Digital Asset Treasuries (DATs) have rapidly emerged as a powerful, and sometimes controversial, force in the crypto investment landscape. As of October 2025, public companies hold over $100 billion in digital assets like Bitcoin and Ethereum on their balance sheets. This trend has not only shifted institutional attention but also introduced new market dynamics for crypto ETFs, including unique risks, fluctuating premiums, and tangible effects on blockchain networks.

DATs vs Crypto ETFs: What Are You Really Buying?

At first glance, investing in a Digital Asset Treasury company might seem similar to buying a crypto ETF or ETP. Both offer exposure to digital assets without the need for direct custody or wallet management. But dig deeper and you’ll find crucial differences that shape returns, risk profiles, and even how these products impact the underlying blockchains.

Crypto ETFs deliver straightforward exposure to assets like Bitcoin or Ethereum. They’re tightly regulated, typically track spot prices closely, and are designed for simplicity and stability. In contrast, DATs are publicly traded companies whose equity value is linked to their crypto holdings, but also influenced by corporate governance decisions, leverage strategies, capital allocation moves, and broader equity market sentiment.

Key Differences: DATs vs. Crypto ETFs (Pros & Cons)

-

Exposure Structure: DATs (Digital Asset Treasuries) offer indirect crypto exposure by investing in public companies holding large crypto reserves (like MicroStrategy or Coinbase), whereas crypto ETFs provide direct, regulated exposure to crypto assets (e.g., spot Bitcoin ETFs).

-

Premiums & Discounts: DAT stocks often trade at premiums or discounts to their net asset value (NAV) due to investor sentiment and market dynamics, while ETFs typically track NAV more closely, reducing pricing anomalies.

