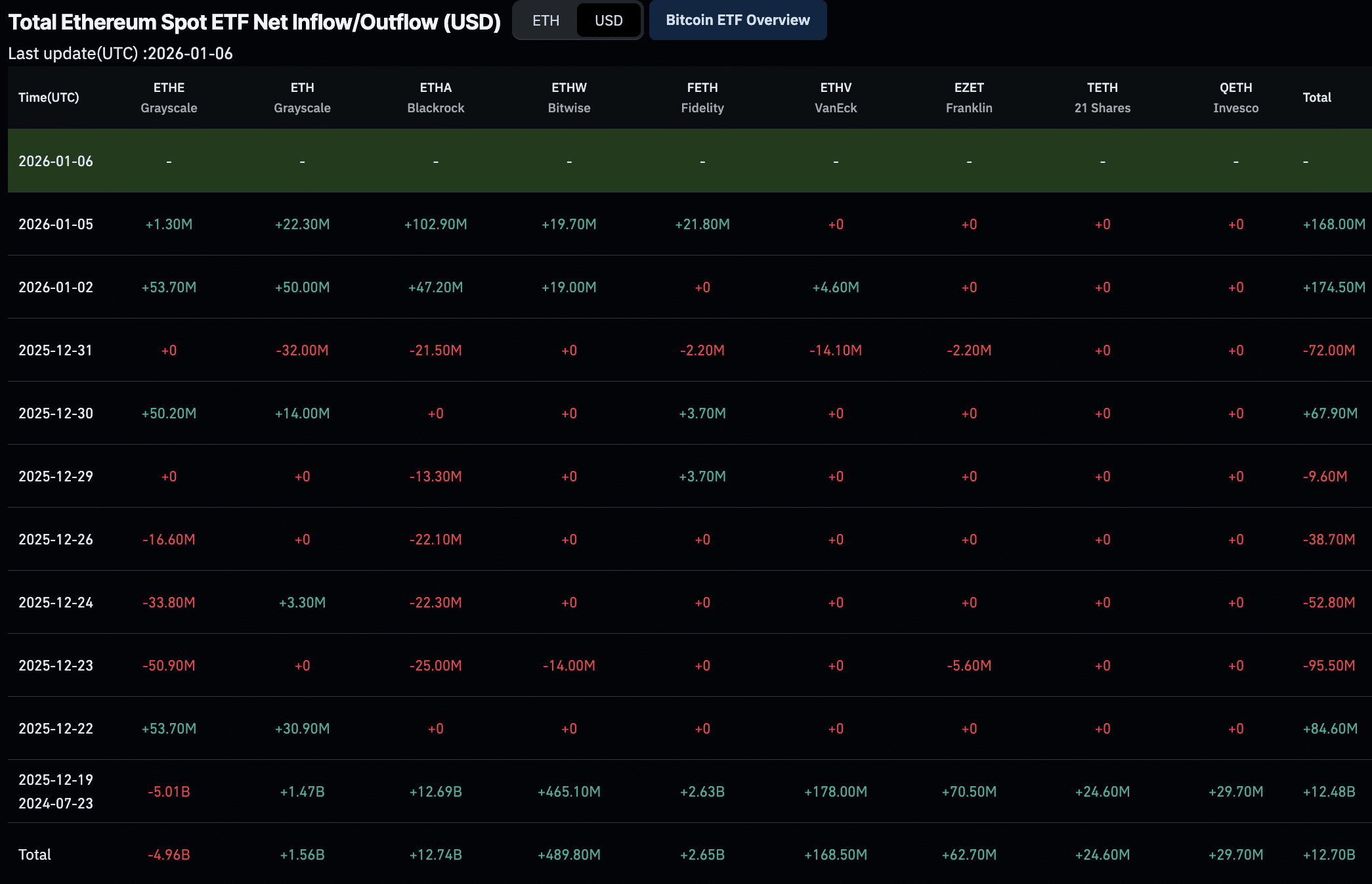

In a market where Ethereum trades at $1,946.89, marking a 3.04% decline over the past 24 hours with a low of $1,933.33, spot ETH ETFs delivered a counterintuitive boost. On February 10,2026, these funds notched a collective net inflow of $13.8184 million, spearheaded by Grayscale’s Ethereum Mini Trust ETF, which pulled in $13.3173 million alone. This surge bumped Grayscale’s cumulative inflows to $1.717 billion, underscoring resilient demand amid volatility.

Such flows matter because they reflect institutional conviction when retail sentiment wavers. Grayscale’s dominance here isn’t accidental; it’s a strategic pivot in a landscape where Ethereum’s ecosystem continues to mature, even as price action lags.

