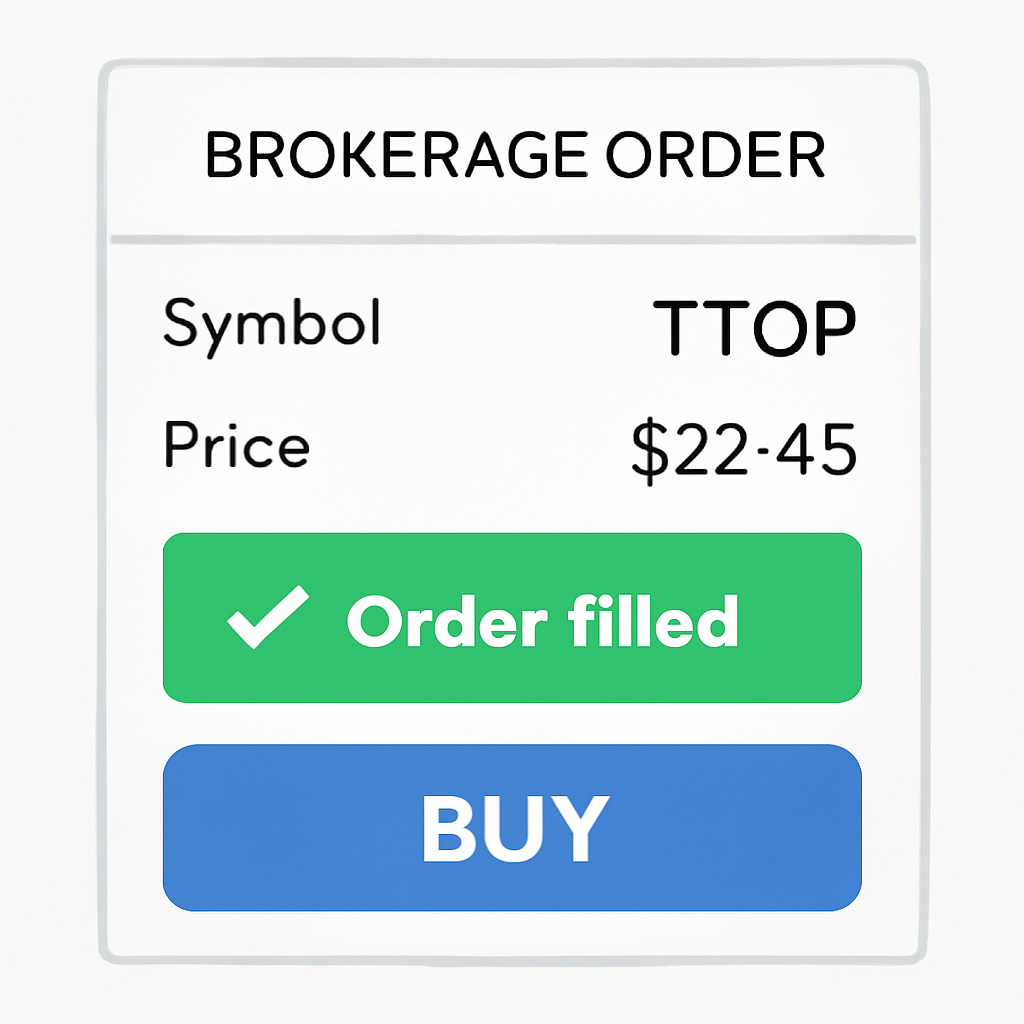

In the fast-paced world of cryptocurrency investing, U. S. investors now have a powerful new tool to navigate volatility and capture broad market growth: the 21Shares FTSE Crypto 10 Index ETF (TTOP). Launched on November 13,2025, this FTSE Crypto 10 Index ETF delivers market-cap-weighted exposure to the top 10 cryptocurrencies by market capitalization, excluding stablecoins. Priced at $22.45 as of the latest data, with a 24-hour change of and $0.3778 ( and 1.69%), TTOP offers a diversified multi-asset crypto basket ETF that’s rebalanced quarterly to keep pace with the crypto leaders.

