In 2025, tracking Bitcoin ETF on-chain holdings has become a must-have skill for any investor or analyst serious about crypto ETF transparency. With Bitcoin (BTC) currently trading at $109,432, the stakes have never been higher for understanding how institutional flows and custody trends shape the market. As spot Bitcoin ETFs attract billions in assets, their on-chain footprints offer a real-time window into market sentiment, supply shocks, and even potential price pivots.

Why Monitor Bitcoin ETF On-Chain Holdings?

Unlike traditional funds, Bitcoin ETFs move real coins on public blockchains. This means every inflow, outflow, or custody shuffle is trackable – if you know where to look. Monitoring these flows helps you:

- Spot large institutional moves that can precede price surges or corrections

- Gauge market confidence by watching AUM trends and supply held by ETFs

- Enhance portfolio decisions using transparent data instead of speculation

- Stay ahead of regulatory shifts and product launches impacting fund flows

The challenge? Navigating a flood of dashboards and analytics tools to find actionable insights.

The Essential Toolkit: Top Tools for Tracking Bitcoin ETF Assets in 2024

If you want precision in tracking Bitcoin ETF assets and custody trends, here’s your curated list of must-use platforms for this year:

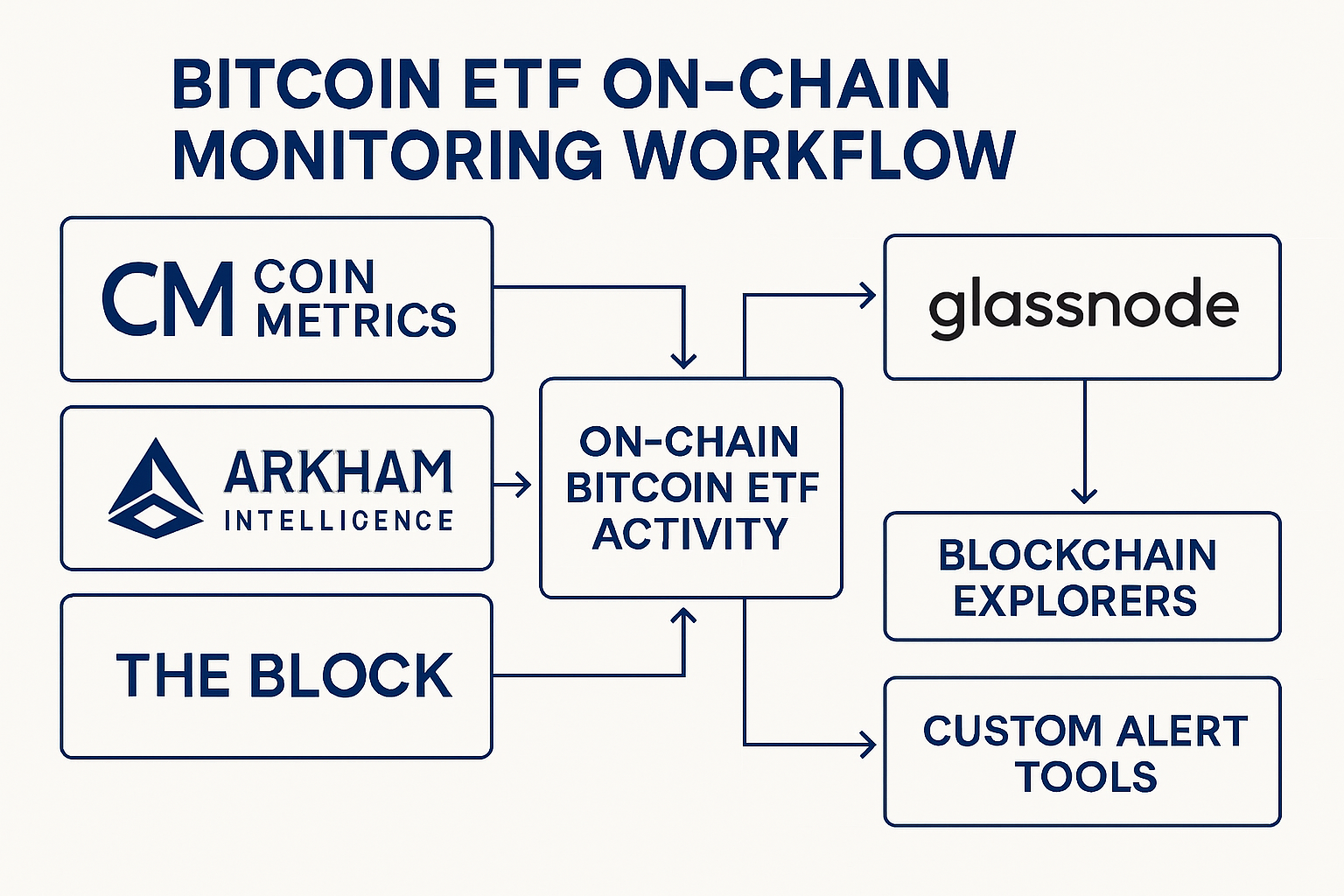

Top Tools & Strategies to Track Bitcoin ETF On-Chain Holdings

-

Coin Metrics ETF On-Chain Insights Dashboard: This platform delivers real-time data on Bitcoin ETF inflows, outflows, and on-chain holdings. Users can track both individual and aggregate ETF flows, monitor the total BTC supply held by ETFs, and analyze shifts in ETF market dominance. Its intuitive interface is ideal for investors seeking up-to-date transparency.

-

Arkham Intelligence Real-Time ETF Flow Tracker: Arkham Intelligence offers real-time tracking of ETF wallet flows by linking wallet clusters to real-world entities. The platform provides visual graphs of fund movements, custodian usage, and counterparty interactions, making it a powerful tool for compliance teams and analysts.

-

The Block’s Bitcoin ETF Data Portal (Spot & Futures): The Block aggregates real-time spot and futures ETF data, including fund flows, performance, and approval status. Its portal allows users to compare multiple ETFs and access historical data for deeper analysis.

-

Glassnode ETF Holdings and Custody Analytics: Glassnode provides institutional-grade analytics on ETF holdings, supply dynamics, and custody trends. Their dashboards merge technical indicators with behavioral data, offering insights into long-term holder activity and market sentiment.

