In today’s fast-evolving digital asset landscape, tracking on-chain ETF flows has become a cornerstone for crypto portfolio optimization. With institutional capital pouring into spot Bitcoin ETFs and new products driving cross-chain exposure, understanding the pulse of ETF inflows and outflows is no longer optional, it’s a strategic imperative. The right analytics can unlock early signals on market sentiment, liquidity shifts, and even sector rotation. Let’s break down the most effective tools and strategies to monitor these critical flows and sharpen your crypto investing edge.

Coin Metrics ETF Flows Dashboard: Real-Time Precision for Portfolio Adjustments

If you want to track ETF flows in crypto with surgical accuracy, start with the Coin Metrics ETF Flows Dashboard. This platform offers granular, real-time data on both individual and aggregate Bitcoin ETF inflows and outflows. What sets Coin Metrics apart is its ability to display not just flow direction but also the total BTC supply held by ETFs. This metric is crucial, when you see the percentage of circulating BTC locked in ETFs rising or falling, it’s a direct readout of institutional conviction (or capitulation).

For example, when Bitcoin maintains its position above $105,171, a surge in net inflows tracked by Coin Metrics often precedes bullish price action as new capital enters the market. Conversely, sharp outflows can foreshadow profit-taking or risk-off behavior among large holders. By integrating this dashboard into your workflow, you gain an actionable lens to anticipate volatility spikes or trend reversals before they hit mainstream headlines.

