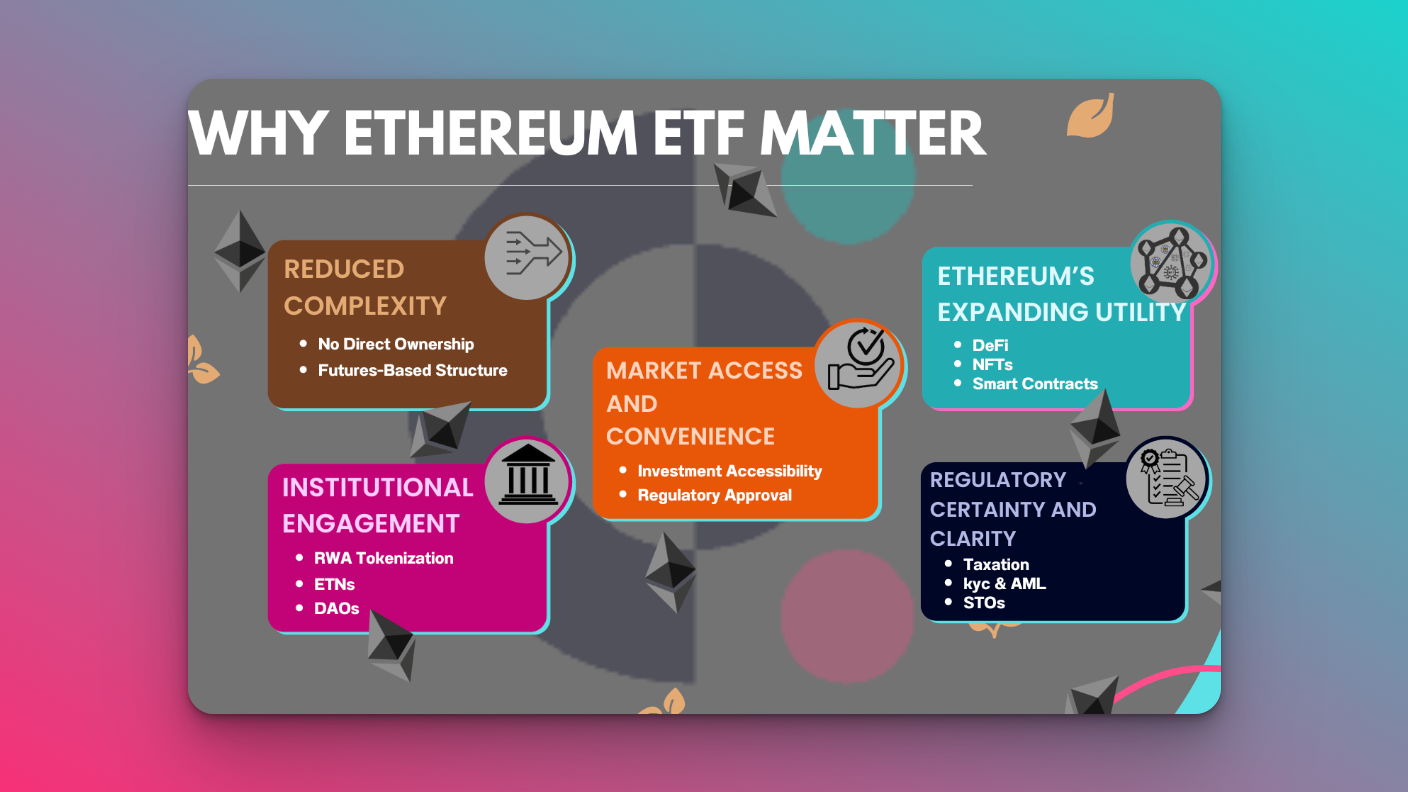

Tokenized ETFs on Ethereum are rapidly transforming global access to traditional financial markets. By converting real-world assets like U. S. stocks and exchange-traded funds into blockchain-based tokens, platforms such as Ondo Global Markets are breaking down barriers that have long restricted non-U. S. investors and everyday users from participating in Wall Street’s growth. At the heart of this revolution is the ability to trade and hold these assets directly on-chain, with enhanced transparency, efficiency, and flexibility.

Ondo Global Markets: Setting New Records in Tokenized Securities

In September 2025, Ondo Finance launched Ondo Global Markets, which has quickly become the world’s largest tokenized securities platform by total value locked (TVL), recently surpassing $240 million (Yahoo Finance). The platform offers non-U. S. investors access to over 100 tokenized U. S. stocks and ETFs on Ethereum, a milestone that signals a new era for crypto ETF accessibility. Each token issued by Ondo is fully backed by the underlying asset, held securely at U. S. -registered broker-dealers, ensuring both transparency and investor protection.

This approach has not only driven Ondo’s TVL to record highs but also catalyzed significant price action for its native ONDO token, which remains up more than 223% from its launch despite recent volatility (CoinGape). Such momentum highlights growing confidence in the promise of on-chain ETFs as a bridge between traditional finance and decentralized protocols.

The Mechanics Behind Tokenized ETFs on Ethereum

The process of bringing traditional finance on blockchain involves several key steps. First, the platform purchases the actual stock or ETF in conventional markets. Then, it issues a corresponding token on Ethereum that represents direct ownership of that asset. This method allows for:

Key Benefits of Tokenizing ETFs on Ethereum

-

Global Accessibility: Platforms like Ondo Global Markets allow investors worldwide, including those outside the U.S., to access and trade over 100 tokenized U.S. stocks and ETFs directly on Ethereum, bypassing traditional geographic and regulatory barriers.

-

24/7 Trading and Instant Settlement: Tokenized ETFs on Ethereum can be traded around the clock, with on-chain transactions settling rapidly—much faster than the traditional two-day settlement cycle, enhancing market efficiency.