-

Utilizing Blockchain Explorers for ETF Wallet Monitoring (e.g., Blockchair, BTCscan): Blockchain explorers like Blockchair and BTCscan enable users to directly monitor ETF wallet addresses on the Bitcoin blockchain. This approach allows for granular, transparent tracking of transactions and holdings in real time.

-

Setting Up Custom Alerts for Large Bitcoin ETF Transfers via Whale Alert or Nansen: Platforms such as Whale Alert and Nansen let users set up real-time alerts for significant ETF-related Bitcoin transfers. These notifications help investors spot major inflows or outflows as they happen.

- Coin Metrics ETF On-Chain Insights Dashboard:

This dashboard is a goldmine for anyone wanting to track individual and aggregate flows into and out of spot Bitcoin ETFs. It breaks down the total BTC supply held by each fund in near real-time, letting you compare fund dominance across issuers. Want to see which ETF just scooped up another thousand BTC? Coin Metrics makes it visible – instantly. - Arkham Intelligence Real-Time ETF Flow Tracker:

Arkham takes things further by assigning real-world identities to wallet clusters used by ETFs. Their visual graphs show not just inflows and outflows but also custodian usage patterns and counterparty interactions – perfect for compliance teams or anyone who loves forensic-level detail. - The Block’s Bitcoin ETF Data Portal (Spot and Futures):

For those who want both spot and futures data in one place, The Block’s portal is essential. It aggregates live AUM figures, performance charts, approval statuses, and lets you compare multiple products side-by-side. - Glassnode ETF Holdings and Custody Analytics:

Glassnode offers institutional-grade analytics including supply dynamics specific to ETFs. You can monitor realized cap changes when funds accumulate or distribute coins – great for reading long-term holder sentiment versus short-term speculation. - Utilizing Blockchain Explorers for ETF Wallet Monitoring (e. g. , Blockchair, BTCscan):

Sometimes the old-school approach is best: plug known ETF wallet addresses into explorers like Blockchair or BTCscan to watch raw transactions as they hit the chain. This method shines when you want direct confirmation without platform interpretation. - Setting Up Custom Alerts for Large Bitcoin ETF Transfers via Whale Alert or Nansen:

Don’t want to watch dashboards all day? Set up custom alerts with Whale Alert or Nansen so you’re notified instantly when a large transfer hits an ETF wallet cluster – crucial during volatile periods or around major announcements.

