The landscape of crypto investing is being redrawn in real time, and nowhere is this more evident than in the explosive rise of on-chain ETFs. These new vehicles are not just another product launch; they are a structural shift, fusing the transparency and programmability of decentralized finance with the regulatory guardrails of traditional markets. As we enter Q4 2025, two blockchains are at the epicenter of this transformation: Solana and Ethereum.

Solana ETFs: Institutional Appetite Meets Next-Gen Performance

Solana’s ascent from a high-throughput experiment to an institutional darling has been nothing short of remarkable. Over the past 12 months, Solana’s ecosystem total value locked (TVL) has soared by approximately 198%, reaching around $38.5 billion. This surge is not just a footnote – it is a signal that capital allocators are taking Solana seriously as both an asset and an infrastructure layer.

Institutional recognition reached a new level in June 2024 when VanEck filed to list the first spot Solana ETF in the U. S. , quickly followed by 21Shares’ own filing (source). The implications are profound: if these ETFs gain approval and traction, they could channel billions in institutional inflows directly onto the chain, tightening supply and driving demand for SOL. Analysts have begun projecting targets as high as $300 or even $500 for SOL should these flows materialize, reflecting growing confidence that ETF-driven demand could fundamentally alter Solana’s market dynamics.

But it isn’t just about price. On-chain ETFs convert off-chain demand into on-chain custodial flows, creating a tighter connection between traditional finance and DeFi. As more assets become accessible via regulated ETFs, baseline demand rises while available float contracts – a classic recipe for volatility but also for sustained price appreciation in bullish cycles.

Ethereum ETFs: The Gateway to Mainstream Crypto Exposure

If Solana represents speed and innovation, Ethereum remains the bedrock for programmable money. The approval of Ethereum-linked ETFs by the SEC in July 2024 marked a watershed moment for mainstream crypto exposure (source). Giants like BlackRock, Fidelity, and Franklin Templeton now offer regulated vehicles for ETH allocation – opening the floodgates to pension funds, endowments, and everyday investors previously sidelined by custody or compliance concerns.

The numbers tell their own story: Ethereum saw $547 million in spot ETF inflows even as its on-chain activity struggled below $4,200. This divergence between strong institutional support via ETFs and declining native network activity highlights how these products can decouple price from on-chain usage – at least temporarily – as capital rotates through regulated channels before rediscovering DeFi protocols on-chain.

Yet challenges remain. Net outflows have occasionally surfaced amid volatility, reflecting both macro uncertainty and competition from faster chains like Solana. Still, with Ether reclaiming key levels above $4,000 and analysts citing faster ETF approvals as a catalyst for future surges, Ethereum’s position as the default smart contract platform appears unshaken.

