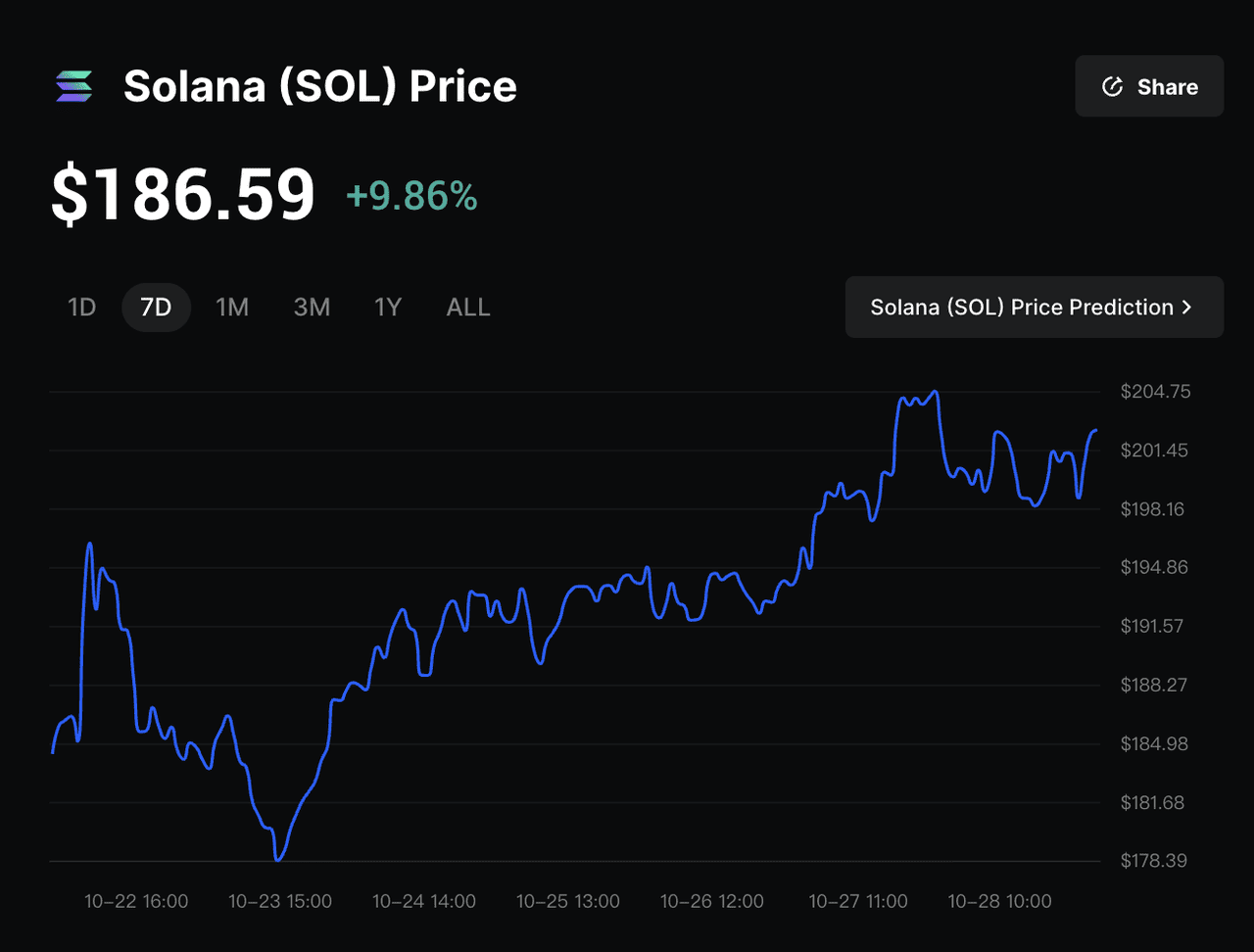

In the volatile landscape of US spot crypto ETFs, Solana (SOL) and XRP funds are carving distinct paths as investors navigate market dips. With SOL trading at $83.38, down 4.15% over the past 24 hours from a high of $88.65, spot SOL ETFs posted $9.6 million in net inflows for the week ending January 23,2026. This contrasts sharply with XRP ETFs, which saw a $40.6 million net outflow in the same period, snapping a prior streak of consistent gains. These SOL ETF inflows signal resilience, while XRP ETF weekly flows highlight shifting sentiment, per data from trackers like SoSoValue.

