In the ever-shifting landscape of cryptocurrency investments, 13F filings remain a goldmine for spotting institutional adoption trends. UBS Group AG, one of Switzerland’s powerhouse banks, recently drew attention for its position in BlackRock’s iShares Bitcoin Trust (IBIT). While not a blockbuster move, this disclosure underscores a cautious yet telling step by traditional finance into spot Bitcoin ETFs. As we peer toward 2026, these filings paint a picture of accelerating Bitcoin ETF institutional adoption, even if UBS is playing it safe.

Digging into the details, UBS held 3,600 shares of IBIT as of March 31,2024, valued at $145,692 back then. Fast forward to current valuations, and that stake sits at around $124,488. It’s a modest exposure for a firm of UBS’s scale, especially when stacked against peers. This UBS Bitcoin ETF holdings position hints at testing the waters rather than diving headfirst, a strategy that aligns with their reputation for prudence in volatile assets.

Unpacking the Significance of UBS’s 13F Bitcoin ETF Disclosure

13F filings, mandated by the SEC for institutional managers overseeing over $100 million in assets, offer a quarterly snapshot of holdings. For spot Bitcoin ETF 13F filings, they reveal not just positions but sentiment. UBS’s entry, first spotlighted in sources like Crypto Briefing and Fintel data, signals that even conservative players are acknowledging Bitcoin’s maturation through regulated wrappers like ETFs.

Why does this matter for 2026? Picture this: as Bitcoin cements its role as digital gold, banks like UBS could scale up if regulatory winds stay favorable. Their stake, though small, normalizes crypto in high-net-worth portfolios. It’s a breadcrumb trail showing institutions dipping toes while retail and non-filers dominate ownership, per NYDIG research.

