Bitcoin ETFs have rapidly become a focal point for both institutional and retail investors, not just as a vehicle for crypto exposure but as a significant force influencing Bitcoin’s price trajectory. As of September 24,2025, Bitcoin is trading at $113,660, reflecting a 1.66% increase over the previous day. This price milestone isn’t just a number – it’s the result of deep shifts in market structure, ETF fund flows, and investor behavior.

Understanding Bitcoin ETF Flows: The Basics

ETF flows represent the net movement of capital into or out of exchange-traded funds. For Bitcoin ETFs, inflows indicate new money entering these funds, prompting issuers to acquire more spot Bitcoin to back their shares. Outflows have the opposite effect – funds may liquidate holdings to meet redemptions. Unlike traditional stock ETFs where flows may be influenced by broad equity sentiment or sector rotation, Bitcoin ETF flows are more directly tied to underlying BTC demand.

Recent research highlights that ETF inflows and outflows are not merely passive reflections of investor sentiment but active drivers of price action. According to Nasdaq, these flows measure capital movement rather than direct asset performance, yet their impact on liquidity and supply-demand dynamics is immediate and pronounced.

BTC Price at $113,660: How ETF Flows Shape Market Dynamics

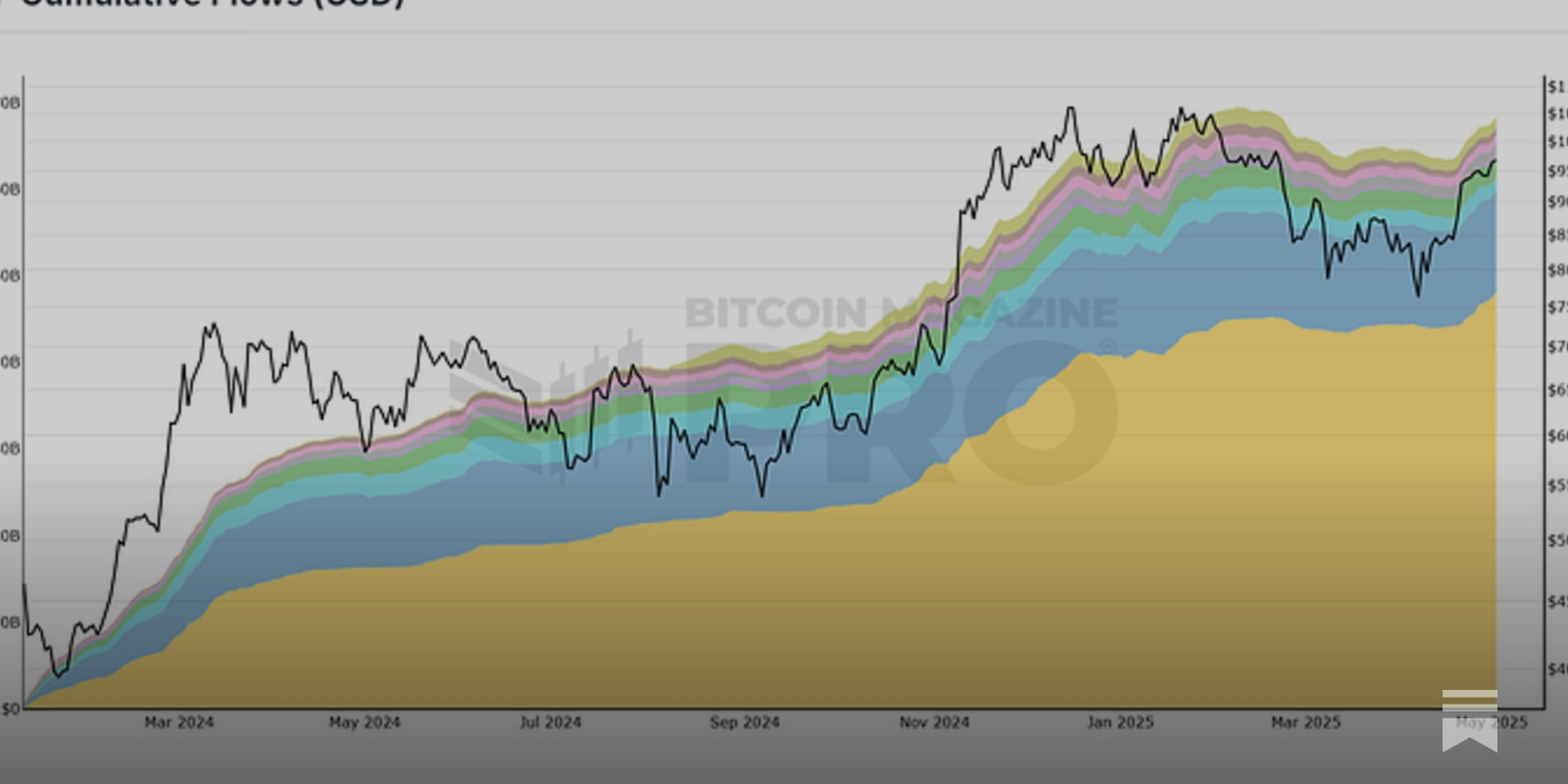

The relationship between ETF flows and Bitcoin’s spot price has tightened considerably in 2025. In April, daily inflows into Bitcoin ETFs surpassed $912 million, fueling renewed bullish sentiment and driving prices higher. Conversely, March 2024 saw Grayscale’s Bitcoin Trust experience $1.9 billion in outflows in a single week – a move that coincided with net outflows across U. S. -listed spot ETFs and contributed to downward pressure on BTC.

This feedback loop is well-documented: inflows push up prices, which attracts more investors (both retail and institutional), resulting in further inflows. Outflows can trigger the reverse effect. A recent analysis noted an R² of 0.80 between ETF flows and short-term BTC price variance – meaning roughly 80% of recent price movements can be explained by fund flow data (source).

The Mechanics Behind Crypto ETF Volatility

The introduction of spot Bitcoin ETFs has changed the nature of volatility in the crypto markets. When large inflows occur – such as those seen during periods of heightened risk appetite or after major regulatory approvals – they absorb significant quantities of available spot BTC from exchanges. This reduction in circulating supply can amplify upward moves when demand surges.

On the other hand, heavy outflows can lead to sudden liquidity events if funds are forced to offload assets quickly, especially during periods when market depth is thin. The result? Enhanced volatility compared to pre-ETF eras.