-

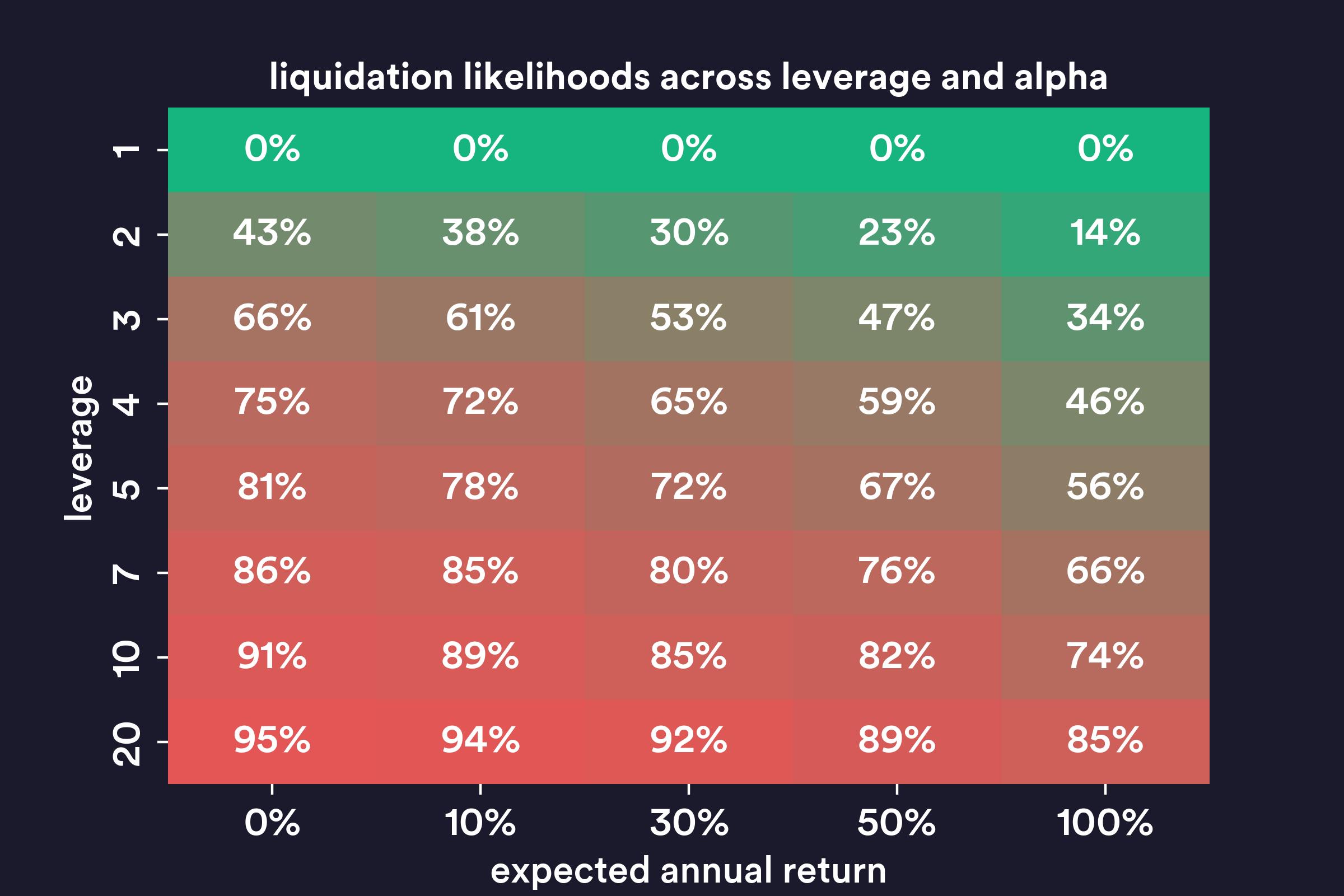

Leverage & Risk: DATs may use leverage to amplify returns, which can boost gains during bull markets but increases downside risk during downturns. Most crypto ETFs do not employ leverage, offering a more stable risk profile.

-

Corporate Governance: Investing in DATs exposes you to company management decisions (capital allocation, debt, operational risks), while ETFs minimize management risk by passively tracking crypto prices.

-

On-Chain Impact: DATs can directly affect blockchain networks by holding or moving large amounts of crypto (e.g., 2 million ETH held by some DATs), potentially impacting liquidity and price. ETFs hold assets off-chain and have minimal direct on-chain impact.

-

Regulatory Landscape: The approval of spot crypto ETFs (like Bitcoin ETFs) offers investors lower-cost, regulated access to digital assets, potentially reducing the appeal of DATs, which benefited from regulatory gaps.

-

Income Potential: Some DATs generate additional income by staking or deploying assets in DeFi, while ETFs typically do not provide staking rewards to investors.

This means when you buy shares in a DAT stock, you’re not just betting on BTC or ETH price action, you’re also exposed to management’s ability to navigate volatility, regulatory shifts, and operational hurdles. For more on these nuanced distinctions, check out this primer from CoinShares.

The Premium Game: Why DAT Stocks Trade Above (or Below) NAV

A defining feature of Digital Asset Treasuries is how their stocks often trade at a premium, or sometimes a discount, to their net asset value (NAV). During bullish cycles when demand for regulated crypto exposure soars but ETF access remains limited (especially for tokens like Solana), DAT equities can command significant premiums. Investors pay extra for indirect access, sometimes far above the actual value of the underlying coins held by these firms.

