Imagine a world where you can access Apple, Microsoft, or the SPDR S and P 500 ETF from your crypto wallet, 24/7, with no brokerage account required. In 2025, that world is here. The launch of Ondo Global Markets on Ethereum has brought more than 100 of America’s most influential stocks and ETFs onto the blockchain as tokenized assets, fundamentally reshaping how global investors interact with U. S. equities.

Tokenized U. S. Equities: Breaking Down Barriers

Historically, investing in U. S. equities like Apple Inc. (AAPL), Microsoft Corp. (MSFT), or NVIDIA Corp. (NVDA) required navigating legacy systems, time zones, and regulatory hurdles – especially for non-U. S. investors. Ondo Finance’s new platform changes the game by offering fully-backed tokenized versions of these household names on Ethereum.

Each token represents a share in a real company or ETF – for example, Alphabet Inc. Class A (GOOGL) Tokenized Stock, Tesla Inc. (TSLA) Tokenized Stock, and Berkshire Hathaway Inc. Class B (BRK. B) Tokenized Stock. These digital assets are backed by the underlying securities held securely at U. S. -registered broker-dealers.

The result? Investors worldwide can now buy fractions of high-value stocks like Eli Lilly and Co. (LLY), Visa Inc. Class A (V), or even broad-market ETFs such as the SPDR S and P 500 ETF Trust (SPY), all with blockchain transparency and efficiency.

The Power List: What’s Actually Available On-Chain?

This isn’t just about tech giants or a handful of blue chips – Ondo’s offering is impressively comprehensive:

Top 20 Tokenized U.S. Stocks & ETFs on Ethereum

-

Apple Inc. (AAPL) Tokenized Stock: Gain on-chain exposure to the world’s most valuable tech company, now available 24/7 on Ethereum.

-

Microsoft Corp. (MSFT) Tokenized Stock: Access the software giant’s performance with instant, blockchain-based trading.