SOL ETFs Build Momentum with Steady Inflows

Spot SOL ETFs have demonstrated robust investor confidence, accumulating over $1.1 billion in assets under management. Bitwise’s BSOL fund leads the pack, underscoring institutional appetite for Solana’s high-throughput blockchain amid its price hovering at $83.38. The recent $9.6 million weekly inflow extends a positive trend, even as broader crypto markets face pressure. Earlier data from SoSoValue showed SOL ETFs pulling in $46.88 million during January 12-16, reinforcing this trajectory.

Technical traders eyeing US spot crypto ETF data note SOL’s inflows correlate with network metrics like transaction volume, which remains elevated despite the -$3.61 24-hour dip. This flow pattern suggests tactical positioning for potential rebounds, distinct from Bitcoin and Ethereum’s mixed performances.

Spot Solana ETFs continue positive momentum with $9.6M inflows last week, led by Bitwise BSOL.

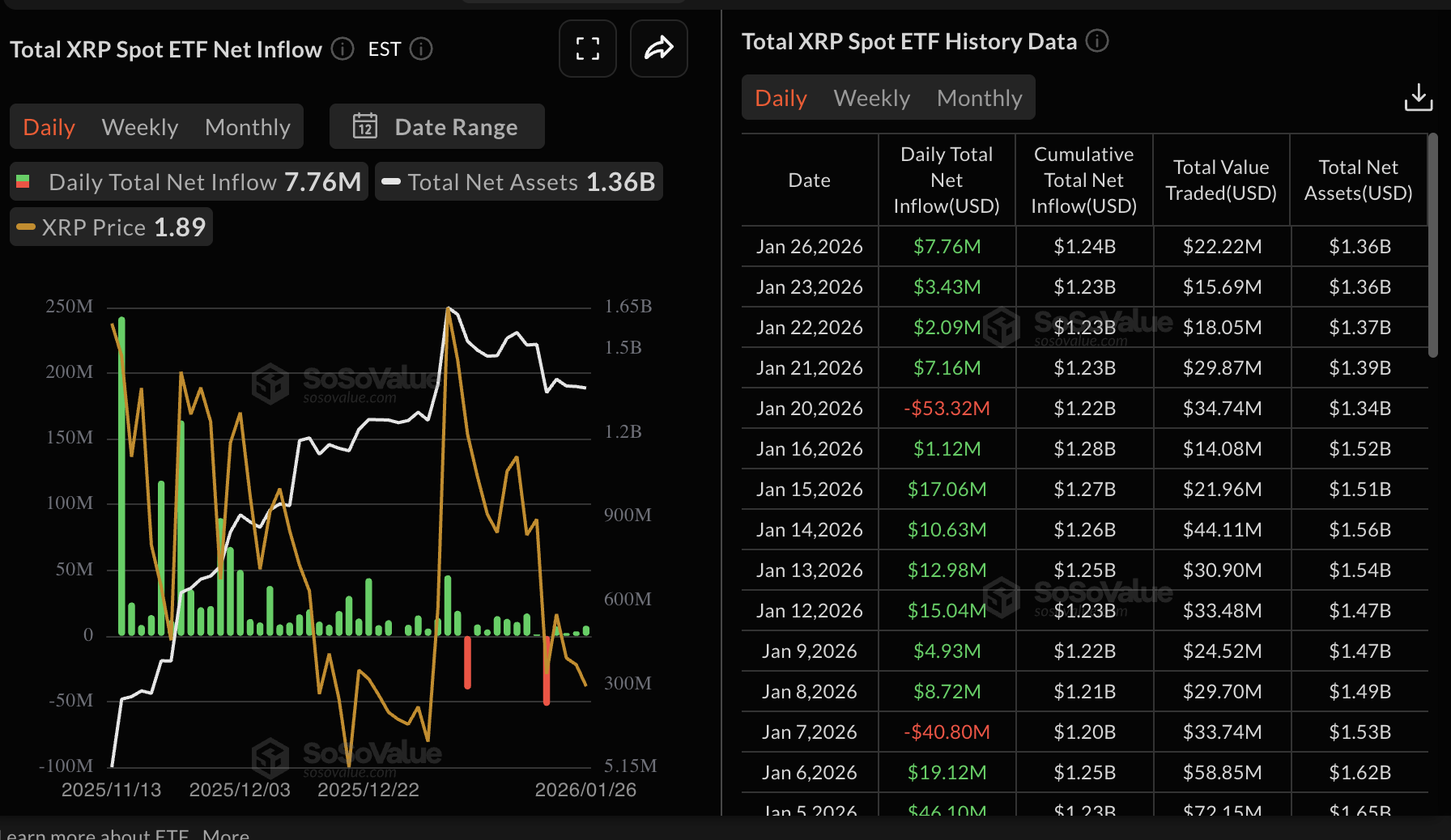

XRP ETFs Snap Inflow Streak Amid Outflows

XRP ETFs, boasting around $1.5 billion in assets earlier, encountered turbulence with a $40.6 million outflow for the week ending January 23. This marked the first significant reversal since inception, including a hefty $53 million exit on January 21, though partially offset later. Prior to this, XRP funds enjoyed a 30-day inflow streak totaling nearly $990.9 million by December 12,2025, with cumulative nets climbing from $1.18 billion to $1.22 billion.

Using the SoSoValue ETF tracker, we see XRP previously outperforming peers, like $56.83 million inflows in mid-January and $17.06 million on January 15, beating BTC, ETH, and SOL daily hauls. Yet, the recent pullback points to profit-taking or regulatory jitters, even as fee waivers from issuers like Franklin Templeton sweetened the deal for institutions.

Solana ETF vs XRP ETF: Flow Divergence Drives Strategies

