Institutional interest in cryptocurrency ETFs continues to accelerate, and BlackRock’s latest move signals a new phase in the evolution of crypto yield products. BlackRock has filed for the Bitcoin Premium Income ETF, a fund designed to generate regular income by employing a covered-call strategy on Bitcoin holdings. This development not only expands BlackRock’s digital asset lineup but also raises important questions about how structured option strategies could reshape the landscape for crypto ETF yield products.

How BlackRock’s Bitcoin Premium Income ETF Works

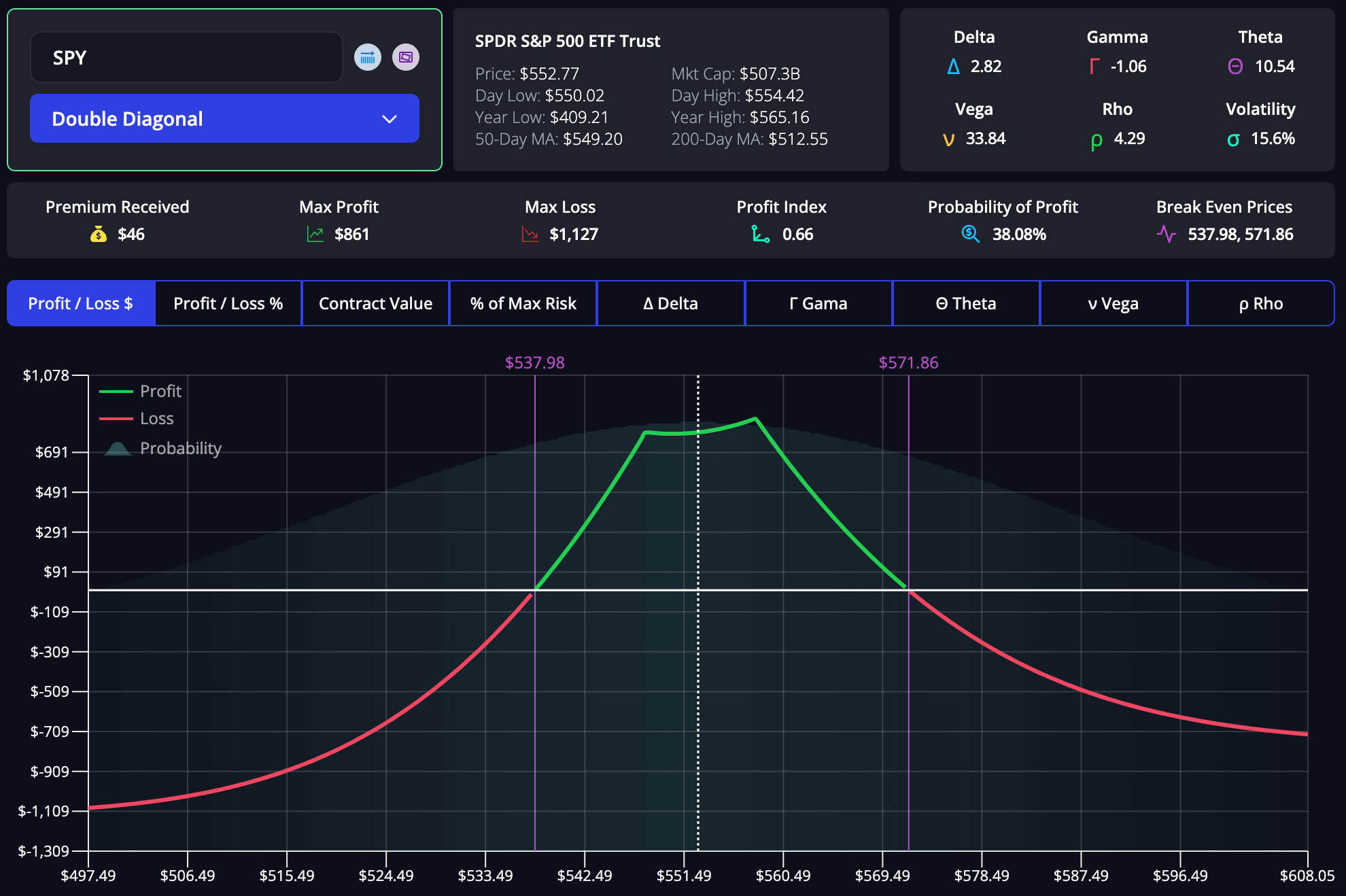

The core mechanism behind the BlackRock Bitcoin Premium Income ETF is straightforward yet sophisticated. The fund intends to hold either spot Bitcoin or closely correlated instruments, then systematically sell call options against those holdings. By selling these call options, the ETF collects option premiums, which are distributed as income to shareholders. This approach is well-established in traditional equity markets but represents a significant innovation when applied to digital assets.