Bitcoin Price Prediction 2026-2031: ETF Flows and Market Dynamics

Professional outlook based on ETF inflows, regulatory trends, and market adoption (Baseline: $113,660 as of September 2025)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Bullish/Bearish Scenario Notes |

|---|---|---|---|---|---|

| 2026 | $92,000 | $125,000 | $168,000 | +10% | Bullish: Sustained ETF inflows, major institutional adoption; Bearish: Regulatory headwinds, ETF outflows |

| 2027 | $109,000 | $145,000 | $195,000 | +16% | Bullish: Mainstream financial integration, global ETF launches; Bearish: Macro tightening, competing crypto ETFs |

| 2028 | $120,000 | $170,000 | $235,000 | +17% | Bullish: Increased scarcity post-halving, tech upgrades; Bearish: Market saturation, regulatory uncertainty |

| 2029 | $140,000 | $195,000 | $265,000 | +15% | Bullish: Major sovereign/institutional BTC reserves; Bearish: Global recession, ETF redemptions |

| 2030 | $160,000 | $220,000 | $295,000 | +13% | Bullish: Bitcoin as digital gold, ETF AUM records; Bearish: Tech vulnerabilities, policy restrictions |

| 2031 | $175,000 | $245,000 | $335,000 | +11% | Bullish: Cross-asset ETF products, mass adoption; Bearish: Competition from new digital assets |

Price Prediction Summary

Bitcoin’s price outlook for 2026-2031 remains robust, supported by ETF inflows, streamlined regulation, and increasing institutional participation. The minimum/maximum ranges reflect both bullish and bearish scenarios, with average prices expected to grow at a steady pace as mainstream adoption accelerates. However, volatility will remain high, with ETF flows, regulatory actions, and macroeconomic factors driving both upward and downward moves.

Key Factors Affecting Bitcoin Price

- ETF inflows/outflows: Direct impact on spot demand and price formation

- Regulatory landscape: SEC policies, global ETF approvals, investor protections

- Institutional adoption: Pension funds, asset managers, sovereign wealth funds entering BTC market

- Market cycles: Post-halving supply dynamics, bull/bear cycles

- Macroeconomic environment: Inflation, interest rates, global risk sentiment

- Technological advancements: Network upgrades, scalability, security

- Competition: Rising popularity of altcoin ETFs (e.g., Solana, XRP) and new digital asset classes

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

ETF Inflows Signal Macro Trends for Investors

The surge in new filings following the SEC’s streamlined approval process signals that mainstream financial integration is accelerating (read more here). With new products tied not just to Bitcoin but also Solana and XRP expected soon, understanding how ETF flows impact underlying asset prices will be essential for portfolio construction and risk management.