-

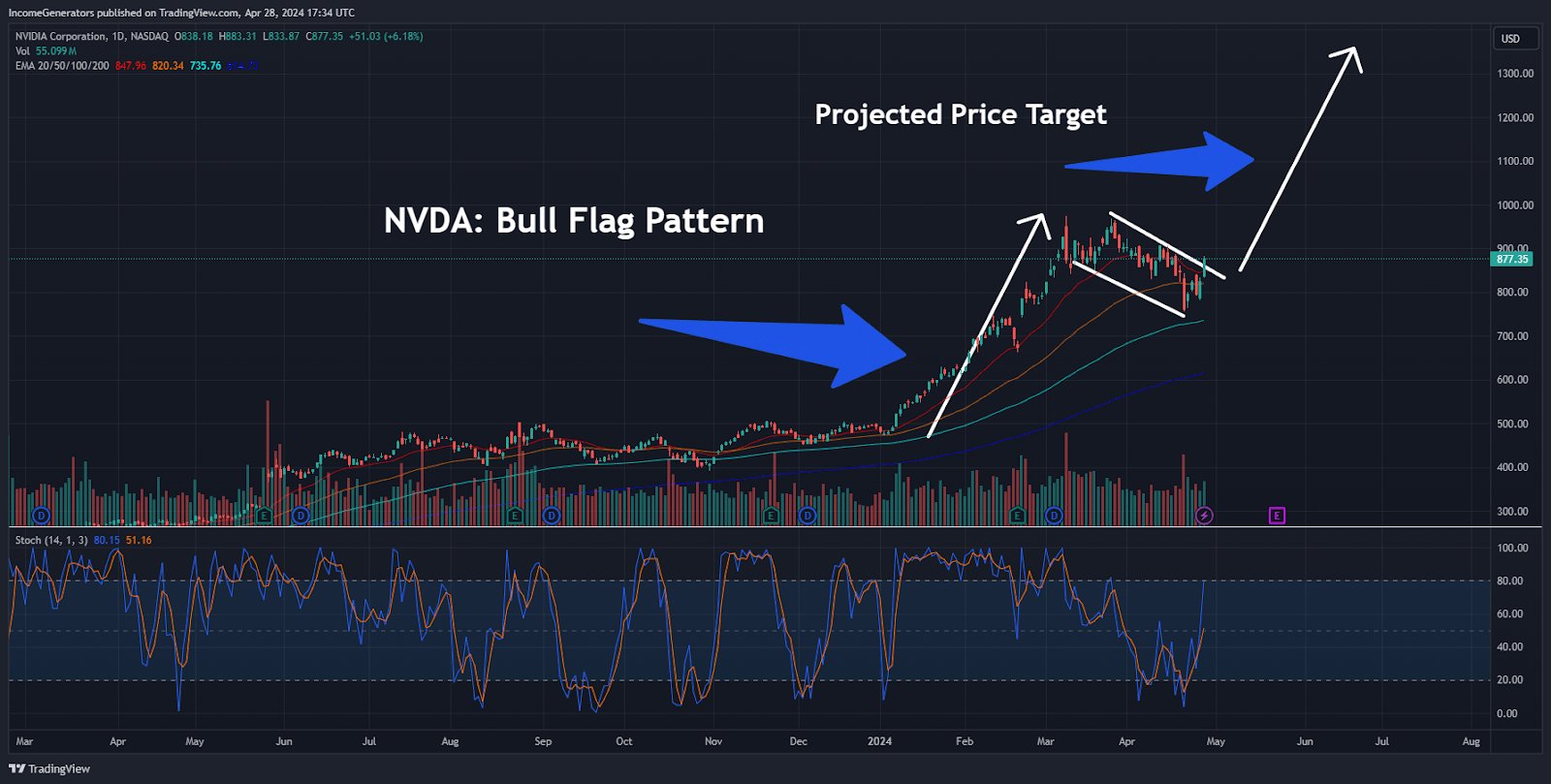

NVIDIA Corp. (NVDA) Tokenized Stock: Tap into the booming AI and semiconductor sector with tokenized NVIDIA shares.

-

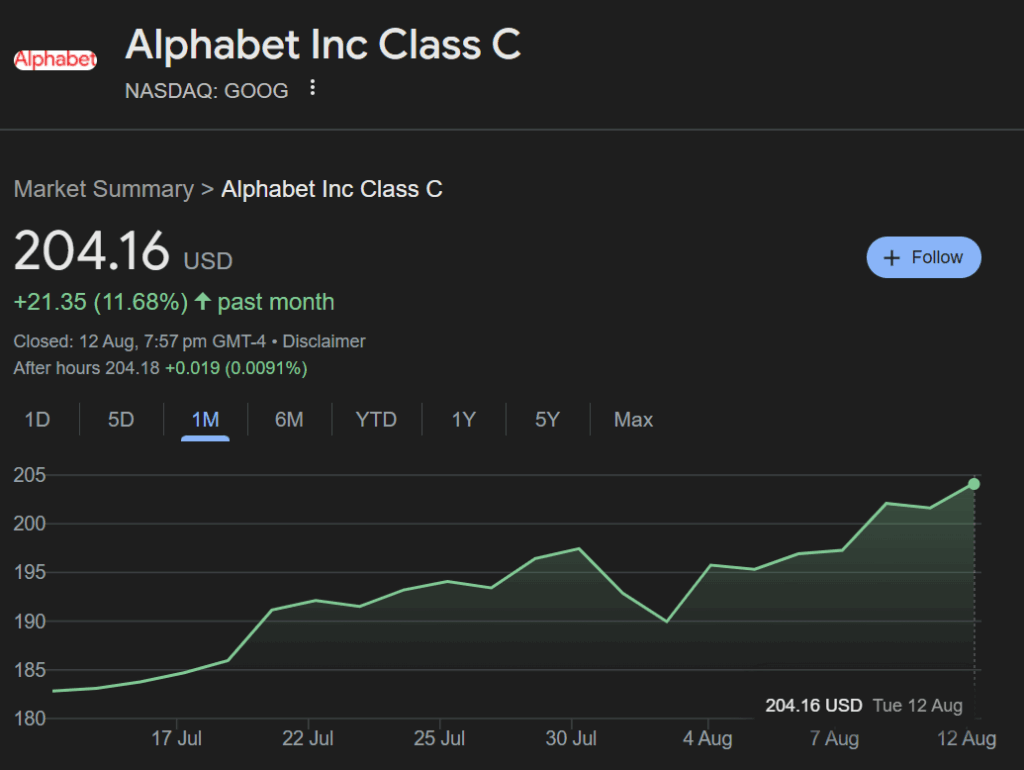

Alphabet Inc. Class A (GOOGL) Tokenized Stock: Invest in Google’s parent company directly from your crypto wallet.

