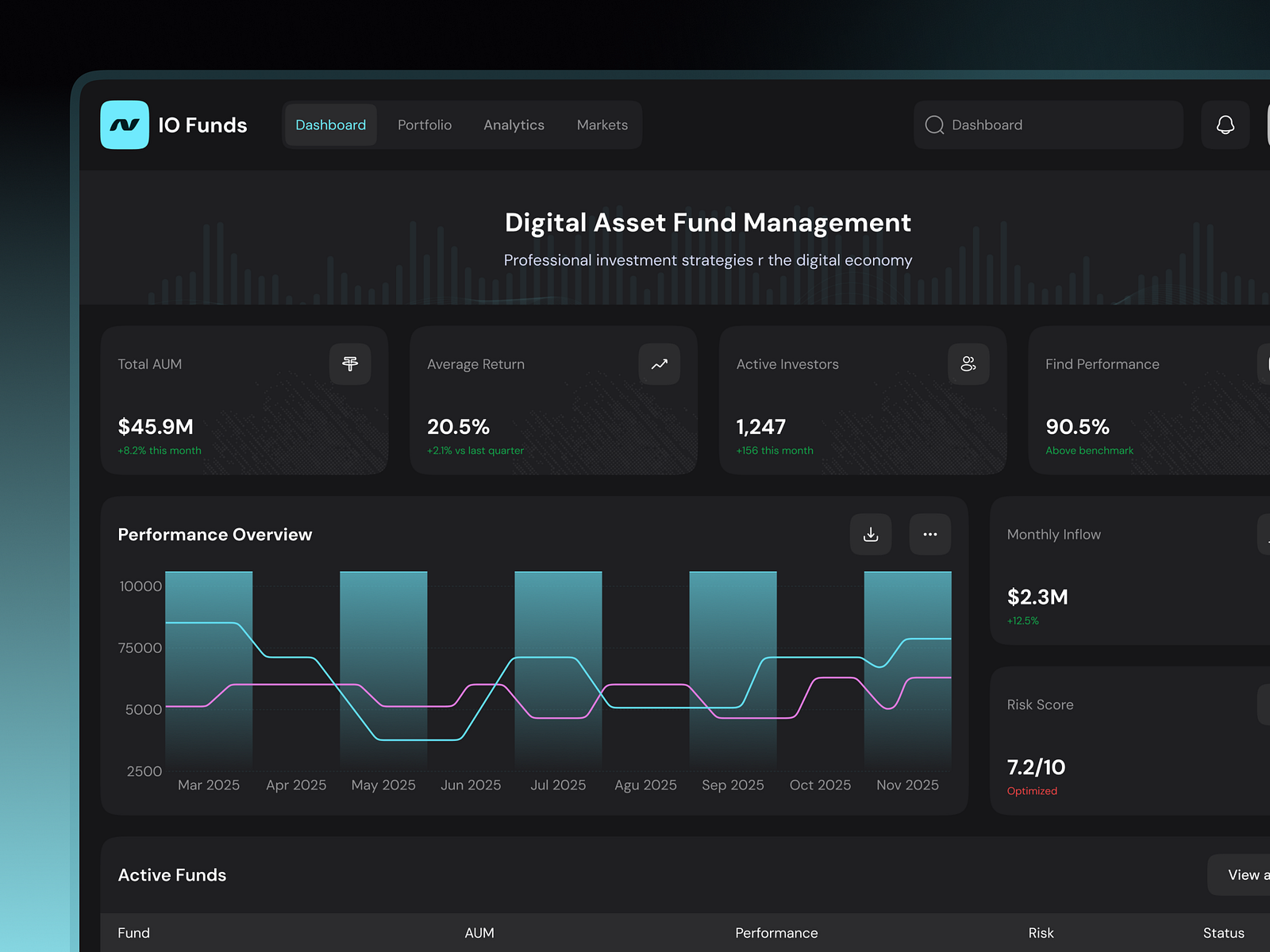

In an era where transparency, programmability, and direct access are redefining finance, Decentralized Token Folios (DTFs) have emerged as a powerful evolution of ETF-style investing. Unlike traditional funds that rely on intermediaries and opaque structures, DTFs operate entirely on-chain, offering investors real-time insight into asset composition and performance. This blockchain-native approach is rapidly gaining traction among both retail and institutional investors seeking diversified crypto exposure without sacrificing control or clarity.