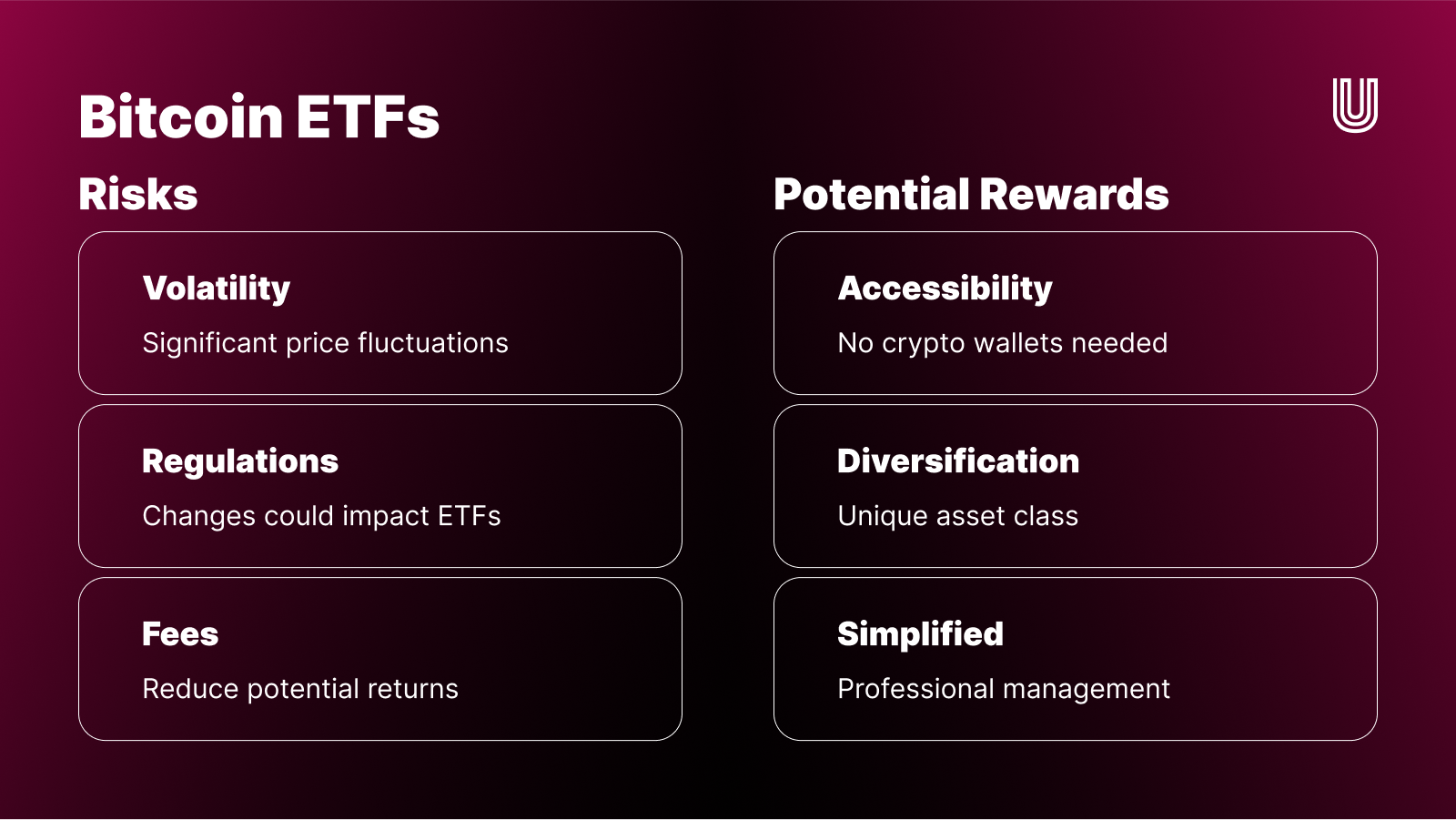

The covered-call strategy effectively monetizes Bitcoin’s volatility, allowing investors to earn yield even when price movement is sideways or modest. However, it’s important to note that this structure caps potential upside. If Bitcoin rallies sharply above the strike price of sold calls, gains are limited; investors receive premium income but forfeit some of the explosive upside that spot holders enjoy.

Comparing Yield: Covered Call Crypto ETFs vs. Traditional Crypto Yield Products

The introduction of a regulated, institutional-grade Bitcoin covered call ETF is poised to disrupt existing crypto yield products. Historically, yield generation in crypto has often involved lending coins to third parties or participating in DeFi protocols, both of which carry counterparty and smart contract risk. In contrast, BlackRock’s approach leverages established derivatives markets and operates within a tightly regulated framework.