-

Fractional Ownership: Tokenization enables investors to purchase fractions of high-priced ETFs, lowering entry barriers and democratizing access to premium assets that would otherwise be out of reach for many individuals.

-

Enhanced Transparency and Security: Platforms such as Ondo Finance ensure that each token is fully backed by the underlying securities, which are held at U.S.-registered broker-dealers. This clear asset backing provides transparency and reduces counterparty risk.

-

Lower Costs and Reduced Fees: By leveraging blockchain infrastructure, tokenized ETFs can minimize intermediaries and administrative overhead, resulting in lower trading and management fees for investors compared to traditional brokerage platforms.

-

Integration with DeFi Ecosystem: Tokenized ETFs on Ethereum can be used within decentralized finance protocols, opening new avenues for lending, borrowing, and structured products built on traditional assets.

Fractional ownership is a game-changer here; investors can now buy portions of high-priced stocks or ETFs without needing large amounts of capital. Settlement times are reduced from the standard two-day cycle to near-instantaneous transactions on-chain. Additionally, trading is available 24/7 without relying on legacy market hours or intermediaries.

The security model is robust: all tokenized assets are fully backed by their real-world equivalents held at regulated custodians (prnewswire.com). This backing ensures that each token always reflects actual economic value, an innovation where many earlier efforts in asset tokenization fell short.

Industry Momentum: From Niche Experiment to Mainstream Adoption

The success of Ondo Global Markets has spurred broader industry adoption of on-chain ETFs. For example, eToro recently announced plans to tokenize 100 U. S. stocks and ETFs using Ethereum as its settlement layer, aiming to integrate these offerings with DeFi protocols for even greater utility (cryptonite.ae). Meanwhile, Nasdaq’s proposal to allow trading of tokenized securities directly on its main exchange underscores how seriously traditional institutions are taking this shift (Reuters).

This wave of innovation is not just about technology; it’s about democratizing access to investment opportunities that were previously out of reach for millions worldwide.

As tokenized ETFs gain traction, the implications for investors are profound. By leveraging Ethereum’s decentralized infrastructure, platforms like Ondo Global Markets are removing friction points that have traditionally limited cross-border participation in U. S. equities and ETFs. The ability to mint, redeem, and trade these assets 24/7 allows investors to respond to global events in real time, something legacy markets simply can’t match.

Moreover, the integration of tokenized ETFs with DeFi protocols is unlocking new financial products and strategies. Investors can now use their on-chain ETF holdings as collateral for lending, participate in automated yield strategies, or access liquidity pools that blend traditional and digital assets. This convergence is fostering a new breed of hybrid finance, where the best features of traditional and decentralized systems co-exist.

Risks and Considerations for On-Chain ETF Investors

Despite these advantages, it’s essential to approach tokenized ETFs with a critical eye. Regulatory clarity remains a work in progress; while platforms like Ondo adhere to strict asset-backing and custody requirements through U. S. -registered broker-dealers, global frameworks are still evolving. Investors should also be mindful of smart contract risks inherent in any blockchain-based product, and the importance of verifying asset backing before participating.

Tips for Evaluating Tokenized ETF Platforms

-

Verify Asset Backing and Custody Arrangements: Ensure the platform’s tokenized ETFs are fully backed by underlying assets, with clear custody held at regulated broker-dealers. For example, Ondo Global Markets holds U.S. stocks and ETFs at U.S.-registered broker-dealers, providing transparency and investor protection.

-

Assess Platform Accessibility and Supported Assets: Consider whether the platform offers global access and a wide selection of tokenized ETFs. Ondo Global Markets, for instance, allows non-U.S. investors to access over 100 tokenized U.S. stocks and ETFs 24/7 on Ethereum.

-

Review On-Chain Settlement and Trading Features: Look for platforms that enable real-time settlement and fractional ownership, reducing entry barriers and improving liquidity. Ondo Finance leverages Ethereum’s blockchain for rapid, transparent transactions and fractionalized tokens.

-

Check Regulatory Compliance and Security Measures: Prioritize platforms that operate within clear regulatory frameworks and implement robust security protocols. Platforms like Ondo Global Markets emphasize regulatory compliance and secure asset storage with independent custodians.

-

Evaluate Integration with DeFi and Trading Flexibility: Platforms that integrate with decentralized finance (DeFi) protocols and offer round-the-clock trading provide additional utility. For example, eToro plans to tokenize U.S. stocks and ETFs on Ethereum, aiming for 24/5 trading and DeFi compatibility.

Liquidity is another factor to watch. While Ondo Global Markets has achieved impressive TVL milestones, currently over $240 million according to Yahoo Finance, the secondary market depth for specific tokens may vary. As more institutional players enter the space and regulatory guardrails solidify, we can expect liquidity conditions to improve further.

What’s Next for Tokenized ETFs on Ethereum?

The rapid ascent of Ondo Global Markets signals that tokenized ETFs are moving from proof-of-concept toward mainstream adoption. With Nasdaq’s plans to list tokenized securities and eToro expanding its offering on Ethereum, competition is set to intensify, a boon for global investors seeking greater choice and flexibility.

The ONDO token itself continues to benefit from this momentum. Despite a 27.61% decline year-to-date, ONDO remains up more than 223% from its launch price, a testament to growing confidence in the platform’s long-term vision (CoinGape). As more assets become available on-chain and DeFi integrations deepen, both retail and institutional capital are likely to accelerate their migration into this emerging ecosystem.

The bottom line: Tokenized ETFs on Ethereum represent one of the most significant breakthroughs in making traditional markets accessible globally. By combining regulatory-grade asset backing with blockchain efficiency and transparency, platforms like Ondo Global Markets are setting a new standard for what financial inclusion can look like in the digital age.