The Mechanics: How DTFs Are Reshaping Crypto Investing

At their core, DTFs take the familiar concept of exchange-traded funds, bundling multiple assets into a single investable product, and supercharge it with smart contracts. This enables portfolios that are not only transparent but also programmable, allowing for features such as automated rebalancing, governance voting, and even AI-driven asset selection.

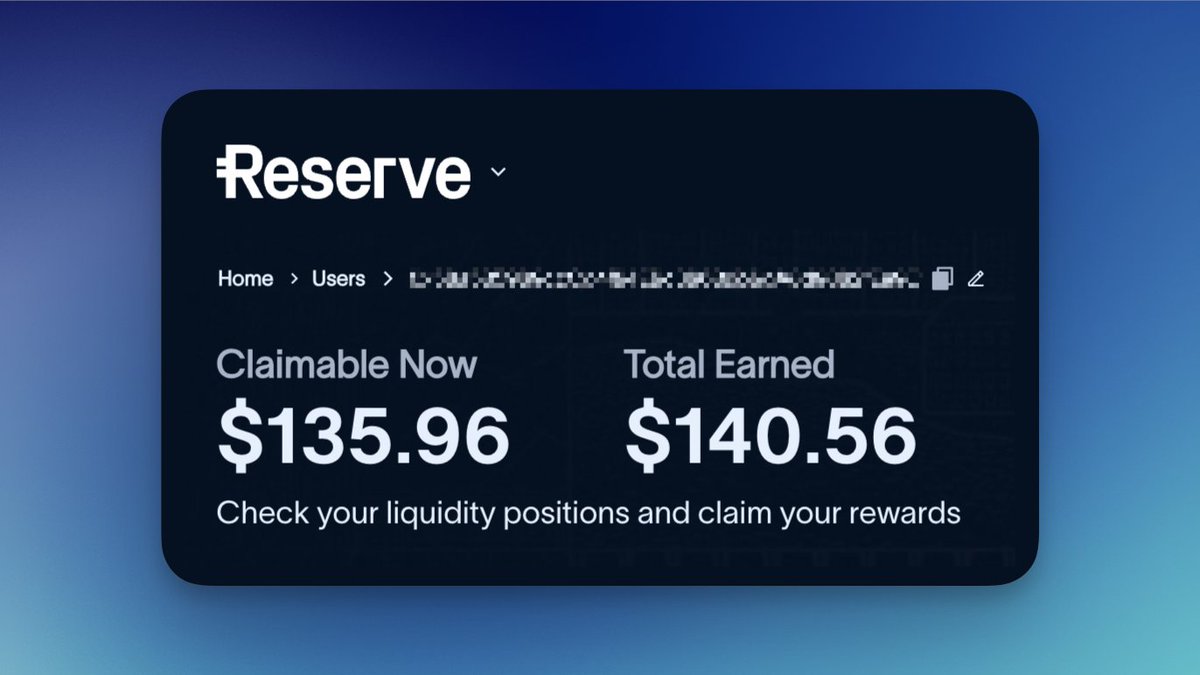

For example, the Reserve Index Protocol, launched in February 2025 by ABC Labs, introduced a suite of 12 index-based DTFs in partnership with industry leaders like Bloomberg Indices and CoinDesk Indices. These products allow anyone to mint or redeem tokens at the current net asset value directly on-chain, no brokers or fund managers required.

Transparency and Trust: Why On-Chain Matters

One of the most compelling advantages of DTFs is their radical transparency. Because every transaction and portfolio adjustment is recorded immutably on public blockchains, investors can verify holdings in real time. This stands in stark contrast to legacy ETFs where portfolio disclosures lag days or weeks behind actual changes.