Grayscale’s $13.3 Million Inflow: Dissecting the Drivers

Grayscale’s Ethereum Mini Trust stands out for its targeted appeal to investors seeking pure ETH exposure without the baggage of broader trusts. The $13.3173 million influx on February 10 represents a pivotal moment, especially as it overshadowed other players. Fidelity’s FETH added a modest $501,100, lifting its total to $2.582 billion, yet Grayscale’s haul signals a preference for its structure amid choppy waters.

Institutional players are voting with capital, channeling funds into Grayscale despite ETH hovering below $2,000.

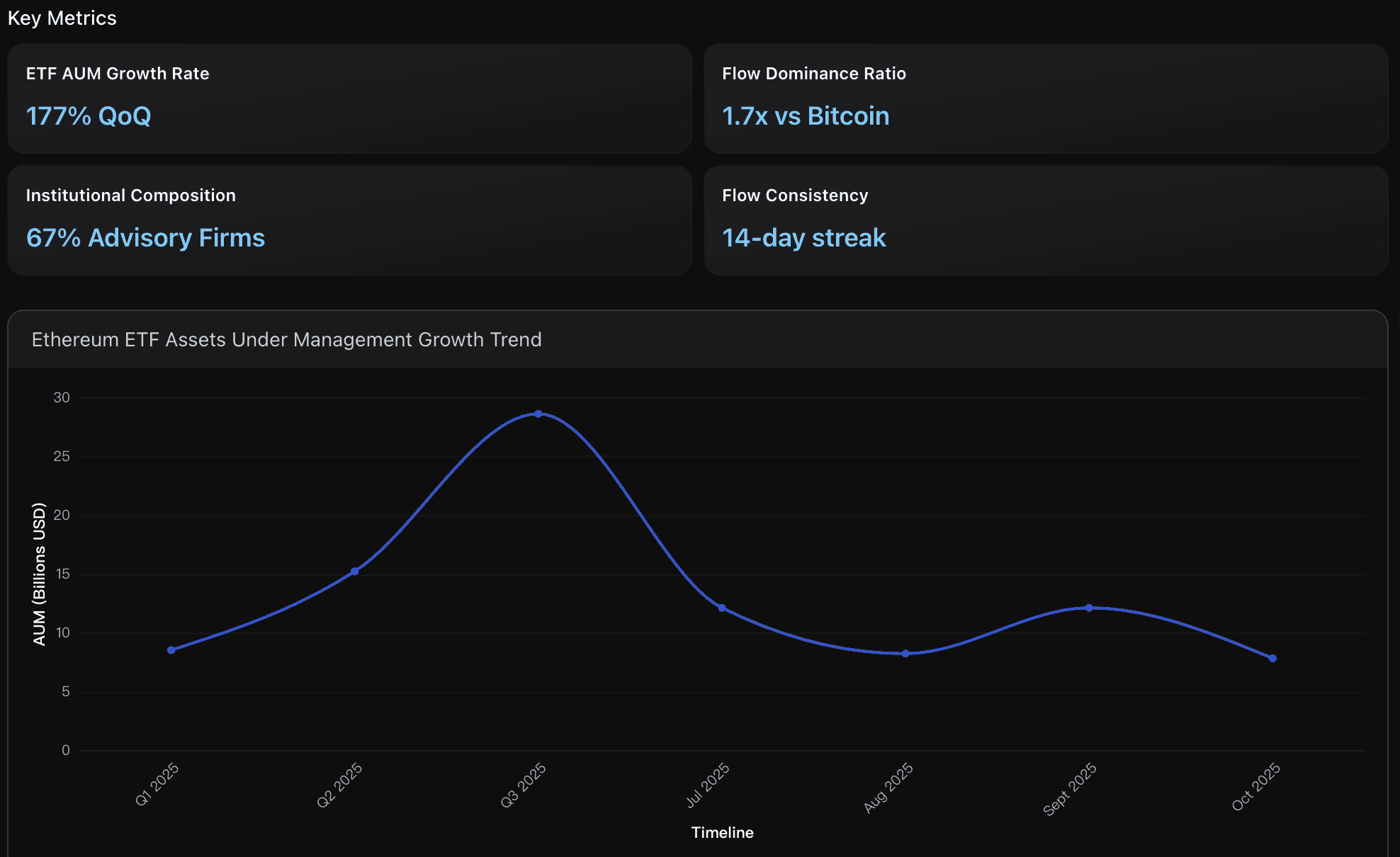

This isn’t isolated. Total ETH spot ETF assets now hit $11.755 billion, capturing 4.84% of Ethereum’s market cap. For context, earlier reports from Farside Investors highlighted divergent flows, with ETH sometimes lagging Bitcoin, but recent data flips the script. Grayscale’s move hints at accumulation ahead of potential catalysts like network upgrades or macroeconomic shifts.

