Bitcoin is trading at $111,415.00 as of October 2025, and spot Bitcoin ETFs are now a mainstream gateway for investors looking to gain exposure to this dynamic asset class. If you’ve ever wondered how to buy Bitcoin ETFs without the headaches of wallets, private keys, or crypto exchanges, you’re in the right place. This guide breaks down the exact steps, risks, and strategic considerations for beginners who want to add Bitcoin spot ETFs to their portfolios, no prior crypto experience required.

Why Bitcoin Spot ETFs Are Changing the Game

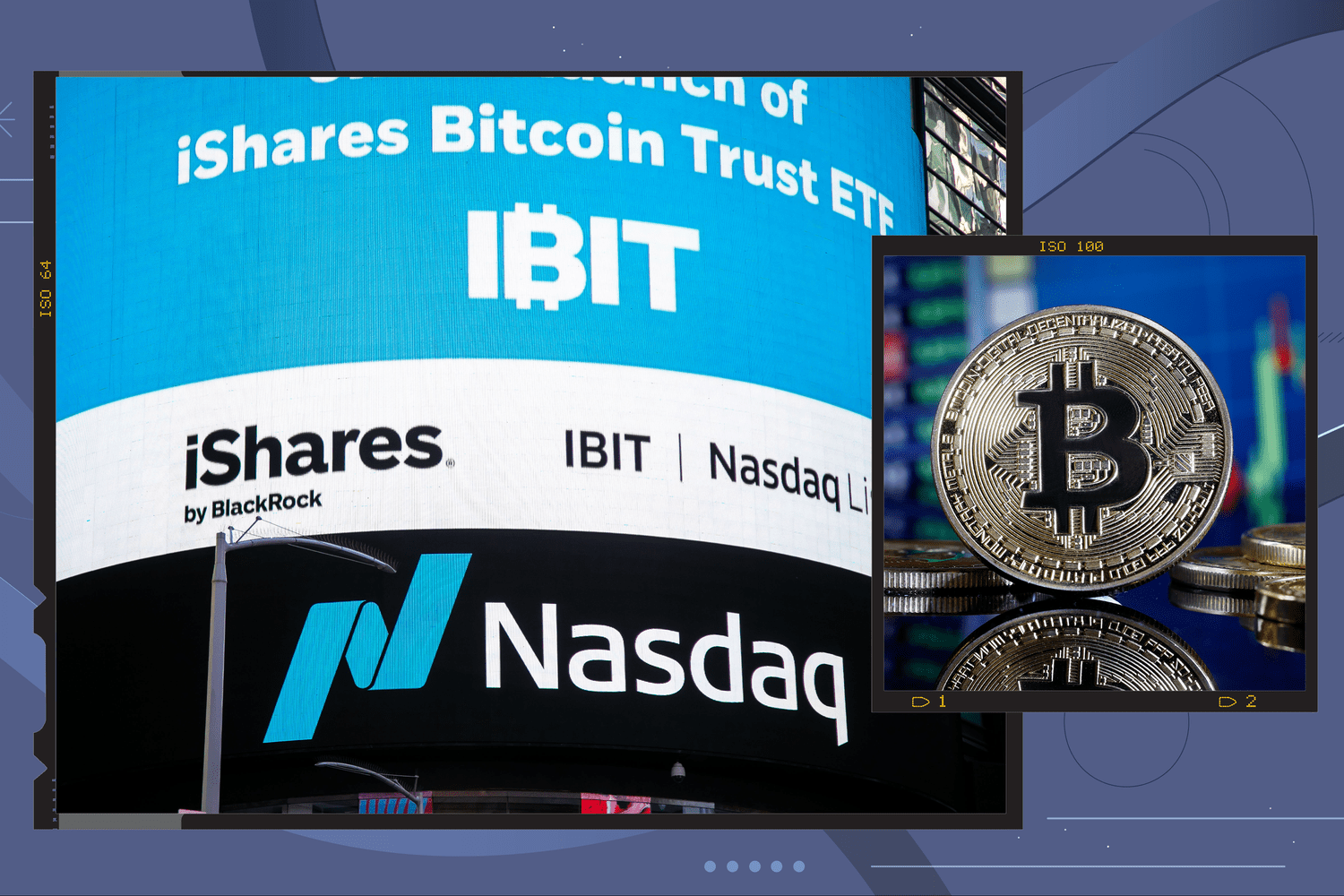

Spot Bitcoin ETFs are a pivotal innovation for both retail and institutional investors. Unlike futures-based products, these ETFs directly hold Bitcoin, mirroring its price movements and eliminating the need for complex crypto custody. With Bitcoin at $111,415.00, the ability to buy, hold, and sell Bitcoin exposure through a regulated brokerage account, just like any stock or traditional ETF, has never been more accessible.

