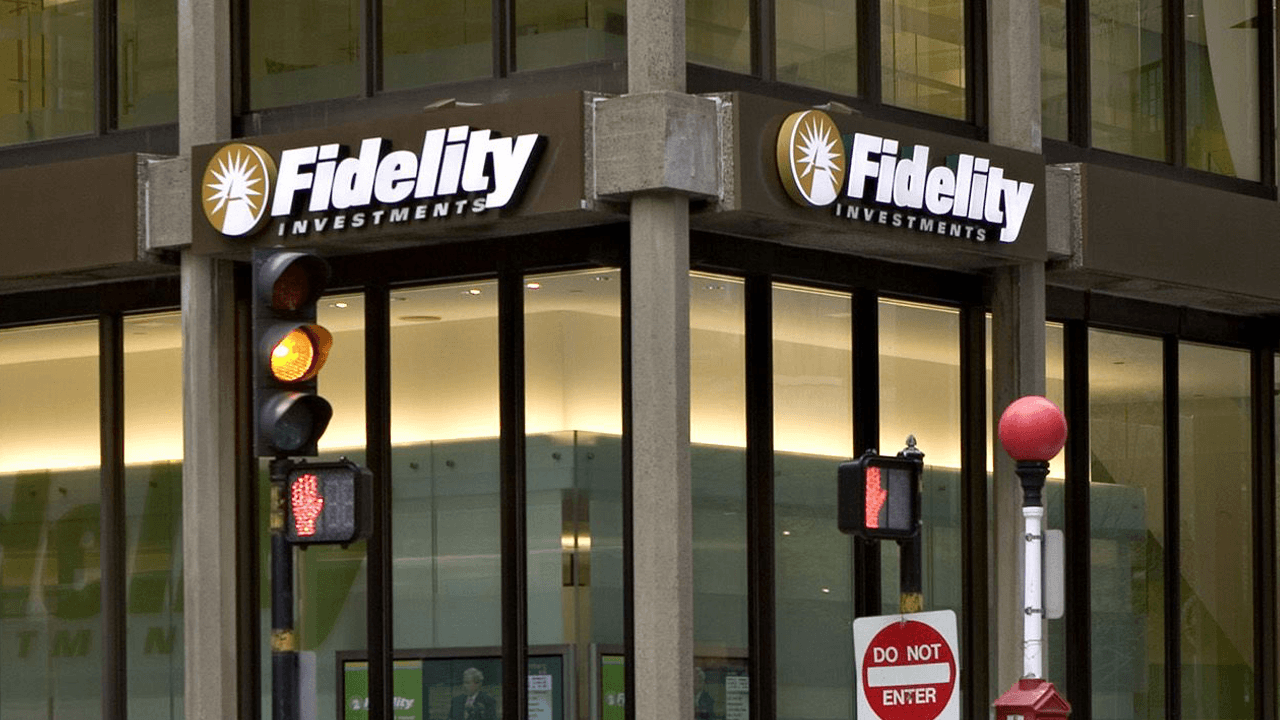

Fidelity Investments has made a decisive move into the on-chain ETF landscape with the launch of the Fidelity Digital Interest Token (FDIT), a tokenized money market fund deployed on Ethereum. While the rollout has been relatively low-profile compared to splashier ETF launches, its implications for institutional DeFi and real-world asset (RWA) tokenization are substantial. As of September 2025, FDIT has attracted over $200 million in assets under management, signaling robust early adoption by sophisticated players.

Institutional On-Chain ETFs: A Quiet Revolution

The FDIT initiative is emblematic of a broader trend: major financial institutions are leveraging blockchain technology to tokenize traditional funds and bring them on-chain. Fidelity’s approach stands out for its technical rigor and regulatory compliance. The fund is anchored primarily in U. S. Treasury securities and cash equivalents, with Bank of New York Mellon providing custody services. The management fee sits at 0.20%, competitive with legacy products but now accessible via programmable tokens.

What sets FDIT apart from prior attempts at tokenized funds is its integration into existing DeFi infrastructure. Ondo Finance, an established RWA protocol, currently holds approximately $202 million in FDIT as a reserve asset for its OUSG yield-bearing token. This strategic partnership creates a feedback loop between traditional capital markets and decentralized protocols, unlocking new composability for both institutional and DeFi-native investors.

Current Market Data: FDIT Surpasses $200 Million On-Chain

The numbers tell the story: as of September 2025, FDIT’s supply exceeds $200 million. This milestone places it among the largest tokenized Treasury funds globally, rivaling efforts from BlackRock and Franklin Templeton. The vast majority of these assets are held by Ondo Finance, which uses FDIT as collateral within its OUSG structure to deliver stable yield opportunities on-chain.

This dynamic highlights two key trends:

Key Drivers of Institutional Adoption of Tokenized ETFs

-

Enhanced Liquidity and 24/7 Market Access: Tokenized ETFs like Fidelity Digital Interest Token (FDIT) enable near-instant settlement and continuous trading on blockchain rails, improving liquidity compared to traditional fund structures.