Unlocking Diversified Exposure with TTOP’s Top Holdings

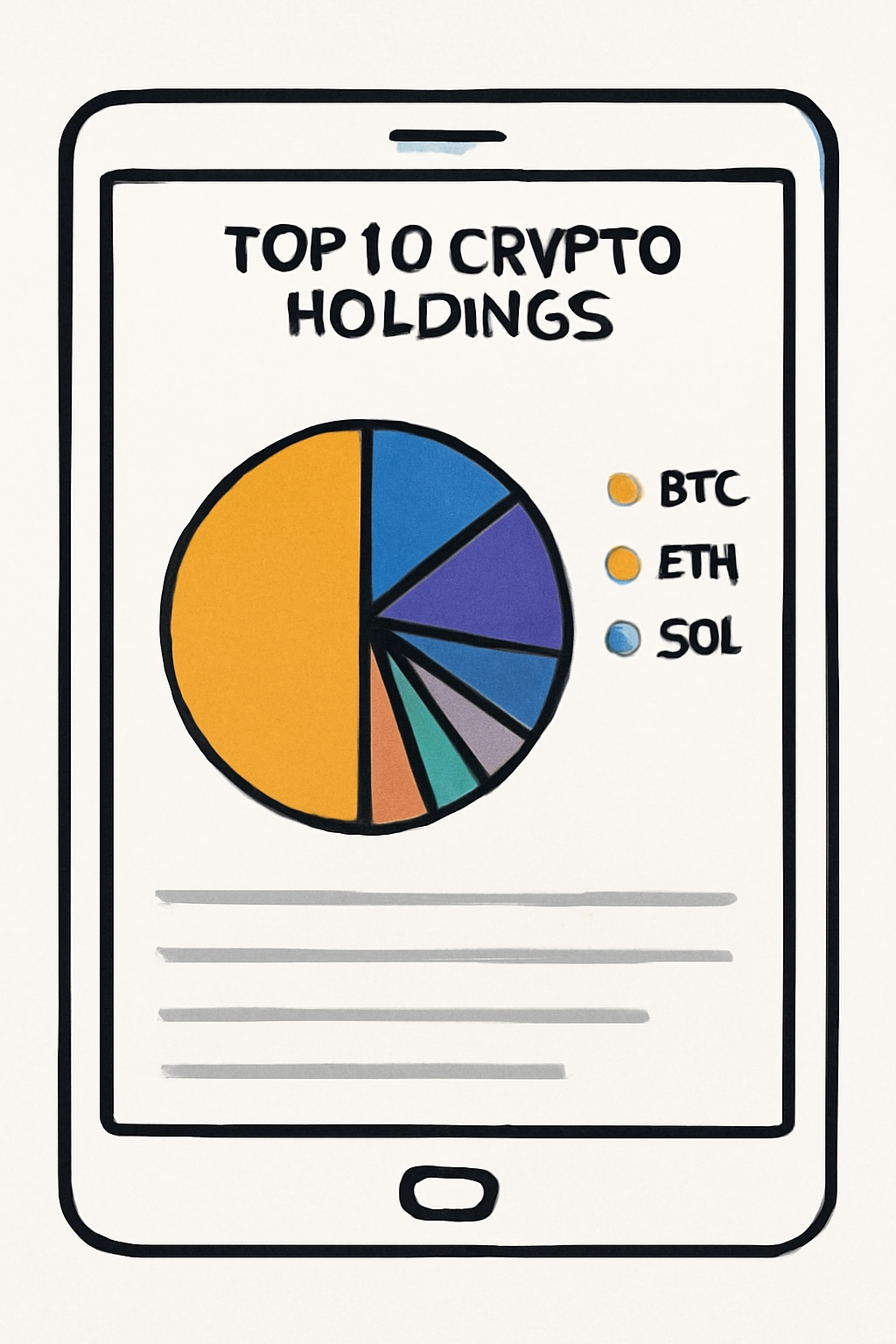

At its core, TTOP tracks the FTSE Crypto 10 Index, bundling Bitcoin (BTC), Ethereum (ETH), BNB (BNB), Solana (SOL), XRP (XRP), Dogecoin (DOGE), TRON (TRX), Toncoin (TON), Cardano (ADA), and Shiba Inu (SHIB). This isn’t just a random mix; it’s a reflection of real market dominance. Bitcoin anchors the portfolio as the undisputed king, providing stability amid broader swings. Ethereum follows with its smart contract prowess, fueling DeFi and NFTs. Then there’s Solana, the high-speed contender challenging Ethereum’s throne, alongside BNB’s ecosystem utility on Binance Smart Chain.

Don’t overlook the surprises: XRP’s cross-border payment edge, Dogecoin and Shiba Inu’s meme-fueled resilience, TRON’s content-sharing ambitions, Toncoin’s Telegram integration, and Cardano’s research-driven approach. Together, they create a basket that’s adaptive and representative of crypto’s diverse narratives. For U. S. investors, this means one ticker for exposure that would otherwise require juggling multiple wallets and exchanges.

With assets under management at approximately $826,095, TTOP is still in its early innings, but its structure under the Investment Company Act of 1940 sets it apart. This regulation brings familiar safeguards like daily transparency and fiduciary oversight, bridging traditional finance with digital assets. Check out how these ’40 Act crypto index ETFs are reshaping U. S. investing.

Performance Snapshot and What It Means for 2025

TTOP’s current price of $22.45 reflects a modest 24-hour gain, with a high and low both at $22.76, signaling tight trading in recent sessions. This stability is a boon for investors wary of crypto’s reputation for wild rides. Managed by 21Shares US LLC under Listed Funds Trust, the ETF trades like any stock, making it accessible through standard brokerage accounts. Its quarterly rebalancing ensures the index evolves, potentially welcoming newcomers if they crack the top 10 while pruning laggards.