-

Amazon.com Inc. (AMZN) Tokenized Stock: Get exposure to the e-commerce and cloud leader via Ethereum-based tokens.

-

Meta Platforms Inc. (META) Tokenized Stock: Participate in the social media and metaverse revolution with tokenized Meta shares.

-

Tesla Inc. (TSLA) Tokenized Stock: Trade the electric vehicle pioneer’s stock 24/7, no traditional broker needed.

-

Berkshire Hathaway Inc. Class B (BRK.B) Tokenized Stock: Access Warren Buffett’s legendary holding company on-chain.

-

Eli Lilly and Co. (LLY) Tokenized Stock: Invest in leading pharmaceutical innovation with tokenized Eli Lilly shares.

-

Visa Inc. Class A (V) Tokenized Stock: Get exposure to the global payments network with blockchain-based Visa tokens.

-

JPMorgan Chase & Co. (JPM) Tokenized Stock: Access the largest U.S. bank’s equity instantly via Ethereum.

-

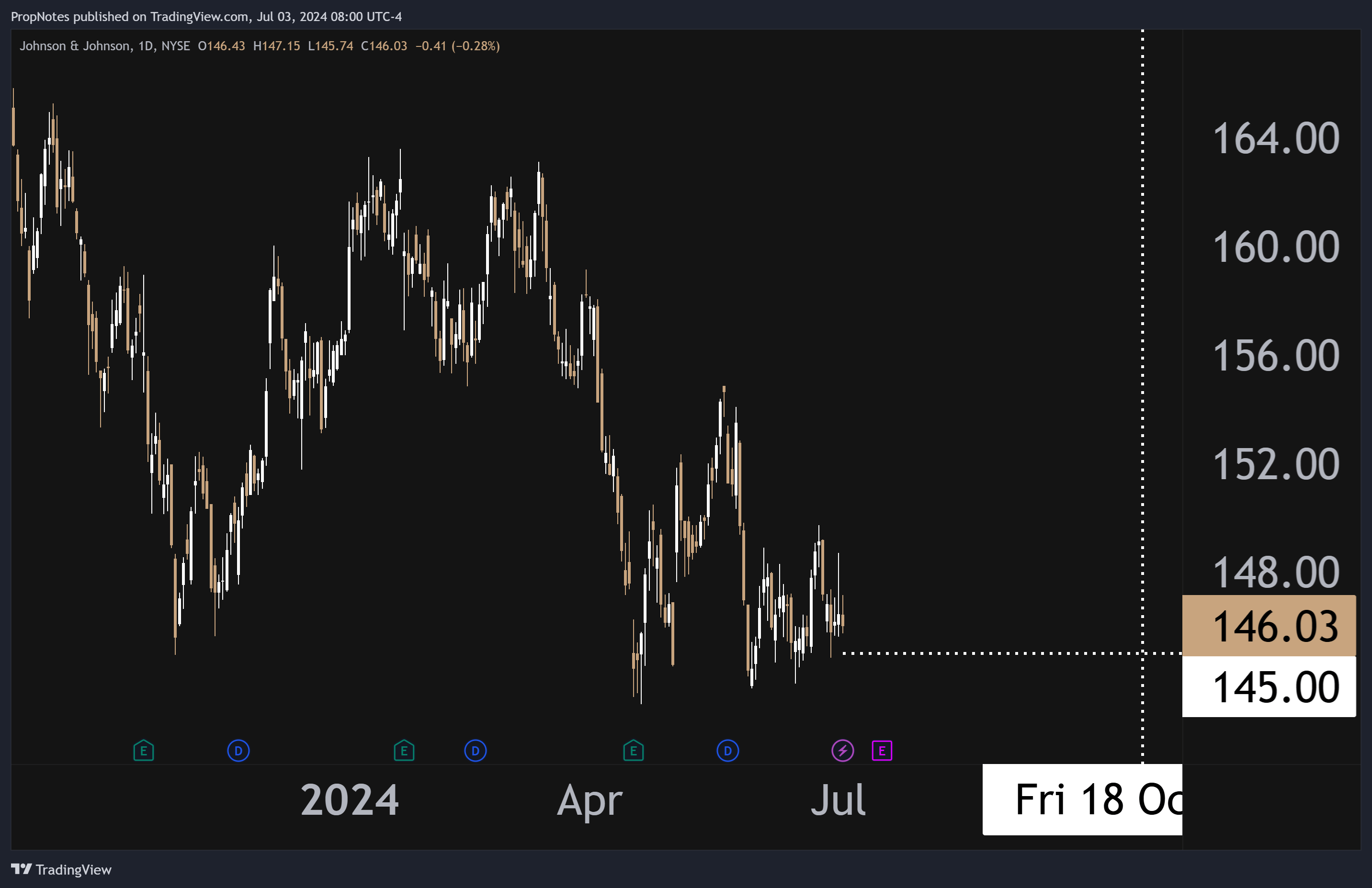

Johnson & Johnson (JNJ) Tokenized Stock: Trade shares of this healthcare and consumer goods leader on-chain.

