The U. S. Securities and Exchange Commission’s (SEC) approval of new fast-track listing standards on September 18,2025, has sent ripples through the crypto investment landscape. This regulatory update is more than a mere procedural tweak – it’s a paradigm shift that could rapidly expand investor access to altcoin ETFs, especially for XRP, ADA, and SOL. With the new framework in place, asset managers and exchanges are poised to capitalize on streamlined approvals, potentially slashing wait times from eight months to just 75 days. The question now: How quickly will we see spot ETFs for these top altcoins hit the market?

SEC Fast-Track Crypto ETF Approval: What Changed?

Historically, launching a spot crypto ETF in the U. S. was an arduous process plagued by regulatory uncertainty and lengthy reviews under Rule 19b-4. Now, thanks to generic listing standards adopted by major exchanges like NYSE, Nasdaq, and Cboe Global Markets, the path is far clearer – and faster. These standards allow commodity-based exchange-traded products (ETPs), including those tied to digital assets with at least six months of futures trading on a CFTC-regulated exchange, to qualify for expedited review.

This means that if an altcoin such as Solana (SOL) or XRP has established futures markets on regulated platforms like CME for six months or more, spot ETFs tracking those assets may be listed in as little as 75 days from filing. That’s a seismic acceleration compared to previous timelines.

![]()

For investors seeking diversification beyond Bitcoin and Ethereum – which already have multiple ETF options – this opens up new frontiers for portfolio construction and risk management.

XRP and SOL ETF Launch Timelines: What Investors Need to Know

The race among altcoins is heating up as futures trading milestones are reached. Solana (SOL) futures began trading on CME on March 17,2025; XRP followed suit on May 19,2025. Based on the SEC’s new rules, spot SOL ETFs could theoretically be approved before XRP ETFs – possibly by mid-September 2025 – with XRP closely behind.

Bloomberg ETF analysts James Seyffart and Eric Balchunas have pegged the odds of approval for both SOL and XRP ETFs at an impressive 95% by year-end. This bullish outlook is echoed by institutional moves: WisdomTree launched a top-20 crypto index fund featuring XRP, ADA, and SOL immediately after the rule change; Grayscale’s Digital Large Cap Fund now trades with exposure to these same assets (source).

ADA ETF Approval Process: The Next Wave?

While Cardano (ADA) does not yet have CME-listed futures as of September 2025, industry participants expect this milestone soon given rising institutional demand. Once achieved – likely within months – ADA could join its peers in benefiting from fast-tracked ETF approvals.

Key Milestones for ADA ETF Eligibility Under New SEC Rules

-

CFTC-Regulated ADA Futures Trading for 6+ MonthsThe SEC’s new generic listing standards require that an asset have at least six months of futures trading on a Commodity Futures Trading Commission (CFTC)-regulated exchange. As of September 2025, ADA futures have not yet launched on major U.S. exchanges like CME, making this the primary milestone for ADA ETF eligibility.

-

Major Exchange Filing Under Generic StandardsOnce ADA futures are established, a major exchange such as NYSE, Nasdaq, or Cboe must file for an ADA ETF using the SEC’s new generic listing standards. This filing process is now streamlined, reducing approval timelines from up to 240 days to as little as 75 days.

-

Demonstrated Market Surveillance and LiquidityExchanges must show robust market surveillance and sufficient liquidity for ADA futures and spot markets, ensuring investor protection and minimizing risks of manipulation, as required by SEC guidelines.

-

SEC Review and ApprovalUnder the new framework, the SEC reviews the ETF application within the shortened timeline. Approval is contingent on meeting all regulatory, operational, and legal standards, including compliance with anti-money laundering and investor protection rules.

-

Operational Readiness and Custody SolutionsETF issuers must demonstrate secure custody and operational readiness for ADA holdings, typically through established custodians and transparent fund operations, before the ETF can launch on public markets.

This evolving regulatory environment is already attracting heavyweight issuers like Franklin Templeton and VanEck to file for diversified crypto index ETFs (source). For investors tracking potential launches or seeking first-mover advantage in altcoin ETF allocations, understanding these eligibility triggers is critical.