Juxtaposing Solana ETF vs XRP ETF flows reveals a pivotal investor pivot. SOL’s consistent positives, against XRP’s stumble, reflect bets on Solana’s DeFi and meme coin ecosystem versus XRP’s payments utility amid Ripple uncertainties. For the week of January 12-16, SOL lagged XRP slightly at $46.88 million versus $56.83 million, but latest data flips the script, with SOL at $9.6 million inflows and XRP negative.

Practical strategies emerge: Accumulate SOL ETFs during dips like the current $83.38 level, leveraging Bitwise’s dominance for low-fee exposure. For XRP, watchful waiting prevails, monitoring if outflows stabilize post the 33-day streak extension noted earlier. Cross-asset data from SoSoValue underscores this SOL ETF inflows edge, prompting rotations from overextended XRP positions.

Historical caution, as in December 2025’s SOL outflows, tempers optimism; see detailed analysis here. Forward-looking, fee incentives could reignite XRP, but SOL’s momentum aligns with on-chain growth.

Solana (SOL) Price Prediction 2027-2032

Forecast incorporating US Spot SOL ETF inflows ($9.6M-$46.88M weekly), XRP ETF outflows, current price baseline of $83.38, and market adoption trends

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $60.00 | $120.00 | $180.00 | +41% (from 2026 est. $85) |

| 2028 | $90.00 | $170.00 | $260.00 | +42% |

| 2029 | $130.00 | $240.00 | $380.00 | +41% |

| 2030 | $170.00 | $340.00 | $550.00 | +42% |

| 2031 | $230.00 | $480.00 | $780.00 | +41% |

| 2032 | $300.00 | $650.00 | $1,050.00 | +35% |

Price Prediction Summary

Solana (SOL) is poised for robust growth through 2032, fueled by sustained ETF inflows signaling institutional confidence, Solana’s superior scalability, and shifting capital from underperforming XRP ETFs. Average prices projected to compound at ~40% annually, reaching $650 by 2032, with bullish maxima over $1,000 amid favorable cycles.