“Spot Bitcoin ETFs have opened the floodgates for mainstream adoption. You can now allocate to Bitcoin with the same ease as buying an S and P 500 ETF. ”

Step 1: Open a Brokerage Account That Supports Bitcoin Spot ETFs

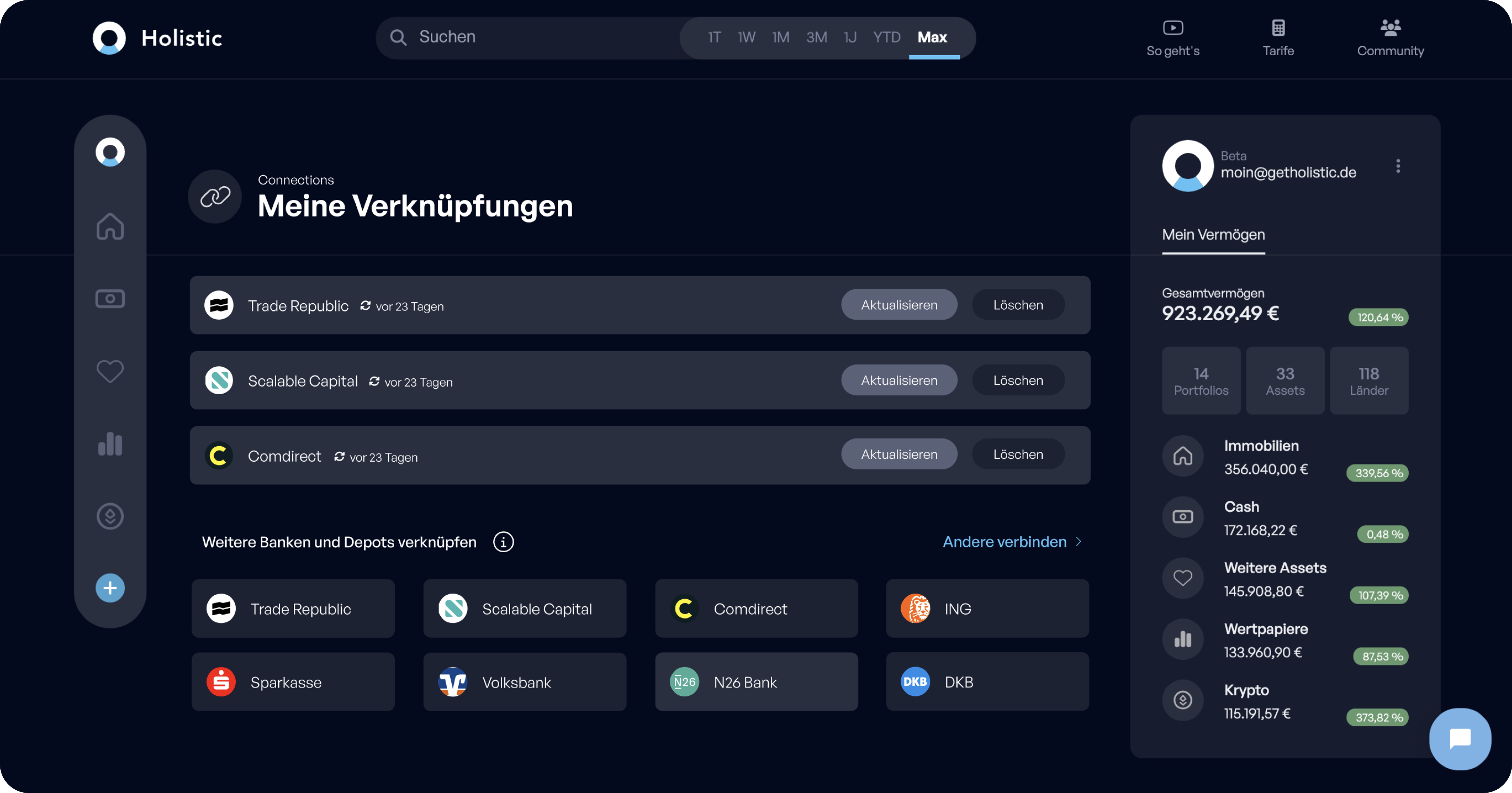

Your first move is to select a reputable brokerage that lists Bitcoin spot ETFs. Major players like Fidelity, Charles Schwab, E*TRADE, Robinhood, and Interactive Brokers all offer access, typically with zero commission fees. During account setup, you’ll complete identity verification (KYC), which usually takes 10-20 minutes. If you’re considering tax-advantaged options, look for platforms that support self-directed IRAs or Roth IRAs for crypto ETF investing.

Step 2: Research and Compare Bitcoin Spot ETFs

Don’t just buy the first ETF you see. There are several leading Bitcoin spot ETFs, each with unique features, fees, and liquidity profiles. The most popular options include:

- iShares Bitcoin Trust (IBIT): Managed by BlackRock, known for strong liquidity and robust trading infrastructure.