The implications are profound not just for individual coins but also for broader market structure. As more altcoin ETFs gain rapid approval under these streamlined rules, we’re likely to see increased liquidity, tighter spreads, and greater institutional inflows across the digital asset sector.

Market Impact: Institutional Flows and Price Dynamics

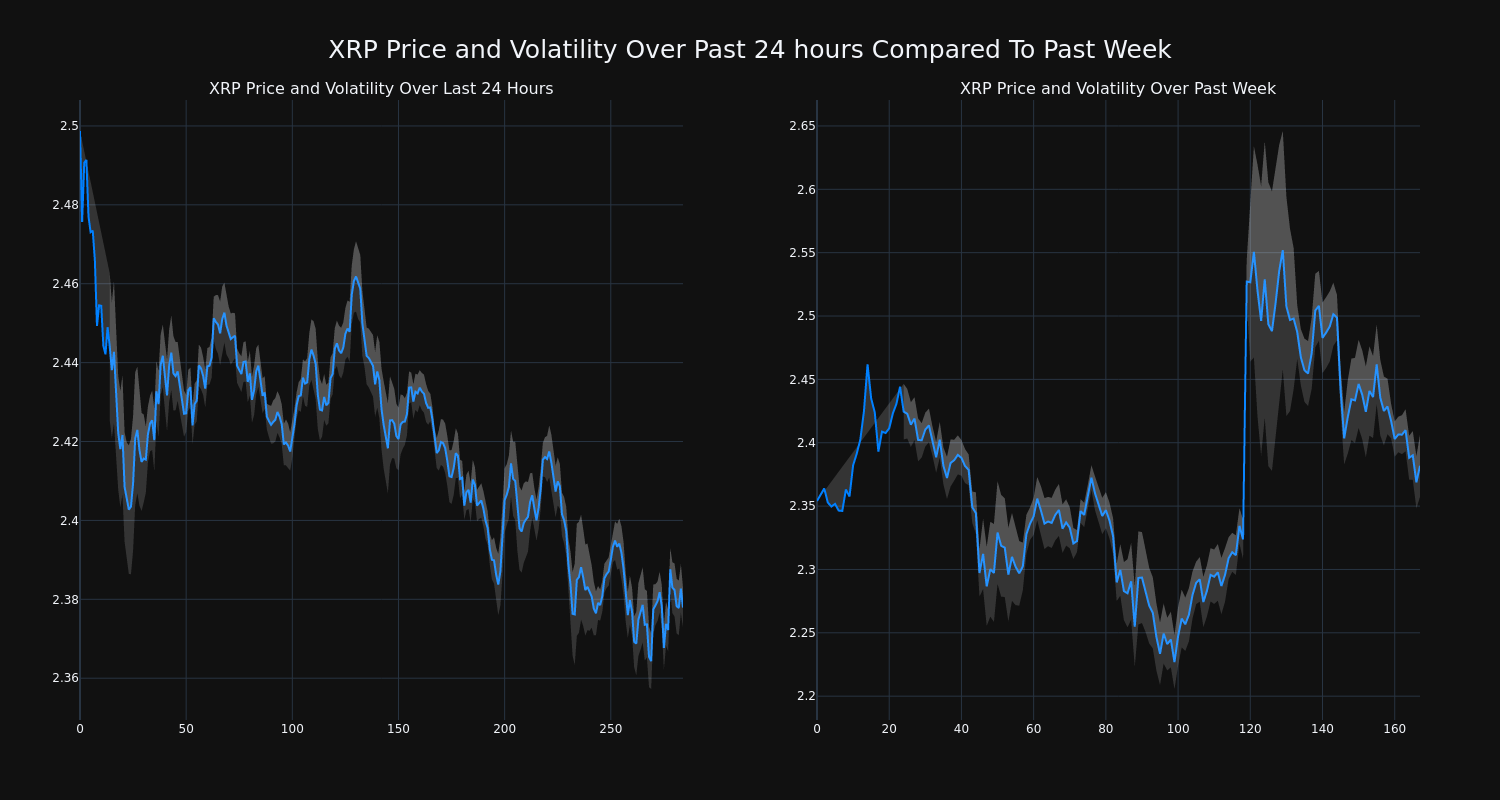

With the SEC’s fast-track crypto ETF approval framework now active, the market is witnessing a surge in institutional interest. Major asset managers are racing to file new products, and liquidity providers are preparing for higher trading volumes across exchanges. This influx is expected to reshape not just price action but also the underlying volatility profiles of assets like XRP, ADA, and SOL. For example, XRP’s price recently dipped below $3 amid ETF anticipation and related developments (source). This highlights how ETF buzz can both fuel rallies and trigger profit-taking as timelines become clearer.

