Solana’s SOL token hovers at $87.89 as of February 8,2026, reflecting a modest 24-hour gain of $2.83 or and 0.0333%, with a daily range between $84.55 and $88.98. This stability comes after the SEC’s approval of multiple spot Solana ETFs, capping a regulatory saga that stretched from initial filings into early 2026. High approval odds from Bloomberg Intelligence (90-100%) and Polymarket (91-99%) fueled investor positioning throughout 2025, transforming Solana ETF approval timeline into a focal point for crypto ETF strategies.

Market watchers tracked nine applications from issuers like VanEck and 21Shares, with the SEC invoking 60-day extensions to push final deadlines to October 16,2025, for several filings. Further delays extended reviews toward March 27,2026, amid debates on custody, market integrity, and SOL’s commodity status. These milestones, detailed in SEC notices and analyst reports, built momentum for what became a reality, boosting institutional demand and network activity.

Navigating the Extended SEC Review Periods

The SEC’s methodical pace tested patience but aligned with precedents from Bitcoin and Ethereum ETFs. Key dates included initial notices in late 2024, updated filings requested by early 2025, and punt decisions from Yahoo Finance reports shifting timelines. Polymarket bettors priced in 91% odds for 2025 approval, rising to 99% by year-end, while ETF Database highlighted summer catalysts. By Q4 2025, nine S-1 amendments addressed regulator concerns, paving the way for green lights.

This Solana ETF launch date trajectory underscores the value of vigilance. Investors who monitored filings via SEC. gov and platforms like The Block gained early edges, as approvals unlocked billions in potential inflows.

Strategic Positioning Ahead of Solana ETF Approvals

With approvals now live from managers like Bitwise and 21Shares, hindsight validates five prioritized Solana investment 2026 tactics that savvy portfolios employed. These practical moves leveraged 91-100% odds and discounted proxies, delivering outsized returns as SOL consolidated above $87.89.

Solana (SOL) Price Prediction 2027-2032

Post-ETF Approval Forecasts: Bear, Average, and Bull Scenarios Based on Institutional Inflows and Market Cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg from 2026 Base of $120) |

|---|---|---|---|---|

| 2027 | $100 | $180 | $350 | +50% |

| 2028 | $90 | $160 | $320 | +33% |

| 2029 | $130 | $250 | $500 | +56% |

| 2030 | $170 | $350 | $700 | +40% |

| 2031 | $220 | $450 | $900 | +29% |

| 2032 | $280 | $600 | $1,200 | +33% |

Price Prediction Summary

Solana’s price is projected to experience robust growth post-2026 ETF approvals, with average prices climbing from $180 in 2027 to $600 by 2032. Bullish maxima reflect peak adoption and bull cycles, while minima account for potential corrections amid volatility.

Key Factors Affecting Solana Price

- Sustained institutional inflows from Solana ETFs driving liquidity

- Solana network upgrades enhancing scalability and TPS

- Growing DeFi, NFT, and meme coin ecosystems on Solana

- Favorable regulatory clarity post-ETF approvals

- Alignment with broader crypto market cycles (e.g., BTC halvings)

- Competition from Ethereum L2s and other L1 blockchains

- Macroeconomic factors like interest rates and global adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

- Dollar-Cost Average into SOL: Starting monthly DCA buys through Q1 2026 capitalized on Polymarket’s 91-100% odds and Bloomberg’s bullish calls. This averaged entries amid volatility, positioning holders for post-approval surges without timing risks. Technicals showed SOL respecting key supports near $84.55, rewarding disciplined accumulation.

- Monitor SEC Deadlines Closely: Alerts for October 16,2025, decisions on VanEck, 21Shares, and others, plus 2026 extensions, enabled nimble pivots. Real-time tracking via fintechlaw. ai and Yahoo Finance prevented surprises from 60-day punts, allowing preemptive scaling.

- Accumulate Grayscale Solana Trust (GSOL): GSOL traded at discounts as a low-risk ETF precursor, offering pure-play exposure sans direct custody hassles. Its convergence to NAV post-approvals amplified gains for early accumulators.