- Fidelity Wise Origin Bitcoin Fund (FBTC): Fidelity’s flagship product with competitive expense ratios.

- Grayscale Bitcoin Trust (GBTC): The original institutional Bitcoin vehicle, now converted to an ETF and often trading with high volume.

When comparing ETFs, focus on:

- Expense ratios: These can range from 0.19% to 1.50%. Lower is generally better, but weigh this against liquidity and tracking accuracy.

- Liquidity: Higher trading volume means tighter spreads and easier execution.

- Tracking accuracy: Does the ETF closely follow the price of Bitcoin ($111,415.00)?

Take your time here, ETF selection can have a real impact on your long-term returns. For more on how spot Bitcoin ETFs can diversify your portfolio, see our in-depth analysis at this link.

Up next: funding your account and executing your first buy order. But before you dive in, let’s look at what the market expects for Bitcoin’s trajectory in the coming months.

Bitcoin (BTC) Price Prediction 2026-2031

Professional forecasts based on current market conditions, ETF adoption, and crypto trends. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $85,000 | $120,000 | $155,000 | +7.7% | ETF-driven inflows, possible regulatory tightening, post-halving volatility |

| 2027 | $90,000 | $135,000 | $180,000 | +12.5% | Continued institutional adoption, global ETF expansion, moderate volatility |

| 2028 | $110,000 | $155,000 | $210,000 | +14.8% | Next Bitcoin halving, increased scarcity, tech improvements (L2, scalability) |

| 2029 | $130,000 | $175,000 | $245,000 | +12.9% | Mainstream financial integration, macroeconomic tailwinds |

| 2030 | $145,000 | $195,000 | $290,000 | +11.4% | Peak adoption phase, increased competition from CBDCs and altcoins |

| 2031 | $135,000 | $210,000 | $325,000 | +7.7% | Market maturation, stabilization, possible regulatory headwinds |

Price Prediction Summary

Bitcoin price predictions through 2031 show a steady upward trajectory, supported by the mainstream adoption of spot Bitcoin ETFs, increasing institutional participation, and periodic supply shocks from Bitcoin halvings. While volatility and regulatory risks remain, the average price projection suggests a compound annual growth rate (CAGR) of around 10-15% from 2025 levels. The maximum price scenarios reflect potential for strong bullish runs during periods of high adoption and favorable macroeconomic conditions, while minimum prices account for possible bear markets or regulatory crackdowns.

Key Factors Affecting Bitcoin Price

- Mainstream adoption of Bitcoin spot ETFs driving institutional and retail inflows

- Bitcoin halving cycles reducing new supply and increasing scarcity

- Global regulatory developments (positive or negative) affecting accessibility and investor confidence

- Macroeconomic factors (inflation, global liquidity, USD strength) influencing demand for Bitcoin as a hedge

- Technological advancements (scalability, security, new use cases) boosting utility and adoption

- Competition from other cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs) potentially impacting Bitcoin’s market share

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Step 3: Deposit Funds Into Your Brokerage Account

With your account open and your ETF shortlist ready, it’s time to fund your brokerage. Most platforms support ACH bank transfers, wire transfers, or even instant deposits for smaller amounts. Make sure you deposit enough to cover your planned investment plus any trading fees (though most platforms now offer zero-commission trades on ETFs). Once your funds clear, you’re ready for action.