As spot ETFs launch, investors should prepare for dynamic flows. Early phases often see rapid inflows from both retail and institutions seeking exposure without direct custody risks. Over time, this could compress spreads and foster a more efficient price discovery process for altcoins previously considered too volatile or illiquid for mainstream portfolios.

Key Players and Issuers: Who’s Leading the Altcoin ETF Charge?

The field of altcoin ETF issuers in 2025 is expanding quickly. WisdomTree’s top-20 crypto index fund was among the first to leverage the SEC’s generic listing standards, featuring allocations to XRP, SOL, and ADA. Grayscale’s Digital Large Cap Fund now offers diversified exposure including these same assets. Meanwhile, Franklin Templeton’s recent filing signals that established financial giants are betting big on diversified crypto baskets rather than single-asset products alone (source).

VanEck and other global players are expected to follow suit as regulatory clarity improves. The result? Investors will have unprecedented choice, ranging from pure-play spot altcoin ETFs to multi-asset indexes, catering to different risk appetites and strategic goals.

What This Means for Crypto Portfolios

The arrival of fast-tracked spot ETFs for XRP, ADA, and SOL brings genuine diversification potential to digital asset portfolios, long dominated by Bitcoin and Ethereum weightings. These new vehicles enable tactical allocation shifts without direct wallet management or security concerns.

Strategic investors should:

This shift also levels the playing field between retail participants and institutions by providing regulated access points with robust oversight, a key step toward mainstream adoption.

Looking Ahead: Risks and Opportunities

While optimism around SEC fast-track crypto ETF approval is warranted, investors should remain vigilant regarding operational risks, such as tracking error between spot prices and ETF NAVs, and evolving regulatory interpretations as these products scale.

The accelerated timeline means markets could see multiple high-profile launches before year-end 2025. With XRP currently below $3, any surprise approvals or delays could drive sharp price swings in either direction. As always, disciplined risk management is essential when navigating this rapidly changing landscape.

Top Opportunities and Risks for Altcoin ETF Investors in 2025

-

1. Faster Access to Major Altcoins via ETFsThe SEC’s new generic listing standards mean investors can gain exposure to leading altcoins like XRP, ADA, and SOL through regulated ETFs, with approval timelines now as short as 75 days. This streamlines entry for both retail and institutional investors.

-

2. Diversification Through Crypto Index FundsMajor asset managers such as Franklin Templeton have filed for new crypto index ETFs, offering diversified exposure to multiple digital assets—including XRP, SOL, and ADA—in a single, regulated product.

-

3. Institutional Adoption and Liquidity GrowthWith spot ETFs expected for XRP, ADA, and SOL, and platforms like NYSE, Nasdaq, and Cboe listing them, institutional participation and overall market liquidity are likely to increase, potentially stabilizing prices and reducing volatility.

-

4. Regulatory and Operational UncertaintyDespite streamlined rules, industry experts caution that operational and legal frameworks are still evolving. Investors face risks if exchanges or issuers struggle to align with the new regulatory standards.

-

5. Altcoin-Specific VolatilityAltcoins like XRP, ADA, and SOL remain highly volatile. For example, XRP’s price recently dipped below $3 amid ETF speculation, highlighting the potential for sharp price swings even as ETF products launch.

-

6. Market Saturation and Product OverlapThe SEC’s approval could trigger a surge of similar ETFs, leading to product overlap and fee competition. Investors may find it challenging to differentiate between offerings and could face dilution of returns as assets spread across multiple funds.

The coming months will be pivotal as issuers finalize filings, exchanges implement operational changes, and regulators monitor early market activity under the new framework. Whether you’re a seasoned allocator or exploring crypto ETFs for the first time, staying informed, and nimble, will be crucial in capturing upside while managing downside during this historic transition.