-

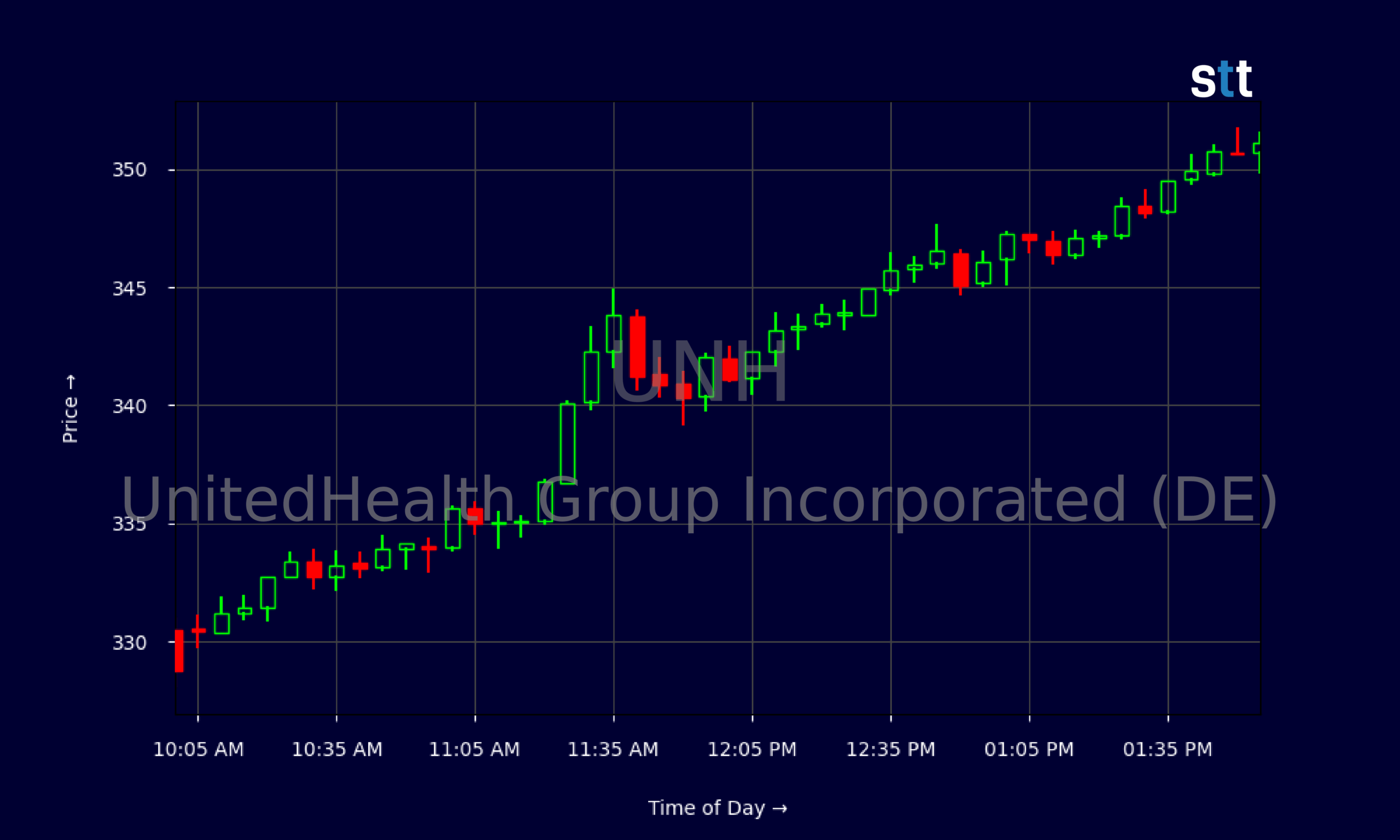

UnitedHealth Group Inc. (UNH) Tokenized Stock: Invest in the largest U.S. health insurer with tokenized UNH shares.

-

Exxon Mobil Corp. (XOM) Tokenized Stock: Gain oil and