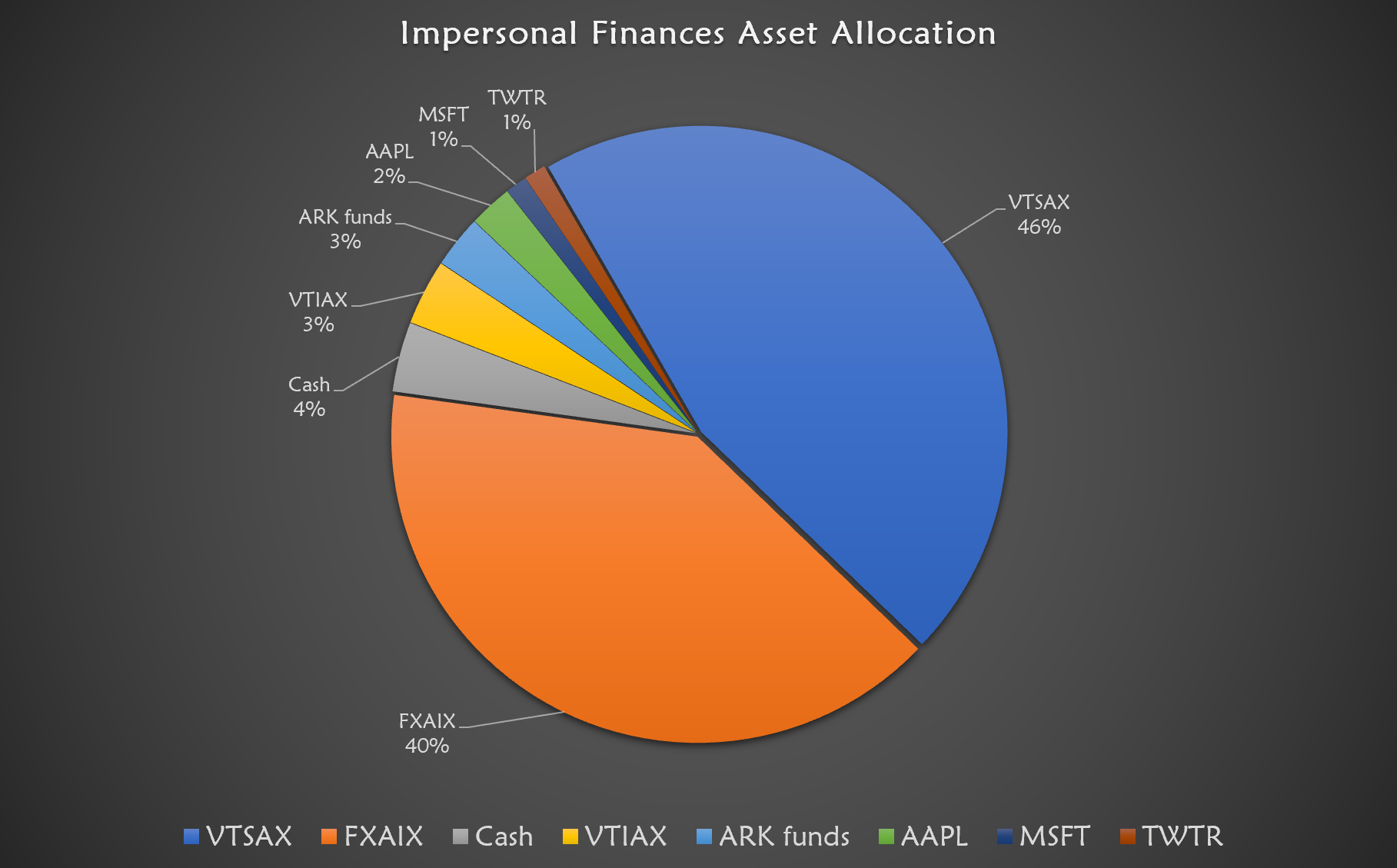

Major Banks’ Bitcoin ETF Holdings from 13F Filings

| Institution | Product | Shares | Value | As of Date |

|---|---|---|---|---|

| UBS Group AG | iShares Bitcoin Trust (IBIT) | 3,600 | $145,692 | March 31, 2024 |

| Goldman Sachs | iShares Bitcoin Trust (IBIT) | N/A | $1.27 billion | December 31, 2024 |

| Barclays | iShares Bitcoin Trust (IBIT) | 2.47 million | $131 million | December 31, 2024 |

| JP Morgan | Spot Bitcoin ETFs | N/A | $731,246 | Q1 2025 (filed May 10) |

Contrasting UBS: The Aggressive Plays by Wall Street Giants

UBS’s restraint stands out amid bolder moves elsewhere. Goldman Sachs ramped up to nearly $1.27 billion in IBIT by December 31,2024, an 88% quarterly jump. Barclays grabbed 2.47 million shares worth $131 million at the same mark. Even JP Morgan and Wells Fargo dipped in with $731,246 across spot ETFs, as per CryptoSlate. Wisconsin’s investment board? A whopping 6 million IBIT shares.