Strategically, this inflow aligns with my view that ETH ETFs serve as a diversification anchor. In portfolios blending traditional assets with crypto, such products mitigate single-asset risk while capturing upside from layer-1 growth.

Institutional Appetite Amid ETH’s Volatility Reset

Ethereum’s price at $1,946.89 reflects short-term pressures, yet ETF metrics paint a brighter picture. Grayscale’s leadership in this $13.8 million daily total underscores growing ETH institutional accumulation, a theme echoing broader trends. Historical data shows inflows often precede price stabilization; for instance, past surges in ETH ETF assets under management reached billions by late 2025.

Consider the contrast with Bitcoin ETFs, which have seen mixed flows lately. While BTC commands larger AUM, ETH’s relative inflows suggest smart money positioning for Ethereum’s edge in DeFi and staking yields. At 4.84% market cap coverage, ETFs are still nascent, leaving room for expansion as adoption scales.

Ethereum ETF inflows surge past Bitcoin patterns from prior months reinforce this, where ETH funds occasionally outpaced BTC during dips.

From a portfolio lens, these signals advocate measured entry points. Investors eyeing spot ETH should weigh this inflow against on-chain metrics, like staking ratios climbing steadily.

Ethereum (ETH) Price Prediction 2027-2032

Projections based on ETF inflow momentum, institutional adoption, and market cycles from current price of $1,946.89

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $2,500 | $4,000 | $6,000 |

| 2028 | $3,000 | $5,500 | $8,500 |

| 2029 | $4,000 | $7,000 | $11,000 |

| 2030 | $5,500 | $9,500 | $15,000 |

| 2031 | $7,000 | $12,000 | $20,000 |

| 2032 | $9,000 | $15,000 | $25,000 |

Price Prediction Summary

Ethereum’s price is forecasted to experience robust growth driven by $13.8M net ETF inflows (Grayscale $13.3M), rising to an average of $4,000 in 2027 and $15,000 by 2032, with min/max reflecting bearish corrections and bullish peaks amid adoption and cycles.

Key Factors Affecting Ethereum Price

- Strong ETF inflows and $11.755B AUM (4.84% of market cap)

- Ethereum upgrades enhancing scalability and use cases

- Institutional interest and regulatory tailwinds

- DeFi/Layer 2 expansion vs. L1 competition

- Macro cycles post-2024 halving and volatility resets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Implications for Spot ETH Positioning[/h2>

For spot ETH investors, Grayscale’s Grayscale Ethereum ETF inflow acts as a bullish undercurrent. Despite the 24-hour dip to $1,946.89, sustained buying pressure from ETFs like the Mini Trust points to undervaluation. This $13.3 million dose of liquidity counters selling from elsewhere, potentially setting a floor.

Key takeaway: diversification via ETFs tempers volatility. Grayscale’s cumulative $1.717 billion now bolsters confidence, inviting allocations from those rotating out of overextended BTC positions. Watch for follow-through; if inflows persist, ETH could reclaim $2,000 swiftly, validating strategic patience over panic.

To gauge the full picture, let’s examine how Grayscale’s performance stacks against peers. While Fidelity trails with smaller daily gains, the collective $13.8184 million inflow elevates total ETH spot ETF AUM to $11.755 billion. This represents a meaningful stake, signaling ETH institutional accumulation even as Ethereum lingers at $1,946.89.

6-Month Cryptocurrency Price Performance Amid Grayscale Ethereum ETF Inflows

Grayscale Ethereum Mini Trust dominates with $13.3173M (96.4%) of $13.8184M total inflows on 2026-02-10 📈, signaling momentum for ETH investors despite bearish trends. AUM: Grayscale $1.717B 📈, Fidelity FETH $2.582B 📈, Total $11.755B 📈.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $1,944.46 | $4,310.07 | -54.9% |

| Bitcoin | $66,878.00 | $112,071.43 | -40.3% |

| Solana | $80.93 | $136.94 | -40.9% |

| BNB | $590.18 | $593.08 | -0.5% |

| XRP | $1.37 | $2.97 | -53.9% |

| Cardano | $0.2544 | $0.8047 | -68.4% |

| Dogecoin | $0.0897 | $0.1922 | -53.3% |

| Chainlink | $8.27 | $25.00 | -66.9% |

| Polkadot | $1.23 | $5.00 | -75.4% |

Analysis Summary

Over the past six months, the cryptocurrency market has declined sharply, with Ethereum down 54.9% to $1,944.46 and Polkadot plummeting 75.4%. BNB remains nearly flat at -0.5%. Despite this, Grayscale’s dominant $13.3M ETH ETF inflow (96.4% share) underscores institutional momentum for spot ETH.