gas sector exposure with tokenized Exxon Mobil equity.

-

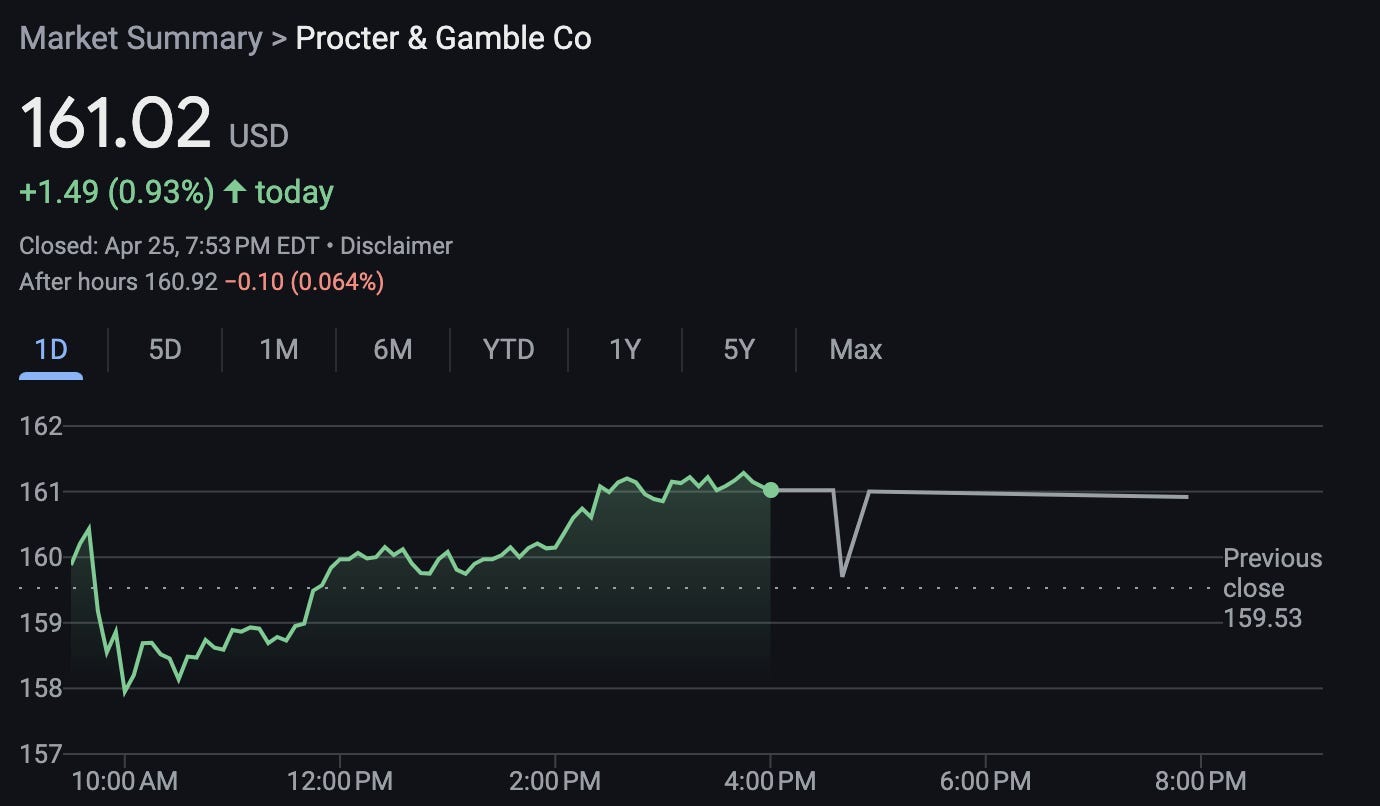

Procter & Gamble Co. (PG) Tokenized Stock: Own a piece of this consumer goods powerhouse through Ethereum tokens.