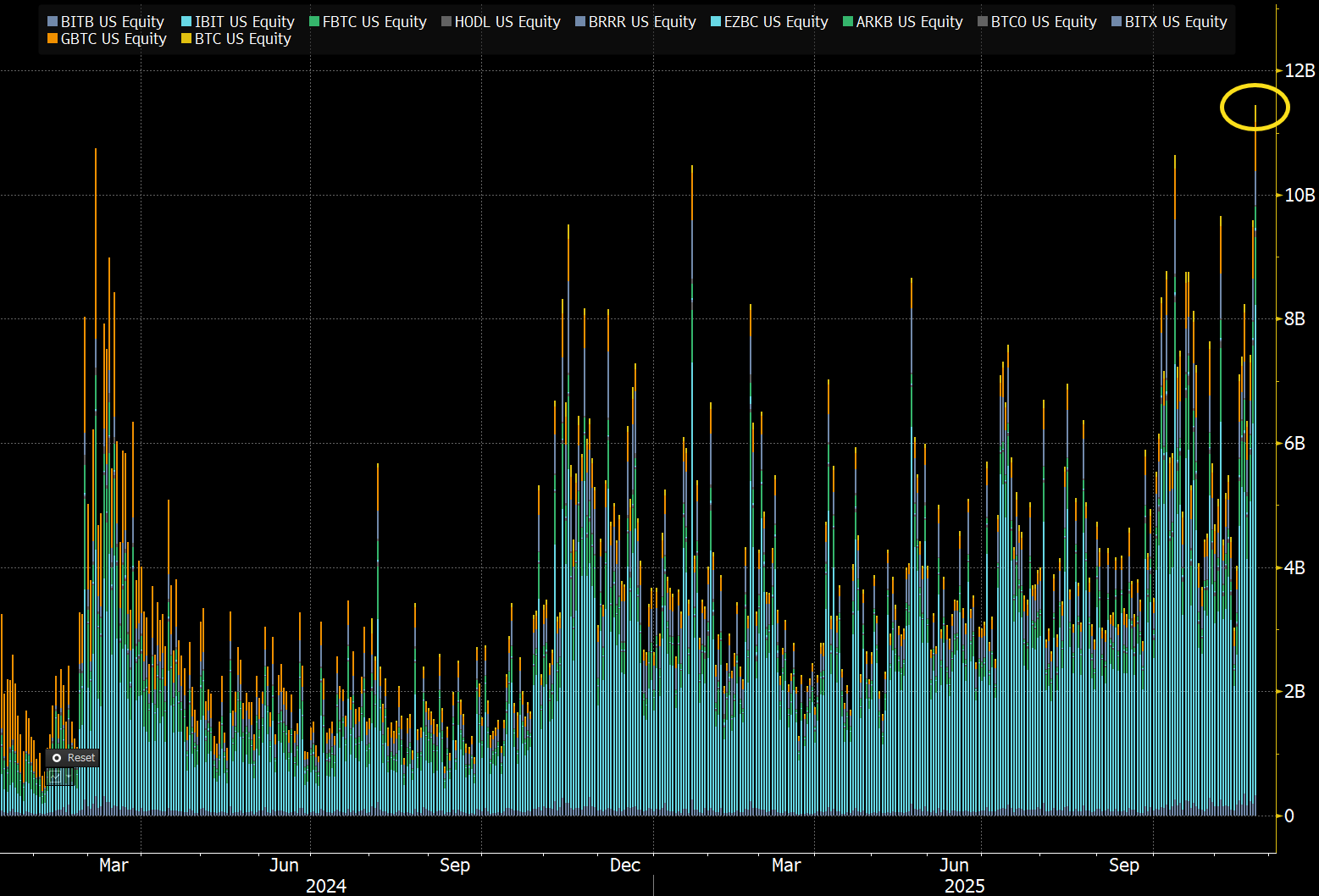

These UBS 13F Bitcoin ETF contrasts highlight divergent appetites. Big asset managers like Morgan Stanley and Citadel fueled nearly $1 billion in ETF inflows last week, flipping prior outflows, says Yahoo Finance. Non-filers, likely retail, still own the lion’s share, but institutions are the growth engine heading into 2026.

UBS’s own research on spot Bitcoin ETFs notes tax treatment as property, not collectibles like gold ETFs, easing adoption barriers. This clarity could spur more filings like theirs, broadening UBS crypto ETF exposure.

Projecting Institutional Momentum into 2026

With filings like UBS’s setting precedents, 2026 could see a tipping point. If patterns hold, expect more banks to echo Goldman’s aggression, driven by portfolio diversification needs. Pensions and endowments, reshaping strategies via ETF inflows, stand to benefit. Check out how 2025 inflows are already transforming allocations.

UBS’s modest hold isn’t hesitation forever; it’s calculated entry. As BTC ETFs prove resilient, watch for their next 13F to potentially double down, fueling broader trends.

That resilience is already evident. Spot Bitcoin ETFs have attracted billions since launch, with institutional inflows accelerating despite market dips. UBS’s position, while understated, contributes to this momentum, chipping away at skepticism one filing at a time.

What Drives Institutional Caution Versus Aggression?

Institutions like UBS weigh risks differently. Regulatory clarity helps, spot BTC ETFs qualify as property for tax purposes, sidestepping gold ETF pitfalls, as UBS itself pointed out. Yet volatility lingers, and compliance hurdles persist. Contrast that with Goldman Sachs, whose $1.27 billion bet reflects confidence in Bitcoin’s long-term store-of-value narrative. Barclays and others followed suit, padding portfolios amid rising BTC prices through 2024 and into 2026.

For UBS, the 3,600 shares represent a pilot program of sorts. Bitcoin ETF institutional adoption thrives when leaders like BlackRock provide seamless wrappers, reducing custody headaches. As more 13F filings roll in, we’ll see if UBS amplifies this or stays sidelined.

Key Factors Accelerating Bitcoin ETF Adoption

-

Regulatory Clarity: SEC approval of spot Bitcoin ETFs in 2024 has removed major hurdles, giving institutions like UBS confidence to disclose holdings via 13F filings.