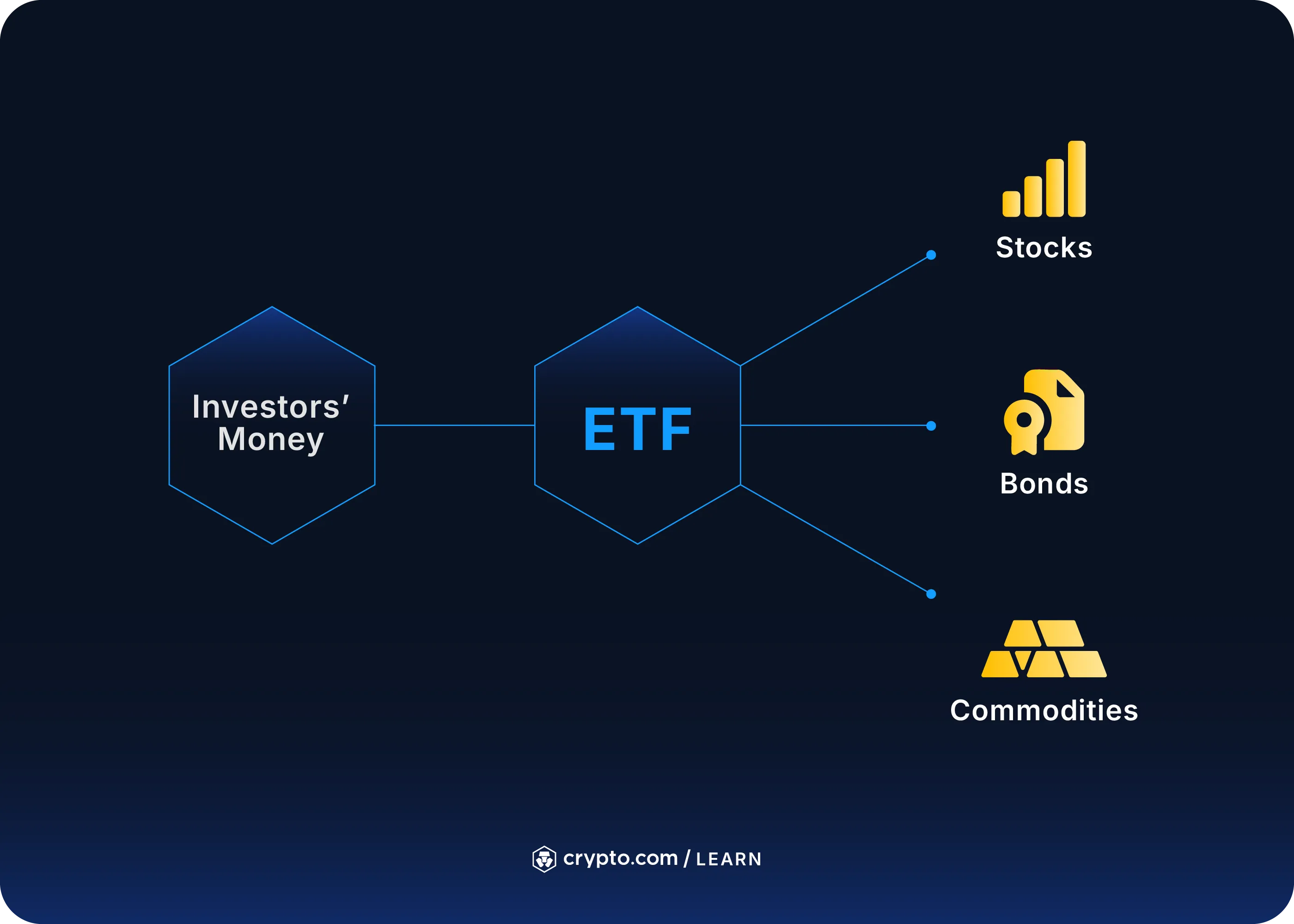

The Mechanics Behind On-Chain ETFs: Transparency Meets TradFi Scale

The innovation powering this revolution lies in how on-chain ETFs tokenize traditional financial assets – stocks or index funds – making them tradable on public blockchains like Ethereum or Solana. Ondo Finance’s launch of over 100 tokenized U. S. stocks and ETFs on Ethereum exemplifies this trend. These tokens represent claims on real-world assets held at U. S. -registered broker-dealers but are accessible 24/7 through smart contracts (source).

Key Advantages of On-Chain ETFs Over Traditional ETFs

-

24/7 Market Access and Liquidity: On-chain ETFs built on platforms like Solana and Ethereum enable investors to trade assets around the clock, unlike traditional ETFs, which are limited to stock exchange hours. This continuous access enhances liquidity and responsiveness to global market events.

-

Enhanced Transparency and Security: Blockchain-based ETFs provide real-time, on-chain verification of holdings and transactions. Investors can independently verify fund assets and flows, reducing reliance on opaque intermediaries.

-

Direct Exposure to Digital Assets: On-chain ETFs allow investors to gain regulated exposure to cryptocurrencies like Solana (SOL) and Ethereum (ETH) without managing wallets or private keys, streamlining access for both retail and institutional participants.

-

Lower Operational Costs and Efficiency: By automating settlement and custody on blockchain networks, on-chain ETFs reduce administrative costs and friction compared to traditional ETF structures, potentially resulting in lower fees for investors.

-

Broader Asset Access and Tokenization: Platforms such as Ondo Finance have begun tokenizing U.S. stocks and ETFs on Ethereum, allowing investors to diversify with both digital and traditional assets in a single, on-chain portfolio.

-

Improved Regulatory Compliance: On-chain ETFs issued by major asset managers like BlackRock, Fidelity, and 21Shares are subject to rigorous oversight, combining blockchain transparency with established regulatory standards.

This blend brings several advantages:

- Transparency: Investors can verify fund holdings live on-chain rather than waiting for quarterly disclosures.

- Efficiency: Settlement times shrink from days to minutes; redemption processes become programmable.

- Accessibility: Global investors can access products without intermediaries or banking restrictions.

- Diversification: Exposure to both digital-native assets (ETH/SOL) and tokenized traditional securities within unified portfolios.

The result is a new breed of investment vehicle that democratizes access while maintaining regulatory oversight – potentially unlocking trillions in global liquidity previously walled off from DeFi markets.

As the lines between traditional and decentralized finance blur, the competitive dynamic between Solana and Ethereum is fueling innovation that benefits investors on both sides. Solana’s rapid throughput and low fees are drawing developers and liquidity at a blistering pace, with its TVL now standing at $38.5 billion. Meanwhile, Ethereum’s institutional credibility and first-mover advantage in smart contracts ensure it remains the default gateway for regulated crypto exposure.

ETF-Driven Price Action: Liquidity, Volatility, and Market Structure

The arrival of spot Solana ETFs and Ethereum ETFs is already influencing price dynamics in profound ways. For Solana, ETF anticipation has fueled bullish sentiment that could see SOL test new highs if inflows accelerate. Analysts are watching closely: a surge of institutional capital could push SOL toward $300 or even $500 in a strong market cycle (source). Ethereum, by contrast, has absorbed $547 million in ETF inflows while struggling to maintain momentum above $4,200, a testament to how ETF flows can support price even as on-chain activity ebbs.

This decoupling of price from native network usage is a new macro theme. ETF-driven demand introduces a layer of liquidity that can buffer volatility but also create disconnects between fundamental activity (like DeFi usage or NFT trading) and asset valuations. The result: more mature markets that still retain crypto’s signature volatility, just with a new set of levers pulling behind the scenes.

Solana Technical Analysis Chart

Analysis by Owen Gallagher | Symbol: BINANCE:SOLUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

Begin by drawing horizontal lines at $120, $140, $180, $220, and $260 to mark key historical support and resistance zones. Use a trend_line tool to map the clear uptrend from early 2024 lows to the current $218.89 price, capturing higher lows and higher highs. Highlight the accumulation range between $120 and $140 from early 2024 to early 2025 using a rectangle. Use vertical_line to mark major inflection points near the breakouts above $140 and $180. Place text annotations to highlight the significance of the recent ETF-driven institutional flows, especially as SOL approaches previous resistance near $220. For risk management, add a horizontal line at $180 as a potential stop-loss for conservative traders. Use callouts to note sharp price recoveries in 2025 following ETF news.