Key Factors Affecting Solana Price

- Continued SOL ETF inflows ($9.6M+ weekly) vs XRP outflows ($40M+), boosting SOL sentiment

- Solana ecosystem expansion in DeFi, NFTs, and high TPS advantages over competitors

- Regulatory tailwinds from spot ETF approvals and potential clarity

- Market cycles aligned with Bitcoin halvings (2028 impact) and institutional adoption

- Technological upgrades reducing outages, enhancing reliability

- Competition risks from ETH L2s and broader market cap dilution in bear phases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Traders leveraging SoSoValue ETF tracker data are recalibrating portfolios based on this divergence. SOL’s inflows persist because its ecosystem delivers real utility; think high-speed DeFi apps and thriving meme sectors that keep on-chain activity buzzing even at $83.38. XRP’s outflows, while a blip after that impressive streak, expose vulnerabilities tied to Ripple’s legal overhang, no matter the fee waivers.

US Spot SOL ETF vs XRP ETF: Weekly Flows Breakdown (Millions USD)

| Period | SOL ETF Flows | XRP ETF Flows | Highlights / Notes |

|---|---|---|---|

| Jan 12-16, 2026 | $46.88M | $56.83M | Strong inflows; XRP outperforms SOL |

| Week ending Jan 23, 2026 | $9.6M | -$40.6M | XRP first outflows since inception, ending ~30-day streak |

| AUM (as of Feb 9, 2026) | $1.1B | $1.5B | SOL led by Bitwise BSOL; fee waivers aided XRP earlier |

| Source | SoSoValue / The Block |

Decoding Weekly Flows: Numbers Tell the Real Story

Breaking down XRP ETF weekly flows and SOL counterparts reveals patterns sharper than price charts alone. XRP’s mid-January surge to $56.83 million for January 12-16 outpaced SOL’s $46.88 million, yet the January 23 week flipped dynamics with SOL’s modest gain holding firm. XRP’s $40.6 million outflow stemmed from a $53 million single-day hit on January 21, hinting at coordinated profit-taking after cumulative inflows hit $1.22 billion.

SOL ETFs, meanwhile, channel steady capital into Bitwise’s BSOL, mirroring Solana’s network resilience. At $83.38, with a 24-hour low of $82.87, SOL avoids the drama, attracting flows that align with transaction spikes. This isn’t blind hype; it’s calculated entry amid broader BTC and ETH outflows, positioning SOL for outsized rebounds if volume sustains.

Cross-reference with earlier highs: XRP’s $17.06 million daily inflow on January 15 crushed peers, but sustainability falters without clearer catalysts. SOL’s trajectory feels more anchored, less prone to streak-ending reversals.