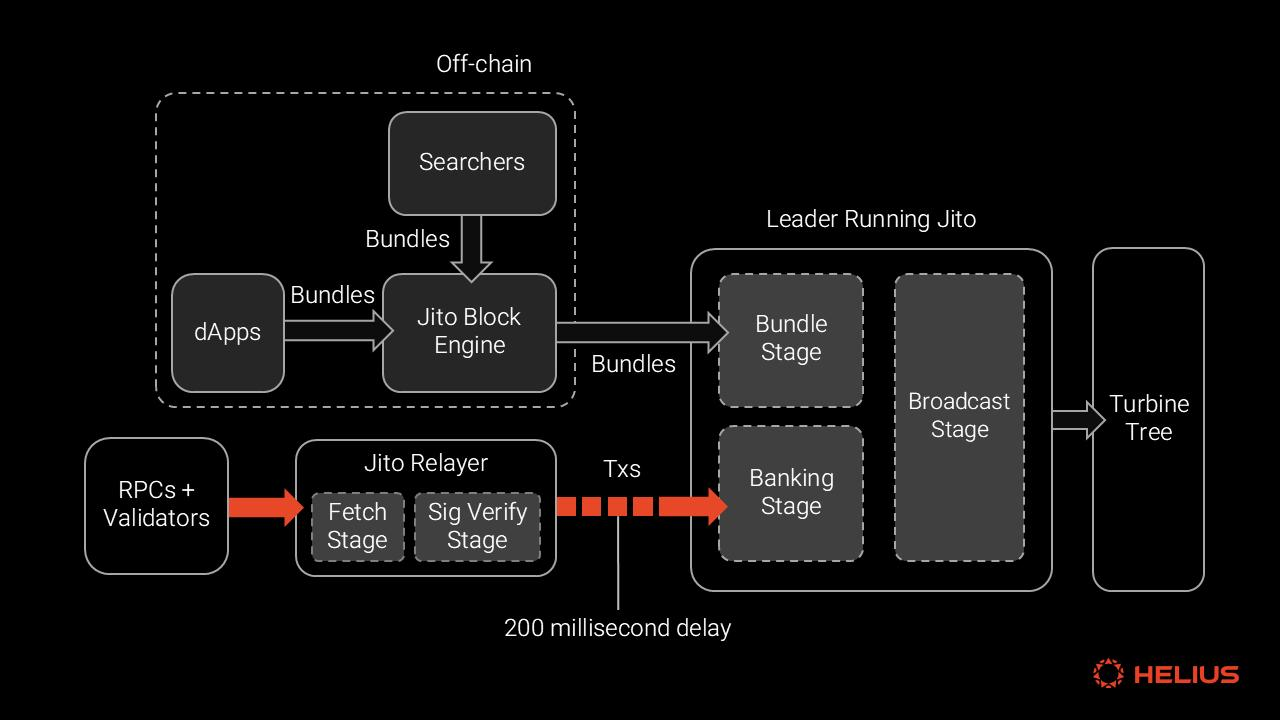

- Diversify into Solana Ecosystem Tokens: Pairing SOL with JTO (Jito) and JUP (Jupiter) captured leveraged network effects. These high-conviction picks rode Solana’s throughput advantages, outperforming amid ETF hype.

- Prepare ETF Allocation Plan: Allocating 5-10% to Solana ETFs upon launch, rebalanced from BTC/ETH, optimized diversification. This structured approach harnessed correlations while capping downside in a maturing market.

Implementing these crypto ETF strategies required blending technical precision with regulatory awareness. Charts revealed bullish patterns as deadlines neared, with volume spikes confirming conviction.