Key Benefits of On-Chain ETF Transparency for Crypto Investors

-

Real-Time Portfolio Visibility: DTFs like those on Reserve Protocol provide investors with real-time, on-chain access to portfolio holdings and allocations. This transparency allows users to verify asset composition and performance at any moment, reducing reliance on third-party reporting.

-

Immutable Audit Trails: All transactions and portfolio changes in DTFs are recorded on public blockchains, creating tamper-proof, auditable records. This ensures trust and accountability for both retail and institutional investors.

-

Automated, Transparent Rebalancing: Smart contracts enable automated and visible rebalancing of DTF portfolios, as seen with Reserve Index Protocol DTFs. Investors can track every adjustment, ensuring portfolios stay aligned with index strategies without hidden actions.

-

On-Chain NAV Calculation: DTFs calculate and display net asset value (NAV) in real time on-chain, allowing users to mint or redeem tokens at transparent, fair prices—eliminating opaque pricing and middlemen.

-

Open, Permissionless Access: Platforms like Bitget Wallet and EzyDTF let anyone globally participate in DTFs, democratizing investment and lowering barriers for both retail and institutional users.

This level of openness not only builds trust but also aligns with regulatory trends pushing for greater disclosure in digital asset markets. For institutional players especially, being able to audit portfolio composition at any moment is a game-changer, helping meet compliance requirements while unlocking new strategies for risk management.

The Programmable Edge: Automation Meets Personalization

The real magic of DTFs lies in their programmability. Through smart contracts, these folios can support complex logic such as scheduled rebalancing, dynamic fee structures, or even AI-powered allocation models like those pioneered by EzyDTF. Imagine a portfolio that automatically shifts exposure between Bitcoin, Ethereum, and emerging Layer 1 tokens based on market signals, all governed by transparent code rather than human discretion.