Key Insights

- Grayscale’s $13.3173M inflow represents 96.4% dominance on 2026-02-10, boosting total ETF AUM to $11.755B.

- All assets show 6-month declines amid bearish trend; BNB outperforms with minimal -0.5% drop.

- Ethereum mirrors XRP/DOGE at ~54% loss, while ADA/LINK/DOT exceed 65% declines.

- ETH ETF flows signal positive outlook for investors despite -54.9% price drop.

- Bitcoin and Solana declines (~40%) less severe than most altcoins.

Prices and 6-month changes sourced exclusively from provided real-time CoinMarketCap historical data (e.g., 2025-08-08 for ETH). ETF inflow/AUM figures from 2026-02-10 context. Last updated: 2026-02-11T13:14:04Z.

Data Sources:

- Main Asset: https://coinmarketcap.com/historical/20250808/

- Bitcoin: https://coinmarketcap.com/historical/20250908/

- Solana: https://coinmarketcap.com/historical/20250308/

- BNB: https://coinmarketcap.com/historical/20250308/

- XRP: https://coinmarketcap.com/historical/20250908/

- Cardano: https://coinmarketcap.com/historical/20250308/

- Dogecoin: https://coinmarketcap.com/historical/20250308/

- Chainlink: https://coinmarketcap.com/historical/20250808/

- Polkadot: https://coinmarketcap.com/historical/20250808/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Zooming out, these ETH ETF flows $13.8M align with patterns where leading issuers anchor sentiment. Earlier divergences, like ETH outflows amid BTC gains, now reverse, pointing to Ethereum’s undervalued positioning. For spot holders, this dynamic offers a buffer; institutional bids absorb downside pressure, fostering stability.

Layer in on-chain signals: staking participation nears record highs, amplifying ETF appeal through yield proxies. Investors gain DeFi exposure without direct custody hassles, a strategic edge in volatile cycles.

Ethereum ETF inflows surge past Bitcoin during prior dips mirrors today’s resilience, where ETH funds defy price weakness.

Strategic Roadmap for Spot ETH Investors

As a portfolio strategist, I view Grayscale’s Ethereum spot ETF Grayscale dominance as a call to action. At $1,946.89, ETH trades at levels ripe for accumulation, backed by ETF conviction. Yet balance tempers enthusiasm; pair these vehicles with fixed-income stabilizers to weather swings.

Key Signals from Grayscale $13.3M ETH Inflow

-

Institutional buying at $1,946.89 floor: Grayscale’s Ethereum Mini Trust ETF attracted $13.3173M on Feb 10, 2026, signaling confidence at ETH’s current price level amid a -3.04% 24h dip.

-

Cumulative $1.717B commitment: Grayscale’s total net inflows reached $1.717B, underscoring sustained institutional dedication to Ethereum exposure.

-

4.84% market cap coverage: Ethereum spot ETFs’ $11.755B AUM covers 4.84% of ETH’s market cap, indicating substantial growth potential ahead.

-

DeFi and staking tailwinds: Ethereum’s robust DeFi ecosystem and staking yields provide fundamental support, amplified by ETF accessibility for institutions.

-

Diversification vs BTC-heavy portfolios: With Fidelity’s FETH at $2.582B cumulative, ETH ETFs offer a strategic balance to Bitcoin-dominated holdings.

This framework forms the backbone of an Ethereum ETF investor guide: monitor daily flows via trusted trackers, allocate 5-10% to ETH ETFs in diversified setups, and rebalance quarterly. Grayscale’s surge exemplifies why; it counters the 3.04% daily drop, positioning savvy allocators for rebound.

Looking ahead, persistent inflows could catalyze ETH toward prior highs, especially if macro tailwinds like rate cuts materialize. Grayscale’s Mini Trust, with its low-fee structure, emerges as a tactical pick for those scaling in gradually. Contrast this with historical outflows in risk-off phases, underscoring the pivot to accumulation.

Past ETH spot ETF outflows in late 2025 serve as a reminder: flows are cyclical, but current trends favor bulls.

Ultimately, Grayscale’s $13.3173 million bet reflects disciplined capital at work. For spot ETH investors navigating $1,946.89 territory, it validates holding firm, blending ETF inflows with personal conviction for compounded returns over time. In a maturing market, such signals separate enduring strategies from fleeting trades.