Amid relentless outflows from established spot Bitcoin and Ethereum ETFs, Truth Social Funds has thrown its hat into the ring with two intriguing truth social crypto etf proposals. The filings, submitted to the SEC, outline a Bitcoin and Ether ETF holding roughly 60% BTC and 40% ETH, complete with staking rewards on the Ethereum allocation, alongside a dedicated Cronos Yield Maximizer ETF focused on CRO and its staking potential. With Bitcoin trading at $69,015.00 after a 0.87% dip over the past 24 hours, this move arrives at a pivotal moment, potentially signaling fresh strategies to combat investor fatigue in the btc eth cro etf space.

Dissecting the Truth Social ETF Filings

Truth Social Funds, tied to Trump Media and Technology Group, isn’t entering the crypto ETF arena quietly. The flagship Truth Social Bitcoin and Ether ETF targets combined performance from BTC and ETH, mirroring a 60/40 split that echoes classic portfolio balancing acts. What sets it apart? A deliberate plan to stake the ETH holdings, generating yields that could appeal to income-seeking investors weary of pure price exposure. Meanwhile, the Truth Social Cronos Yield Maximizer ETF zeros in on CRO, the Cronos blockchain’s native token, blending spot exposure with staking rewards to maximize returns.

Both products will lean on Yorkville America Equities as advisor, charging a competitive 0.95% management fee. Crypto. com steps up as custodian, liquidity provider, and staking handler, pending approval. This partnership underscores a strategic pivot toward yield-generating mechanics in an otherwise volatile asset class. For diversified portfolios, these crypto etf staking rewards could serve as a bridge between traditional fixed-income hunger and digital asset growth, especially as Bitcoin hovers at $69,015.00.

The Truth Social Bitcoin and Ether ETF is designed to seek investment results corresponding to the combined performance of Bitcoin and Ether.

Critics might dismiss this as hype-driven, given the Trump affiliation, but the structure aligns with maturing on-chain ETF trends. Staking ETH could yield 3-5% annually, depending on network conditions, while CRO staking on Cronos often exceeds 10% APY, offering a tangible edge over non-yielding competitors.

Staking as the Yield Lifeline

In a landscape where spot ETFs have popularized crypto access, yields remain the missing piece. Truth Social’s emphasis on crypto etf staking rewards addresses this head-on. Ethereum staking post-Merge has proven reliable, with validators earning rewards for securing the network. Allocating 40% to staked ETH in the BTC/ETH fund could boost total returns by 1-2% annually, a boon when Bitcoin sits at $69,015.00 and broader markets grapple with rate uncertainty.

The CRO-focused fund takes it further, positioning Cronos as a high-yield play. Cronos, with its EVM compatibility and DeFi ecosystem, benefits from robust staking incentives. Investors get price upside plus passive income, potentially reversing the appeal of low-yield alternatives. As a strategist, I see this as disciplined innovation: layering income on growth assets without excessive leverage. Yet, risks loom; staking introduces smart contract vulnerabilities and lock-up periods, demanding careful position sizing in any balanced allocation.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts based on Truth Social BTC/ETH ETF filings with staking rewards, amid current outflows and 2026 price of $69,015

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $85,000 | $120,000 | $170,000 | +74% |

| 2028 | $110,000 | $160,000 | $230,000 | +33% |

| 2029 | $150,000 | $220,000 | $320,000 | +38% |

| 2030 | $200,000 | $300,000 | $450,000 | +36% |

| 2031 | $280,000 | $420,000 | $650,000 | +40% |

| 2032 | $380,000 | $580,000 | $900,000 | +38% |

Price Prediction Summary

Bitcoin is set for robust long-term growth from 2027-2032, with average prices rising from $120,000 to $580,000. Bullish drivers include new Truth Social ETFs (60% BTC/40% ETH with staking), the 2028 halving, institutional recovery from outflows, and increasing adoption as a store of value.

Key Factors Affecting Bitcoin Price

- Truth Social BTC/ETH ETF approval and inflows, with ETH staking yields enhancing appeal

- Bitcoin halving in 2028 reducing supply and historically sparking bull runs

- Recovery from $410M spot BTC ETF outflows, signaling bottoming market

- Regulatory progress and Trump Media’s crypto push boosting sentiment

- Macro factors: inflation hedge, global adoption in payments and DeFi

- Technological upgrades improving scalability and security

- Competition managed by BTC dominance (~50% market share projected)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Outflows Expose Cracks in the ETF Foundation

