For years, crypto ETFs have promised to bridge the gap between digital assets and traditional finance, but operational quirks kept them one step removed from their commodity ETF cousins. That changed in July 2025, when the U. S. Securities and Exchange Commission (SEC) approved in-kind creations and redemptions for Bitcoin and Ethereum ETFs. This move is more than regulatory housekeeping – it’s a structural shift with profound implications for investors, market makers, and the entire crypto ETF ecosystem.

Bitcoin and Ethereum ETFs Enter a New Era

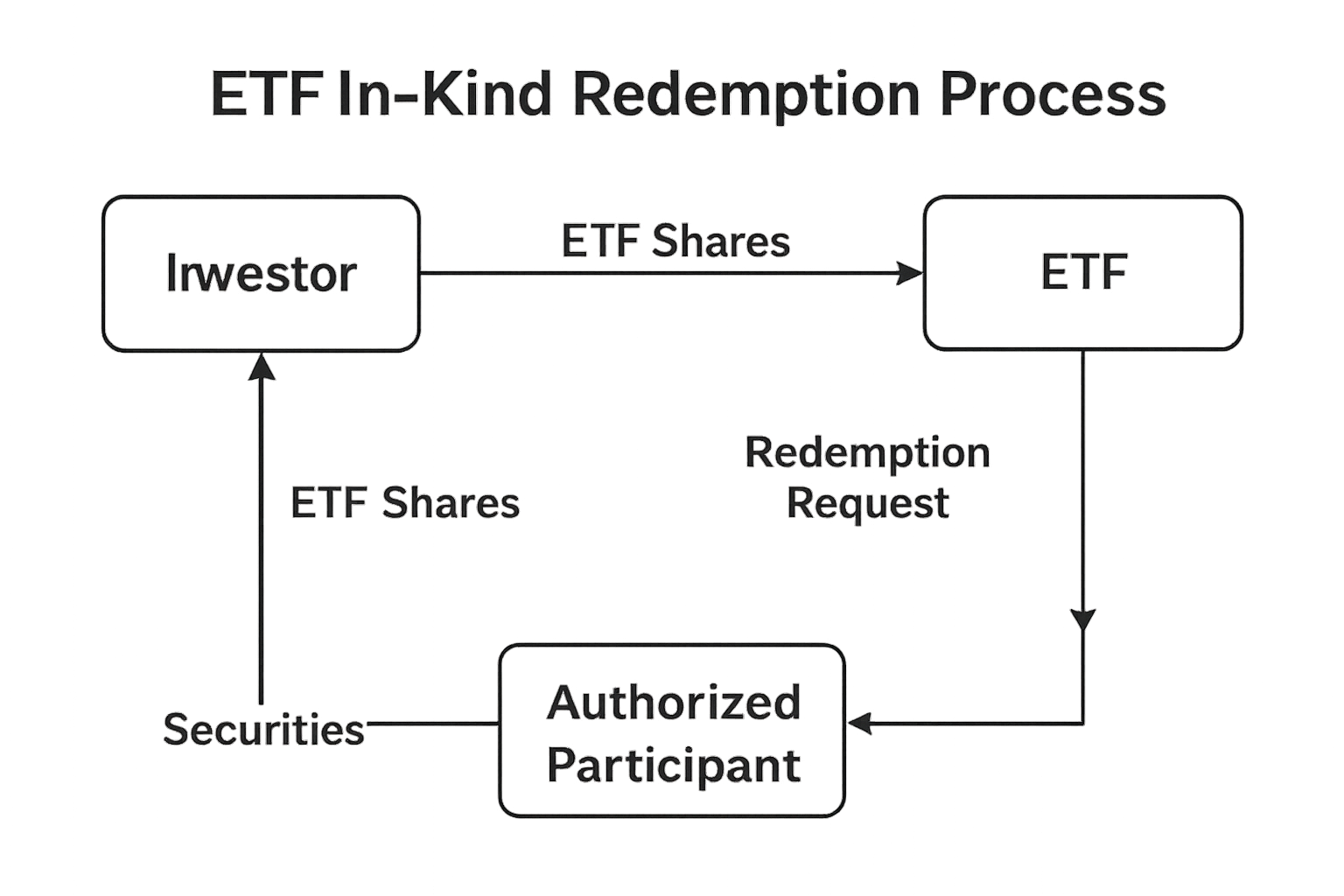

The SEC’s green light means authorized participants can now swap ETF shares directly for the underlying assets – Bitcoin or Ethereum – instead of converting everything to cash first. This is not just a technicality. It brings crypto ETFs in line with established commodity funds, like those tracking gold or oil, where in-kind redemptions are standard. The timing couldn’t be more significant: as of October 16,2025, Bitcoin (BTC) trades at $110,689 and Ethereum (ETH) sits at $4,000.42, both reflecting a maturing market hungry for institutional-grade tools.

“Today’s approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market. ” – SEC statement

Why In-Kind Redemptions Matter for Crypto ETFs

At its core, an in-kind redemption crypto ETF process allows large players to exchange baskets of ETF shares for actual Bitcoin or Ethereum, sidestepping the friction of cash settlement. This seemingly simple change unlocks several key advantages:

Key Benefits of In-Kind Redemptions for Crypto ETFs

-

Enhanced Operational Efficiency: In-kind redemptions allow ETF shares to be exchanged directly for Bitcoin or Ethereum, eliminating the need for cash conversions. This streamlines ETF operations and reduces friction, making the process faster and more cost-effective for both issuers and authorized participants.

-

Lower Transaction Costs: By bypassing multiple cash transactions and associated conversion fees, in-kind redemptions can significantly reduce overall transaction costs for investors and funds. This cost-saving is especially impactful in volatile markets like those for Bitcoin (currently $110,689) and Ethereum (currently $4,000.42).

-

Potential Tax Advantages: Direct asset exchanges through in-kind redemptions can help defer taxable events, potentially allowing investors to postpone capital gains taxes compared to cash redemptions. This is a well-established benefit in traditional commodity ETFs now extended to crypto ETFs.