-

Broadcom Inc. (AVGO) Tokenized Stock: Access the semiconductor and software leader’s stock 24/7.

-

Mastercard Inc. Class A (MA) Tokenized Stock: Trade one of the world’s top payment networks on the blockchain.

-

Home Depot Inc. (HD) Tokenized Stock: Get on-chain access to the leading home improvement retailer.

-

Chevron Corp. (CVX) Tokenized Stock: Invest in a major U.S. energy company via tokenized shares.

-

Costco Wholesale Corp. (COST) Tokenized Stock: Trade shares of the popular warehouse retailer anytime, anywhere.

You’ll find everything from growth titans like Amazon. com Inc. (AMZN), Meta Platforms Inc. (META), and NVIDIA Corp. (NVDA) to financial stalwarts such as JPMorgan Chase and Co. (JPM), Berkshire Hathaway Inc. Class B (BRK. B), and sector leaders like UnitedHealth Group Inc. (UNH).

The ETF lineup is equally robust: think fractional access to the market’s most liquid funds including the iShares Core S and P 500 ETF (IVV), technology-focused Invesco QQQ Trust Series 1 ETF (QQQ), total market coverage with the Vanguard Total Stock Market ETF (VTI), and even innovative picks like the ARK Innovation ETF (ARKK).

A New Era for Crypto ETF Liquidity and Global Access

No more waiting for Wall Street to open: these on-chain ETFs and tokenized stocks trade around the clock, mirroring crypto’s always-on nature while maintaining deep liquidity thanks to their direct connection to real-world assets.

Ondo Finance’s launch has already seen rapid adoption, particularly after Trust Wallet integrated these assets for its 200 million users globally – making it easier than ever to diversify into U. S equities without leaving DeFi.

This approach isn’t just about convenience; it’s about financial inclusion at scale:

- No minimums: Buy $10 worth of Tesla or $5 in SPY instantly.

- No borders: Investors in Asia, Africa, Europe – anyone outside the U. S. , really – now have direct exposure to American markets without intermediaries.

- No downtime: Trade Apple or Microsoft tokens at midnight or during weekends just like any cryptocurrency.

Tokenization is also unlocking access to previously hard-to-reach sectors. Not only can you buy a slice of Procter and amp; Gamble Co. (PG) or Broadcom Inc. (AVGO), but you can also tap into utility and real estate markets with tokenized funds like the Duke Energy Corporation (DUK) Tokenized Utility Sector Fund, iShares U. S. Real Estate ETF (IYR) Tokenized REIT Fund, and Realty Income Corporation (O) Tokenized REIT Fund.

The Diversity of On-Chain U. S. Equities: From Tech to Industrials

This new era means investors aren’t limited to just the FAANGs or big ETFs. The breadth of assets spans every major sector, including:

- Healthcare: Access blue chips like Johnson and amp; Johnson (JNJ), Eli Lilly and Co. (LLY), Pfizer Inc. (PFE), and Merck and amp; Co. , Inc. (MRK).

- Banks and amp; Financials: Trade shares of giants such as Morgan Stanley (MS), Citigroup Inc. (C), The Goldman Sachs Group, Inc. (GS), and more, all on-chain.

- Consumer Brands: Own fractions of iconic companies like The Coca-Cola Company (KO), PepsiCo, Inc. (PEP), and even retail powerhouses like Walmart Inc. (WMT).

- Aerospace and amp; Industrials: Gain exposure to American manufacturing through tokens for companies such as Boeing Company (BA), Caterpillar Inc. (CAT), and defense leader Lockheed Martin Corporation (LMT).

This level of diversity gives global investors a toolkit for building sophisticated portfolios, no matter where they are or what size their budget may be.