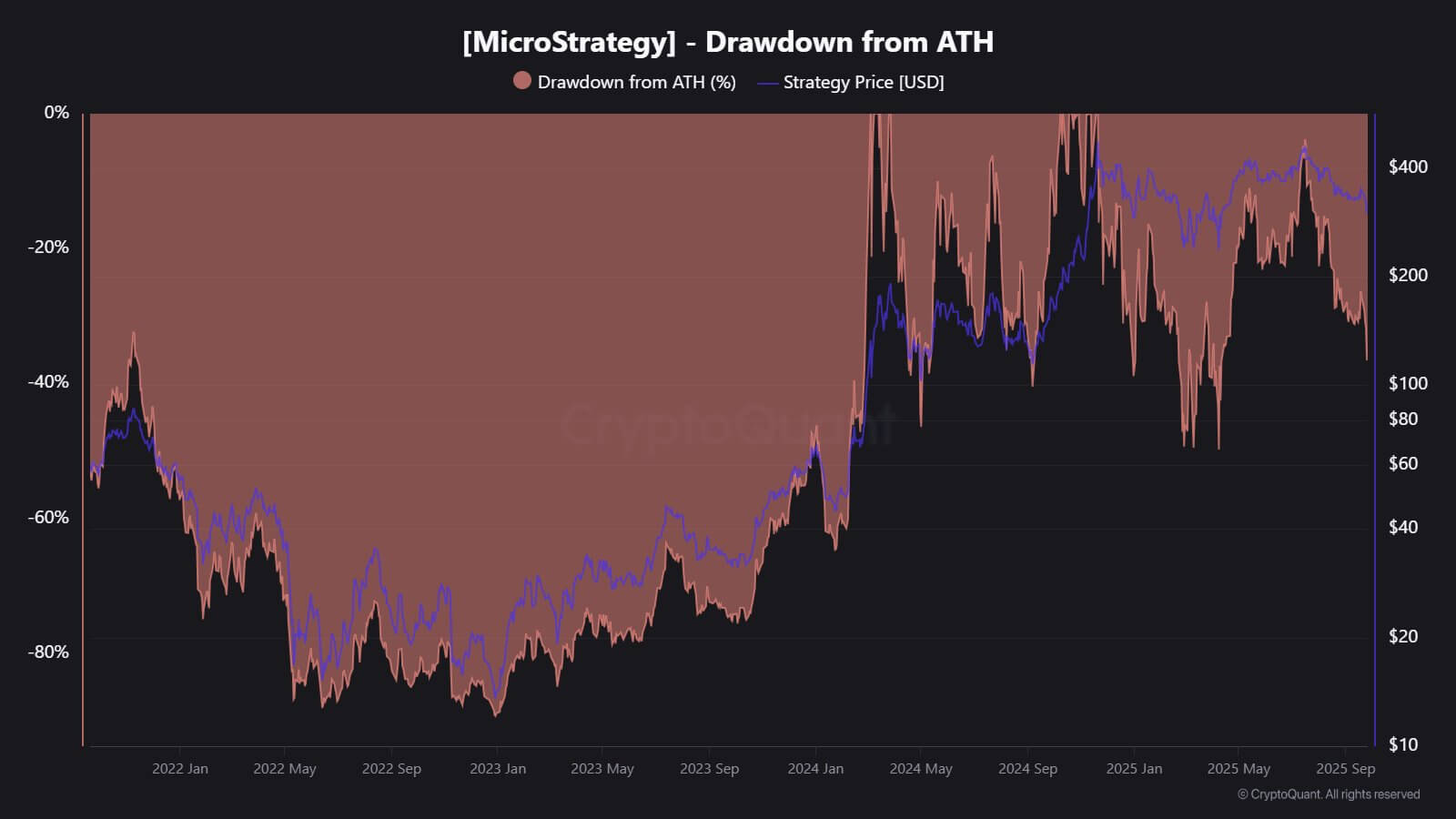

This premium is not guaranteed. Market downturns can swiftly erase it or flip it into a discount. When that happens, especially if leverage is involved, companies may be forced to sell crypto reserves to buy back shares or shore up balance sheets. This dynamic can accelerate sell-offs during bear markets and amplify volatility both in share prices and on-chain activity.

The flywheel effect here is real: reflexive growth when things are good can turn into rapid deleveraging when sentiment sours (detailed analysis). As one Forbes piece highlights, maintaining that premium is key to survival, and once it’s lost, the consequences can be severe.

The Risk Spectrum: Leverage, Regulation and Corporate Governance

Leverage sits at the core of many DAT strategies. Used wisely during bull markets it can turbocharge returns; mismanaged during downturns it becomes an existential threat. This risk isn’t theoretical, recent cycles have shown how quickly over-leveraged treasuries must unwind positions when premiums vanish or credit tightens (PanewsLab deep dive).

- Regulatory risk: The approval of new spot ETFs (such as those for Solana) could make the DAT model less appealing by providing investors with lower-cost alternatives, potentially shrinking premiums overnight.

- Corporate governance: When you buy into a DAT stock you’re relying on management teams to execute sound capital allocation strategies, not always a given in fast-moving markets.