In my view, TTOP’s launch accelerates crypto’s mainstream adoption. Single-asset ETFs like Bitcoin spot funds were game-changers, but baskets like this spread risk intelligently. Imagine holding BTC’s store-of-value strength alongside SOL’s scalability bets and DOGE’s cultural staying power, all without direct custody hassles. For 2025 portfolios, it’s a compelling diversification play amid regulatory clarity and institutional inflows.

Strategic Advantages of the FTSE Crypto 10 Index

The index methodology is elegantly simple yet effective: market-cap weighting means BTC and ETH command the lion’s share, around 70-80% typically, while altcoins like TON and SHIB add growth potential. Excluding stablecoins keeps the focus on high-beta assets primed for appreciation. Investors gain from TRX’s steady user growth and ADA’s sustainability focus, creating a portfolio that’s more than the sum of its parts.

Compared to its sibling, the 21Shares FTSE Crypto 10 ex-BTC Index ETF (TXBC), TTOP includes Bitcoin for that foundational exposure many demand. Both funds, launched simultaneously, cater to varied risk appetites in the crypto basket ETF 2025 space. As crypto markets mature, products like TTOP could draw billions in AUM, much like equity index funds did decades ago.

21Shares FTSE Crypto 10 Index ETF (TTOP) Price Prediction 2026-2031

Annual forecasts reflecting crypto market volatility, ETF inflows, and long-term adoption trends from current price of $22.45 (Dec 2025)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $19.00 | $38.00 | $65.00 | +69% |

| 2027 | $25.00 | $55.00 | $95.00 | +45% |

| 2028 | $30.00 | $80.00 | $140.00 | +45% |

| 2029 | $40.00 | $110.00 | $190.00 | +38% |

| 2030 | $50.00 | $150.00 | $260.00 | +36% |

| 2031 | $65.00 | $200.00 | $350.00 | +33% |

Price Prediction Summary

TTOP ETF, tracking the top 10 cryptocurrencies, is expected to experience strong growth amid a maturing crypto market, with average prices rising from $38 in 2026 to $200 by 2031—a 790% cumulative increase from current levels. Bullish scenarios driven by institutional adoption and halvings contrast with bearish risks from regulation and economic downturns, resulting in wide min-max ranges.

Key Factors Affecting 21Shares FTSE Crypto 10 Index ETF Stock Price

- Crypto market cap expansion and top 10 asset performance

- Institutional inflows into regulated ETFs like TTOP

- Bitcoin halving cycles (next in 2028 boosting sentiment)

- Regulatory clarity under SEC’s ’40 Act framework

- Macroeconomic factors including interest rates and global adoption

- Technological advancements in Ethereum, Solana, and others

- Potential volatility from geopolitical events and competition

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Yet growth potential lurks in the altcoin slice, where Solana’s transaction speed, XRP’s payment rails, and Toncoin’s messaging app synergy could outperform in bull runs. Cardano’s methodical upgrades and TRON’s entertainment ecosystem add layers of innovation, while meme coins like Dogecoin and Shiba Inu remind us that community hype drives real value in crypto.

Navigating Risks in the Multi-Asset Crypto Basket

TTOP isn’t without hurdles. Crypto’s volatility means even a diversified basket at $22.45 can swing sharply; that 24-hour high and low hugging $22.76 shows current calm, but quarterly rebalances might force sales during dips. Regulatory shifts under the SEC Act 1940 offer protections, yet black swan events like exchange hacks or macro downturns loom. BNB’s ties to Binance introduce centralized risks, and SHIB’s speculative nature amplifies downside. My take: pair TTOP with bonds or gold for balance, treating it as 5-10% of a portfolio to harness upside without overexposure.

For those eyeing alternatives, TXBC strips out BTC for pure altcoin plays, suiting Ethereum maximalists or Solana bulls. But TTOP’s full top 10 blend captures Bitcoin’s ballast, making it ideal for broad multi-asset crypto ETF US entry. As AUM climbs from $826,095, liquidity should improve, tightening spreads for everyday traders.

Why TTOP Fits Your 2025 Strategy

Picture this: instead of chasing individual pumps in DOGE or ADA, TTOP automates the heavy lifting. Its market-cap weighting self-adjusts to leaders like BTC and ETH, which likely dominate 70% and, freeing you to focus on long-term trends. Toncoin’s rise via Telegram mini-apps or TRX’s stablecoin dominance on its chain could juice returns, all under one roof. For newcomers, it’s a gentle on-ramp; pros appreciate the tax drag reduction from ETF wrappers versus direct holdings.

In a year of potential rate cuts and ETF approvals, TTOP positions investors for crypto’s next leg up. I’ve seen indices like this transform asset classes, from tech stocks to commodities. Here, it democratizes access to XRP’s Ripple wins or Cardano’s Africa-focused pilots without KYC headaches on exchanges.

Ultimately, TTOP embodies crypto’s maturation, blending meme resilience with enterprise utility. At $22.45, with its and $0.3778 daily nudge, it’s primed for those ready to ride the top 10 wave. Dive in via your IRA or taxable account, and let the FTSE Crypto 10 Index do the diversification for you. Knowledge like this turns market noise into portfolio signal.