-

Operational Efficiency and Cost Reduction: Blockchain-based tokenization streamlines fund administration, reduces reliance on intermediaries, and lowers operational costs through automated smart contracts.

-

Improved Transparency and Auditability: On-chain records of tokenized ETFs provide real-time, immutable transaction histories, enhancing transparency for both issuers and investors.

-

Broader Accessibility and Fractional Ownership: Tokenized funds allow for fractionalized investment, enabling a wider range of investors—including those with smaller capital—to access institutional-grade products like FDIT.

-

Integration with DeFi and On-Chain Ecosystems: Institutional-grade tokens such as FDIT can be used as reserve assets in decentralized finance protocols (e.g., Ondo Finance’s OUSG), unlocking new yield strategies and composability.

-

Regulatory-Grade Custody and Compliance: Major institutions partner with established custodians like Bank of New York Mellon to ensure secure, compliant management of tokenized assets, addressing key institutional concerns.

-

Proven Institutional Backing and Growing AUM: With over $200 million in assets under management and anchor investors like Ondo Finance, FDIT demonstrates real institutional demand and scalability for tokenized ETFs.

The technical architecture enables near-instant settlement, transparent auditability via public blockchains, and fractional ownership that was previously impractical for money market funds. For institutions seeking to optimize liquidity management or participate in DeFi without direct exposure to crypto volatility, FDIT offers an attractive bridge product.

Tokenized ETFs 2024: Competitive Landscape and Regulatory Nuance

Fidelity’s move comes amid accelerating competition in the tokenized ETF sector. BlackRock’s BUIDL fund and Franklin Templeton’s BENJI have also crossed significant AUM milestones this year, but Fidelity’s integration with Ondo marks a distinct approach by embedding itself directly into existing DeFi rails.

The regulatory environment remains complex but navigable for large institutions with robust compliance frameworks. By focusing on fully-backed U. S. Treasuries and working with established custodians like Bank of New York Mellon, Fidelity sidesteps many legal ambiguities plaguing more exotic crypto-backed products.

While the market for tokenized ETFs in 2024 is rapidly evolving, Fidelity’s FDIT stands out for its institutional-grade architecture and direct utility within DeFi protocols. The fund’s transparent on-chain issuance, combined with a clear regulatory posture, positions it as a credible gateway for both risk-averse capital allocators and crypto-native liquidity providers seeking dollar-denominated yield.

One of the most compelling aspects of the FDIT structure is its programmability. Investors can transfer or redeem shares 24/7 via Ethereum smart contracts, eliminating traditional settlement bottlenecks. This not only improves efficiency but also creates new possibilities for composability, FDIT tokens can be integrated into lending markets, automated portfolio strategies, and even used as collateral in synthetic asset platforms. The implications for liquidity management are significant, as institutions can now move large amounts of capital on-chain with full transparency and auditability.

The Road Ahead: Scaling On-Chain Institutional Adoption

Despite these advances, widespread adoption of on-chain ETFs still faces hurdles. Regulatory clarity remains a moving target globally, and cross-chain interoperability is an unresolved technical challenge. However, the momentum from major players like Fidelity signals a paradigm shift: traditional finance is not just experimenting with blockchain, it’s operationalizing it at scale.

Fidelity’s $200 million and AUM in FDIT demonstrates that tokenized funds are more than a proof-of-concept, they are becoming core infrastructure for next-generation financial products.

The next phase will likely see further integration between tokenized funds and permissioned DeFi ecosystems tailored to institutional compliance requirements. As more real-world assets come on-chain, ranging from Treasuries to private credit, investors should expect increased competition among issuers to deliver lower fees, deeper liquidity pools, and enhanced reporting tools.

Key Advantages of FDIT Over Legacy Money Market Funds

-

24/7 On-Chain Liquidity: FDIT is issued on the Ethereum blockchain, enabling investors to transfer, redeem, or trade shares at any time without reliance on traditional banking hours.

-

Lower Minimum Investment & Global Accessibility: As a tokenized asset, FDIT can be fractionalized, allowing for smaller investment sizes and broader access compared to legacy funds typically restricted by higher minimums and jurisdictional barriers.

-

Instant Settlement & Reduced Counterparty Risk: Blockchain-based transactions settle rapidly, minimizing the settlement delays and counterparty risks often associated with legacy money market funds.

-

Transparency & Real-Time Auditing: FDIT’s holdings and transactions are visible on-chain, providing investors with real-time transparency into fund assets and flows, unlike the periodic reporting of traditional funds.

-

Programmable Finance & DeFi Integration: FDIT can be integrated into decentralized finance (DeFi) protocols, enabling use as collateral or in automated strategies, which is not possible with conventional money market funds.

The rise of institutional on-chain ETFs like FDIT is not just about digitizing existing products; it’s about fundamentally reengineering access to yield and liquidity in global markets. For investors tracking the intersection of TradFi and DeFi, this quiet revolution deserves close attention as it reshapes capital flows across both domains.