-

Tax Advantages: Spot Bitcoin ETFs are taxed as property—not collectibles like gold ETFs—allowing favorable long-term capital gains rates, as noted by UBS research.

-

Portfolio Diversification: Bitcoin’s low correlation with stocks and bonds helps institutions like Goldman Sachs ($1.27B in IBIT) balance portfolios effectively.

-

Proven ETF Inflows: Billions in inflows, fueled by 13F disclosures from JP Morgan, Wells Fargo, and others, signal strong demand and reversing outflows.

-

BTC Price Stability: Maturing market with reduced volatility encourages conservative players like UBS (3,600 IBIT shares worth $145,692 as of March 2024).

Retail investors, via non-filers, hold the bulk now, but institutions dictate direction. Their entries spark inflows, stabilize prices, and legitimize the asset class. Think of it as a flywheel: one bank’s disclosure begets another’s.

Investor Takeaways: Positioning for 2026 ETF Trends

Spotting these trends early pays off. Track upcoming 13F deadlines, filings due 45 days post-quarter end, for fresh UBS updates. A bump from 3,600 shares could signal conviction. Meanwhile, monitor peers; if Goldman doubles down, expect ripples.

Diversification stands out as the big win. Pensions eyeing inflows reshaping allocations or endowments hedging inflation will lean on ETFs like IBIT. UBS’s crypto toe-dip reassures: even staid players see value.

Projected 2026 Institutional Bitcoin ETF Holdings Growth

| Institution | Current Value (Q4 2024) | Projected Increase |

|---|---|---|

| UBS | $124K | 2-5x |

| Goldman Sachs | $1.27B | 50% |

| Barclays | $131M | 30-40% |

| Overall AUM Impact | – | $50B |

Challenges remain, sure. Counterparty risks, liquidity crunches during volatility. But ETFs mitigate these versus direct holdings. For newcomers, start small, mimic UBS’s scale while learning the ropes.

Layer in on-chain data for fuller context. Whale accumulations align with ETF buys, hinting at synchronized bullishness. As 2026 unfolds, expect spot Bitcoin ETF 13F filings to dominate headlines, with UBS potentially joining the bold pack.

Forecasting BTC and ETF Trajectories

Gazing ahead, Bitcoin’s path ties directly to these disclosures. Sustained institutional bids could propel prices higher, rewarding early positions.

Bitcoin (BTC) Price Prediction 2027-2032

Predictions driven by institutional ETF adoption trends from 13F filings (e.g., UBS, Goldman Sachs) and market cycles

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $95,000 | $150,000 | $220,000 | +25% |

| 2028 | $130,000 | $220,000 | $350,000 | +47% |

| 2029 | $170,000 | $300,000 | $500,000 | +36% |

| 2030 | $230,000 | $420,000 | $700,000 | +40% |

| 2031 | $300,000 | $550,000 | $900,000 | +31% |

| 2032 | $420,000 | $780,000 | $1,300,000 | +42% |

Price Prediction Summary

Bitcoin prices are projected to grow substantially from 2027-2032, with average prices rising from $150K to $780K, fueled by accelerating institutional adoption via ETFs (as seen in 13F disclosures), Bitcoin halvings in 2028 and 2032, regulatory tailwinds, and its role as a macro asset. Bear cases reflect potential recessions or regulatory hurdles, while bull cases assume massive inflows and adoption.

Key Factors Affecting Bitcoin Price

- Surging institutional inflows into BTC ETFs, evidenced by 13F filings from UBS, Goldman Sachs, and others

- Bitcoin halvings in 2028 and 2032 boosting scarcity and historical bull cycles

- Improving regulatory clarity and mainstream financial integration

- Technological upgrades (e.g., Lightning Network, Ordinals) enhancing utility

- Macro factors: inflation hedging amid fiat debasement

- Market cap expansion toward $10T+ with sustained dominance over altcoins

- Potential risks: geopolitical tensions, competition, or delayed adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

UBS’s story illustrates the shift: from fringe to fixture. Their UBS crypto ETF exposure, alongside giants’, forecasts a portfolio staple. Stay vigilant on filings; they don’t lie. In this game, patience meets data for confident plays.