Key Differences: Covered Call Crypto ETFs vs DeFi Yield Products

-

Income Generation Method: Covered call crypto ETFs like BlackRock’s Bitcoin Premium Income ETF generate yield by selling call options on Bitcoin holdings, collecting premiums for investors. In contrast, DeFi yield products (e.g., Aave, Compound) typically earn yield by lending crypto assets to borrowers or providing liquidity to decentralized exchanges.

-

Risk Profile and Regulation: Covered call ETFs are regulated financial products listed on major exchanges and managed by institutions like BlackRock, offering investor protections and oversight. DeFi yield products operate on decentralized protocols, often without centralized oversight, exposing users to smart contract and protocol risks.

-

Yield Consistency and Predictability: Covered call ETFs provide predictable, regular income distributions from option premiums, though upside is capped. DeFi yields can be highly variable, fluctuating with market demand, protocol incentives, and liquidity conditions.

-

Exposure to Underlying Asset: BlackRock’s ETF holds Bitcoin or related instruments, but caps potential gains if Bitcoin’s price surges above the call strike price. DeFi products typically allow uncapped exposure to price appreciation, but may require locking assets or accepting impermanent loss.

-

Accessibility and User Experience: Covered call ETFs are accessible via traditional brokerage accounts and require no crypto wallet or blockchain interaction. DeFi yield products require self-custody wallets (like MetaMask) and direct interaction with smart contracts, which can be complex for newcomers.

This distinction could be transformative for risk-averse investors seeking exposure to crypto ETF income strategies. With traditional DeFi yields fluctuating due to market demand and protocol incentives, an options-based strategy provides greater transparency regarding expected returns, albeit with its own trade-offs around capped upside.

Market Context: Institutional Adoption and Competition Intensifies

The timing of this launch is notable given that BlackRock’s existing iShares Bitcoin Trust (IBIT) has already amassed over $83 billion in assets since January 2024, a testament to surging institutional adoption (source). The new Premium Income ETF is positioned as a complementary product rather than a replacement for direct spot exposure.

This move may prompt other asset managers to explore similar structures or enhance their current offerings in order to stay competitive. The arrival of an institutional player like BlackRock into the crypto yield arena could accelerate both innovation and regulatory scrutiny across the sector.

For investors, the key question is how this ETF’s risk-reward profile stacks up against both spot Bitcoin ETFs and decentralized yield platforms. The covered-call strategy thrives in periods of high volatility or range-bound price action, as option premiums tend to be larger and more frequent. However, in a sharply bullish regime, the opportunity cost of forfeited upside can become significant, especially for those accustomed to Bitcoin’s historic surges.

Another consideration is liquidity and transparency. BlackRock’s ETF structure offers daily liquidity and standardized disclosures, which are often lacking in DeFi protocols or offshore lending platforms. This could make the BlackRock Bitcoin Premium Income ETF especially attractive to institutional allocators, pension funds, and risk-averse individual investors who have been hesitant to embrace crypto due to operational uncertainties.

Potential Impact on Crypto Yield Ecosystem

The entrance of a heavyweight like BlackRock into the crypto yield space is likely to have ripple effects throughout the industry. Existing DeFi protocols may face pressure to increase transparency around their own risks and returns. At the same time, competition from regulated vehicles could spur further innovation, potentially leading to hybrid models that blend on-chain transparency with off-chain regulatory safeguards.

It is also possible that we will see a migration of capital from riskier or opaque platforms into more familiar ETF wrappers. For many investors, the trade-off between capped upside and reliable income may be worthwhile if it comes with improved oversight and reduced counterparty risk.

What Investors Should Watch Next

- Yield Consistency: Track how stable option premiums remain as market conditions shift.

- Regulatory Developments: Monitor SEC feedback on similar products; regulatory clarity could shape adoption rates.

- Competitive Response: Watch for new entrants or enhancements from rival asset managers.

- Market Volatility: Recognize that option-based yields depend heavily on sustained volatility in Bitcoin prices.

The launch phase will be crucial for setting expectations around distribution frequency, expense ratios, and actual net yields versus traditional crypto income avenues. Investors should review prospectuses carefully and assess whether a capped-upside approach aligns with their long-term objectives, especially given Bitcoin’s unique return profile compared to equities or fixed income assets.

Final Thoughts: A New Era for Crypto ETF Income Strategies?

The BlackRock Bitcoin Premium Income ETF represents a pivotal step forward for regulated crypto yield products. By bringing established options strategies into the digital asset world, and wrapping them in an accessible ETF format, BlackRock is poised to broaden participation among mainstream investors while raising the bar for transparency and oversight across the sector.

If successful, this model could become a blueprint for future offerings tied to other cryptocurrencies or even tokenized real-world assets. For now, it signals that institutional adoption is not only deepening but also evolving, shifting from pure price speculation toward sophisticated income generation within well-governed frameworks.