this evolving ecosystem.

Ondo’s roadmap is aggressive, with the platform aiming to surpass 1,000 tokenized assets by year-end. This expansion will include not just additional U. S. equities and ETFs but also broader blockchain support, such as BNB Chain and Solana. For investors, this means a rapidly diversifying universe of on-chain securities that can be traded, transferred, or integrated into DeFi strategies without the legacy friction of traditional brokerages.

What sets Ondo apart is its commitment to regulatory compliance and security. All tokenized assets are fully backed by the corresponding real-world securities, which are held by U. S. -registered broker-dealers. This direct linkage ensures that each on-chain token is redeemable for its underlying asset value and not just a synthetic representation, a critical distinction for institutional adoption.

Practical Implications for Investors

The practical impact of tokenized ETFs on Ethereum extends beyond simple accessibility. Investors can now:

Key Use Cases for Tokenized US Equities on Ethereum

-

Collateral in DeFi Protocols: Tokenized US equities from Ondo Finance can be used as collateral in decentralized finance (DeFi) applications, enabling users to unlock liquidity or participate in lending/borrowing markets while retaining exposure to traditional assets.

-

24/7 Global Trading Access: Unlike traditional stock exchanges, platforms like Ondo Global Markets allow non-U.S. investors to buy and sell tokenized US stocks and ETFs on Ethereum at any time, regardless of market hours or local holidays.

-

Peer-to-Peer Transfers and Settlement: Tokenized equities are fully transferable across Ethereum wallets and compatible with major custodial solutions such as BitGo and Ledger, enabling direct peer-to-peer settlement without intermediaries.

-

Real-Time Pricing and Data Feeds: Chainlink Data Streams provide secure, high-throughput, real-time price feeds for tokenized equities, ensuring accurate valuation and risk management for DeFi protocols and investors.

-

Efficient Portfolio Rebalancing: Onchain tokenization allows investors to rebalance portfolios instantly and globally, moving between US stocks, ETFs, and other digital assets without traditional settlement delays or geographic restrictions.

This flexibility empowers both retail and professional traders to deploy capital more efficiently. For example, using tokenized equities as collateral in decentralized lending protocols unlocks liquidity without triggering taxable events or requiring asset liquidation.

Additionally, interoperability with major wallets and custodians like Trust Wallet, OKX Wallet, Bitget, BitGo, and Ledger lowers operational risk while offering seamless integration with existing crypto infrastructure (source). As these integrations deepen, expect secondary markets for tokenized stocks to mature rapidly, potentially rivaling centralized exchanges in both depth and price discovery.

The Road Ahead: Risks and Opportunities

While the promise of on-chain US equities is compelling, it is not without risks. Regulatory clarity remains a moving target in many jurisdictions. Investors should pay close attention to evolving compliance standards as platforms like Ondo expand globally. However, the model’s transparency, where every transaction is auditable on public blockchains, provides a foundation for robust risk management frameworks.

The collaboration between Ondo Finance and Chainlink has set a new benchmark for secure and transparent access to U. S. financial markets via Ethereum. With real-time pricing accuracy provided by Chainlink Data Streams and institutional-grade custody solutions underpinning asset backing, the infrastructure is in place for serious capital inflows from both crypto-native funds and traditional asset managers exploring digital rails.

If current growth rates persist, and if regulatory headwinds do not intensify, the next year could see exponential increases in both available assets and user participation across these platforms. The convergence of DeFi composability with traditional equity exposure has moved from theory to practice, and those positioning early stand to benefit from this paradigm shift in capital markets.