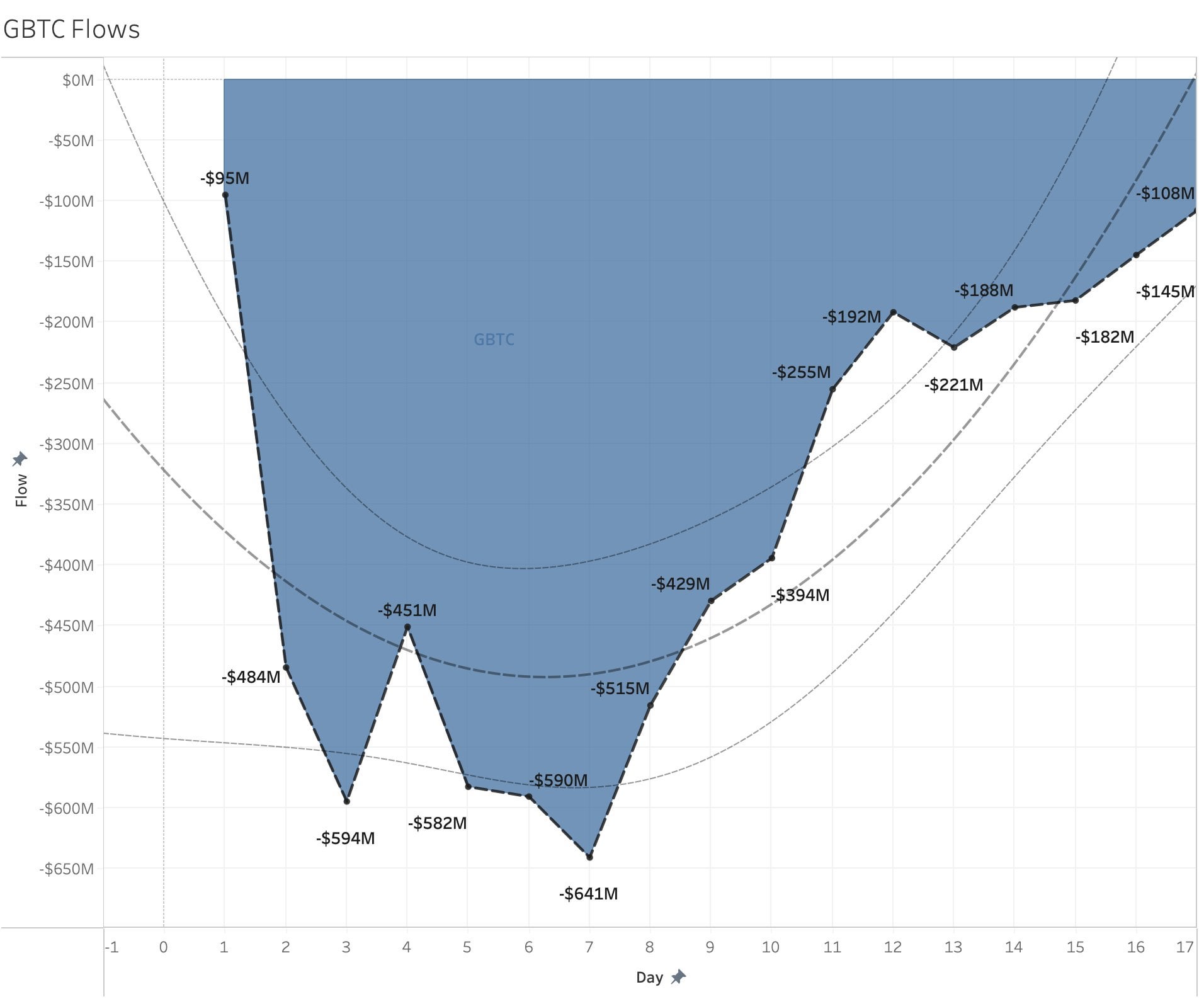

U. S. spot Bitcoin ETFs bled $410.37 million on February 12,2026, with BlackRock’s IBIT alone accounting for $157.56 million in withdrawals. Ethereum ETFs fared no better, posting $113 million in outflows, including seven straight days of redemptions for ETHA. This marks weeks of consecutive exits, even as Bitcoin holds $69,015.00 after ranging from $68,805 to $70,908 in the last day.

Why the exodus? Institutional profit-taking post-rally, regulatory overhang, and opportunity costs from rising traditional yields play roles. BlackRock’s ETHA trades 30% underwater from peaks, amplifying redemption pressures. Truth Social’s filings emerge here as a potential etf outflows reversal catalyst, injecting staking yields to retain capital. If approved, these funds could draw sidelined retail and yield-chasers, diversifying the ETF roster beyond plain-vanilla spot products.