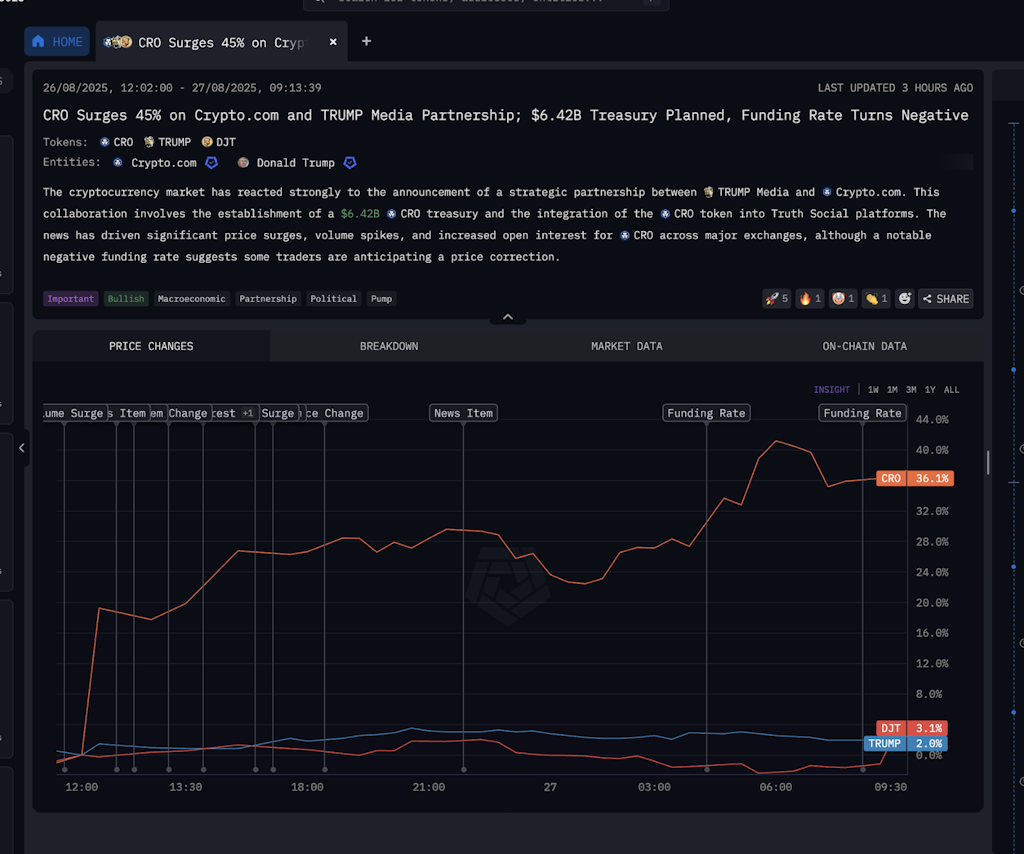

ETF Inflows: What Today’s Data Tells Us

This week’s flows show that while BTC has dipped slightly (-1.31% over the past 24 hours), several top ETFs continue accumulating coins at a steady pace. The Coin Metrics dashboard confirms that aggregate holdings across U. S. -listed spot ETFs remain robust even with the recent price pullback. These metrics are especially valuable now as more structured protection products enter the scene – like Calamos’ new option-coupled BTC fund launched in January 2025.

Tactics: Building Your Own On-Chain Monitoring Strategy

No single tool covers every angle; smart investors layer multiple sources for full visibility. Here are actionable strategies to maximize your edge:

- Diversify your data feeds: Use Coin Metrics for big-picture trends; Glassnode for behavioral analytics; Arkham for granular flow tracing; The Block for cross-product comparisons.

- Create custom dashboards: Many platforms let you tailor views – focus on specific ETFs, threshold transfers, or even custody wallet activity that aligns with your thesis.

- Add alerting automation: Don’t miss key moves! Set up notifications so large transfers don’t slip past your radar during busy news cycles.