-

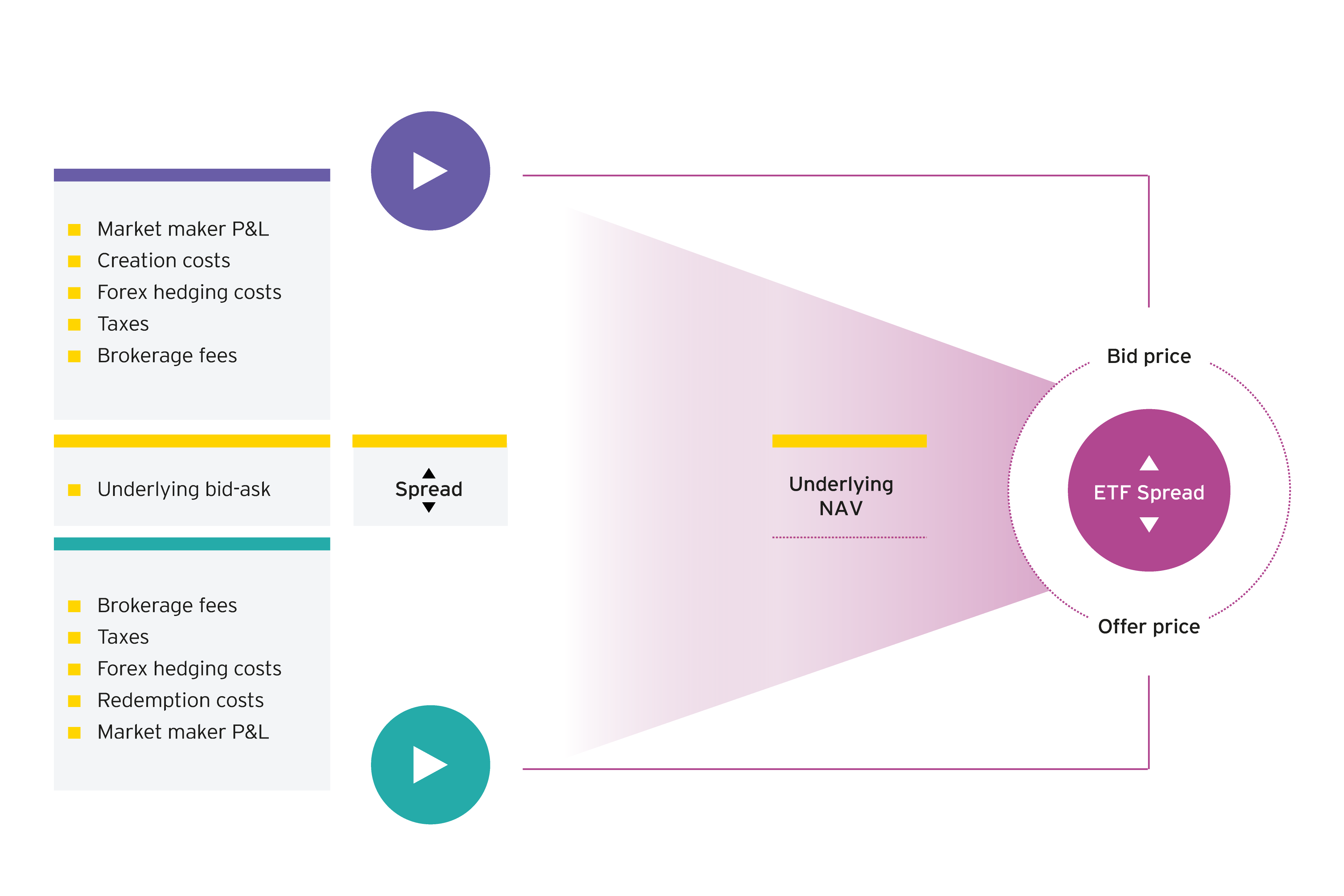

Improved Market Liquidity: The operational improvements and cost savings of in-kind redemptions attract more institutional investors, which can increase trading volumes and liquidity. This may result in tighter bid-ask spreads for both Bitcoin and Ethereum ETFs, benefiting all market participants.

-

Alignment with Traditional ETF Practices: The SEC’s approval brings Bitcoin and Ethereum ETFs in line with established practices used in commodity ETFs, fostering greater confidence and participation from traditional financial institutions.

Operational efficiency tops the list. By removing the need to liquidate assets for cash, ETF sponsors can lower transaction costs and reduce tracking error relative to spot markets. The process also improves arbitrage mechanisms – a critical factor in keeping ETF prices tightly aligned with their net asset value.

Tax implications are another game-changer. In-kind transactions often defer taxable events for institutional investors, echoing the tax efficiency seen in traditional ETFs. For sophisticated traders managing large positions in Bitcoin or Ethereum ETFs, this could mean significant savings over time.

Liquidity Surge: Institutional Interest Heats Up

The market’s reaction was swift and telling. Following the SEC’s approval, net inflows into Ethereum ETFs alone hit $106 million on their first day of trading under the new rules. This surge is more than headline fodder – it signals that institutional players are finally getting tools they trust to manage exposure at scale. Enhanced liquidity means tighter bid-ask spreads and greater depth across both spot and derivatives markets.

This isn’t just about numbers on a screen. With Bitcoin holding above $110,000 and Ethereum near $4,000, these products now offer direct access to two of the world’s most important digital assets via regulated vehicles with robust creation-redemption mechanisms.

The Macro View: Regulatory Normalization and Market Maturity

The SEC’s decision is part of a broader trend toward normalizing crypto within U. S. capital markets. As each new Bitcoin ETF in-kind creation or Ethereum ETF redemption process receives regulatory clarity, barriers to entry fall for pensions, endowments, and hedge funds previously sidelined by operational risk or compliance headaches.