Explore Coin Metrics’ ETF On-Chain Insights

AmberLens by Amberdata: Institutional-Grade Analytics for Deeper Market Context

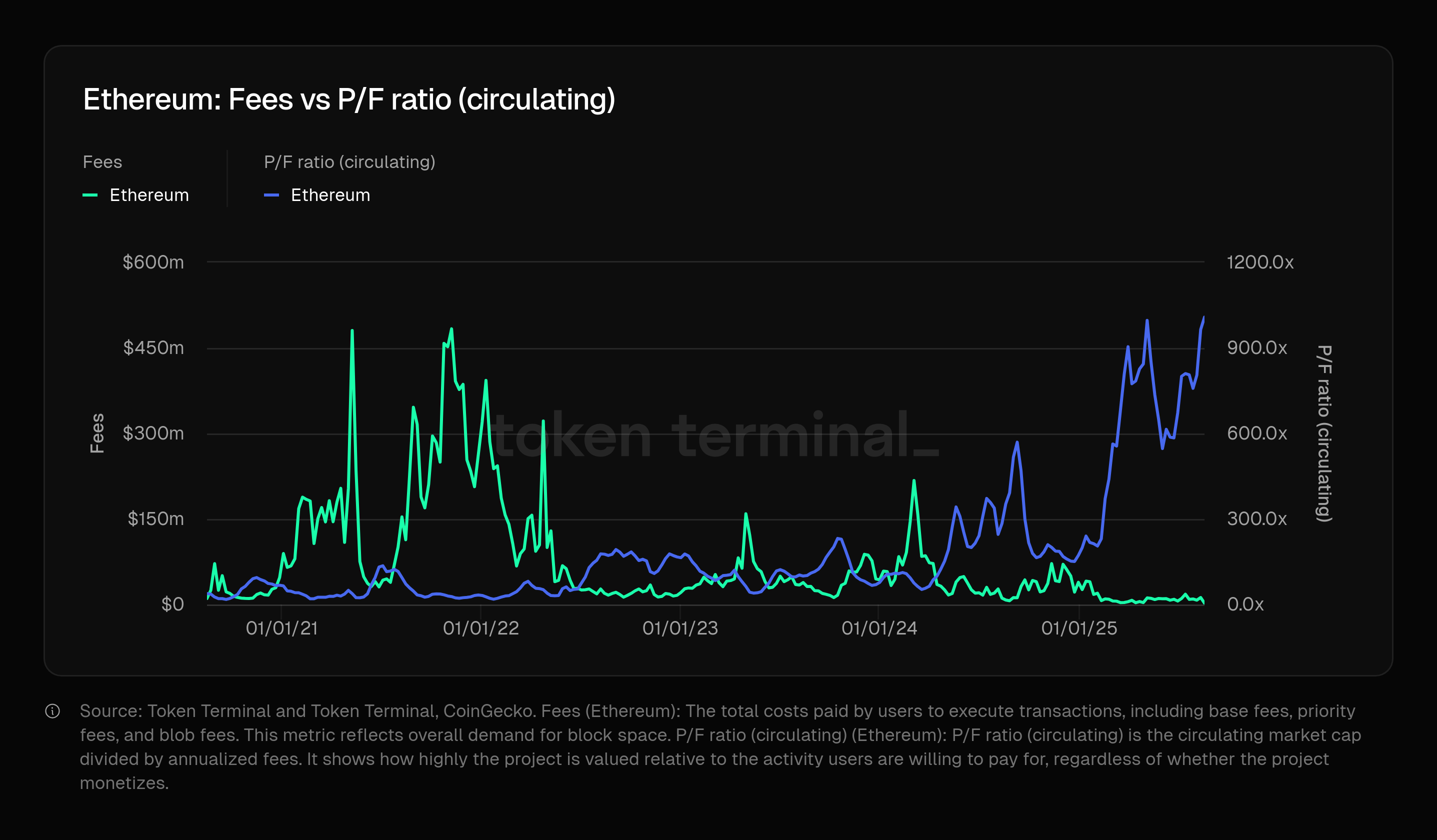

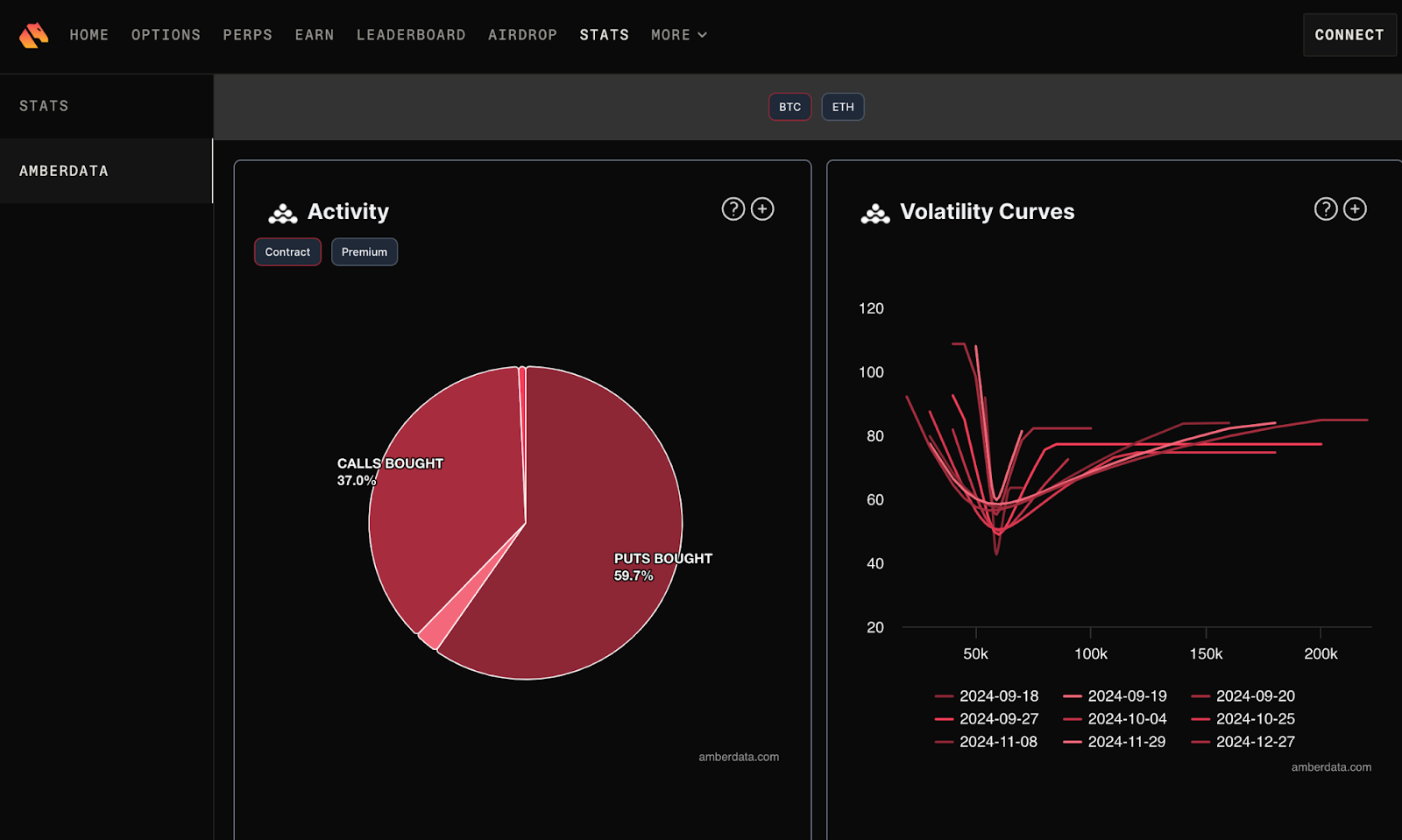

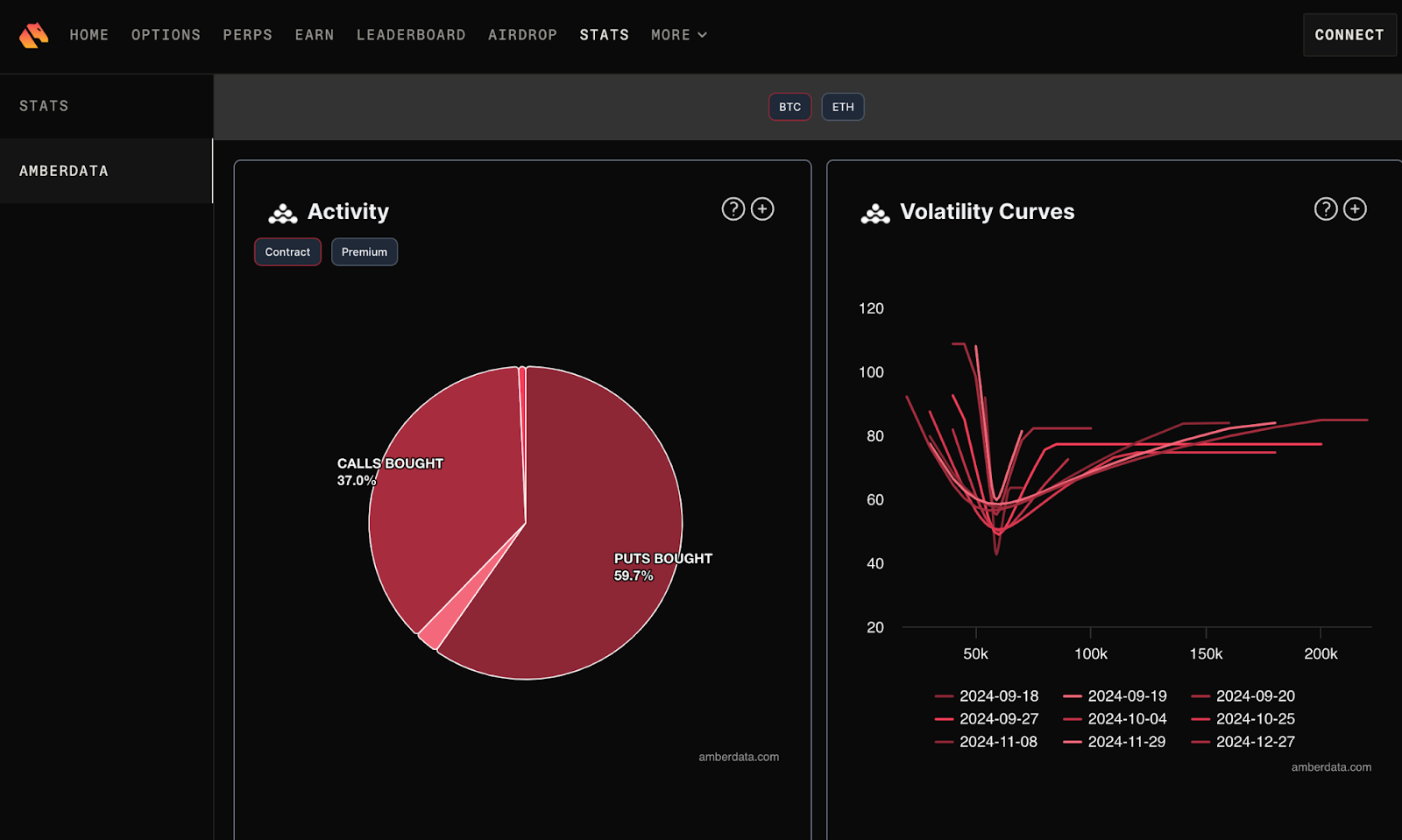

For those seeking a more holistic view that goes beyond raw flow numbers, AmberLens by Amberdata stands out as an institutional-grade analytics engine. AmberLens empowers users to monitor on-chain ETF movements alongside key market indicators such as exchange liquidity, derivatives positioning, and wallet activity clusters. Its advanced visualizations can highlight not just where capital is moving but also how those flows interact with broader liquidity conditions.

This matters because an uptick in ETF inflows during periods of thin order books can trigger outsized price moves, insights that AmberLens surfaces through its customizable alerts and dashboards. The platform is particularly valuable for active traders who want to connect on-chain activity with macro narratives and microstructure trends.