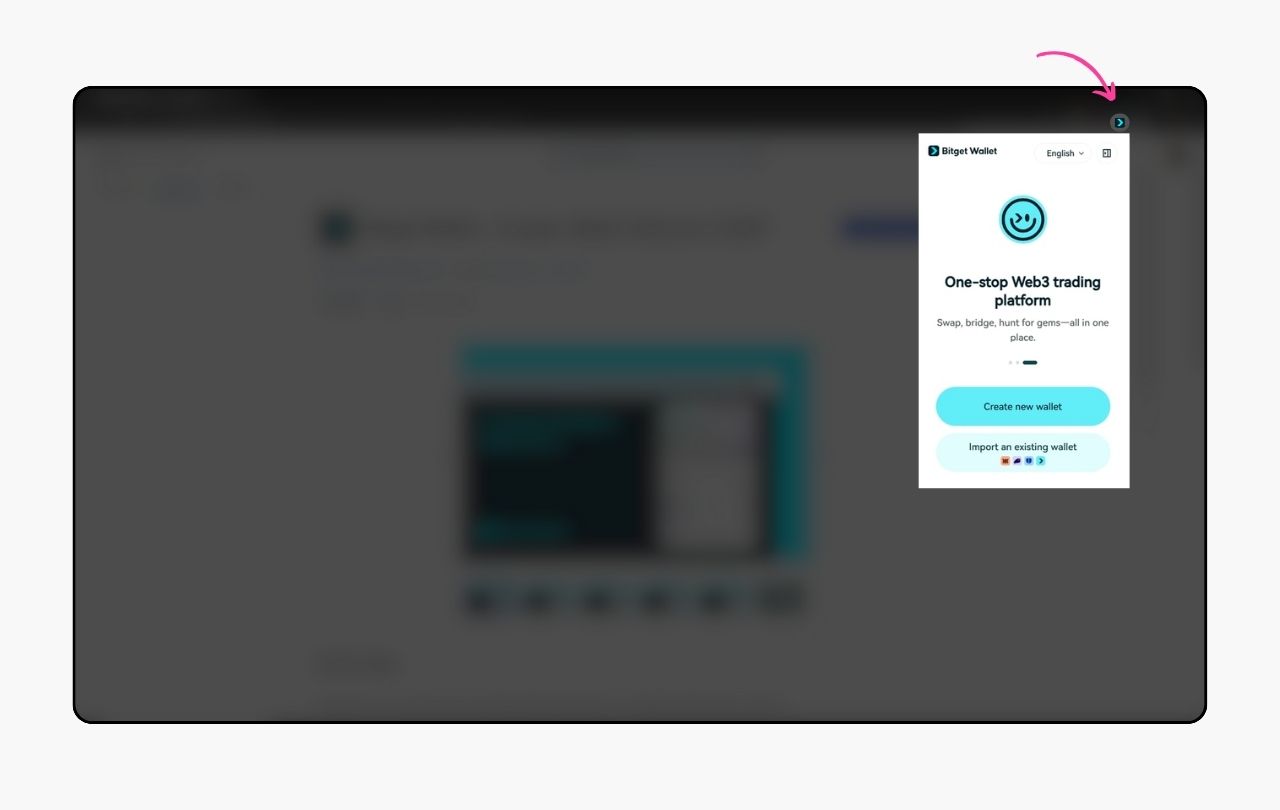

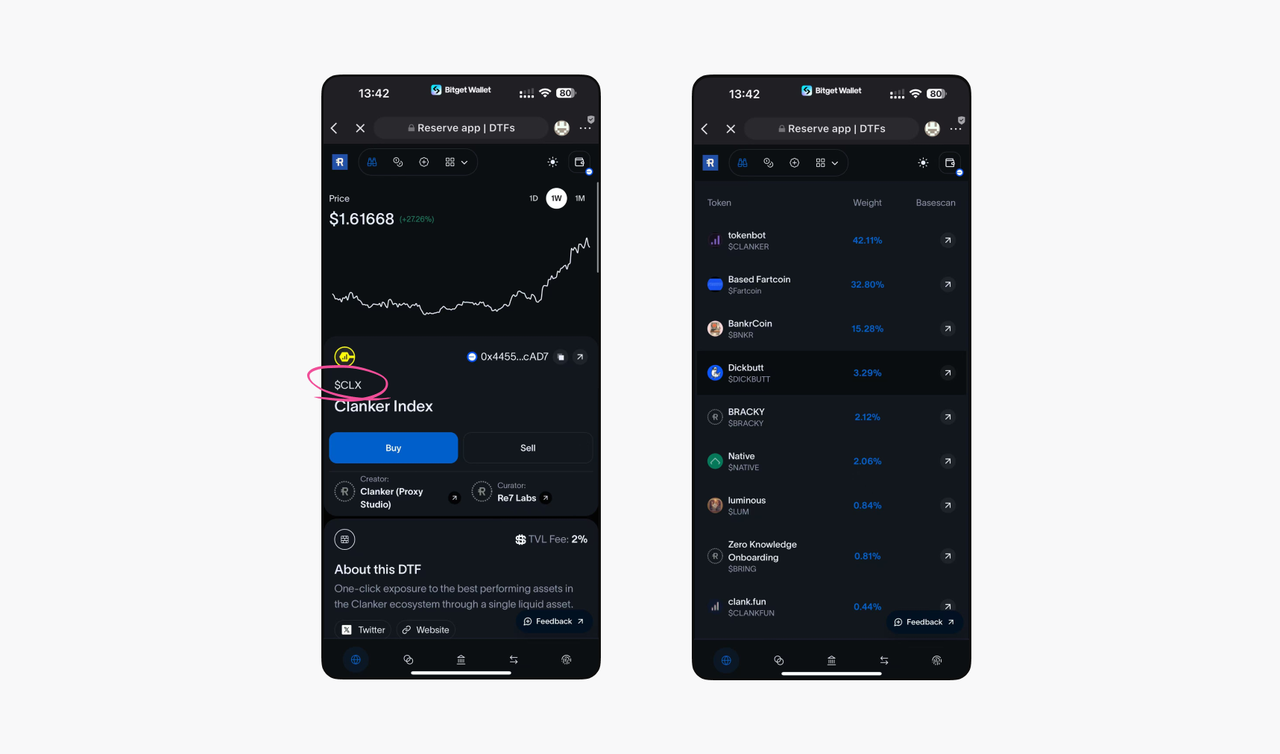

This innovation extends to user experience as well. With integrations like Bitget Wallet’s support for Reserve’s DTFs (see details here), retail investors can now access broad-based crypto indices, such as the Bloomberg Galaxy Crypto Index, with just a few taps. The result? Lower barriers to entry and unprecedented flexibility for portfolio construction.