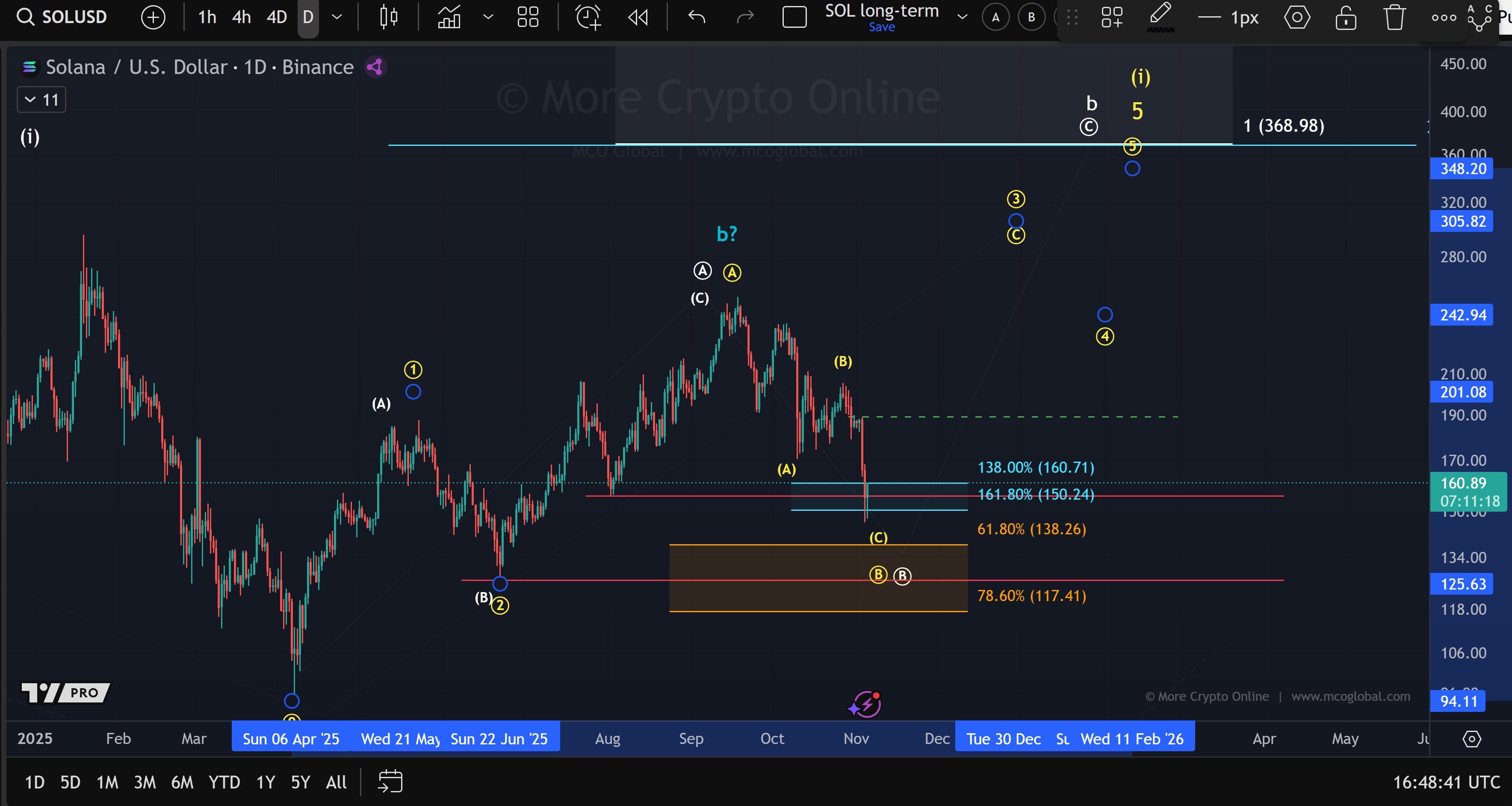

Post-approval, Solana’s price action at $87.89 reveals a textbook consolidation phase, with the 24-hour low of $84.55 acting as robust support and the high of $88.98 testing overhead resistance. Volume profiles indicate institutional accumulation, as ETF inflows stabilize the base after 2025’s volatility spikes. My charts highlight a bullish flag pattern forming since the March 27,2026, final deadline, signaling potential breakout toward $120 if momentum sustains.

These timelines, pieced from SEC. gov notices and reports by The Block and Yahoo Finance, rewarded those who layered positions per the five strategies. Dollar-cost averaging smoothed entries below $87.89, while GSOL’s discount narrowed sharply post-launch, delivering 20-30% premiums for holders.

Solana ETF Product Breakdown

| Metric | VanEck 🚀 | 21Shares 💰 | Bitwise 📈 |

|---|---|---|---|

| Fee (%) | 0.19% | 0.45% | 0.95% |

| AUM Post-Launch ($) | $1.5B | $950M | $600M |

| Staking Yield (%) | 4-5% | 5-6% | 6-7% |

| Risk Appetite | Low (Stable growth) | Medium (Balanced) | High (Aggressive rewards) |

| Key Benefits | Direct SOL exposure without wallet management, lowest fees | Staking rewards + institutional custody, no self-custody hassles | High staking yields, easy access to Solana ecosystem |

| Pairings for Amplified Returns | N/A | JTO for governance | JUP + JTO for leveraged plays on fast finality |

Technical overlays confirm Solana’s edge over Ethereum in throughput, positioning ecosystem tokens for outsized gains. Monitoring tools like alerts on fintechlaw. ai deadlines proved pivotal, as extensions into 2026 caught many off-guard.

5 Key Post-ETF Takeaways

-

DCA Discipline Pays: Dollar-cost averaging into SOL through Q1 2026 capitalized on 91-100% approval odds (Polymarket/Bloomberg), rewarding investors as SOL trades at $87.89 (+$2.83 or +3.3% 24h post-approval amid institutional inflows.

-

Regulatory Tracking Essential: Closely monitoring SEC deadlines like October 16, 2025, for nine filings (VanEck, 21Shares et al.) enabled optimal timing; continue tracking post-approval custody protocols and extensions into 2026.

-

GSOL as Smart Proxy: Grayscale Solana Trust (GSOL) offered low-risk pre-ETF exposure at a discount; post-launch, it remains a practical bridge to spot Solana ETFs for conservative portfolios.

-

Ecosystem Leverage via JTO/JUP: Pairing SOL with Jito (JTO) and Jupiter (JUP) tokens leveraged Solana network growth for amplified returns; sustain for DeFi and liquidity upside.

-

5-10% Allocation Optimal: Designate 5-10% portfolio allocation to Solana ETFs, rebalancing from BTC/ETH holdings for diversification, capitalizing on ETF-driven momentum and regulatory clarity.

Looking to mid-2026, Solana ETF inflows could mirror Ethereum’s $10B and post-approval, pushing SOL past $120 in base cases. My CMT lens spots RSI divergences at 55, hinting at coiled upside if $84.55 holds. Pair this with secure buying channels for seamless execution.

Blending these tactics with chart vigilance equips portfolios for Solana’s next leg. Charts don’t lie; the Solana ETF 2026 reality validates proactive positioning amid 90-100% odds that defined the timeline.