- Piggyback on blockchain explorers: When transparency matters most (like verifying post-announcement inflows), raw explorer data is unbeatable for confirmation.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on ETF flow trends, on-chain analytics, and evolving institutional participation

| Year | Minimum Price | Average Price | Maximum Price | Predicted YoY % Change (Avg) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $94,000 | $123,000 | $165,000 | +12.5% | ETF inflows steady; post-halving supply impact supports price, but global macro headwinds may create volatility. |

| 2027 | $106,000 | $138,000 | $185,000 | +12.2% | Institutional adoption grows; regulatory clarity improves, boosting ETF AUM and BTC demand. |

| 2028 | $122,000 | $156,000 | $210,000 | +13.0% | On-chain holding concentration increases; new ETF products and broader financial integration drive prices. |

| 2029 | $136,000 | $174,000 | $238,000 | +11.5% | ETF competition intensifies; technology upgrades (e.g., BTC scaling solutions) enhance utility and confidence. |

| 2030 | $148,000 | $192,000 | $262,000 | +10.3% | Mainstream institutional allocation normalizes; macroeconomic shifts (e.g., inflation, global liquidity) influence flows. |

| 2031 | $162,000 | $210,000 | $290,000 | +9.4% | Wider adoption as a digital reserve asset; regulatory harmonization and further ETF expansion support sustained growth. |

Price Prediction Summary

Bitcoin’s price is projected to experience moderate but consistent growth from 2026 through 2031, underpinned by expanding ETF adoption, maturing on-chain analytics, and increased institutional participation. The minimum and maximum price ranges reflect potential global economic turbulence, regulatory shifts, and market cycles, while the average price path suggests a progressive, sustainable uptrend.

Key Factors Affecting Bitcoin Price

- ETF inflow/outflow trends and on-chain holding concentration

- Regulatory developments and global policy clarity affecting ETF and crypto markets

- Institutional adoption rates and integration with traditional finance

- Technological innovations (e.g., scalability, security improvements)

- Macroeconomic conditions (inflation, interest rates, liquidity)

- Competition from other digital assets and alternative investment products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Layering these strategies not only sharpens your market view but also helps you stay nimble in a market where institutional flows can shift sentiment in hours. The rise of on-chain ETF analytics in 2024 means that sophisticated investors are no longer limited to delayed or opaque reporting. Instead, anyone can tap into real-time custody movements and flow data, often before the headlines catch up.

Navigating Risks and Interpreting Signals

It’s important to remember that while on-chain ETF analytics offer unprecedented transparency, interpreting the data requires nuance. Not every large outflow signals bearish intent; sometimes it’s a routine rebalance or internal transfer between custodians. That’s why combining tools, like using Arkham Intelligence for wallet provenance and Glassnode for behavioral context, can help you avoid false alarms.

For those new to on-chain tracking, start by following aggregate trends: is the total BTC supply held by ETFs growing or shrinking? Are certain funds consistently leading inflows? Tools like The Block’s Bitcoin ETF Data Portal make it easy to benchmark one product against another, while custom alerts via Whale Alert or Nansen ensure you’re never caught off guard by sudden moves.

Staying Ahead: What’s Next for Crypto ETF Transparency?

With Bitcoin holding above $109,432, demand for real-time, transparent fund data is only intensifying. As new products like structured protection ETFs roll out and global regulators push for stricter disclosures, expect on-chain monitoring to become standard practice, not just for analysts but for everyday investors too.

The next frontier? Integrating AI-driven insights with on-chain dashboards. Imagine predictive alerts that flag not just what happened but what might happen next based on historical flow patterns and macro events. While we’re not quite there yet, today’s toolkit already empowers you to cut through noise and focus on the metrics that matter most.

Final Thoughts: Mastering On-Chain ETF Analytics in 2024

The key takeaway: Don’t rely on a single source or surface-level headlines. Instead, combine Coin Metrics’ precision dashboards, Arkham Intelligence’s wallet mapping, The Block’s cross-market comparisons, Glassnode’s deep analytics, raw explorer data from Blockchair/BTCscan, and automated alerts from Whale Alert or Nansen.

This holistic approach will help you track Bitcoin ETF assets with confidence, whether you’re managing a portfolio or simply want to stay ahead of the latest crypto ETF custody trends. As always in crypto: clarity breeds confidence.