As programmable ETFs become more commonplace, the user experience is evolving rapidly. Investors can now choose between passive index strategies or actively managed DTFs that leverage automation and AI to optimize returns. Products like EzyDTF are setting a new standard by offering cross-chain portfolios, meaning users aren’t limited to assets on a single blockchain, an important step in building resilient, future-ready crypto allocations.

Moreover, the ability to participate in governance adds another layer of personalization. Token holders can vote on key parameters such as rebalancing frequency or asset inclusion, giving investors direct influence over how their portfolios are managed. This dynamic approach stands in contrast to traditional ETFs, where investors have little say beyond buying or selling shares.

Navigating Risks and Regulatory Considerations

Despite their promise, DTFs are not without risks. Smart contract vulnerabilities remain a concern; while transparency helps with auditing, bugs or exploits can still impact funds if not properly managed. Additionally, as regulators around the world continue to refine their stance on DeFi products, compliance frameworks for on-chain ETFs are still developing. Institutional adoption will hinge on clear guidance and robust security practices.

That said, early movers like Reserve have demonstrated how rigorous design and transparent operations can bring institutional trust to crypto indexing (learn more here). As DTFs mature and attract more oversight, expect best practices around audits, insurance, and governance to become standard features.

Who Stands to Benefit?

The democratizing force of DTF crypto investing is hard to overstate. For retail investors, programmable ETFs put sophisticated strategies within reach, no coding or deep technical know-how required. For institutions and family offices, on-chain ETF transparency provides auditability and operational efficiency that traditional wrappers struggle to match.

With more than $212M in market cap as of 2025 (source), DTFs are quickly gaining legitimacy as core building blocks for diversified digital asset portfolios. The ability to bundle tokens from thousands of new projects launching daily means investors can capture sector-wide growth without chasing individual winners, a critical advantage in today’s fast-moving market.

How DTFs Lower Barriers for First-Time Crypto Investors

-

Seamless Access via Reserve Index Protocol: The Reserve Index Protocol enables anyone to create, buy, or redeem diversified crypto portfolios on-chain, eliminating the need for traditional brokerages or intermediaries.

-

One-Click Diversification with Bitget Wallet Integration: Bitget Wallet now supports DTFs, allowing users to gain broad crypto exposure—such as the Bloomberg Galaxy Crypto Index—through a single token, making portfolio diversification simple and accessible.

-

Real-Time Transparency on Public Blockchains: DTFs operate fully on-chain, offering real-time visibility into portfolio holdings and performance so first-time investors can track their investments with confidence and clarity.

-

Automated Portfolio Management with Smart Contracts: DTFs use programmable smart contracts for automated rebalancing and governance, reducing the need for manual oversight and making sophisticated strategies accessible to beginners.

-

AI-Powered Simplicity through EzyDTF: EzyDTF introduces AI-driven decentralized portfolios, streamlining asset selection and management for newcomers seeking hassle-free, diversified crypto exposure.

Looking Ahead: The Next Frontier for Programmable Asset Management

The rise of Decentralized Token Folios signals a fundamental shift in how we think about asset management, one that is open-source by default and engineered for customization at scale. As protocols expand cross-chain capabilities and integrate AI-driven logic, expect programmable ETFs to move beyond simple index tracking into realms like personalized risk profiles and real-time tax optimization.

For those willing to embrace this new paradigm, the rewards extend far beyond convenience. On-chain ETF transparency fosters trust among all participants; programmability empowers both novice and professional investors; accessibility ensures that anyone with an internet connection can participate in global markets without gatekeepers.

The era of opaque fund management is giving way to a world where every trade is visible and every rule is encoded in smart contracts. Whether you’re seeking broad exposure through a single token or want granular control over your portfolio’s evolution, Decentralized Token Folios offer a compelling vision for the future of investing, one where transparency isn’t just an ideal but a lived reality.