The result? Crypto ETFs are no longer experimental outliers, they’re fast becoming mainstream instruments that sit comfortably alongside gold or S and P 500 funds on institutional trading desks.

Still, this shift is not without its complexities. Each exchange and ETF provider must secure individual SEC approvals for in-kind processes, and the industry is watching closely for further regulatory guidance. As the market digests these changes, expect a period of adjustment as operational workflows are refined and custody solutions evolve to meet the demands of direct settlement ETF crypto transactions.

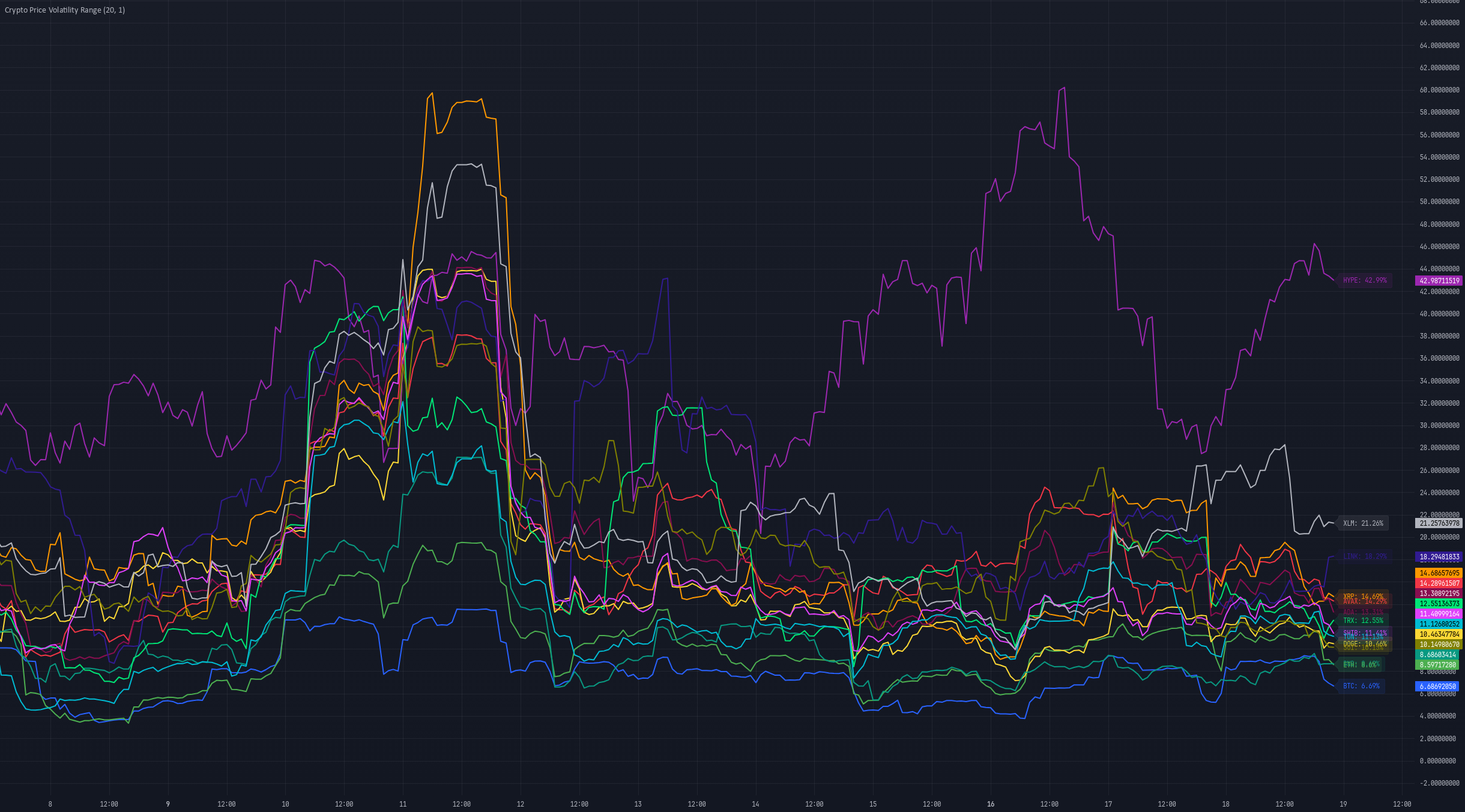

For investors, the practical upshot is clear: greater confidence in tracking accuracy, lower friction on large trades, and a more robust arbitrage ecosystem. Market makers can now cycle assets between ETF shares and spot coins with unprecedented efficiency, helping to stabilize pricing during periods of volatility. This is particularly relevant at today’s levels, with Bitcoin at $110,689 and Ethereum at $4,000.42, where even small inefficiencies can translate into millions in slippage or opportunity cost.

What to Watch: Risks and Opportunities Ahead

As with any market innovation, new risks emerge alongside new opportunities. In-kind redemptions require sophisticated custody infrastructure to securely handle large flows of Bitcoin or Ethereum. While this reduces reliance on cash settlement, it also demands robust operational controls and insurance, especially as institutional volumes grow.

Furthermore, while tax deferral is a major benefit for many investors, tax treatment can vary based on jurisdiction and individual circumstances. It’s imperative that investors consult with professionals familiar with ETF tax implications Bitcoin or Ethereum-specific nuances before making allocation decisions.

Key Risks and Considerations for In-Kind Redemption Crypto ETFs

-

Regulatory Uncertainty Remains: Although the SEC has approved in-kind redemptions for Bitcoin and Ethereum ETFs, regulatory guidance may evolve, and exchanges still require individual approvals for each ETF. Investors should monitor ongoing SEC statements and compliance requirements.

-

Custody and Security of Underlying Assets: In-kind redemptions require direct handling of Bitcoin and Ethereum. This increases exposure to risks such as hacking, theft, or mismanagement at the custodian level. Leading custodians like Coinbase Custody and BitGo are commonly used, but no system is infallible.