If you’re serious about reading the market’s heartbeat in real time, pairing Coin Metrics’ granular flow data with AmberLens’ contextual analytics gives you a 360-degree view few investors possess.

Integrating Crypto Portfolio Trackers with On-Chain ETF Data: The Token Metrics Advantage

The final piece of the puzzle is translating these insights into actionable portfolio decisions. Leading platforms like Token Metrics now integrate on-chain ETF flow data directly into their portfolio management suites. This means you can optimize your asset allocation based on real-time trends, whether that’s tilting towards assets seeing net positive inflows or reducing exposure where ETFs are bleeding capital.

Top Crypto Portfolio Trackers for On-Chain ETF Flows

-

Coin Metrics ETF Flows Dashboard: Provides granular, real-time tracking of individual and aggregate Bitcoin ETF inflows and outflows, as well as the total BTC supply held by ETFs. This precision is crucial for identifying capital rotation and shifts in market sentiment, empowering investors to make data-driven portfolio decisions.

-

AmberLens by Amberdata: An institutional-grade analytics platform enabling users to monitor on-chain ETF movements alongside key market indicators. AmberLens offers advanced visualization and alerting for ETF-related capital flows and their impact on liquidity, making it invaluable for strategic portfolio optimization.

-

Integrating Crypto Portfolio Trackers with On-Chain ETF Data (e.g., Token Metrics): Leverage leading portfolio management tools that now incorporate on-chain ETF flow data. Platforms like Token Metrics allow investors to optimize asset allocation based on real-time ETF inflow and outflow trends, ensuring your portfolio stays aligned with the latest institutional activity.

The integration allows for dynamic rebalancing strategies that respond instantly to changing fund flows, crucial when volatility accelerates around major price milestones like Bitcoin holding above $105,171. This data-driven approach supports both long-term allocation tweaks and short-term tactical trades for active managers.

Learn more about AI-driven crypto portfolio management using on-chain data

What truly sets this new breed of portfolio trackers apart is their ability to synthesize ETF flow data with your existing holdings, surfacing actionable signals in real time. For instance, if Token Metrics alerts you to a surge in net inflows into Ethereum ETFs while Bitcoin ETF flows plateau, you can proactively adjust your allocation, potentially front-running broader market rotations. This level of granularity is a game-changer for both risk management and alpha generation.

Consider the ripple effects: as more capital accumulates in ETFs, on-chain metrics such as supply held by funds and wallet concentration can shift rapidly. These changes are instantly reflected in platforms like Coin Metrics and AmberLens, but only portfolio trackers with native on-chain ETF data integration, like Token Metrics, allow you to automate rebalancing or set rules-based triggers. The result? You’re no longer reacting to yesterday’s news; you’re positioning ahead of the next wave.

Strategic Takeaways: Sharpening Your Edge with On-Chain ETF Analytics

To maximize your crypto investing edge in 2025 and beyond, make these steps part of your core process:

Checklist: Essential Tools for Tracking On-Chain ETF Flows

-

Coin Metrics ETF Flows Dashboard: Provides granular, real-time tracking of individual and aggregate Bitcoin ETF inflows and outflows, as well as the total BTC supply held by ETFs—crucial for identifying capital rotation and market sentiment shifts.

-

AmberLens by Amberdata: An institutional-grade analytics platform that enables users to monitor on-chain ETF movements alongside key market indicators, offering advanced visualization and alerting for ETF-related capital flows and their impact on liquidity.

-

Integrating Crypto Portfolio Trackers with On-Chain ETF Data (e.g., Token Metrics): Use leading portfolio management tools that now incorporate on-chain ETF flow data, allowing investors to optimize asset allocation based on real-time ETF inflow/outflow trends.

By layering real-time ETF flows from Coin Metrics, contextual analytics from AmberLens, and dynamic allocation tools from Token Metrics, you’re building a robust toolkit for navigating today’s volatile markets. This approach empowers you to:

- Spot early signs of trend reversals when institutional sentiment shifts.

- Dynamically rebalance portfolios as capital rotates between assets or sectors.

- Quantify market conviction using up-to-the-minute supply and flow metrics.

- Avoid lagging indicators by acting on live on-chain data instead of delayed fund reports.

The bottom line: On-chain ETF analytics aren’t just another dashboard, they’re the foundation for strategic decision making in a market that moves at algorithmic speed. As Bitcoin continues to hold above $105,171, the investors best equipped to track and act on ETF flows will capture the lion’s share of opportunity in this new era of digital asset management.