- Single-token concentration: Many DATs are heavily exposed to one asset (BTC supply or ETH supply), increasing vulnerability if that token faces sector-wide headwinds.

- Crowded trades: Thin trading volumes and evolving custody risks mean exits can be tricky during periods of stress.

This complex web of factors means that while DAT equities may offer leverage and income potential beyond what simple ETFs provide, they do so at the cost of amplified risk across multiple dimensions (Phemex breakdown).

For investors, this risk-return calculus is a moving target. When premiums are high and capital is cheap, DATs can outpace spot crypto or ETF returns. But the tide can turn fast. If credit markets tighten or NAV premiums dry up, companies may hit a “refinancing wall”: unable to roll debt or raise new equity without diluting existing shareholders. The result? Forced liquidations and potential downward pressure on both share prices and the underlying tokens themselves.

On-Chain Impact: How DATs Move Crypto Markets

The influence of Digital Asset Treasuries goes well beyond their stock tickers. Their collective buying (and sometimes selling) power can leave visible footprints on blockchain networks like Bitcoin, Ethereum, and Solana. For example, several Ethereum-focused DATs now control over 2 million ETH: roughly 5% of circulating supply, a concentration that both supports liquidity and presents systemic risk if large-scale liquidations occur (details here).

When these treasuries stake assets or deploy them into DeFi protocols, they can enhance network security and yield opportunities for all participants. But the flip side is stark: if financial stress forces a major DAT to offload holdings, it could trigger sharp price moves and liquidity crunches on-chain.

How DAT Activity Shapes BTC, ETH & SOL Supply

-

Large-Scale Accumulation Reduces Liquid Supply: DATs like MicroStrategy and Tesla collectively hold over $100 billion in Bitcoin and Ethereum, locking up significant portions of circulating supply and reducing liquidity on exchanges.

-

Potential for Sudden On-Chain Selling Pressure: If DATs face financial stress or their stock trades at a discount to NAV, they may be forced to sell large portions of BTC, ETH, or SOL, triggering sharp on-chain price drops and network volatility.

-

Staking and DeFi Participation Boosts Network Security: Ethereum-focused DATs, holding over 2 million ETH (about 5% of supply), often stake assets or deploy them in DeFi, enhancing network security and liquidity but concentrating influence in a few hands.

-

Leverage Amplifies Market Swings: Many DATs use leverage to increase crypto exposure. In bull markets, this can fuel rapid accumulation, but in downturns, forced liquidations can exacerbate price declines and destabilize on-chain activity.

-

Premiums and Discounts Affect On-Chain Activity: DAT stocks often trade at premiums to NAV, encouraging further accumulation of crypto. If premiums vanish, DATs may halt purchases or liquidate holdings, impacting supply and price stability for BTC, ETH, and SOL.

This reflexivity is unique to DATs compared to crypto ETFs. ETFs merely track asset prices; they don’t directly interact with blockchains or participate in staking/yield strategies. As such, while ETFs offer simplicity and regulatory clarity, they lack the operational leverage (and risk) that comes with active treasury management.

Investor Takeaways: DATs in a Maturing Crypto ETF Era

As spot ETFs proliferate for assets like Bitcoin and potentially Solana, the case for Digital Asset Treasuries will continue to evolve. Some investors will still be drawn by the potential upside of leveraged treasury management, especially when premiums are robust, but many will likely prefer the transparency and predictability of regulated ETF structures.

For those considering exposure via DAT stocks instead of (or alongside) crypto ETFs, it’s essential to:

- Understand not just what you own but how it’s managed.

- Monitor NAV premiums/discounts as a real-time sentiment gauge.

- Factor in leverage levels, and be wary when debt-fueled growth meets tightening markets.

- Stay alert to regulatory changes that could reshape the playing field overnight.

The bottom line? Digital Asset Treasuries have injected new energy, and new hazards, into the crypto investment ecosystem. Whether you’re seeking amplified returns or simply want exposure without custody headaches, understanding these structures’ risks and their ripple effects across both equity markets and blockchains is more important than ever. As always in crypto: clarity breeds confidence.