-

Tax Complexity and Reporting: While in-kind redemptions may defer some taxable events, the IRS has not issued comprehensive guidance for crypto ETF transactions. Investors must consult tax professionals to navigate potential reporting challenges and evolving tax treatment.

-

Market Volatility and Price Impact: As of October 16, 2025, Bitcoin trades at $110,689 (down 1.69%) and Ethereum at $4,000.42 (down 3.02%). Large in-kind redemptions could amplify price swings, especially during periods of low liquidity or heightened volatility.

-

Operational Complexity for Investors: In-kind processes are typically accessible only to authorized participants and large institutions. Retail investors may face indirect exposure to operational risks and may not benefit from the same efficiencies as institutional players.

-

Counterparty Risk with Authorized Participants: The in-kind model relies on a network of authorized participants, such as J.P. Morgan and Goldman Sachs. Failures or disruptions among these institutions could impact ETF operations and investor outcomes.

Looking forward, the normalization of in-kind redemption structures could pave the way for even broader crypto ETF adoption. It may also set the stage for similar mechanisms in future asset classes, think tokenized real-world assets or on-chain ETF products, further blurring the lines between digital and traditional finance.

“The approval of in-kind redemptions removes a significant barrier to institutional participation in crypto ETPs. ” – Katten Muchin Rosenman LLP

The Bottom Line: Crypto ETFs Come of Age

The SEC’s approval of in-kind creations and redemptions marks an inflection point for digital asset markets. By aligning Bitcoin and Ethereum ETFs with best practices from the commodity world, regulators have catalyzed a new wave of institutional engagement, and given retail investors access to deeper, safer liquidity pools.

As we stand with Bitcoin above $110,000 and Ethereum near $4,000, the story is no longer about whether crypto belongs in mainstream portfolios, but how quickly traditional finance will adapt to this new reality. For those seeking more technical detail or historical context on this evolution, see our deep dive at How In-Kind Redemptions Are Transforming Bitcoin ETFs.