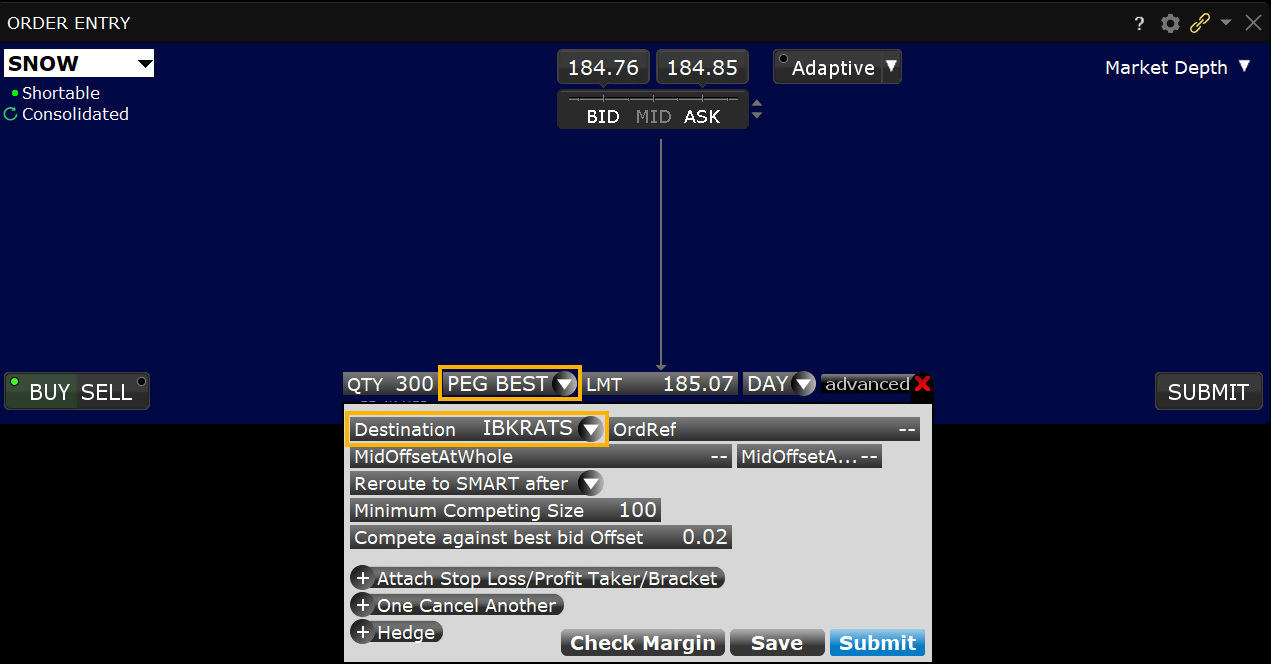

Step 4: Place a Buy Order for Your Chosen Bitcoin Spot ETF

Now for the critical moment: executing your first trade. Using your brokerage’s trading platform, search for the ETF ticker you’ve chosen, such as IBIT, FBTC, or GBTC. Enter the number of shares or dollar amount you wish to invest. Decide between a market order (buys at the current price) or a limit order (sets your maximum purchase price). Double-check all details before confirming. With Bitcoin currently at $111,415.00, even small price moves can be meaningful, especially if you’re allocating a significant sum.

This step is straightforward but strategic. If you want immediate exposure, use a market order. If you expect short-term volatility or want more control over entry price, set a limit order just below the current market value. Remember: ETF trades only execute during regular market hours, unlike Bitcoin itself, which trades 24/7, so plan accordingly.

Step 5: Monitor and Manage Your Investment

Your journey doesn’t end after hitting “buy. ” To succeed with Bitcoin spot ETF investing, active oversight is key:

- Regularly review performance: Track how your ETF is moving relative to Bitcoin’s live price ($111,415.00). Most brokerages offer charting and performance tracking tools.

- Consider portfolio rebalancing: As Bitcoin’s value shifts, it may become an outsized portion of your holdings. Rebalance periodically to stay aligned with your risk tolerance, many experts suggest keeping crypto exposure between 1% and 5% of your total portfolio.

- Stay informed on ETF developments: Expense ratios can change and new products may launch with better features or lower fees.

- Watch for tax events: Selling shares can trigger capital gains taxes unless held in tax-advantaged accounts like Roth IRAs.

This ongoing management sets successful investors apart from passive speculators. The best strategy combines discipline with adaptability as markets evolve.

Key Takeaways for Crypto ETF Beginners

Bitcoin Spot ETF Investment Checklist: 5 Key Steps

-

Open a brokerage account that supports Bitcoin spot ETFs (such as Fidelity, Charles Schwab, or E*TRADE) and complete any required identity verification. These reputable platforms offer access to leading spot Bitcoin ETFs and ensure regulatory compliance.

-

Research available Bitcoin spot ETFs (e.g., iShares Bitcoin Trust [IBIT], Fidelity Wise Origin Bitcoin Fund [FBTC], or Grayscale Bitcoin Trust [GBTC]) and compare fees, liquidity, and tracking accuracy. Evaluating these factors helps you select the ETF best aligned with your investment goals.

-

Deposit funds into your brokerage account, ensuring you have sufficient capital to cover your intended investment and any associated trading fees. Most platforms support ACH bank transfers for quick funding.

-

Place a buy order for your chosen Bitcoin spot ETF by using the brokerage’s trading platform—select the ETF ticker, enter the amount, and choose order type (market or limit). Double-check all details before confirming your purchase.

-

Monitor your investment regularly, review ETF performance, and consider portfolio rebalancing as needed to align with your financial goals and risk tolerance. Staying proactive helps you respond to Bitcoin’s price movements and market shifts.

The mainstreaming of spot Bitcoin ETFs means anyone can now participate in crypto’s upside without needing to master wallets or private keys. By following these five steps, opening a qualified brokerage account, researching ETFs like IBIT or FBTC, funding your account, placing strategic buy orders, and monitoring your position, you’ll be positioned to capitalize on this new era of regulated crypto investing.

If you’re ready to go deeper on portfolio construction and risk management with crypto ETFs, don’t miss our deep dive on diversification strategies at this link.