Strategically, this underscores portfolio resilience. Amid outflows, blending BTC’s store-of-value thesis with ETH and CRO staking creates hybrid exposure. At current levels, with BTC down 0.87% to $69,015.00, such vehicles might stabilize flows by appealing to long-term holders seeking compounded returns over spot volatility.

Yorkville America Equities brings institutional-grade oversight, while Crypto. com’s role ensures seamless staking execution on Cronos and Ethereum networks. This setup positions the funds as viable options for those eyeing on-chain etf solana-like innovations, though focused on proven chains like Cronos.

Yield Comparison: Truth Social vs. Incumbents

Established players like BlackRock and Fidelity offer zero-yield spot ETFs, leaving investors exposed solely to price swings. Truth Social’s btc eth cro etf twist introduces staking as a differentiator. Projected ETH staking yields hover around 3-5%, while CRO could deliver 10-15% APY based on current Cronos rates. At Bitcoin’s steady $69,015.00 level, these extras compound meaningfully over horizons beyond the daily -0.87% noise.

Comparison of Truth Social BTC/ETH/CRO ETFs vs BlackRock IBIT/ETHA

| Fund | Allocation | Staking Yield Estimate | Mgmt Fee | Recent Outflows |

|---|---|---|---|---|

| Truth Social Bitcoin & Ether ETF | 60% BTC ($69,015), 40% ETH | ~1.4% blended (ETH staking est. 3.5%) | 0.95% | N/A (Proposed) |

| Truth Social Cronos Yield Maximizer ETF | 100% CRO | ~7-10% (CRO staking) | 0.95% | N/A (Proposed) |

| BlackRock IBIT | 100% BTC ($69,015) | None | 0.25% | $157.56M (Feb 12) |

| BlackRock ETHA | 100% ETH | None | 0.25% | $9.3M (recent day) |

Such yields aren’t guaranteed; they fluctuate with network participation and protocol upgrades. Still, they challenge the status quo, potentially sparking an etf outflows reversal by attracting yield-starved capital. Imagine reallocating 5-10% of a traditional 60/40 portfolio here: BTC anchors stability, ETH adds smart contract utility, CRO amplifies income.

Risks and Regulatory Realities

No discussion of novel ETFs skips pitfalls. Staking locks assets, exposing them to slashing risks if validators falter. Cronos, while efficient, trails Ethereum in decentralization metrics, inviting scrutiny. SEC approval remains uncertain; past delays on staking provisions highlight hurdles. Trump Media’s political ties could polarize regulators, yet the filings’ substance aligns with recent approvals for spot products.

Market timing adds layers. With Bitcoin ranging $68,805-$70,908 in 24 hours and settling at $69,015.00, volatility persists. Outflows signal caution, but they also create entry points for contrarians. As a portfolio strategist, I advocate sizing these at 2-5% initially, monitoring approval timelines and yield realization.

Truth Social ETF Pros & Cons

-

Staking Yield Boost: ETH (40% allocation) and CRO staking generates rewards, enhancing returns beyond spot price exposure.

-

Diversification: 60% BTC ($69,015, -0.87% 24h), 40% ETH, plus CRO exposure across assets.

-

Proven Custodian: Crypto.com as custodian, liquidity, and staking provider for secure operations.

-

Regulatory Risk: SEC approval pending; delays or denials could impact launch and liquidity.

-

Market Outflows: Spot BTC ETFs saw $410M net outflows on Feb 12, signaling investor caution.

-

High Volatility & Fees: Crypto prices fluctuate (BTC 24h low $68,805); 0.95% management fee adds costs.

Broader adoption hinges on execution. If Crypto. com delivers reliable custody, these funds could pioneer yield-enhanced crypto exposure, much like how bond ETFs evolved fixed income.

Strategic Allocation Insights

For balanced investors, integrate via core-satellite: anchor with broad equities, satellite 3% to the BTC/ETH fund for growth-plus-yield, 2% to CRO for aggressive income. Rebalance quarterly, harvesting staking rewards to buy dips when Bitcoin tests $69,015.00 supports. This tempers outflows’ narrative, framing Truth Social as evolution, not gimmick.

Stakeholder reactions vary. Enthusiasts hail political momentum; skeptics question viability amid $410 million Bitcoin ETF exits. Data favors the former: staking’s track record on Ethereum bolsters credibility, while Cronos’ DeFi traction offers upside. Yorkville’s fee discipline at 0.95% undercuts some rivals, enhancing net returns.

Truth Social’s proposals arrive as market digestion sets in. Bitcoin’s resilience at $69,015.00, despite outflows, underscores enduring appeal. These ETFs, if greenlit, enrich the toolkit, blending crypto’s alpha with income discipline. Diversification demands such hybrids; patient capital may find rewards in the yield pivot.