SOL ETF Inflows vs XRP Outflows Strategies

-

1. Dollar-cost average into SOL ETFs at $83.38 dips, targeting leader Bitwise BSOL amid $9.6M weekly inflows.

-

2. Hedge XRP holdings with stop-losses after $40.6M ETF outflow, signaling potential sentiment shift.

-

3. Rotate capital from XRP to SOL ETFs on SoSoValue flow signals confirming SOL momentum.

-

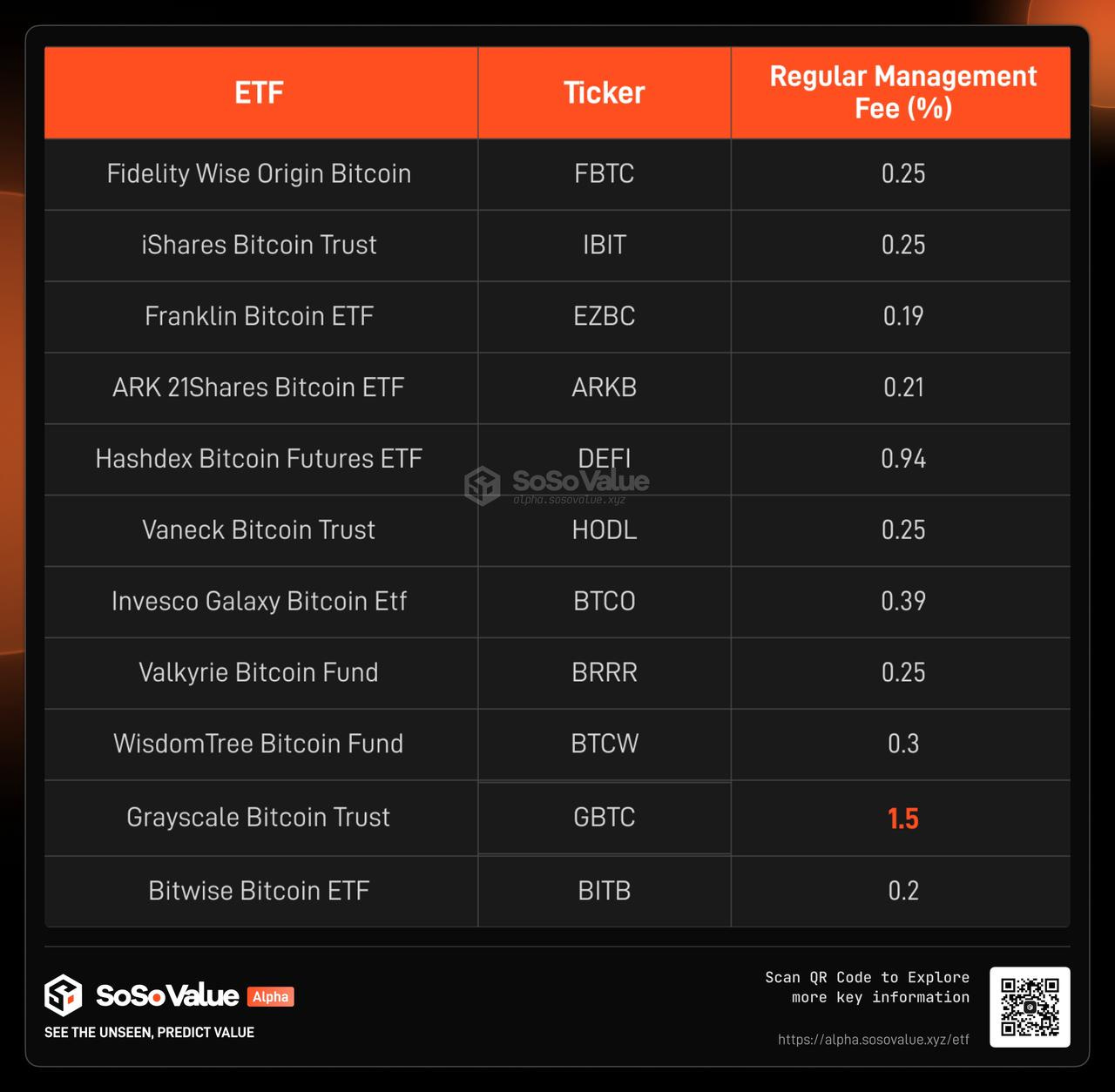

4. Monitor fee waivers from Franklin Templeton and Grayscale for XRP ETF re-entry opportunities.

-

5. Track on-chain metrics via Arkham or Whale Alert to confirm ETF flow trends.

Risk-Adjusted Plays: Positioning for the Next Leg

Smart money isn’t chasing yesterday’s winners blindly. For SOL, the play is accumulation; its $9.6 million inflow amid a -4.15% price slide screams undervaluation. Pair this with Solana’s edge in scalability, and you’re betting on infrastructure that powers real dApps, not just payments promises.

XRP holders face a tactical retreat. That 30-day streak built $990.9 million by late 2025, but outflows signal caution. Institutions eyeing Franklin Templeton waivers might dip back in, yet until sentiment flips, sidelining makes sense. Blend both? A 60/40 SOL-XRP ETF split hedges ecosystem bets without overcommitting to either.

Zoom out on US spot crypto ETF data: SOL’s momentum echoes its December cautionary outflows, a reminder that flows lag price but lead conviction. As Binance-Peg SOL dips to $83.38, inflows validate the floor. XRP’s rebound hinges on recapturing that $63 million ETP lead from prior weeks, but for now, SOL steals the spotlight.

Position accordingly: Scale into SOL for growth, tread lightly on XRP until inflows resume. Charts and flows don’t lie; they spotlight where capital flows next.