The Future: Fractional Ownership Meets Global Liquidity

The real magic happens when you combine blockchain’s programmability with these mainstream assets. Imagine setting up automated strategies, rebalancing between the likes of the S and amp;P 500 ETFs: (SPDR S and amp;P 500 ETF Trust (SPY), iShares Core S and amp;P 500 ETF (IVV), Vanguard S and amp;P 500 ETF (VOO), Invesco QQQ Trust Series 1 ETF (QQQ), iShares Russell 2000 ETF (IWM), Vanguard Total Stock Market ETF (VTI), SPDR Dow Jones Industrial Average ETF Trust (DIA), iShares MSCI Emerging Markets ETF (EEM), ARK Innovation ETF (ARKK), Schwab U. S. Broad Market ETF (SCHB)): or dollar-cost averaging into tech stocks like Apple, Microsoft, NVIDIA, Alphabet Class A and amp; C, Amazon, Meta Platforms. All this is possible directly from your wallet.

This isn’t just innovation for innovation’s sake, it’s about creating real-world utility for everyday investors.

Unique Tokenized Stocks Beyond Big Tech

-

Union Pacific Corporation (UNP) Tokenized StockAmerica’s largest railroad operator is now accessible 24/7 on Ethereum, letting global investors track U.S. infrastructure growth in real time.

-

Honeywell International Inc. (HON) Tokenized StockThis industrial and technology leader’s tokenized shares provide blockchain-based exposure to aerospace innovation and smart manufacturing.

-

Deere & Company (DE) Tokenized StockBest known for its iconic green tractors, Deere’s tokenized stock brings agricultural tech and equipment investing to the blockchain era.

-

Starbucks Corporation (SBUX) Tokenized StockEnjoy a taste of the world’s most recognizable coffee brand—now as a tokenized stock, enabling seamless, borderless investment in consumer trends.

-

General Electric Company (GE) Tokenized StockFrom jet engines to renewable energy, GE’s tokenized equity lets investors tap into American industrial transformation via the Ethereum network.

What About Security and Transparency?

A common question is: Are these tokens really backed by the underlying stocks or ETFs? The answer is yes, each token is fully collateralized by actual shares held at U. S. -registered broker-dealers, ensuring regulatory compliance and investor protection.

The use of Ethereum smart contracts adds another layer of transparency: all transactions are auditable on-chain in real time. This means you can verify that your holding in something like the Bristol-Myers Squibb Company (BMY) Tokenized Stock or the Nextera Energy, Inc. (NEE) Tokenized Utility Sector Fund is backed by genuine assets.

The Road Ahead: Scaling to Over 1,000 Assets

The Ondo Global Markets roadmap aims to expand from over 100 tokenized U. S. equities today to more than 1,000 by year-end, including additional REITs (Simon Property Group, Duke Energy Corporation) and sector funds (Sempra Energy

Most Popular Tokenized U.S. Stocks & ETFs on Ethereum

-

Lowe’s Companies (LOWon): Access tokenized shares of the home improvement giant Lowe’s, now tradable 24/7 on Ethereum. Explore LOWon

-

IBM (IBMon): Invest in tokenized IBM shares, representing the iconic technology and consulting leader, directly on-chain. Explore IBMon

-

Qualcomm (QCOMon): Gain exposure to Qualcomm’s innovation in wireless technology via tokenized QCOM shares on Ethereum. Explore QCOMon

-

Oracle (ORCLon): Trade tokenized Oracle shares, bringing enterprise software exposure to your crypto wallet. Explore ORCLon

-

Netflix (NFLXon): Own a piece of the streaming revolution with tokenized Netflix shares on Ethereum. Explore NFLXon

-

Nvidia (NVDAon): Participate in the AI boom by trading tokenized Nvidia shares, one of the most in-demand tech stocks. Explore NVDAon

-

Alphabet (GOOGLon): Access tokenized shares of Google’s parent company, Alphabet, for on-chain exposure to the digital economy. Explore GOOGLon

-

SPDR S&P 500 ETF Trust (SPYon): Diversify instantly with tokenized shares of the world’s most popular S&P 500 ETF, now on Ethereum. Explore SPYon

-

iShares MSCI Emerging Markets ETF (EEMon): Get global exposure with tokenized EEM shares, tracking emerging market equities. Explore EEMon

-

Apple (AAPLon): Trade tokenized Apple shares, giving you blockchain-based access to one of the world’s most valuable companies. Explore AAPLon