For investors, monitoring Bitcoin ETF flows is now a leading indicator of where the market may head next. The interplay between ETF demand and Bitcoin’s spot price is not static – it’s a dynamic system shaped by macroeconomic sentiment, regulatory changes, and the evolving appetite of both institutions and retail participants.

Key Takeaways for Crypto ETF Investors

Top 5 Actionable Insights for Crypto ETF Investors

-

Monitor Daily ETF Inflows and Outflows for Market Signals. Significant inflows into Bitcoin ETFs often precede upward price movements, as seen in April 2025 when daily inflows topped $912 million and Bitcoin rose to $113,660. Conversely, large outflows can signal or accelerate price declines, as with the $1.9 billion outflow from Grayscale Bitcoin Trust in March 2024.

-

Understand the Feedback Loop Between ETF Flows and Bitcoin Price. ETF inflows can create a positive feedback loop: rising inflows push up Bitcoin’s price, which in turn attracts more investors—both retail and institutional—further boosting inflows and price momentum.

-

Track Regulatory Changes Impacting ETF Launches. The SEC’s recent move to streamline ETF approvals to 75 days has triggered a surge in new crypto ETF filings, including for assets like Solana and XRP. These regulatory shifts can affect fund flows and market sentiment, influencing Bitcoin’s price trajectory.

-

Watch Institutional Participation Through Major ETF Providers. Large asset managers such as BlackRock, Fidelity, and Grayscale play a pivotal role in driving ETF flows. Their products’ inflows and outflows can significantly impact Bitcoin’s liquidity and price formation.

-

Use ETF Flow Data as a Short-Term Price Predictor. Research shows a strong correlation (R² ≈ 0.80) between ETF flows and Bitcoin’s short-term price movements. Regularly analyzing net inflows and outflows can help anticipate near-term price action, especially during periods of heightened volatility.

As Bitcoin maintains its position at $113,660, here are several critical insights for those navigating the ETF landscape:

- ETF inflows often precede upward price moves. Large inflows signal new capital entering the ecosystem, typically pushing prices higher as funds acquire spot BTC to match demand.

- Outflows can trigger rapid corrections. When sentiment sours or macro shocks hit, outflows force funds to liquidate holdings, adding downward pressure to prices.

- Liquidity events are amplified in thin markets. During periods of low exchange liquidity, the impact of large ETF redemptions or creations can be outsized, leading to sharp volatility spikes.

- Diversification across products is growing in importance. With new ETFs tied to Solana and XRP on the horizon, single-asset concentration risk may increase if one product dominates flows. Savvy investors should monitor cross-asset ETF flow patterns for early risk signals.

- Regulatory shifts can rapidly alter flow dynamics. The SEC’s faster approval timeline has already led to a surge in filings. Each new product launch has the potential to redirect capital and reshape liquidity in underlying markets (details).

The importance of real-time data cannot be overstated. As ETFs become a dominant channel for crypto exposure, price discovery increasingly happens through fund flows rather than just spot exchange activity. Investors should integrate ETF flow analytics into their toolkit alongside traditional technical and on-chain metrics.

Navigating Crypto ETF Volatility: Practical Strategies

Navigating this new era requires discipline. Here are several strategies seasoned professionals use when managing portfolios exposed to crypto ETFs:

- Tactical allocation adjustments: Responding quickly to significant net inflows or outflows by rebalancing positions can help capture momentum or avoid drawdowns.

- Diversified exposure: Allocating across multiple crypto assets and ETF issuers helps mitigate idiosyncratic fund risks tied to single products or management teams.

- Monitoring regulatory calendars: Staying ahead of key approval dates or regulatory announcements allows investors to anticipate volatility spikes related to product launches or rule changes.

The bottom line: as Bitcoin’s price sits at $113,660 – with daily swings reflecting both optimism and caution – understanding how ETF flows shape market structure is now essential knowledge for any serious crypto investor. Whether you’re building a long-term portfolio or trading short-term volatility, keeping an eye on these fund movements will provide a decisive edge in anticipating market turns and managing risk effectively.